Do you know how Compounding Dividends started?

My name is TJ Terwilliger and I’ve been a loyal Partner of Compounding Quality since the beginning.

I love investing and writing. I am trained as a physical therapist (physiotherapist if you’re not in the US), so I also love to help other people.

I thought it would be really cool to combine these 3 passions by writing a newsletter.

Through Compounding Dividends, I can write and help other investors while following my passion for the stock market.

And that’s how Pieter (Compounding Quality) and I joined forces.

Compounding Dividends is all about building a Dividend Income Machine for you.

How? One Dividend At A Time.

When did you get interested in investing?

I first realized the power of investing in stocks around 12 years old.

It was a hot summer day, and I was sitting in the grass beside the road. I was reading a newspaper and drinking an orange soda.

My best friend and I delivered all the newspapers in our town. We had a monopoly 🙂

Usually, I would just look at the comics or read the sports section during our breaks. But this time, I flipped to the stocks section.

If you’ve never seen newspaper stock quotes, they’re in tiny print and you just get a little bit of information.

I saw the high and low prices for the stocks.

I quickly realized that you could make a lot of money by buying them at the low price and selling them at the high price.

At that point, I didn't really understand how hard it is to time the market. But I could see the potential to build wealth by investing in stocks.

How I got to Dividend Investing

I started by reading the classic investing books:

The Intelligent Investor

One Up on Wall Street

Margin of Safety

Stocks for the Long Run

The Most Important Thing

Value investing made complete sense to me.

So I went off looking for bargains.

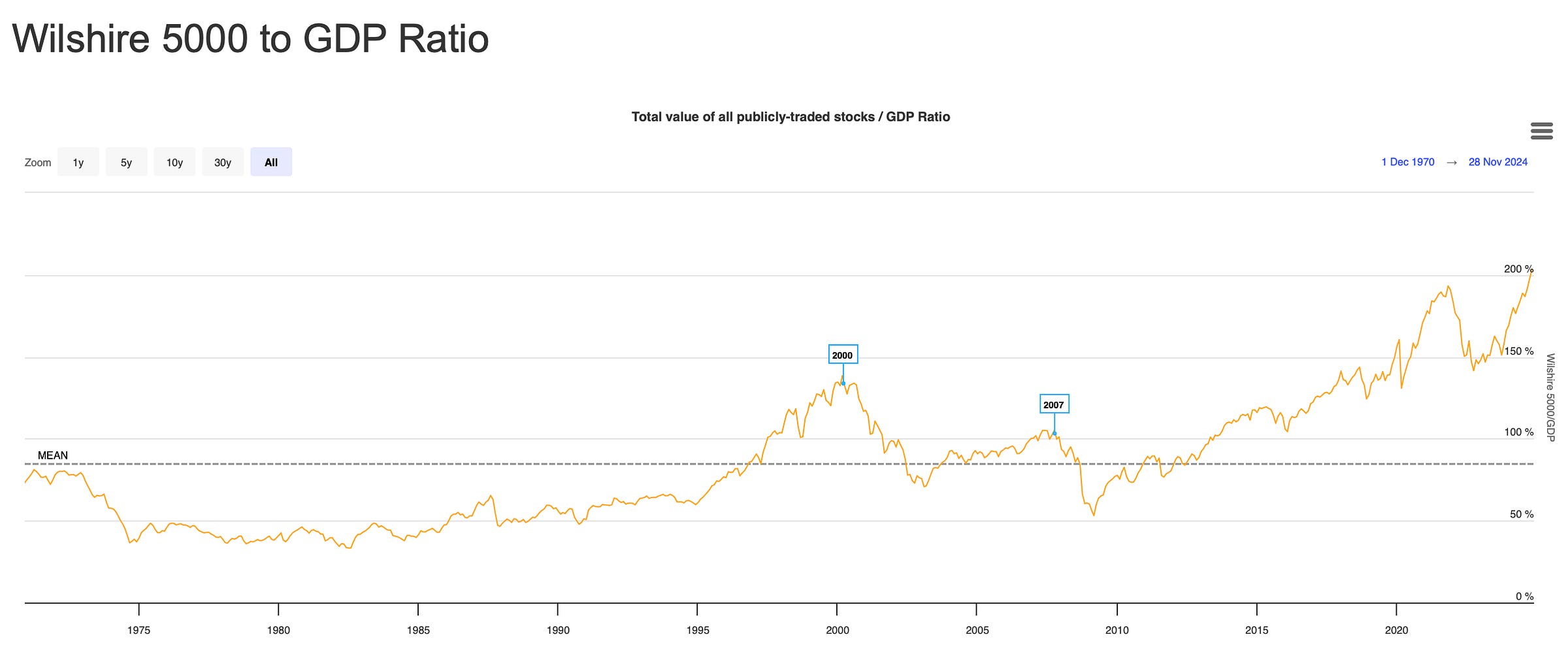

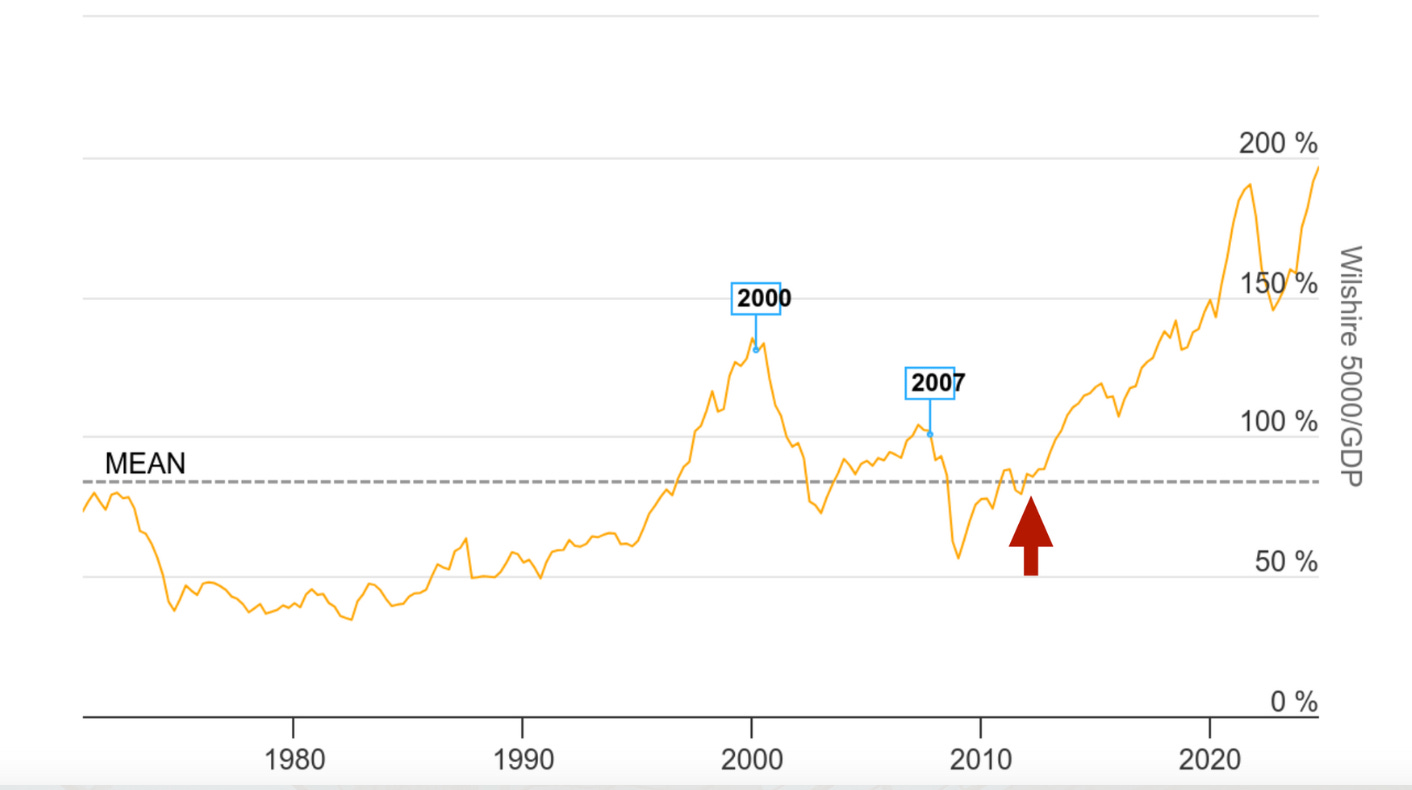

The picture below is the “Buffett Indicator”.

It’s a measure of the overall valuation of the stock market compared to the economy.

It divides the total market capitalization of publicly traded companies by the country's Gross Domestic Product (GDP).

I started about where the red arrow is:

The stock market has become more expensive since I started investing seriously.

That doesn't mean there aren't good deals sometimes. But they're harder to find.

As the market kept going up, I started trying to understand what was happening.

Some really good investors had also noticed a change in the market.

‘I view the markets as fundamentally broken…Passive investors have no opinion about value. They’re going to assume everybody else has done the work.’ - David Einhorn

“Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reason, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.” - Warren Buffett

Fortunately, David Einhorn also had an answer that made a lot of sense to me.

In his Q4 2023 letter, he said:

“We have become even more disciplined about price and emphasize investments where we get paid by the issuers, as opposed to relying on other investors to revalue the security. Payment can come to us in the form of buybacks, dividends, interest, or in some cases, a take-out from a buyer…Many of our largest holdings are offering double-digit returns directly to investors.”

I don't know what the stock market will do.

I don't know if passive investing has broken the markets, or if investors have become gamblers.

What I do know is that it makes a lot of sense to me to remove the opinions and emotions of other investors.

And to get paid directly by the companies I own.

What separates Compounding Dividends?

At Compounding Dividends, there are no commercial incentives (except for the subscription fee).

Honesty and integrity are essential and we genuinely want to do the right thing.

And what’s even more important? We are PARTNERS in this.

We’re in this together. Real money is invested in the Compounding Dividends Portfolio.

If you do well, I do well, and the other way around.

Here’s what Charlie Munger said about the power of incentives:

So who are you?

If we’re going to be partners, you should know a little more about me.

Here's some basic info to get to know each other:

My name is TJ Terwilliger

I live in the United States (Pennsylvania)

I have 2 children (10 and 12 years old)

Hobbies:

Exercise (running, cycling, lifting weights) - this year I ran a half-marathon on an abandoned section of highway, including tunnels - a cool enough experience that I took a selfie during the race - notice the runners with headlamps still on in the tunnel behind me:

Reading books

Coaching Little League Baseball

Any reason to be outside (hiking, backpacking, camping) - currently that involves getting my dog out bird hunting as much as possible, he also enjoys running and mounting biking with me - bonus points if you know his breed:

My goal with Compounding Dividends is to build a true partnership with you.

That means you need to know something about me.

Hopefully this article has given you a better sense of who I am.

The best is yet to come!

I'm excited to have you as a partner in this investing journey.

One Dividend At A Time,

TJ

PS Become a Partner of Compounding Dividends and receive an EXCLUSIVE webinar about Dividend Stocks + My 5 Favorite Dividends Stocks for 2025

Whenever you’re ready

Whenever you’re ready, you can subscribe here:

Used Sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

“Partnership” is thrown around a lot in hollow client / brand / transactional business settings. Love the wholly personal approach to it here. Hi TJ! I’m Andrei 👋

How do i get a copy of 5 dividend stocks for consistent income in 2025?

I am unable to find it on the website.

Thanks. Mark