💸 The market's falling-what are you going to do?

Plus an article from Wall Street's wisest man

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

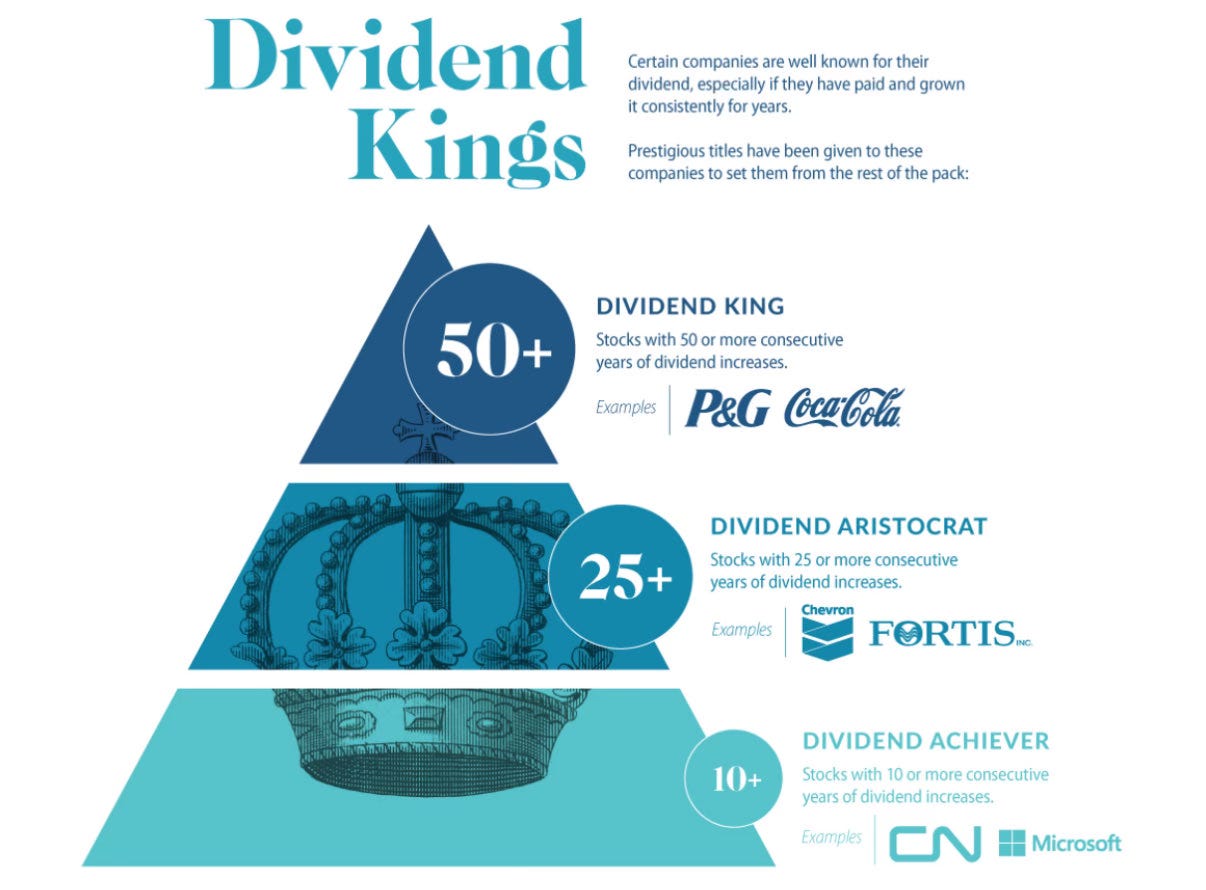

1️⃣ Dividend Kings: A Guide for Investors

In the world of dividend investing, certain companies stand out for their exceptional track records. This infographic highlights three categories of dividend-paying stocks:

Dividend Kings (50+ years): These elite companies have increased their dividends for over 50 consecutive years, showcasing remarkable resilience.

Dividend Aristocrats (25+ years): Firms in this category have raised their dividends for at least 25 years. They demonstrate a strong commitment to returning value to shareholders.

Dividend Achievers (10+ years): These companies have consistently increased dividends for a minimum of 10 years, indicating stable growth and reliability. Some of the next Dividend Aristocrats and Kings are in this list.

Investing in these categories can provide a reliable income stream and potential for long-term growth.

2️⃣ The market's falling-what are you going to do?

Panic?

Or finally take advantage?

Here’s the secret the pros understand - but almost no one talks about.

You have to stop thinking about what’s happening this week, or this month.

And start thinking about the next ten years.

Because ten years from now…

Garbage will still need to be picked up.

Businesses will still need cloud services.

And people will still be ordering way too much stuff from Amazon.

3️⃣ An Investing Quote

You can’t predict bear markets, but here’s what you can count on…

They happen, and every time - the crowd panics. They sell. They scream. They swear off stocks forever.

That’s your cue that it’s a good time to buy.

It’s not complicated, but it takes guts.

“There will be bear markets about twice every 10 years and recessions about twice every 10 or 12 years but nobody has been able to predict them reliably. So the best thing to do is to buy when shares are thoroughly depressed and that means when other people are selling.”

- John Templeton

4️⃣ Wall Street’s Wisest Man

In June of 2001 - during the dot com crash, Jason Zweig did an interview with Charley Ellis.

It’s full of wisdom that’s applicable today - here are some of my favorite pieces:

Stocks getting cheaper should be good news

Acting rationally when everyone else is emotional is a great way to make money

Good investing is boring - like the process at a toothpaste factory

Click the image to read the article.

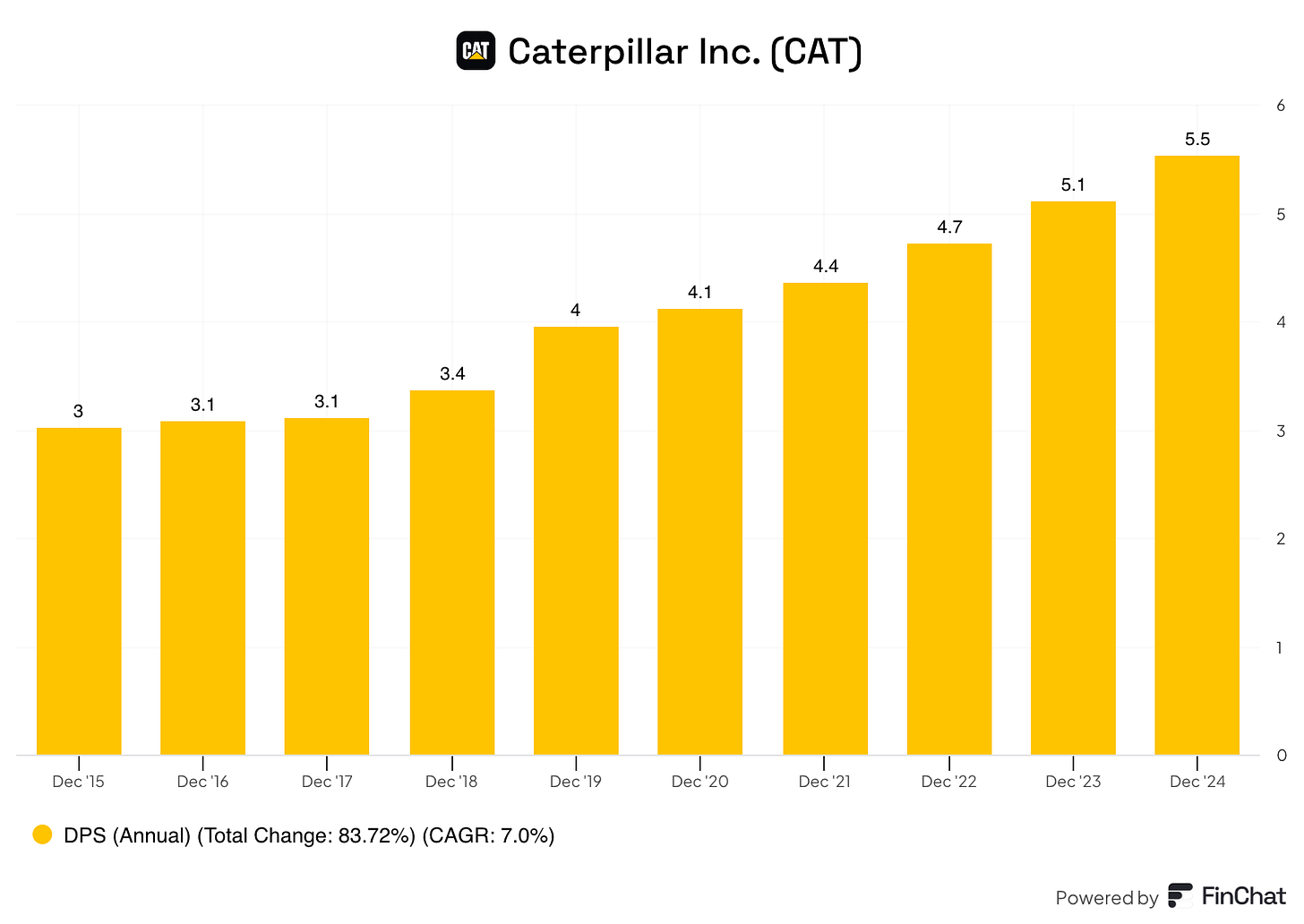

5️⃣ Example of a Dividend Stock

Caterpillar is a company that will still be around in 10 years, and the share price is down 20% so far this year. Let’s take a look at it.

They sell heavy machinery, engines, and equipment used in construction, mining, and agriculture.

Profit Margin: 16.7%

Forward PE: 15.5x

Dividend Yield: 1.7%

Payout Ratio: 24.9%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Thanks for sharing my post from X!