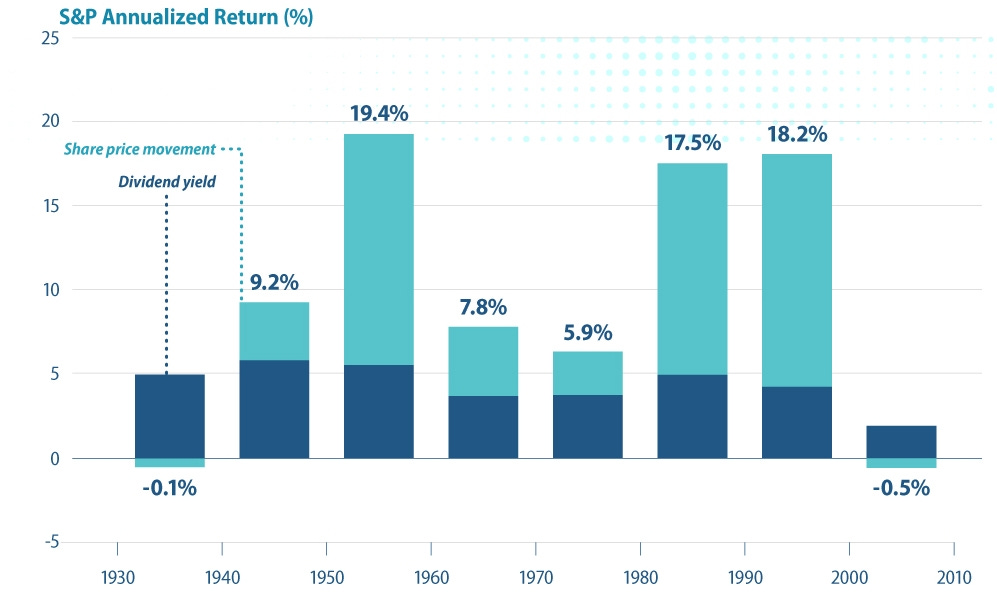

💸 The Power of Dividends

Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Dividend Stability

Do you want to sleep well as an investor?

Companies that pay out a dividend are way less volatile:

Source Visual Capitalist: The Power of Dividend Investing

2️⃣ Reinvest your dividends

If you invested $10,000 in 1960, you would have $460,000 today.

When you would have reinvested your dividends, you would have almost $2.6 million!

Reinvest your dividends and let the magic of compounding do its work for you.

Source: Morningstar

3️⃣ A dividend quote

Buying a stock makes you the owner of a company.

The dividends you receive can be seen as the interest payments in your bank account.

"Successful investing is about owning businesses and reaping the huge rewards provided by the dividends and earnings growth of our nation's - and, for that matter, the world's - corporations." - John C. Bogle

4️⃣ Great investors like dividends

Walter Schloss took a night class from Benjamin Graham, then went on to compound capital at over 20% per year for almost 30 years.

He was the first investor Buffett mentioned in the famous “Superinvestors of Graham-and-Doddsville”.

Why Walter Schloss likes stock dividends? You can find it here:

Source: Finding Compounders (Twitter)

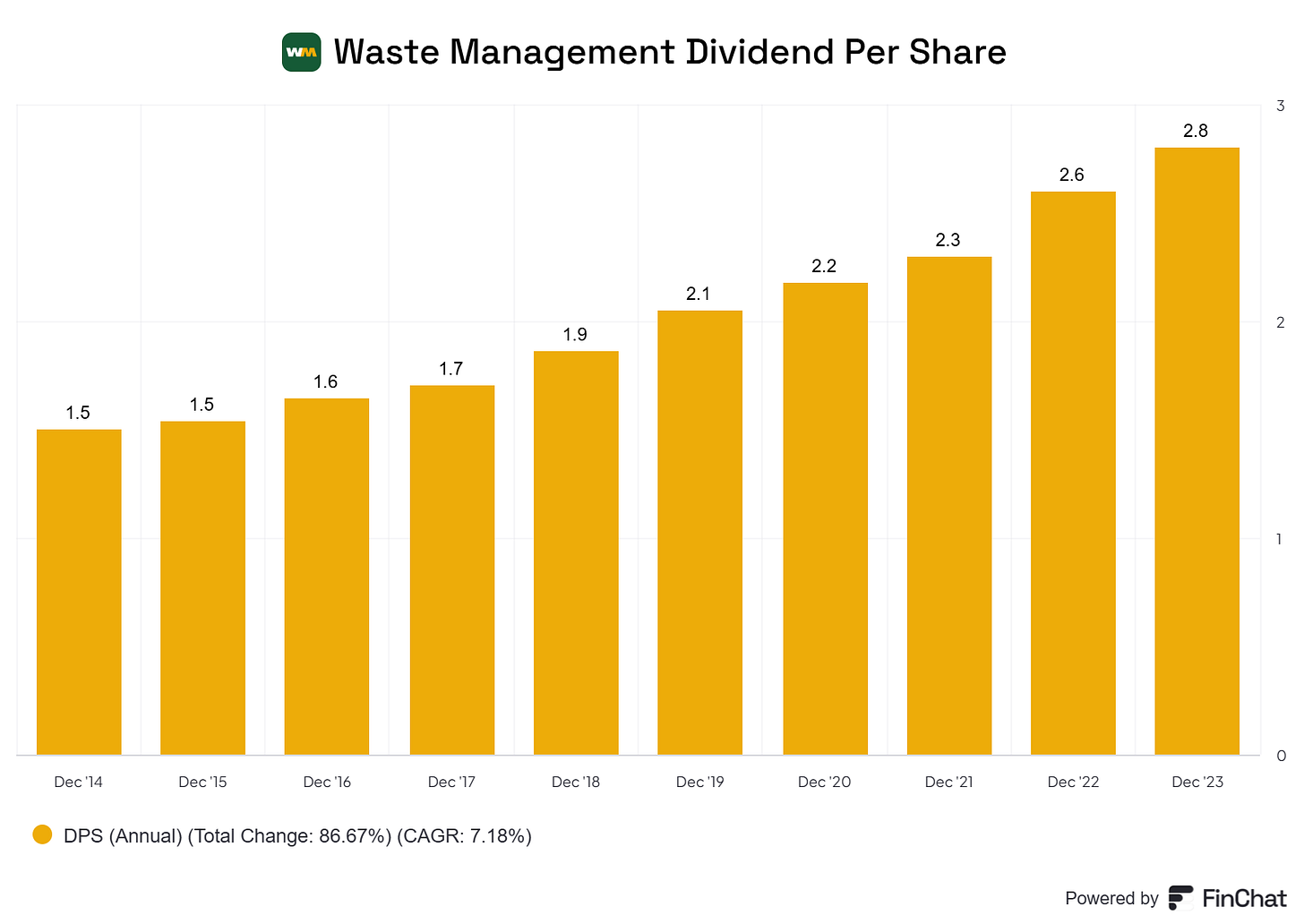

5️⃣ Example of a dividend stock

Waste Management has been growing its dividend since the Great Financial Crisis in 2008.

Profit Margin: 12.1%

Forward PE: 26.0x

Dividend Yield: 1.5%

Payout Ratio: 22.1%

Source: Finchat

This is the type of chart we love to see!

🙏 Blessed to have you 🙏

Great news! Compounding Dividends is expanding.

We are very proud to welcome TJ Terwilliger as a writer.

He will make sure that Compounding Dividends uses a clear structure (just like Compounding Quality):

Each Wednesday: You get 5 Dividend insights in less than 5 minutes

Each Saturday: You get a full article (deep dive)

🙏 Help me welcome TJ by liking this post. We are truly blessed to have you! 🙏

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

But there is a tax rate of 30% on dividends in Belgium (>812€), plus in some cases also a foreign withholding tax. Would you then still opt for this 'only'because of less volatility? Thanks

Hello TJ Terwilliger! 👋 I'm looking forward to seeing more of your articles here! ☺️

Reinvesting dividends back into stock increases your yield on your original investment (or simply cost), especially if the dividend is increased. Even in my short investment journey I see my yield on cost for some of my business holdings rise to as high as 15%. I think this where another quote from Charlie Munger fits in well. Never interrupt compounding unnecessarily! 📈

I see many people on Seeking Alpha complaining about the less-than 1% yield on Apple and Microsoft and that the dividend is so low it should be removed. No, it shouldn't! ⛔ That would punish long term holders whose yield on cost could be well over 7% or even 10%!

At some point I will see my original investment returned to me through all past dividends and future dividends will be like an endless milk chocolate bar that I can munch on forever. 🍫 Just for fun, I track in my spreadsheet how much of my original I received back. My three highest are ExxonMobil (XOM) at 34.6%, Hercules Capital (HTGC) at 32.3%, and OneMain Holdings at 27.8% 👍