Some investing strategies require complex algorithms, mountains of data, and an army of analysts. But the best ones? They’re often the simplest.

Take the Chowder Rule - a straightforward formula that helps investors identify high-quality dividend growth stocks. It’s an easy way to separate great investments from mediocre ones.

And yet, Wall Street barely talks about it.

The Secret to Dividend Growth Investing

Dividend investing isn’t about chasing the highest yields. That’s often a mistake.

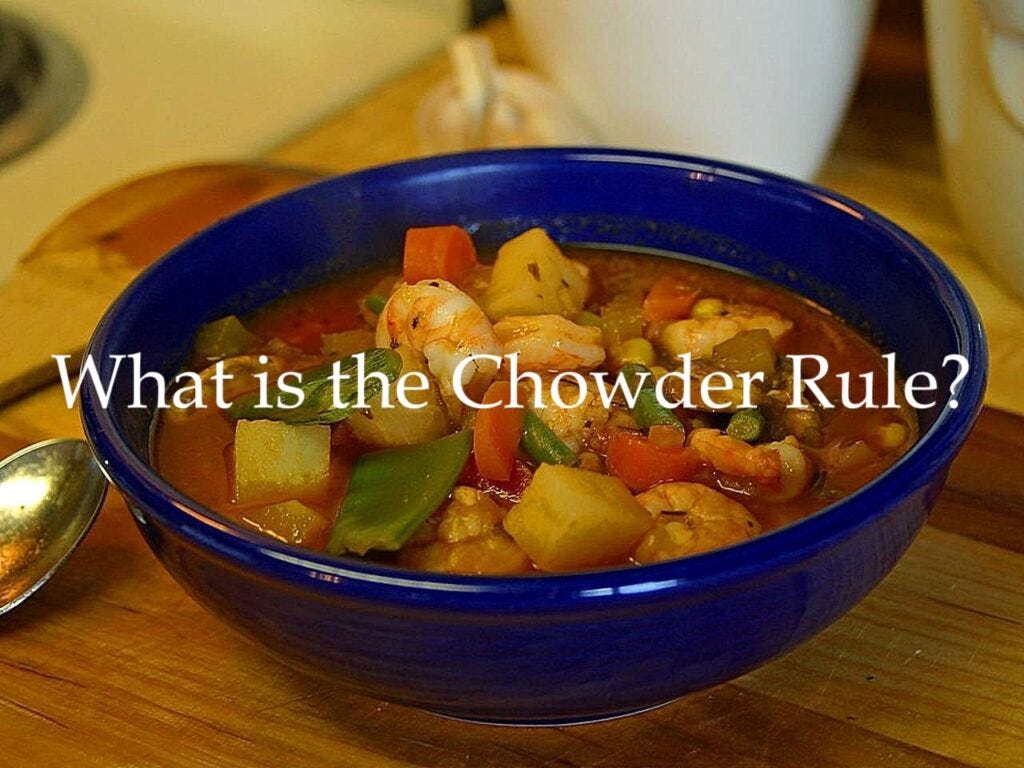

Instead, the real secret is finding stocks that both pay dividends and grow them consistently. Over time, compounding dividend growth beats high-yield stocks that stay stagnant - or worse, get cut.

Take a look at the performance of the S&P 500 Dividend Aristocrats - consistent dividend growers compared to the Dow Jones Select Dividend Index - a high yield index.

That’s where the Chowder Rule comes in. It combines both current yield and growth potential, helping you find a balance between immediate income and long-term growth.

How It Works

The Chowder Rule is simple:

Dividend Yield + Dividend Growth Rate (5-year average) ≥ 12%

For utility stocks, which tend to grow dividends more slowly, the threshold is lower:

Dividend Yield + Dividend Growth Rate (5-year average) ≥ 8%

Some investors use a third rule if the starting yield is <3%:

Dividend Yield + Dividend Growth Rate (5-year average) ≥ 15%

The rule was created to be a final valuation check, not a screening tool.

In other words, you should understand the business, trust the management team, and already want to own the stock before you consider the Chowder Rule.

However, it can also be useful to do a quick check of the rule before you deeply research a company that is very overvalued.

Why It Works

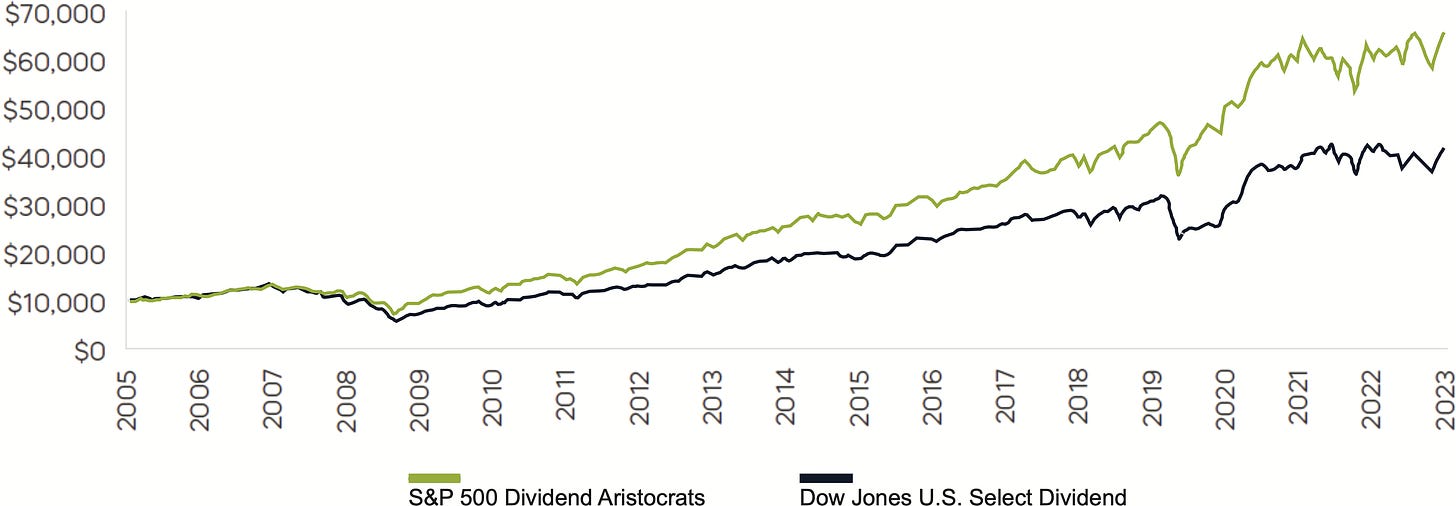

It all comes down to compounding.

A stock that yields 3% but grows its dividend by 9% per year will double its dividend payments in about eight years. That’s the power of dividend growth.

Compare that to a stock yielding 6% but barely growing its dividend.

In a few years, the first stock will outpace the second - because its dividend keeps rising, and so does the stock price.

Finding the Right Stocks

The Chowder Rule works best for companies with strong competitive advantages, stable cash flows, and a history of increasing payouts. Think of companies like:

Johnson & Johnson (JNJ) – A healthcare giant with a bulletproof balance sheet

MSCI (MSCI) – A leading provider of critical decision support tools and services for the global investment community, known for its robust analytics and data-driven insights

Texas Instruments (TXN) – A tech company that doesn’t just survive but thrives in downturns

These aren’t just stocks. They’re cash-generating machines that reward investors year after year.

The Bottom Line

Most people make investing harder than it needs to be. But the best strategies - like Dividend Growth Investing using the Chowder Rule - are simple and effective.

Find stocks that pass this test, hold them, and watch your wealth grow. It’s not flashy, but it works. And that’s what really matters.

3 Interesting Stocks Meeting the Chowder Rule

I took a quick look through our investable universe and picked out 3 interesting companies that currently meet the Chowder Rule.

Here they are: