Dear Partner,

Today I want to share the Compounding Dividends Owner’s Manual which tells you exactly what to expect.

The goal of Our Portfolio is to build a reliable income stream while growing your wealth.

How? One Dividend At A Time.

We are partners

Please note that I called you a Partner in the first sentence of this email.

From now on, I’ll always call you a partner.

Why? Because we’re in this together. My money will be invested in the portfolio with 100% transparency.

This means I eat my own cooking.

If you do well, I do well, and the other way around.

“My wife, Susie, and I have more than 99% of our net worth in Berkshire Hathaway.” – Warren Buffett

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as owner-operators.” – Warren Buffett

“I think I've been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I've underestimated it.” - Charlie Munger

Why is an Owner’s Manual important?

An owner’s manual is essential to make sure that you start this journey with proper expectations.

Compounding Dividends will not aim for the highest possible return.

Instead, we aim to do the same thing as Warren Buffett. We are business owners.

“Our goal is to make meaningful investments in businesses with long-lasting favorable economic characteristics and trustworthy managers.” - Warren Buffett

We think the best way to buy a stock is like buying a local business:

Pick a business that has done well and grown before

Make sure it will keep growing in the future

Get a good manager to run it day-to-day

Pay a price based on how much money you can take from the business over time

Then, we relax and enjoy the money coming in, without stressing about what the market says our business is worth today or what people might pay for it in 5 or 10 years.

If that sounds good to you, then Compounding Dividends might be something you'd like.

The essence of the portfolio

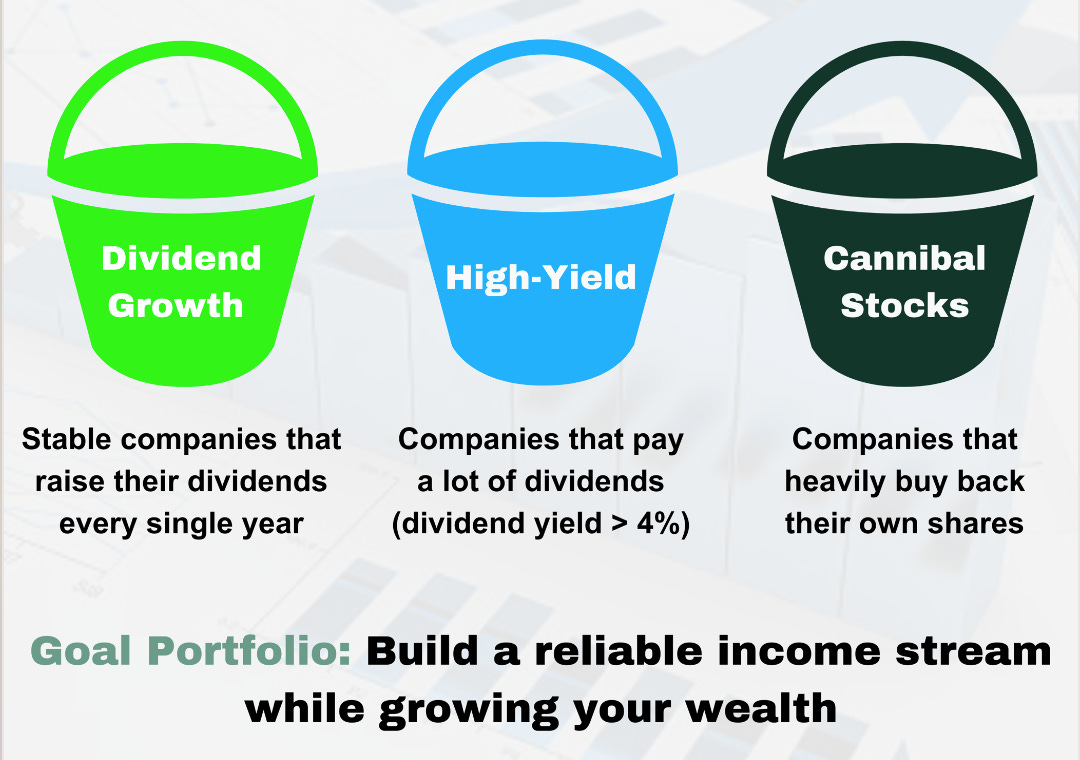

We will invest in 3 buckets of Dividend Stocks:

Dividend Growth Stocks

Stable companies that have raised their dividends for at least 10 years in a row.

Over the past 20 years, stocks of companies that consistently grew their dividends returned an average of 10.7% per year, compared to 7.3% for non-dividend payers.

“The prime purpose of a business operation is to pay dividends regularly and, presumably, to increase the rate as time goes on.” - Benjamin Graham

High-Yield stocks

These companies have a high dividend yield (> 5%)

High-yield stocks add income to the portfolio, as well as stability - they tend to fall less in market downturns.

“A stock dividend is something tangible - it’s not an earnings projection; it’s something solid, in hand. A stock dividend is a true return on the investment. Everything else is hope and speculation.” - Richard Russell

Cannibal stocks

Companies that heavily buy back their own shares

When outstanding shares decrease, your stake in the company increases

“Pay close attention to the cannibals.” - Charlie Munger

Portfolio Characteristics

✅ The portfolio will invest worldwide (developed countries only)

✅ We’ll own 15-20 stocks

✅ The portfolio goal is to build a reliable income stream while growing your wealth

✅ We won’t trade a lot. Activity and costs harm our results

✅ We won’t try to time the market (We’re way too dumb for that)

✅ The characteristics of companies in the portfolio:

Sustainable competitive advantages

Quality management in place

Healthy balance sheet

An attractive history of growth in earnings and dividends

Good capital allocation

History of returning capital to shareholders

Ability to grow shareholder returns in the future

Trading at fair valuation levels

Portfolio goal

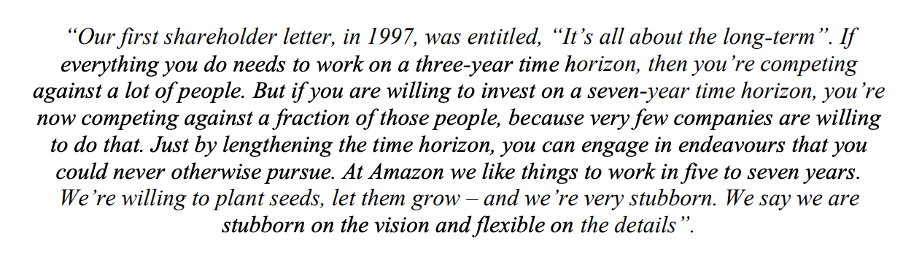

Our portfolio will focus solely on the long term.

While Wall Street likes to think in quarters, we like to think in quarter decades.

Here’s what Jeff Bezos has to say about this topic:

The goal of the portfolio?

To build a reliable income stream while growing your wealth.

Become a Partner

You want to join this journey?

Become a Partner of Compounding Dividends and get access to everything:

One Dividend At A Time

TJ & Pieter

This was quite a revealing article about the Compounding Dividend approach!

I take it the portfolio will exclude CEFs, then since they are funds and not companies?

How would you recommend using both Compounding dividends and compounding quality for investments for an 18 y.o? for a 62 y.o.? An equal split? more dividends for the younger or older ? How would you use the ETF vs stock choices in the dividends portion.

where do I look for the current portfolio?

thank you