Investing in real estate is a proven wealth-creation strategy.

Real estate usually earns about 8% to 10% over time. It’s very similar to stock returns.

Let’s teach you everything about REITs today.

Here are some reasons why investing in real estate is so popular.

Properties can become more valuable over time

You get reliable, steady income

You can use borrowed money, boosting the yield

There is typically consistent demand

Investing in real estate can also protect your overall portfolio from stock market changes.

However, buying and managing properties can be complicated:

The initial costs are high

It’s hard to buy and sell properties quickly

You have responsibilities like dealing with tenants and maintenance

It can be stressful, especially if major problems come up

Wouldn't it be nice if you could get the benefits of real estate investing without all the hassles?

That's where Real Estate Investment Trusts (REITs) come in.

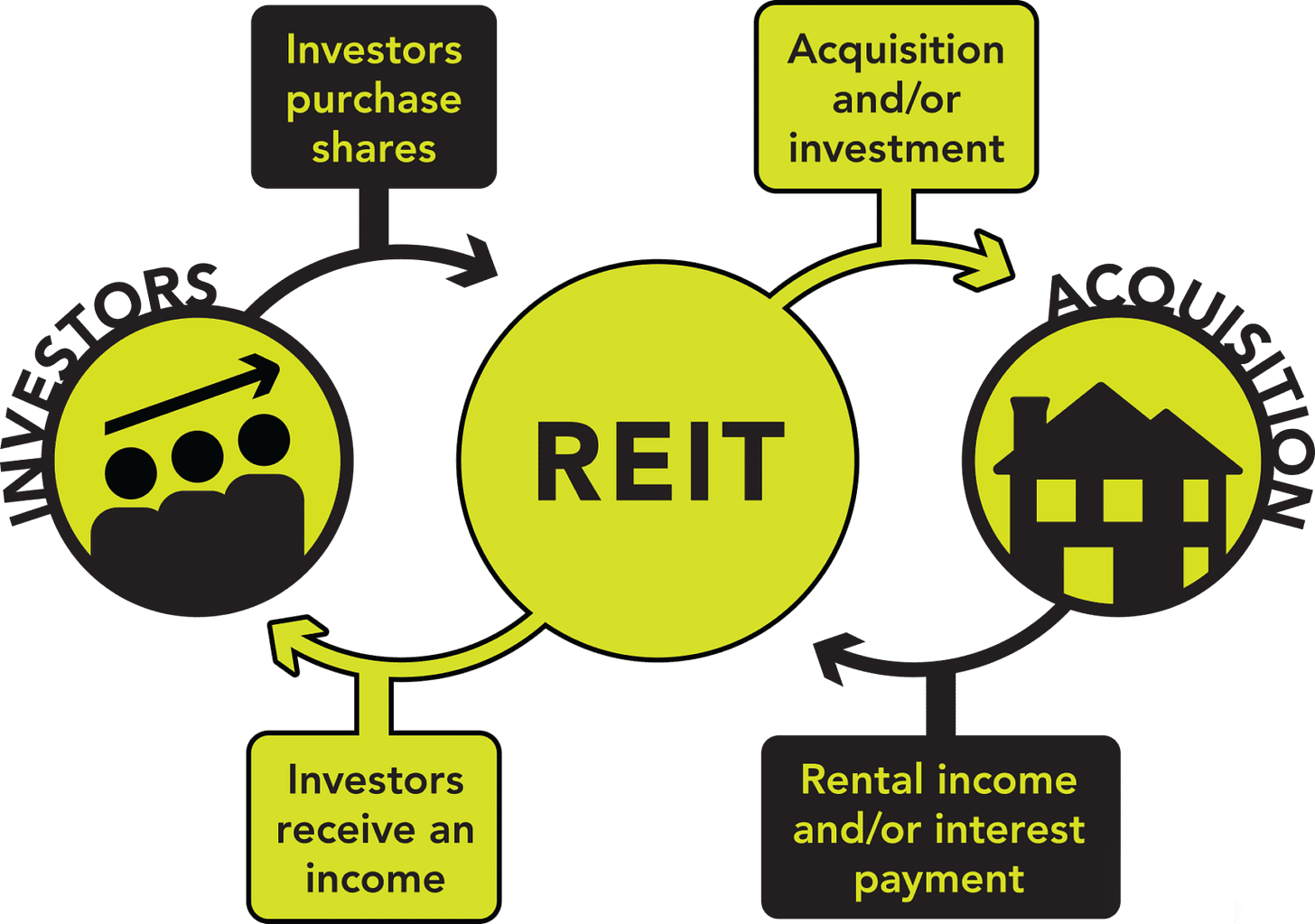

REITs are a way for regular people to make money from real estate without being a landlord.

They use pooled investor money to buy, run, and earn income from a group of properties.

The passive nature, and high, steady dividends make them attractive investments.

Many REITs also have low volatility, adding stability to a portfolio.

Whether you're new to investing or looking to diversify your portfolio, this guide will teach you everything you need to know about REITs.

REITs Versus Stocks

You can buy shares of a REIT on the stock market, just like a regular stock. But there are some differences.

A REIT is a company that owns and manages a group of real estate properties that make money, like apartment buildings, offices, or shopping centers.

A regular stock is a share of a company that sells a product or service.

Key differences:

REITs must earn at least 75% of income from real estate and pay out 90% of the profits as dividends to avoid corporate taxes.

REITs don’t keep much profit for growth, so they raise money by selling new shares and taking on debt.

REIT Metrics

REITs should be evaluated using different metrics than a dividend paying stock.

Let’s talk about the most important ones.

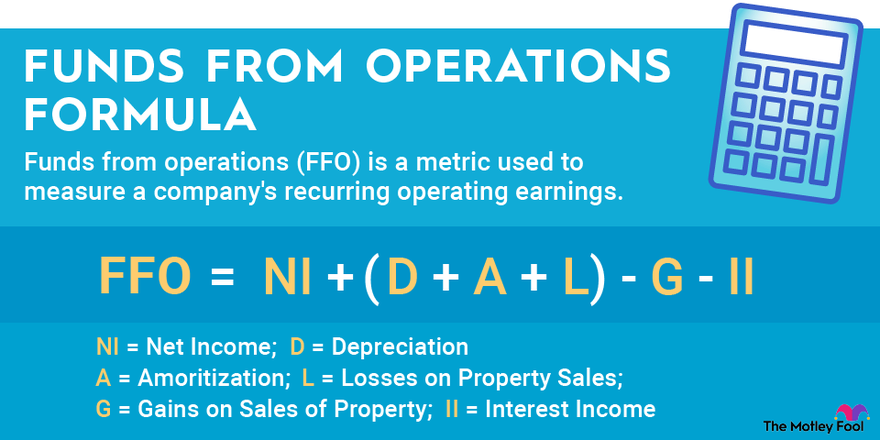

Funds from Operations (FFO): Measures a REIT's cash flow.

The formula is: Net income + depreciation and amortization - gains from property sales

FFO gives a clearer picture of a REIT's cash flow and dividend safety than regular earnings.

Adjusted Funds from Operations (AFFO): This is similar to free cash flow for REITs.

Takes FFO and subtracts maintenance costs

Also adjusts for straight-line lease revenue and costs related to growth through new debt or equity.

Shows how much cash a REIT has available to pay dividends.

Some REITs may refer to AFFO as "Funds Available for Distribution" (FAD).

These key metrics help you evaluate a REIT's cash flow

Evaluating Dividend Sustainability

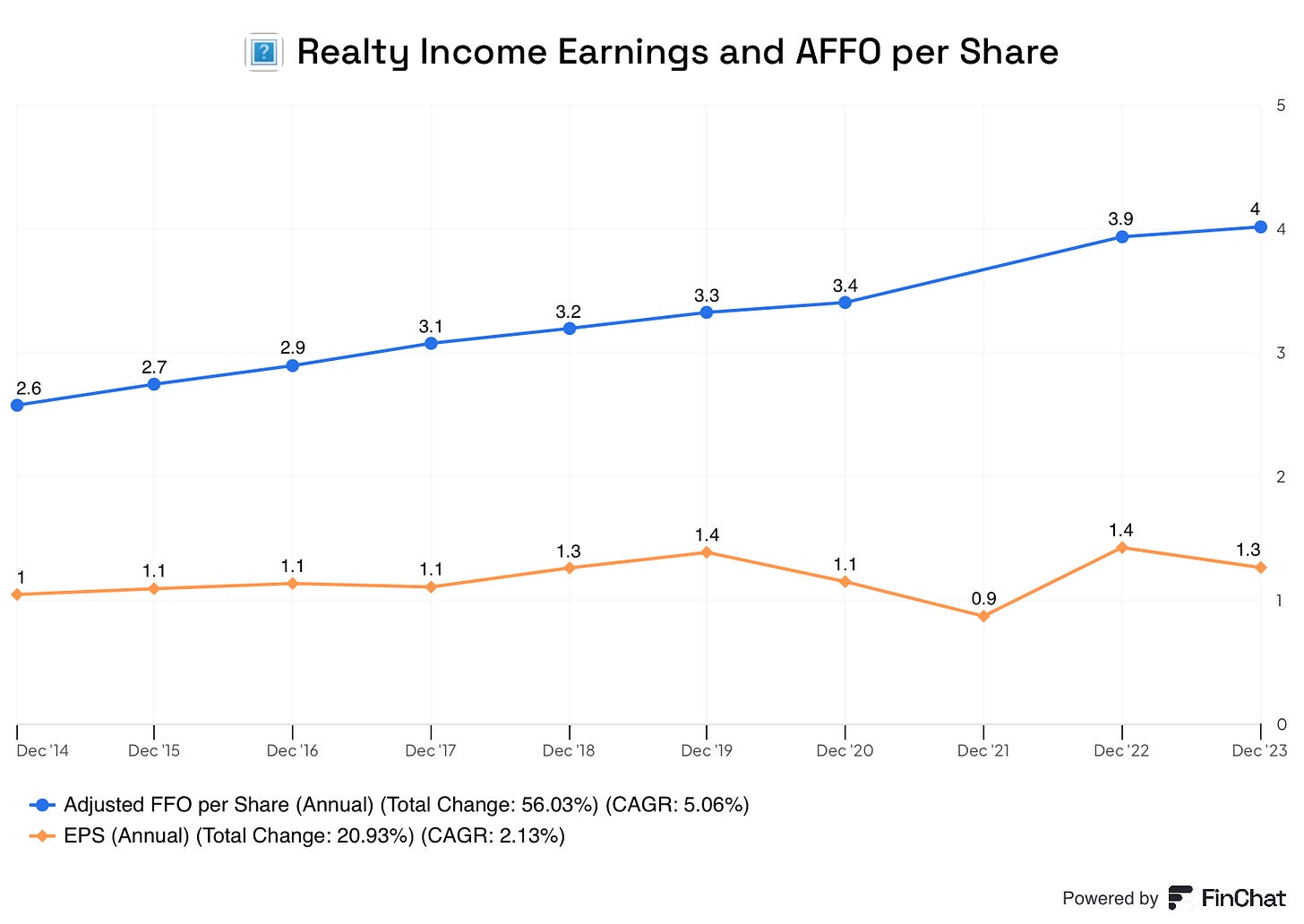

Earnings Per Share (EPS) and Free Cash Flow (FCF) can be misleading when looking at a REIT.

EPS is often low due to non-cash expenses like depreciation

FCF includes growth costs funded externally, making it low or negative

Here’s the difference in Realty Income’s EPS and AFFO per share.

Source: Finchat

FFO or AFFO payout ratio is more useful than EPS or Free Cash Flow payout ratios.

For example, in 2023, Realty Income had:

EPS Payout Ratio: 234%

FCF Payout Ratio: 113%

AFFO Payout Ratio: 76%

The high payout ratios when you use EPS or FCF make it look like Realty Income's dividend is at risk.

But its AFFO payout ratio of 76% indicates a safe, stable dividend - remember that REITs must distribute most of their taxable income.

Looking at the Balance Sheet

REITs often use debt to grow, because debt is usually cheaper than issuing stock.

That means it's important to check the REIT's balance sheet is healthy.

Investors often do this by looking at the leverage ratio (Debt/EBITDA)

It shows how leveraged the REIT is and also gives an idea of management’s ability to keep the cost of debt low.

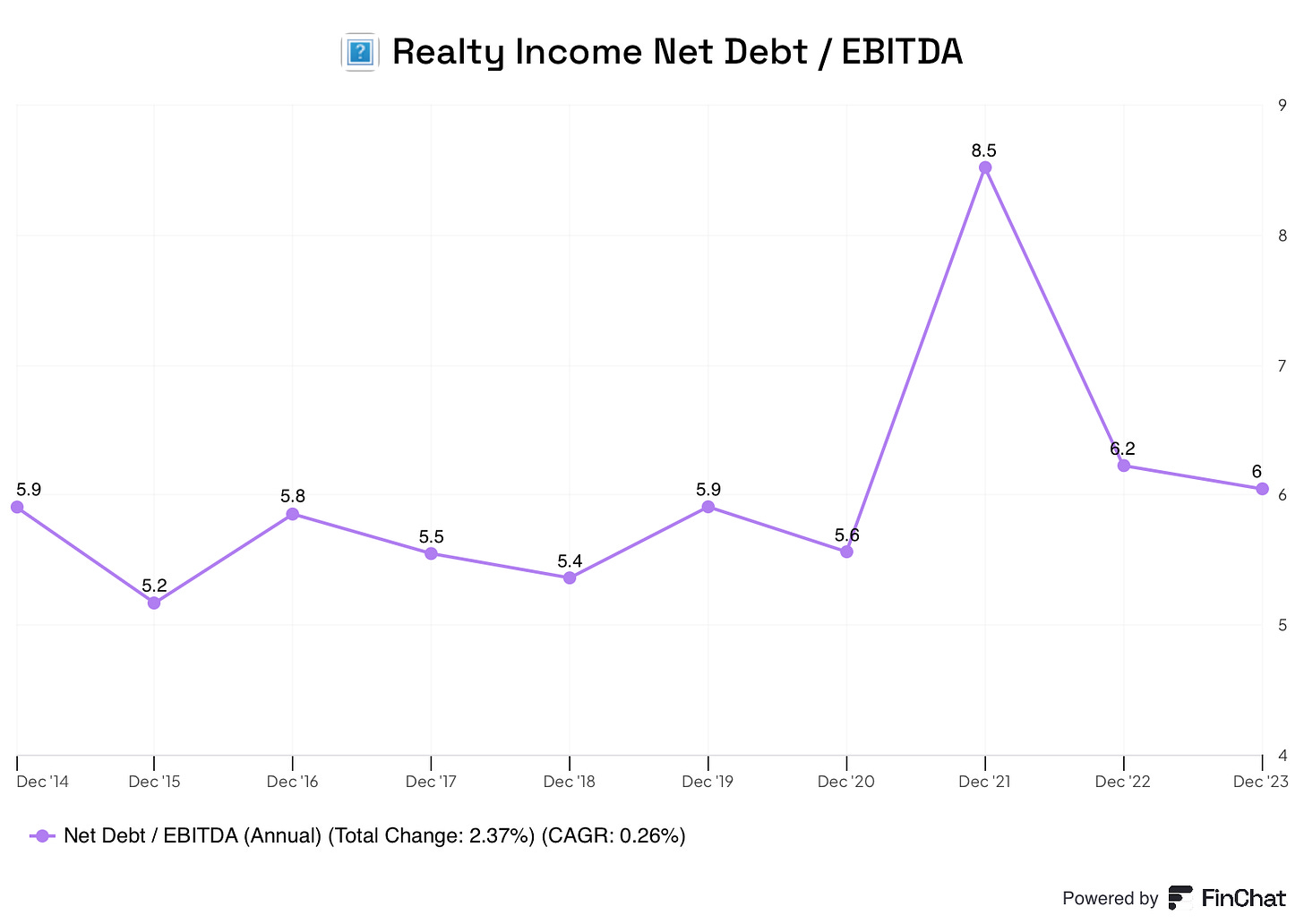

Here’s the Net Debt / EBITDA ratio for Realty Income:

Source: Finchat

Realty Income keeps this number between 5 and 6 - a ratio of 5 or less is generally considered conservative.

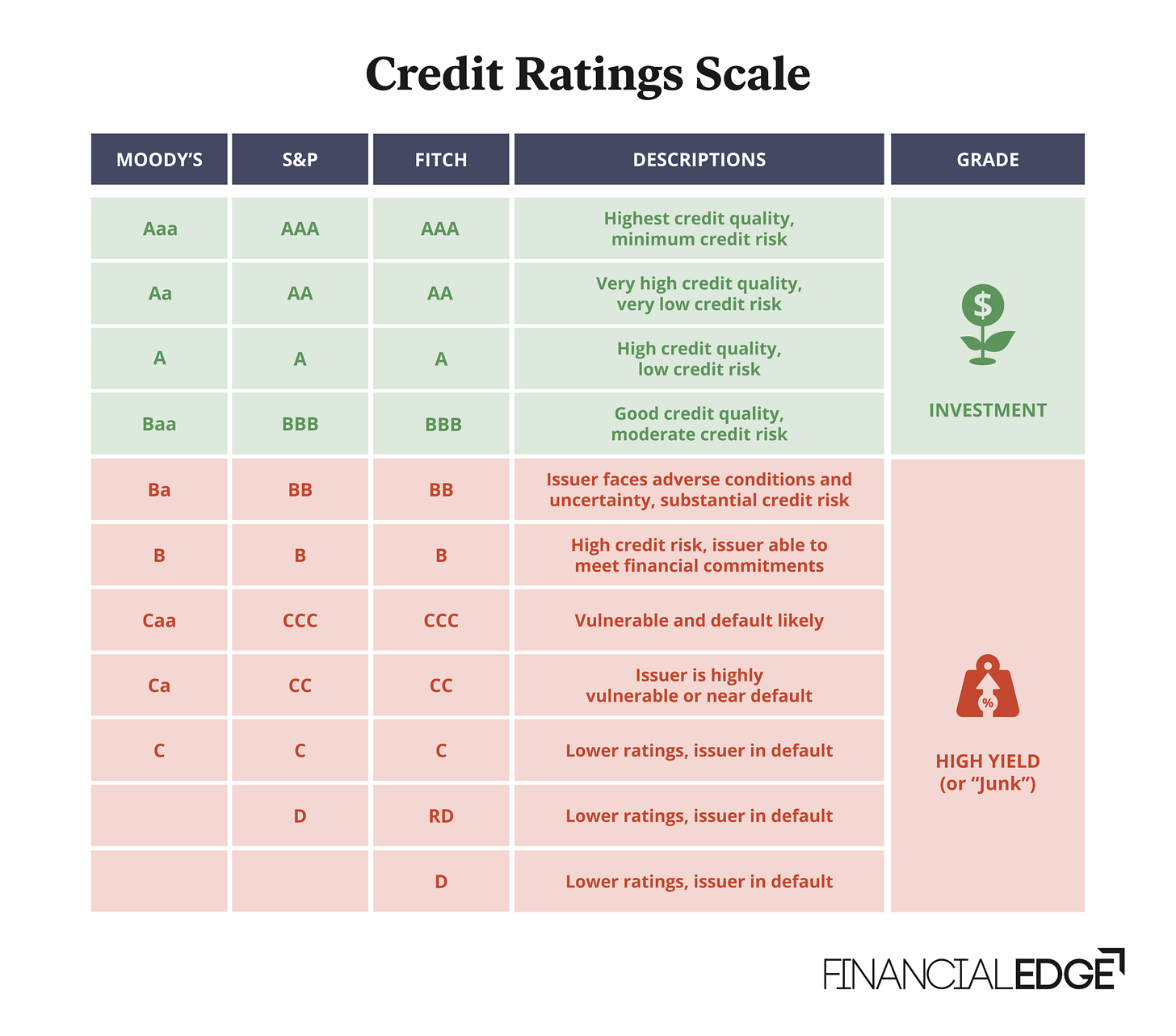

Credit Ratings

A REIT's credit rating is another helpful sign of its financial health.

An investment-grade credit rating (BBB- or higher) lets it borrow money at lower costs. This makes it easier for the REIT to find good real estate investments.

Cost of Capital Matters for Growth

Cost of capital refers to how much it costs a REIT to get money to fund its business.

It’s very important for a REIT’s long-term growth.

A lower cost of capital means it’s more affordable to buy new buildings.

This makes the REIT more profitable and lets them grow their real estate over time.

There are three main sources of capital for a REIT:

Undistributed cash flow - This is the cheapest, but smallest, source

Debt - This is usually the next cheapest option

Cost of debt = total interest expense / total debt

Equity - Issuing new stock is the most expensive source

It increases future claims on the REIT's cash flow and raises dividend costs

A higher share price lowers the cost of equity, allowing a REIT to buy more properties without heavily diluting existing shareholders.

If a REIT's share price is too low, the cost of new capital may be higher than the cash the new properties earn. This makes growth difficult.

For a REIT to grow the dividend, it has to maintain an investment-grade credit rating and manage the cost of capital.

Management’s Role

Management’s job is not just finding good properties to invest in. They also need to manage the REIT's capital effectively.

When share prices are high, they should use equity to fund acquisitions and strengthen the balance sheet.

When prices fall, they should use more debt to minimize dilution and maintain AFFO and dividend growth.

Valuing a REIT

Remember that a REIT's earnings per share (EPS) and free cash flow can seem low because of things like depreciation, amortization, and money spent on growth.

This means you can't value a REIT the same way you would value a regular dividend-paying stock.

Some better ways to value a REIT include:

Price/FFO or AFFO - Similar to the price-to-earnings ratio for other companies.

Dividend Yield - Higher yields often mean lower valuations. Investors buy REITs for the dividends.

You can compare a REIT's current valuation to its own past range and to similar REITs. This can help you decide if it is reasonably priced.

My Target

When valuing REITs, I look for 10% or more annual total returns.

Our usual methods of comparing the current Dividend Yield to the past, and the Reverse Dividend Discount Model still work for REITs.

But the earnings growth model needs to be modified a bit for REITs:

Expected return = AFFO/Share Growth + Dividend Yield + Change in Price/AFFO multiple

We’ve used Realty Income as an example through this article.

Let’s go ahead and value it to see if it might be an interesting investment.

Valuing Realty Income

Dividend Yield

Realty Income’s dividend yield is somewhat high compared to the past 10 years.

Source: Finchat

Earnings Growth

We need 3 numbers for this model:

AFFO/Share Growth: 4.5%

Dividend Yield: 5.4%

Change in P/AFFO Multiple: 1% expansion (17 to 19 over 10 years)

Expected Return = 4.5% + 5.4% + 1% = 10.9%

Reverse DDM

Here’s the formula:

Expected growth = Required return – (DPS next year / Current share price)

Let’s put some numbers in for Realty Income:

Required return: 10%

DPS next year: $3.24 (2.5% growth)

Current share price: $56

Expected growth = 10% - ($3.24 / $56) = 4.2%

This tells us that the market is pricing in a 4.2% growth in the dividend

5-year DPS CAGR: 2.9%

Conclusion

Investing in REITs can seem complicated, but once you understand the industry-specific metrics, evaluating a REIT is very similar to evaluating a dividend paying stock.

REITs provide a simpler, more liquid way to invest in rental properties, with less paperwork involved.

They can provide:

High Dividend Yields: They’re required to distribute at least 90% of their taxable income as dividends, resulting in higher dividend yields compared to many other stocks

Steady and Reliable Payments: Rental income is a stable and predictable source of income

Diversification: Adding REITs to a portfolio can provide exposure to the real estate asset class, which tends to have low correlation to stocks and bonds

Potential for Capital Appreciation: Share prices can appreciate over time as the underlying property values and rents increase

Professional Management: Gain access to institutional-quality real estate portfolios managed by experienced real estate investment teams

Liquidity: REIT shares can be easily bought and sold on stock exchanges, providing more liquidity compared to direct real estate ownership

One Dividend At A Time

TJ

PS The best investment is always one in yourself. Want to learn more? Join Compounding Dividends here.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

REITs are a fantastic way to get into real estate and collect a dividend income stream! Best of all, you don't have to deal with calls at 3am to fix burst water pipes.

In addition to FFO payout ratios and all that, I also look at Debt/Assets, Debt/Equity, and EBITDA/Interest Expense. These are additional "sniff checks" for me to see how well management is handling debt. The last one is interesting because it shows how many times over their earnings are used to pay for interest expenses. The REIT could have so much expensive debt that all of their earnings are being funneled to not paying down debt but just paying their lenders interest!

Some investors also get confused about the ever rising share count for the typical REIT. I'll see complaints about this in the comments section of Seeking Alpha.

"My ownership is being diluted!"

"Management is careless!"

"New stock issuance is killing my stock price!"

Many don't know or understand that REITs are obligated under law to pay out at least 90% of profits to shareholders. After doing that most REITs have almost no money left over to grow their portfolios. The only course of action they can do to raise money (other than sell a property) is to issue stock. Yes, this will cause a momentary drop in the stock price. Use that as a buying opportunity! Strawberry FIelds recently issued something like $35M of stock (~3.3M shares). The stock price fell by 24% or so, from $12.42 to $9.40. Management's test is how they use the proceeds. Is this capital cheaper so that it can replace more pricey capital? Are they going to use this capital to buy some way, way, way underpriced property that will bring in rent by the truckload? Or, is management going to throw a daily pizza party for employees and buy a private jet.

You won't see explosive growth like you would with NVIDIA. REITs are for those who want steady-eddy dividends so they can comfortably and reliably live their lives.

This was a great article, TJ. Thanks for writing it.

How does a REIT compare to an ETF that tracks real estate, like VNQ?

In the future, will you be providing examples of specific REITs that you feel are interesting investment opportunities?