Hi Partner 👋

Welcome to this week’s 🔒 exclusive edition 🔒 of Compounding Dividends. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

Last week, we shared more than 450 interesting dividend growth stocks with you.

But High-Yield Companies can be very interesting too.

Today's list includes all interesting High-Yield Companies.

Our Dividend Portfolio

Even though we're focusing on High-Yield Companies today, we’re still looking for good businesses with:

Sustainable competitive advantages

Quality management

Healthy balance sheets

Attractive histories of growth

“The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.” - Benjamin Graham

Creation of the watchlist

Our watchlist is split into three parts:

Dividend Growth Stocks: Stable companies that raise their dividends every year

High-Yield Stocks: Companies that return a lot of capital as dividends

Cannibal Stocks: Companies that heavily buy back their own shares

The goal is to provide you with a reliable income stream.

The company can’t keep raising its dividends if earnings don't grow while growing your dividends.

High-Yield Companies

Today’s article will focus on High-Yield Companies.

These companies have yields much higher than the market yield.

High-Yield Companies are interesting because they generate a lot of income.

The image shows that the higher the yield, the less you need to invest to get the same $500 dividend payment.

High-Yield Companies Perform Well

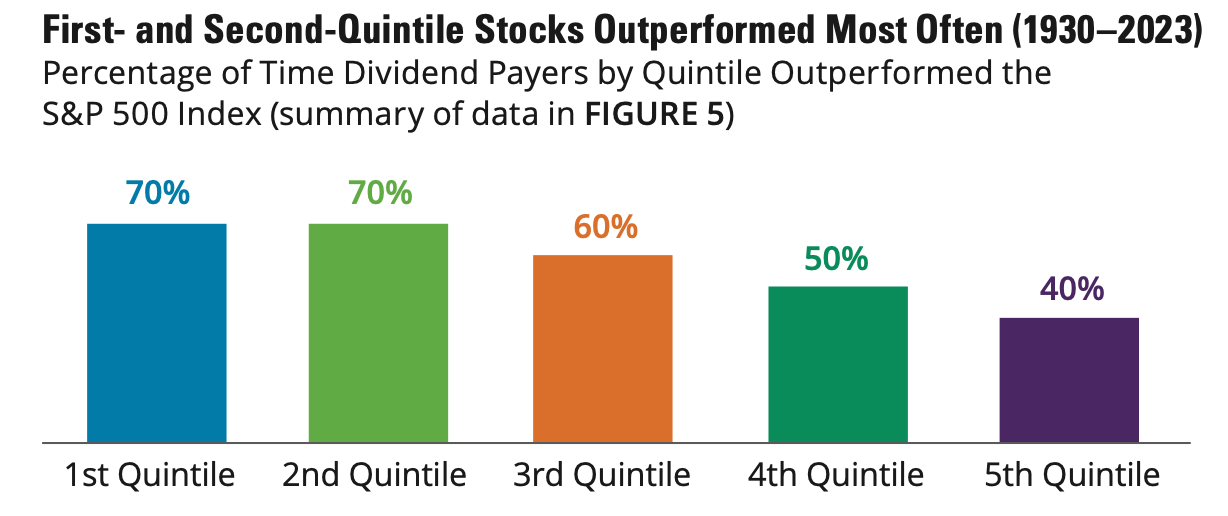

Wellington Management found that companies in the top 40% of dividend yields outperform the S&P most often:

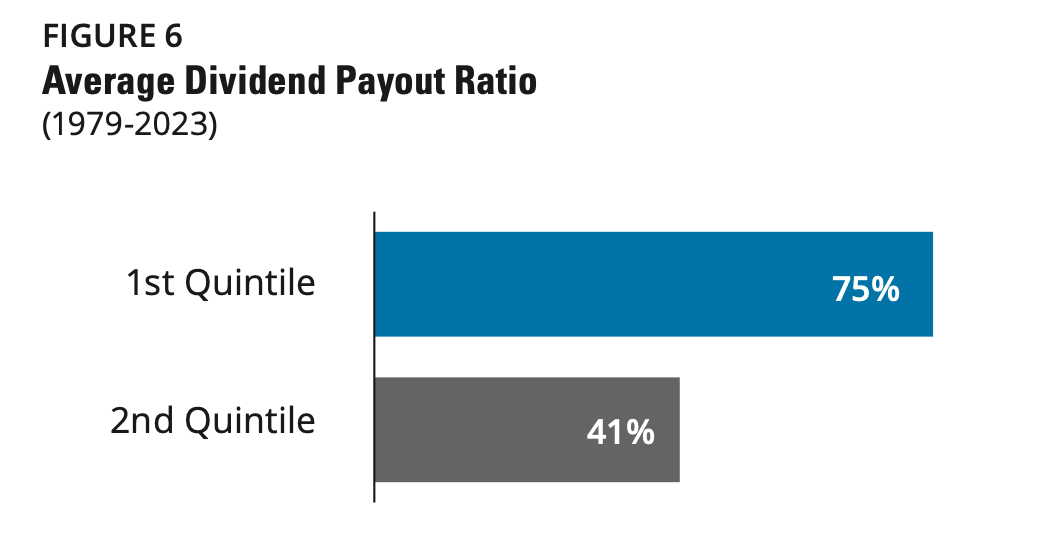

High-Yield Doesn’t Mean High Payout Ratio

A common criticism of High-Yield Companies is that they pay out too much in dividends.

The same study found this isn’t always true.

Reinvestment

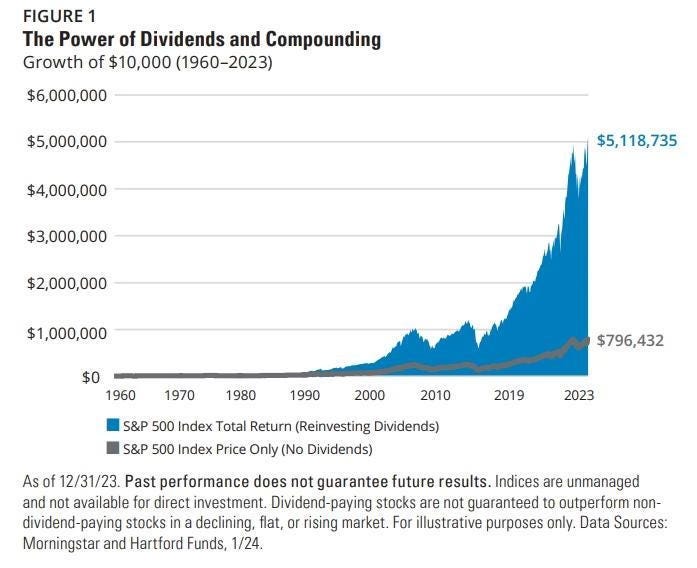

The beautiful thing about High-Yield Companies is that they’ll reliably provide you income.

This allows you to retire comfortably.

But until you retire, you can reinvest your dividends.

This fuels compounding over time.

A Historical High-Yield Example

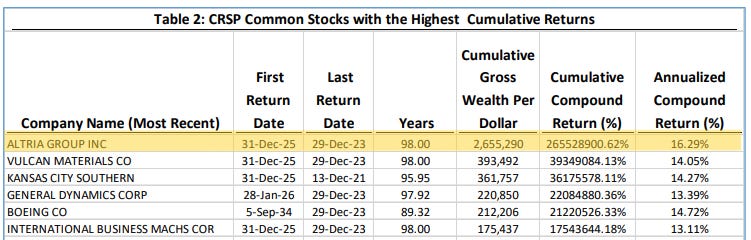

We’ve talked about Altria being the best performing stock over the past 100 years before.

Altria was formerly known as Philip Morris. They’re a tobacco company that sells cigarettes, primarily under the Marlboro brand, as well as smokeless tobacco products.

They have grown at over 16% per year for the last 98 years.

A $1 investment in Altria in 1925 is worth over $2.6 million (!) today.

Source: Which U.S. Stocks Generated the Highest Long-Term Returns?

Altria’s More Recent Performance

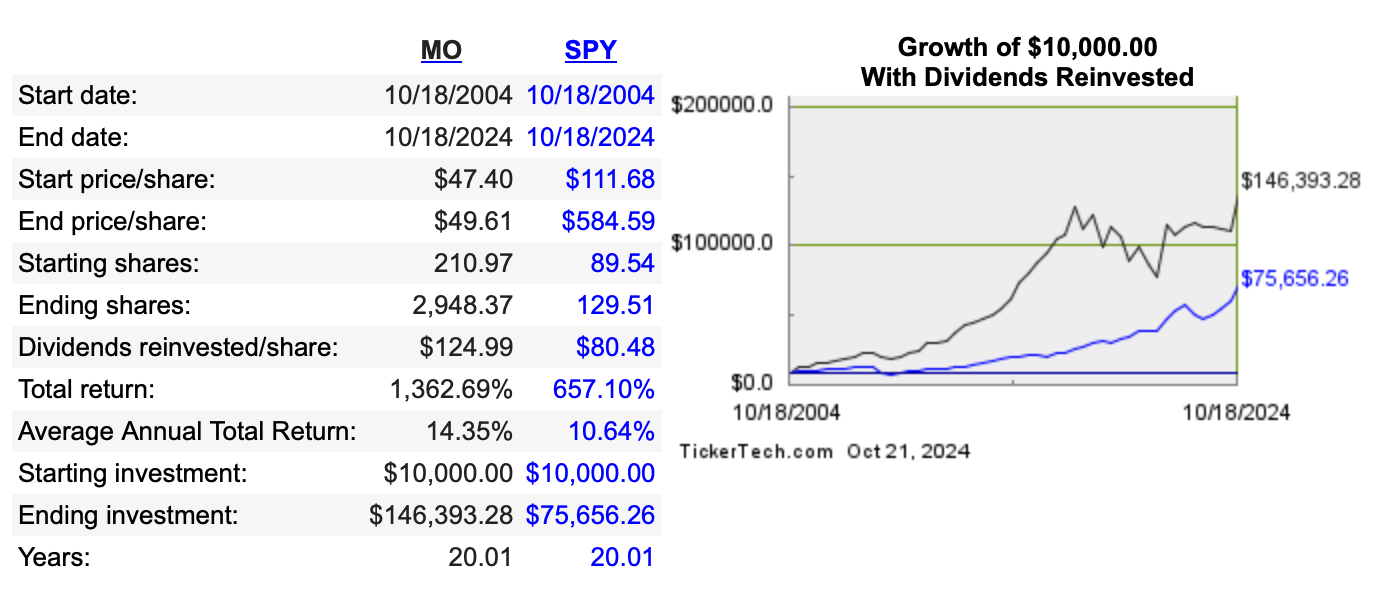

Buying Altria in 1925 would have been great, but most of us weren't investing back then.

What about a more recent investment?

If you invested $10,000 in Altria 20 years ago and reinvested your dividends, you would have earned over 14% per year, outperforming the S&P.

Even better?

You’d now receive more than $11,000 in dividend payments each year - more than your original investment!

One more interesting point:

These returns happened with a flat stock price! Altria was trading at $47.40 when this example started, and ended at $49.61.

Reinvesting your generous dividends made this possible.

Selecting the companies

For the High-Yield Bucket, we looked for companies with dividend yields that are much higher than the S&P (currently 1.3%).

Our Criteria:

Dividend Yield: 3.75% or higher

5-Year Dividend Growth: 3.75% or more

Revenue Growth: 3% or more

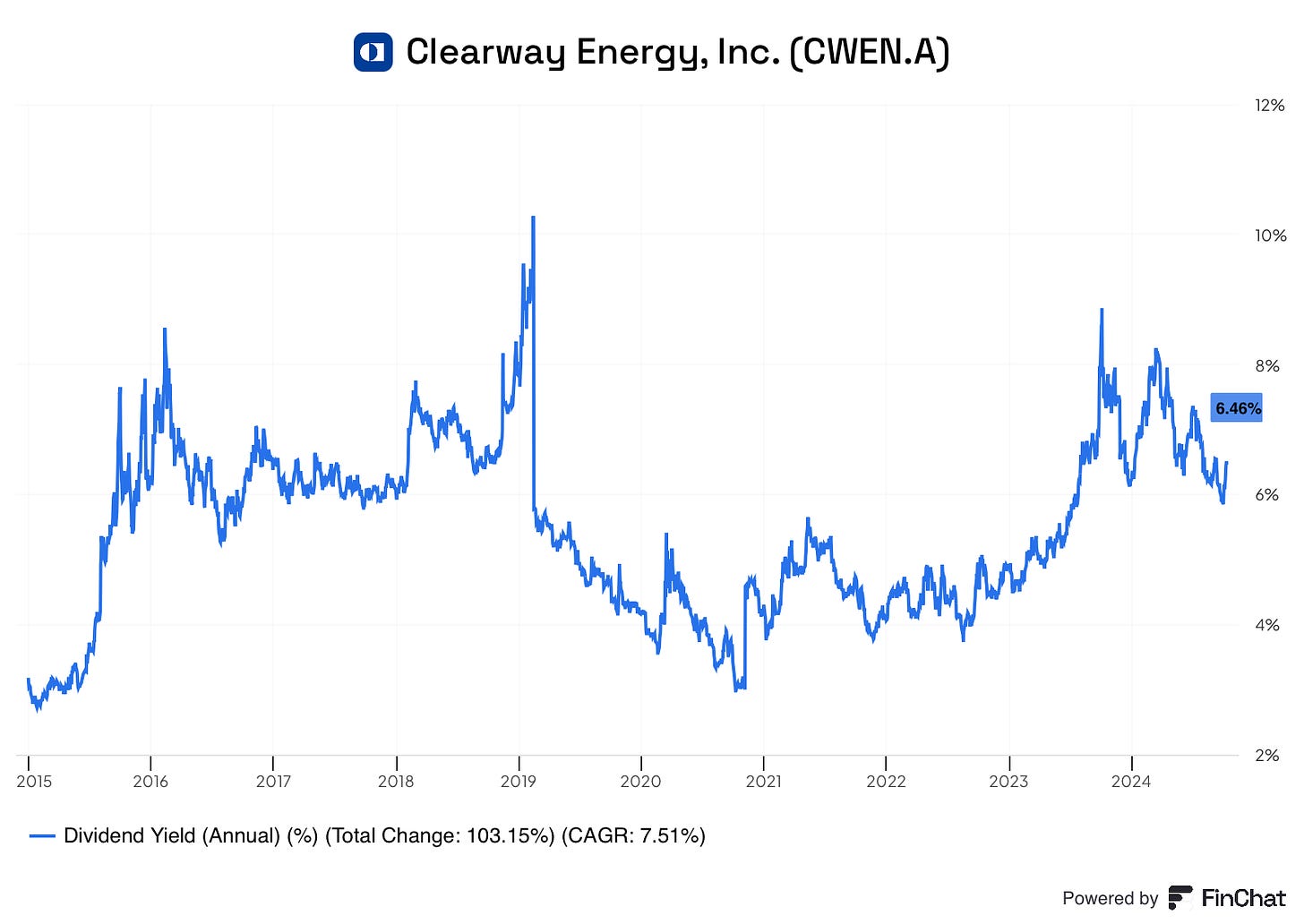

An example from our list? Clearway Energy.

Clearway generates electricity using wind and solar.

They currently have a dividend yield of over 6%.

Source: Finchat

Our Portfolio will be built based on the watchlist.

Partners of Compounding Dividends will get access with 100% transparency.

This allows you to watch our entire Portfolio 24/7.

Does this interest you?

Consider becoming a Partner of Compounding Dividends.

If you join this month, you enjoy a discount of 30%:

A Few Highlights

The highest yielding company on the list:

🖥️ CMB Technology at 21.1%

A few High-Yield Companies with strong Dividend Growth:

🏬 Main Street Capital: 10% per year

🛜 Cogent Communications: 12% per year

The average dividend yield in the High-Yield Universe is 6.3%.

This means that an investment of $10,000 yields you $630 in dividends every single year!

The High-Yield Universe

Are you ready to look at more than 190 companies with strong dividend payouts?

Let’s dive into the list!

![High-Yield Topics for MRCP Part 1 [Highly Recommended] High-Yield Topics for MRCP Part 1 [Highly Recommended]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff1559558-3062-4d94-bc75-bfae1e53eb23_1024x440.jpeg)