💸 The $8 Million Janitor

Everyone can get rich with dividend stocks

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

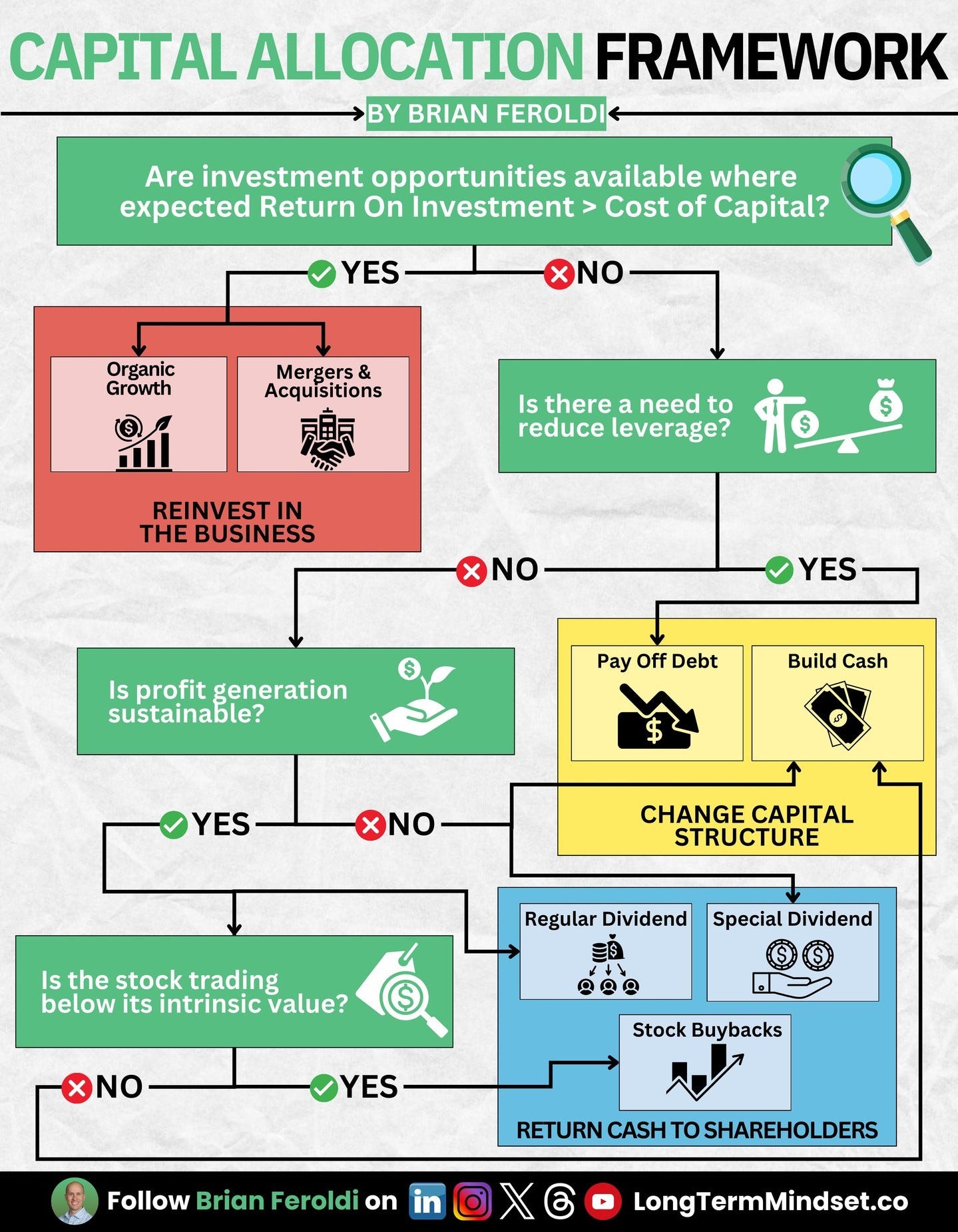

1️⃣ Capital Allocation

The most important task of management? Making capital allocation decisions.

The picture shows the long-term approach we want managers to take.

Before paying dividends or buying back shares, they should focus on growing and sustaining the business.

2️⃣ Record Inflows

Last month, people invested $140 billion into US stock funds.

This is the largest amount in a single month since the year 2000.

Investors seem to be very confident about the US stock market.

3️⃣ An investing quote

Richard Russell was an investment newsletter author.

He wrote the Dow Theory Letters from 1958 until his death in 2015 at the age of 91.

He was known for his contrarian and cautious investment approach, often urging readers to be wary of irrational exuberance in the markets.

“A stock dividend is something tangible - it’s not an earnings projection; it’s something solid, in hand. A stock dividend is a true return on the investment. Everything else is hope and speculation.” - Richard Russell

4️⃣ The $8 Million Janitor

Do you know about Ronald Read?

He had a regular job that didn’t pay a lot.

Why am I telling you about him?

Because he saved almost $8 million by investing in stocks that paid dividends!

Click the picture to read his story on X, or the link below it if you don’t have an account.

If you don’t have an account on X, you can read the story here.

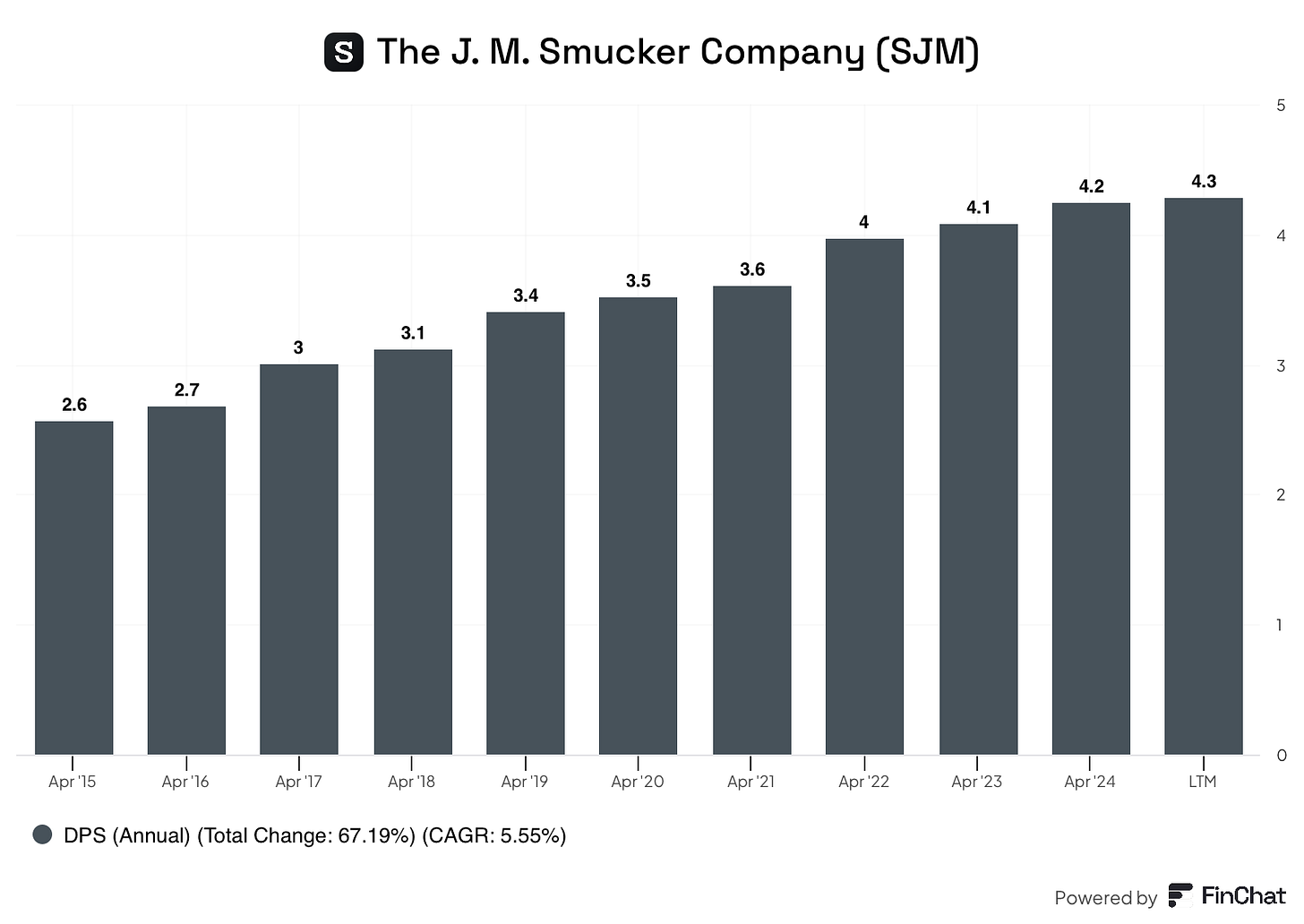

5️⃣ Example of a dividend stock

Today we’ll look at one of the stocks Ronald Read owned.

J.M. Smucker sells consumer food and beverage products, like Folgers coffee, Jif peanut butter, and Uncrustables frozen sandwiches.

Profit Margin: 9.1%

Forward PE: 11.8x

Dividend Yield: 3.7%

Payout Ratio: 86.4%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I remember reading about Ronald Read when he passed away. This was a long, long time before I wanted to become an investor. Stories like Ronald's are more common than we think. I'm sure we're all familiar with the book, "The Millionaire Next Door". In that book we learn the habits of millionaires (i.e. "rich folks") and it turns out that most of them live surprisingly frugal and modest lives. The typical millionaire doesn't have two new supersized trucks. You won't see them in fancy-expensive clothes and don't expect a Rolex watch on their wrist. This kind of frugality naturally leads them to spend less than they earn and the excess money is saved and invested.

Ronald is an extreme (lucky?) case because he lived beyond frugally. He wasn't miserly - just super, super, super frugal. Also, his investments exploded upward and compounded several times over. The wealth and the numbers didn't seem to get to him because he saw it grow slowly and organically. He got used to seeing them and acknowledging them that it was a natural part of his financial life. I think he looked at his portfolio like he would a pencil sharpener. It's there on his table, works when he needs it, but leaves it alone otherwise.

Some would say that he could and should have lived it up a little more. Then again, he probably didn't care for those activities and pleasures. He did what he wanted, how we wanted, when he wanted. That right there is living rich to me - complete control over your time on this earth.