Warren Buffett once said, "The value of a business is the cash it's going to produce in the future."

Simple. Logical. But most investors miss the point.

When you buy a stock, you're not buying a magic ticket that goes up and down in price. You're buying a piece of a real business. And if you’re a real business owner, what matters most?

Cash.

Not theoretical earnings. Not growth projections. Actual, tangible cash. The money that lands in your pocket.

The ‘Frozen Corporation’

Benjamin Graham, the father of value investing, used to talk about a concept he called a "frozen corporation."

A company whose charter prohibited it from ever paying out any profits to its owners. No dividends. No liquidation. Just a pile of money that theoretically belongs to shareholders - but can never be touched.

What is such a business worth?

The logical answer is that the ‘frozen corporation’ is worth $0.

But, for some reason, many investors today act like frozen corporations are the best kind of investment.

They buy stocks that reinvest every penny. They cheer when management spends billions on acquisitions, new factories, or buybacks. They say dividends are a waste of capital.

But here’s the reality: The goal of investing isn’t for the company to compound capital. It’s for YOU to compound YOUR capital.

There are only two ways to make money from a stock:

Get paid dividends from the business

Sell your shares to another investor for more than you paid

That’s it.

Dividends are real. They’re money in your hands. They compound over time. Reinvest them, and your cash flow grows exponentially.

Selling your shares for a profit? That’s just a guess. A hope that someone in the future will pay more than you did. It’s the “greater fool” strategy.

The Owner’s Mindset

Buffett tells us to think like business owners. So, if you owned a private business, how would you measure success?

Would you obsess over how much you could sell it for someday? Or would you focus on how much cash it could generate for you, year after year?

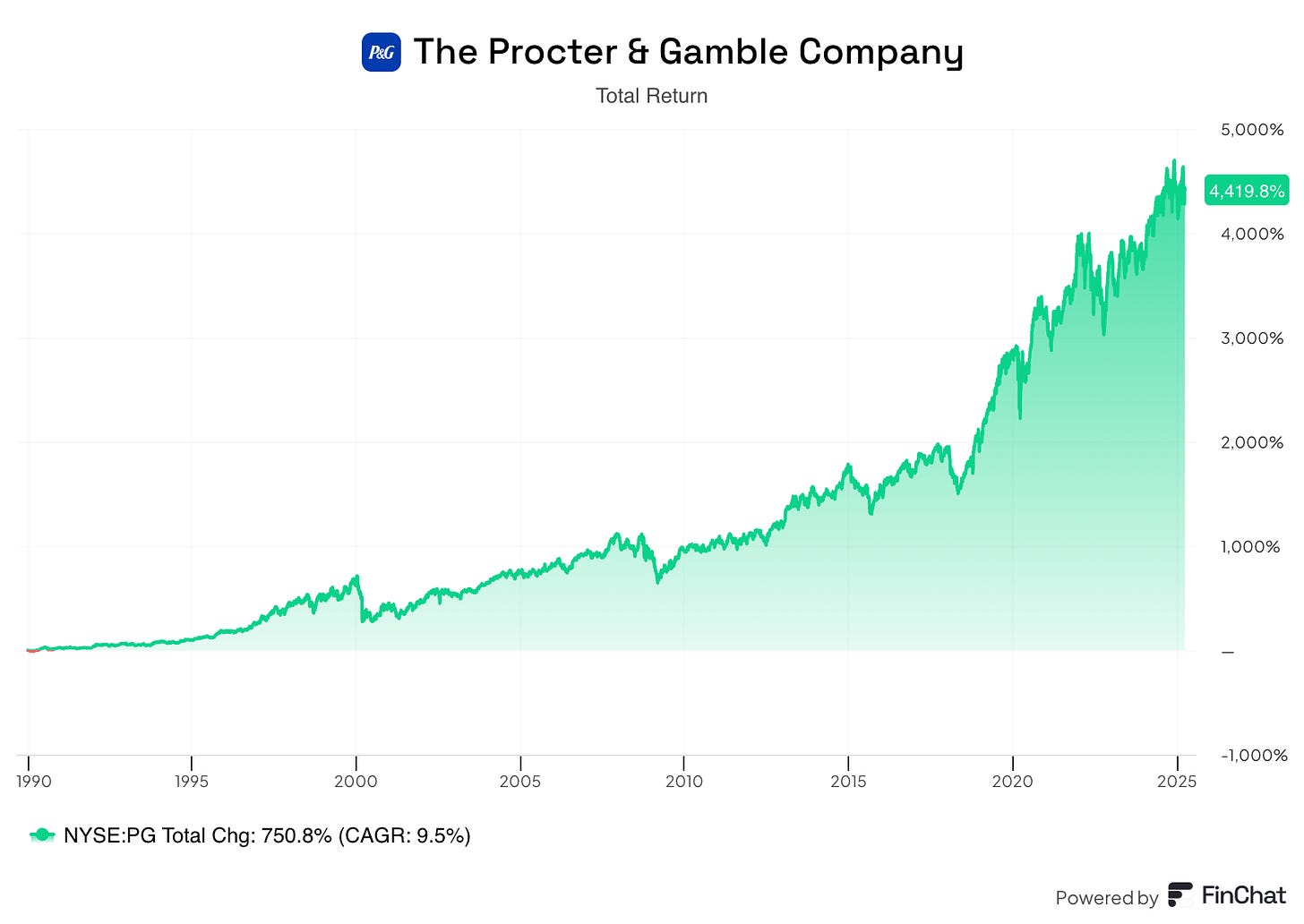

The best businesses in the world do both. They grow in value, but they also return capital to their owners. Think about Coca-Cola, Johnson & Johnson, or Procter & Gamble - businesses that have rewarded shareholders for decades with rising dividends.

If you invest for dividends, you’re not at the mercy of market speculation. You don’t have to hope the price goes up. You don’t have to rely on Wall Street’s moods. You own a business that pays you to own it.

That’s real investing.

If you want to hear Warren Buffett talk about the ‘frozen corporation’ at the 1998 shareholder meeting, the video is below:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data