👋 Howdy Partner!

When stocks fall… most people panic.

They sell, curse the market, and swear off investing “until things calm down.”

But guess what?

Smart investors know that volatility is not the enemy. It’s an opportunity.

And if you understand the hidden power of dividends… you might even hope for the next crash.

Let me explain.

The One Thing the Market Can’t Touch

When the market crashes… share prices drop.

Sometimes a little. Sometimes a lot.

But there’s one part of your investment the market can’t take from you.

Your dividends.

It doesn’t matter if the stock drops 20%… 30%… or even 50%.

As long as the company continues paying its dividend, you still get paid.

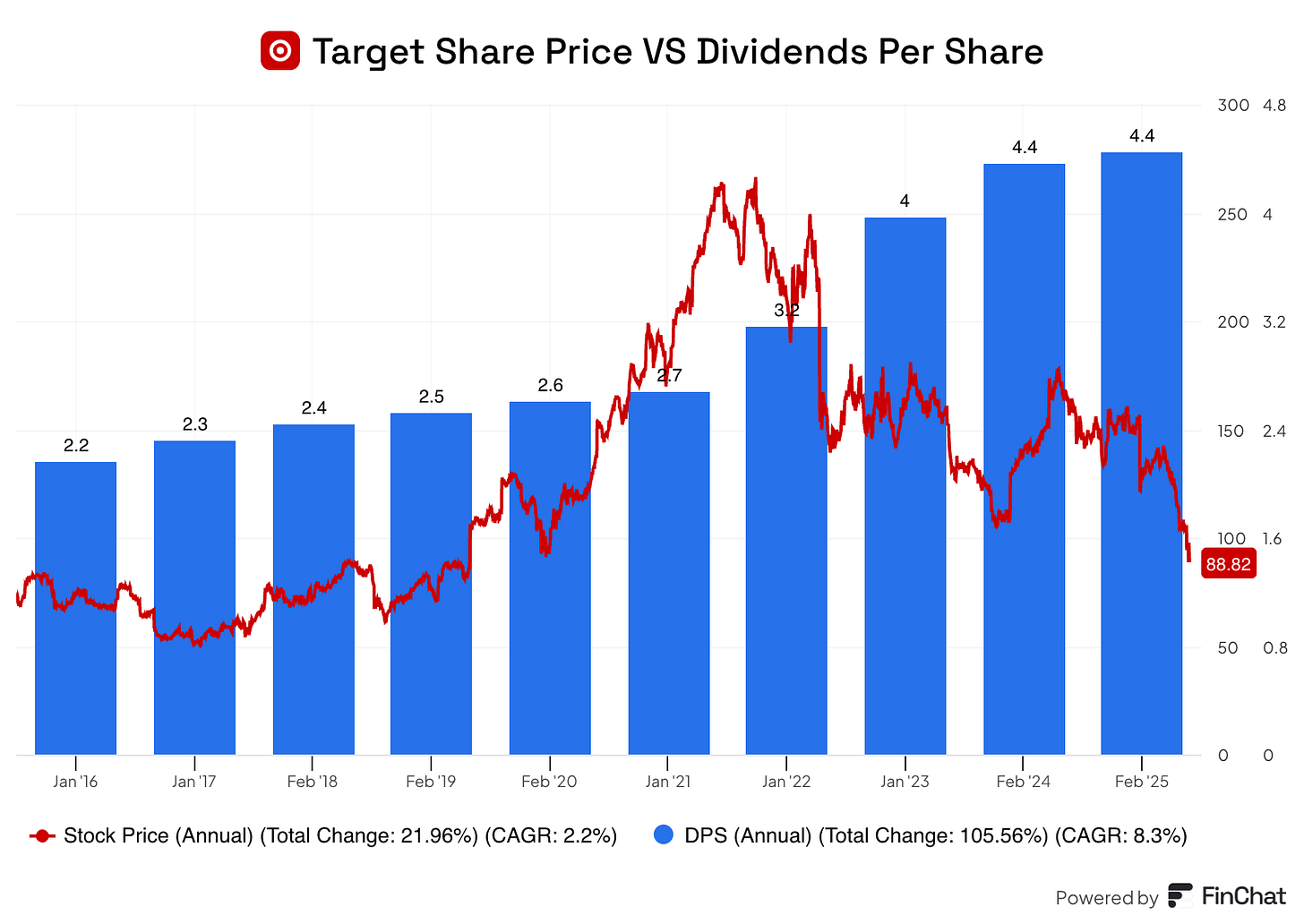

Look at Target - the stock price has been falling since 2021.

But the dividend? Up every year.

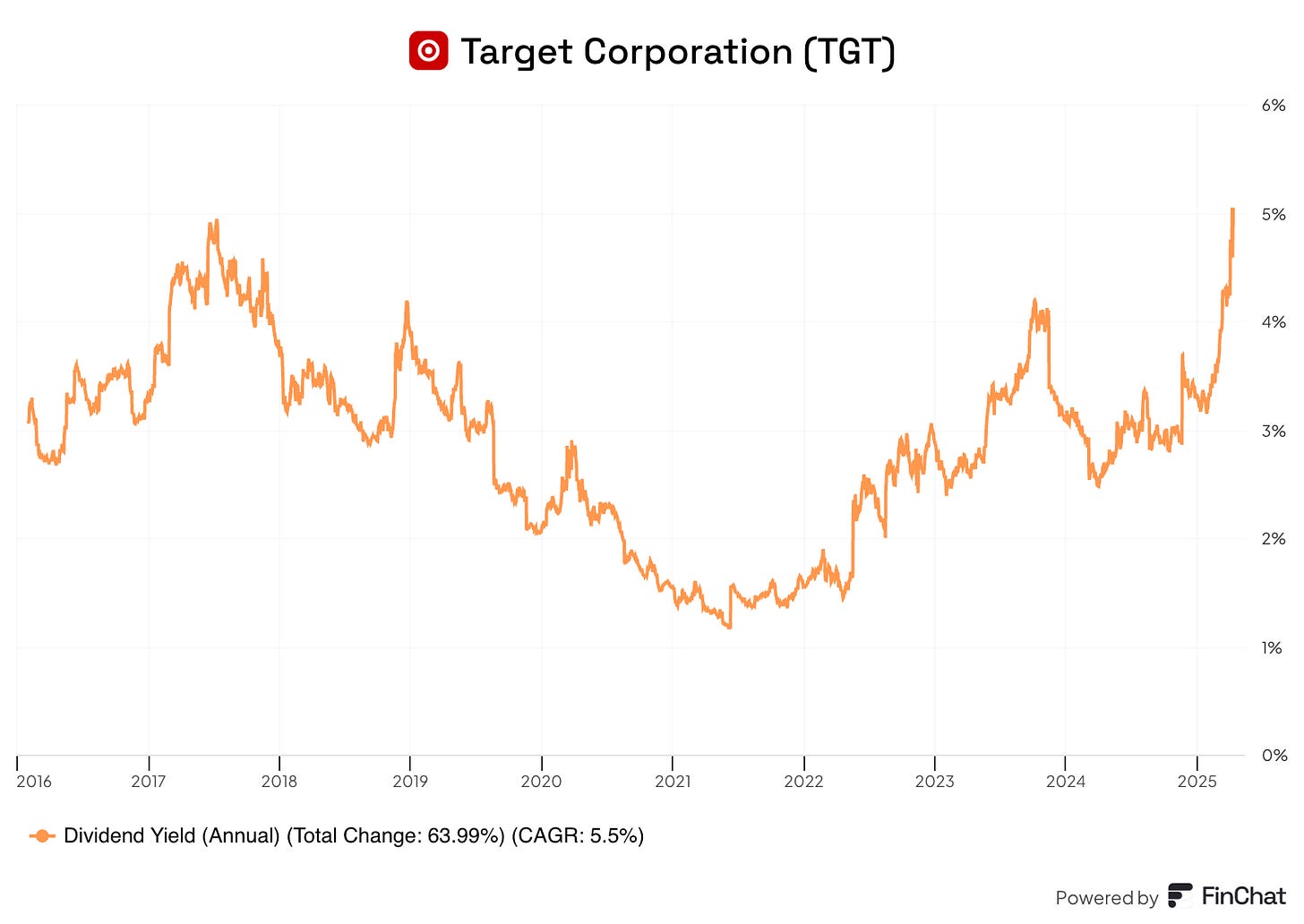

The Crazy Part? Yield Goes Up

Let’s say you bought a stock for $100 that pays a $4 annual dividend.

That’s a 4% yield.

Now imagine the market crashes… and your stock drops to $80.

The dividend stays the same – you still collect $4 a year.

But now the dividend yield isn’t 4% anymore.

It’s 5%.

And if the stock drops to $60?

You could now earn 6.7% on the same company.

You can paid more when you buy during a downturn.

Here’s Target’s yield during the same time period - look at how it goes up as the stock price goes down.

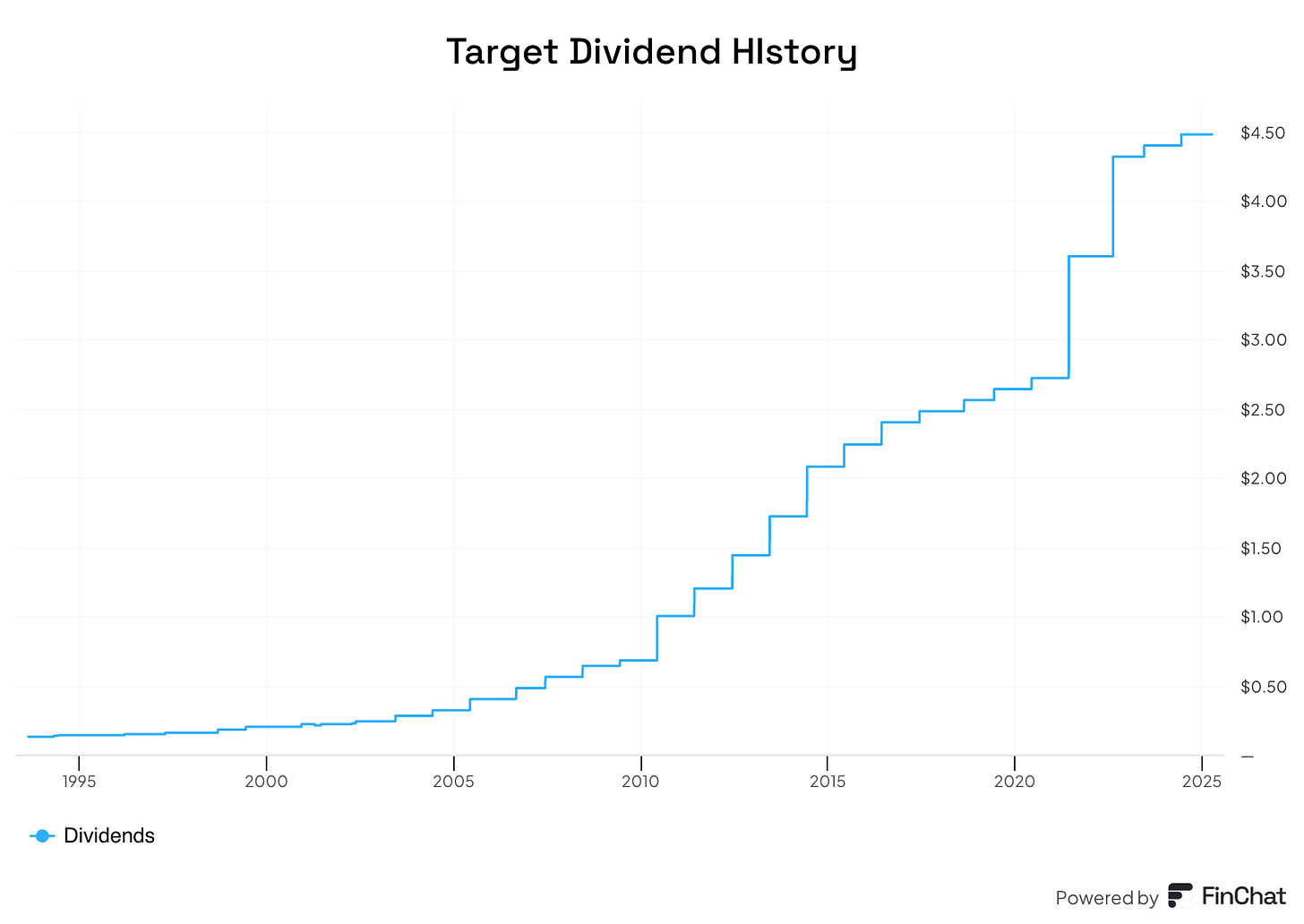

Dividends Are Sticky. For a Reason.

Here’s what most people don’t understand.

Cutting a dividend is a last resort.

When a company lowers its dividend, it tells investors one thing loud and clear:

“We’re in trouble.”

That’s why management teams do everything they can to maintain payouts… even in tough times.

They cut costs.

They sell assets.

They delay projects.

But they keep the dividend.

Because it’s a promise to investors.

And breaking it has consequences.

Target has raised its Dividend for 54 years - it’s a Dividend King, and management doesn’t want to give up that throne.

Buffett’s $816 Million Dividend Check

Warren Buffett understood this back in the 1980s.

That’s when he bought a massive stake in Coca-Cola.

Today, that same stake pays him $816 million in dividends every single year.

That’s $204 million quarterly

$2.23 million daily

Not bad considering Berkshire Hathaway paid a total of about $1.3 billion for its stake in the company from 1988 to 1994.

Buffett didn’t buy Coke at a high yield - it was about 2.8% when he started buying.

But because he bought it cheap… and held it, over time, the yield on his original investment soared.

It’s what we call “yield on cost.”

Buffett is earning more than 60% a year on what he originally paid.

That’s the magic of growing dividends.

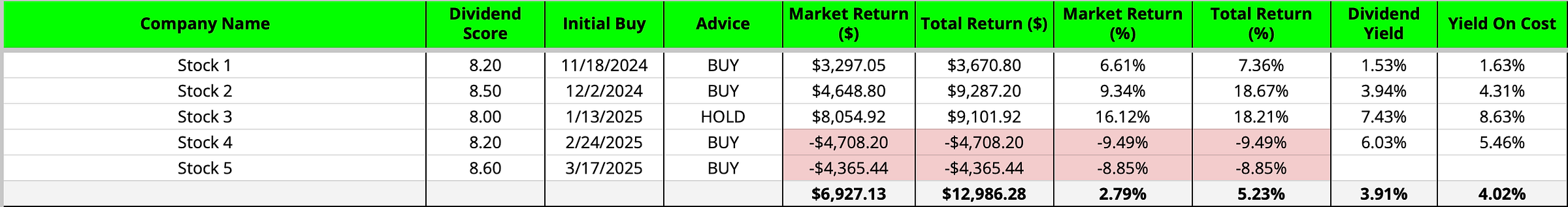

Our Portfolio Proves the Point

If you’ve been following our portfolio, you know the results.

Since our launch in November, the S&P 500 is down 8.6%.

We’re up more than 5%.

That’s not luck.

That’s the power of high-quality dividend stocks.

We focus on businesses that are built to last.

Companies with real profits. Real cash flows. And a long history of paying shareholders.

When the market panics, our stocks hold firm.

And our income doesn’t budge.

Want to Sleep Better During the Next Crash?

Then own dividend stocks.

Not the flashy kind. Not the “hope and hype” tech stocks.

I’m talking about the companies that treat their shareholders like partners.

The ones that have paid – and raised – their dividends for decades.

Because when the market crashes, you’ll have something most people don’t.

Cash flow.

Peace of mind.

And maybe even a higher yield.

Bottom line:

Market crashes hurt. But if you own the right dividend stocks…

They’re a blessing in disguise.

Keep collecting. Keep compounding. Keep calm.

Because the next crash might just be your biggest payday yet.

One Dividend At A Time,

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data