Dividend Week

Hi Partner 👋

You clicked here to take your "Dividend Week" education even further.

But why am I right here with you today?

Well, I have a confession to make…

Something had been torturing me in the past few months.

I’m only talking about torture in an intellectual sense.

But this issue cuts deep into the heart of my investment philosophy.

What if you are someone like my dad?

He already has some capital and is just looking to generate extra income from his investments.

Compounding Quality isn’t here, I’m afraid.

Should he invest in risk-free bonds?

That would be terrible. My dad’s buying power would decline year after year.

And because my dad isn’t the only one in this situation…

I’ve decided it’s time to introduce a better strategy to generate income AND protect your buying power AT THE SAME TIME.

This 120% gain is a problem

“Capital allocation is the most important task of the CEO.” – Compounding QualitySince I began investing, my core philosophy has always been to buy companies that have already won and are on track to keep winning.

A major factor to keep winning is great capital allocation.

My preferred capital allocation choice is reinvesting in the business.

Take Kelly Partners Group.

This company is a serial acquirer of chartered accounting businesses.

That’s why the best use of Kelly Partners Group’s cash is to keep growing via M&A.

The strategy is clearly working.

The stock climbed over 120% since we added it to our portfolio. 📈

But that kind of gain would’ve really bugged me at the start of my investing journey.

Don’t get me wrong.

I would’ve been more than happy with a position that more than doubled my money in less than a year (and yours hopefully too).

But when you compare Kelly Partners with a company like Coca-Cola, you’re wondering what’s going on.

Got $8 billion burning a hole in your pocket? 🔥

Coca-Cola is giving a fortune away instead of reinvesting it. 💸

In fact, Warren Buffett pockets almost $25 every second just from owning Coca-Cola stocks in dividends.

That’s $776 million every year.

This got me thinking…

… Capital allocation is key to Warren Buffett’s investment success.

Yet, he’s ok with Coca-Cola distributing all this money to its shareholders?

Why does he not convince Coca-Cola’s CFO to invest this money back into the business?

He could try. Buffett is Coca-Cola’s largest shareholder.

But Coca-Cola is different to most companies on the stock market.

Some stocks are like your favorite coffee shop

Here’s a simple rule…

“When you look at a public company, look at it exactly the same way that you would look at buying a business down the road, like a car wash or a coffee shop."Car washes and coffee shops don’t reinvest all their cash after they’ve established themselves.

If the product is perfect and customers are happy, there’s no need to keep innovating year after year.

Their owners just collect the cash the business makes.

It’s the same with Coca-Cola…

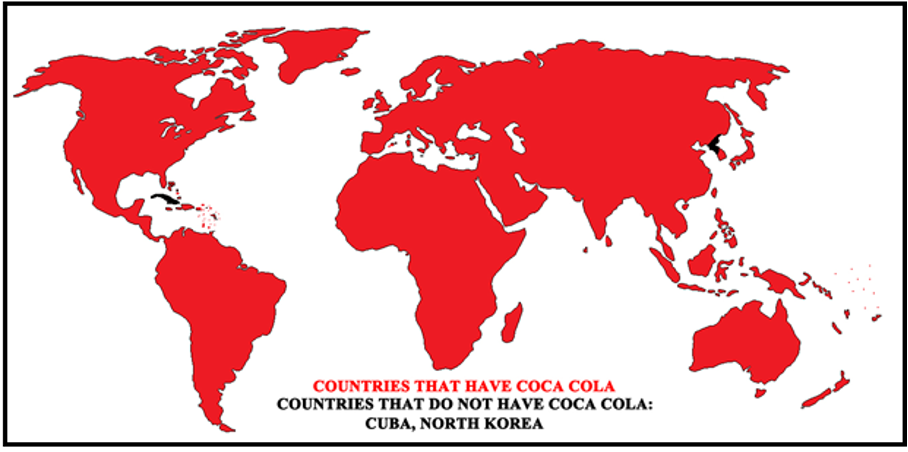

Coca-Cola has beaten the game

It has the perfect product…

Coke is the most popular soft drink in the world.

Its basic formula hasn’t changed substantially since 1925.

Coca-Cola owns a flawless supply chain that it began building in the early 1900s.

Today, there are just two countries in the world where you can’t get a Coke:

Cuba and North Korea.

In other words, Coca-Cola is so far along in its journey as a business…

… It doesn’t need to reinvest a lot of cash.

Instead, it can give away more than $8 billion to its shareholders in the form of dividends.

And Coca-Cola is just one example, of course:

McDonald’s pays more than $5 billion in dividends every year

Bank of America almost $8 billion

And Chevron more than $11 billion

These businesses are essentially money-printing machines.

They sell the perfect (or near-perfect) product that doesn’t require a lot of reinvesting.

Stocks like this are “boring”

It’s easy to overlook this simple reality…

… The media bombards us with disruptions like AI, crypto, or space-flying rockets all the time.

Countless companies with a great but “boring” product get lost in the noise.

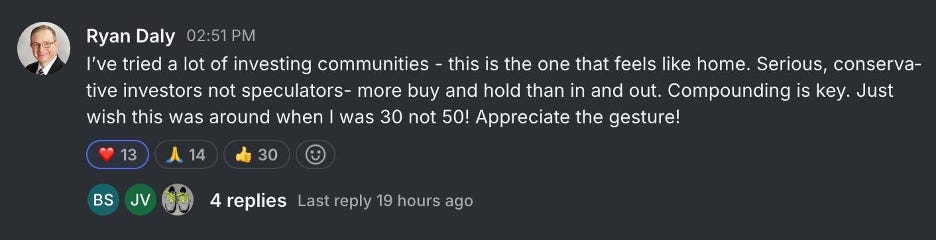

Some of the Compounding Quality Partners have been interested in dividend stocks for quite some time.

Take Josh. He is better known as TJ Terwilliger in Our Community.

Maybe you've seen his invaluable insights yourself.

The more I talked with him, the more I realized that there’s a massive thirst in our Community to learn more about dividends.

That’s why I decided to kick-off Dividend Week…

… Because history tells us neglecting dividend payers is a big mistake.

Ignoring dividends would’ve cost you 700%

You’ll miss out on almost half of the potential gains in the markets that way.

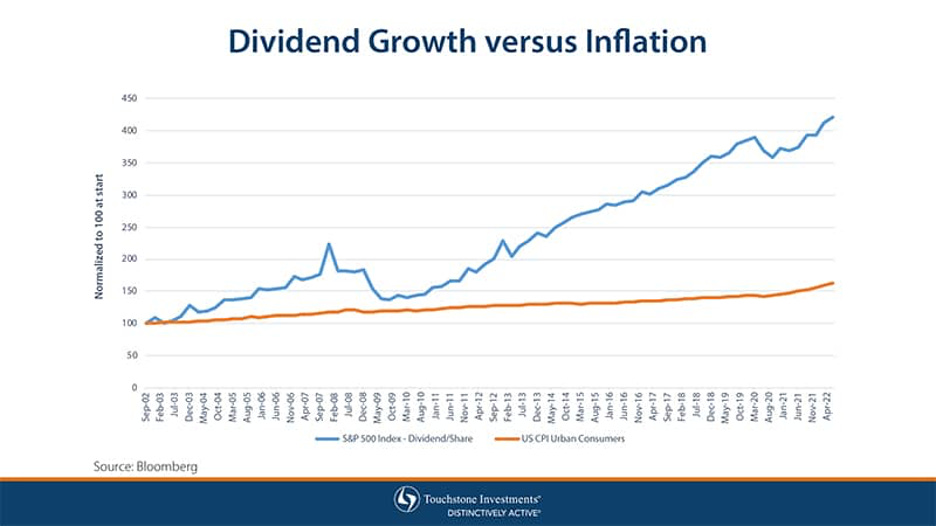

Just look at this chart:

It breaks down the total return of the S&P 500 between 1993 and 2022:

The aggregate total return was +1,481%

+700% came from dividends & dividend reinvestment

Only the remaining +781% are attributable to price appreciation

Almost half of all the gains were the result of dividends.

Can you afford to miss out on that amount of money?

And we’re just scratching the surface…

Because companies across the S&P 500 aren’t necessarily the best dividend stocks.

The S&P 500 is a selection made by a committee according to factors such as:

Market cap

Trading volume

Earnings

That’s why…

If you hand-select the best dividend stocks, your profit potential is even bigger 🔎

However, that’s where a lot of dividend investors make their biggest mistake.

Because they only pay attention to the dividend payout.

In the long run, this approach will NOT maximize your returns.

In fact, if you don’t know what you’re doing, the results can be catastrophic.

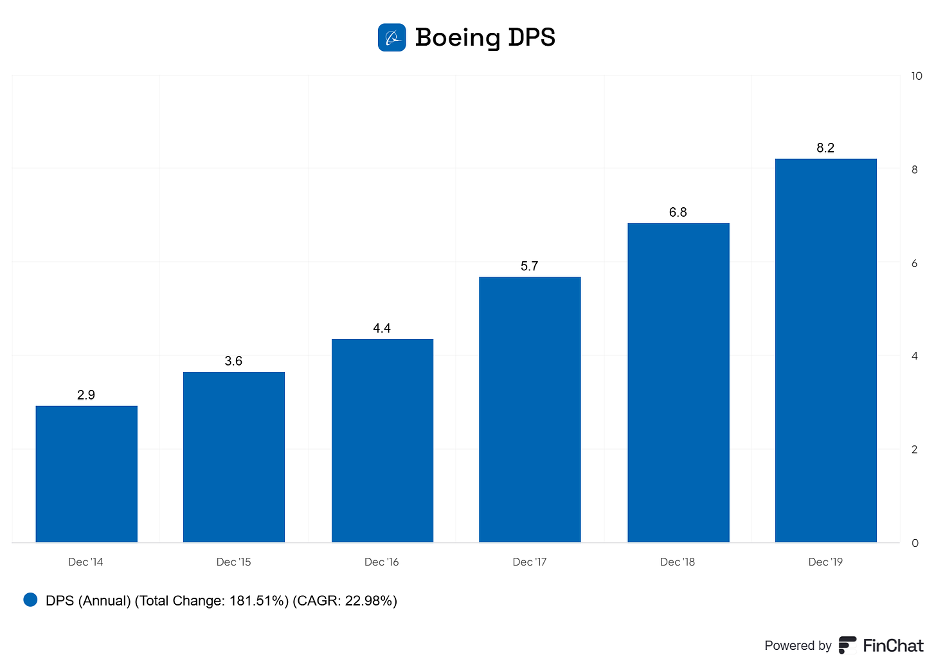

Take Boeing.

Boeing grew their dividend from 2014 to 2019 at a rate of more than 23% a year:

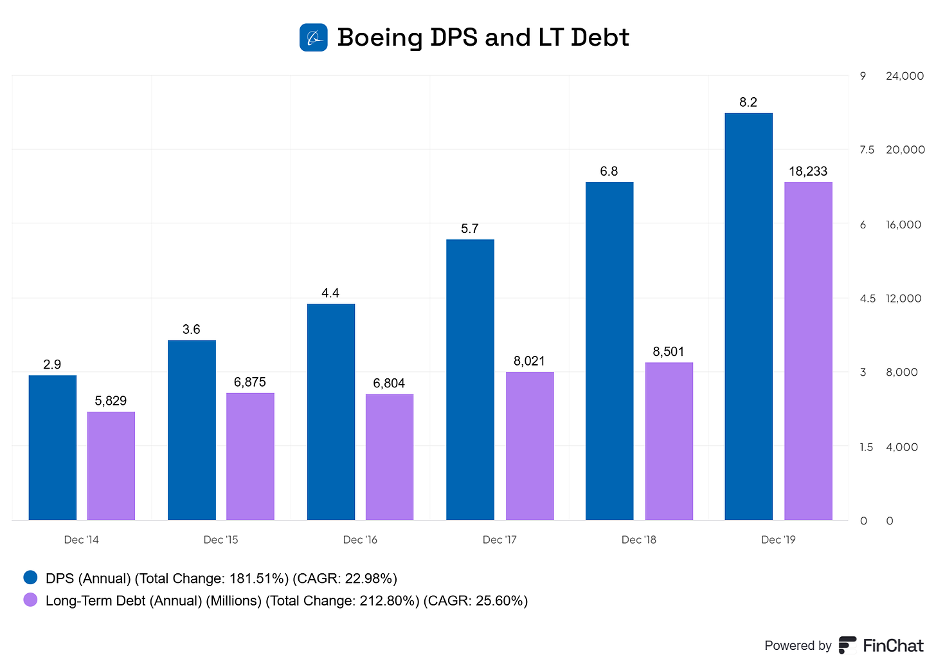

But since their revenue and operating income declined, they had to finance their dividends by growing their debt:

Eventually, Boeing stopped paying dividends altogether

Not to mention the stock took a nosedive recently:

That’s why you should make sure a company’s fundamentals support a high dividend in the long run.

Here are some key factors to take into account:

The payout ratio: It should be below 60%

The dividend yield: It should be above 1.5% (equal to the current yield of the S&P 500)

The dividend growth: It should be above 8%

And the revenue growth: It should be above inflation

The perfect counterexample to Boeing is Coca-Cola.

At the time Warren Buffett bought the stock in 1988, the company paid just a $0.08 dividend per share.[1]

This doesn’t sound very exciting.

But it was an incredible buying opportunity.

Because even though the stock was beaten down at that time…

…It was obvious that Coca-Cola was the most popular soft drink in the world.

That’s how Buffett could load up Coca-Cola stock for just $2.79 a share.

Today, dividends are at $2.00 per share…

25 times higher!

It’s how Buffett collects $776 million every year from Coca-Cola.

And dividend stocks aren’t just great at growing your money.

They also protect your wealth when the going gets rough

I’m talking about

Inflation

Recessions

Let’s look at inflation first…

The reason dividends are a good hedge against inflation is simple:

High-quality companies can often raise prices to protect cashflows.

As a result, they can support their payout ratios and dividend payments through various market cycles.

During recessions dividend stocks historically outperform the market:

A study by Nova Southeastern University compared the S&P 500 Dividend Aristocrat Index with the S&P 500 Index.[1]

It found that the dividend stocks outperformed the S&P 500 by 6.45% per year.

That’s because dividend-paying companies have made a commitment.

Management teams will often try to maintain the company's dividend as long as possible.

Cutting the dividend is one of the last things they want to do.

It would signal financial stress and reduce confidence in the business.[2]

And thanks to this commitment you can build a…

Dividend Income Machine

If you keep reinvesting what you earn, your machine will eventually produce a lot of income.

This is the power of compounding.

It’s like a snowball that keeps going faster and faster.

Let’s say you invest $10,000 in a Portfolio with a dividend yield of 5%.

You add $7,000 to your Portfolio each year.

You reinvest your dividends.

After 32 years, can you guess how much dividends you will receive every single year?

This is under the assumption that your Portfolio returned 7% per year and dividends increased by 6% per year.

The correct answer is $78,384.85

This is steady income for you to collect – without selling a single stock.

Most companies pay dividends quarterly.

There are 3 typical quarterly patterns for dividend payments:

January, April, July, and October

February, May, August, and November

March, June, September, and December

If you pick one from each group, you can collect a dividend check each month.

And to help you get started, I prepared something very special for Dividend Week.

I’m talking about my brand-new report called…

“5 Dividend Stocks For Consistent Income in 2025”

I went through the entire universe of dividend stocks and handpicked 5 stocks which you should buy today to start collecting steady dividends in 2025.

Here are their key characteristics:

Sustainable competitive advantages

Quality management in place

Healthy balance sheet

An attractive history of growth

Good capital allocation

History of returning capital to shareholders

Ability to grow shareholder returns in the future

Trading at fair valuation levels

If you only buy 5 dividend stocks this year, these companies should be it.

How to get your hands on this report in the next 5 minutes

I’ll send you my exclusive report over completely FREE of charge the moment you give Compounding Dividends a try.

Let me explain exactly what Compounding Dividends is…

As you know, I’m a Quality Investor by heart.

That’s why I didn’t immediately recognize the strong demand within Our Community for in-depth research on dividend stocks.

But being a great investor is all about learning and growing. So, I listened to what you want and created something special along with TJ.

Like I said, his investing insights are phenomenal.

Maybe you caught a recent webinar I hosted with TJ, where he shared his insights on dividends, drawing from his 15 years of investing experience.

TJ and I decided to team up in the long run…

… To let you celebrate Dividend Week every week.

I’m talking about the launch of…

Compounding Dividends

Compounding Dividends is all about building a reliable income stream while growing your wealth.

It’s where TJ pours his vast Dividend Investing knowledge into finding the best money-making opportunities.

TJ and I opened the doors to Compounding Dividends a few weeks ago.

And since the early adopters were raving…

… We wanted to kick off Dividend Week so even more people have the chance to discover Compounding Dividends.

Compounding Dividends works just like Compounding Quality does.

Here’s everything you’ll get:

📈 1. Access to the Portfolio

You’ll have access to Our Portfolio with 100% transparency. REAL MONEY is invested in this Portfolio.

💰 2. Buy-Hold-Sell List

Based on the investable universe of interesting Dividend Stocks, you’ll receive a Buy-Hold-Sell List that will be updated monthly.

📊 3. Idea of the Month

Each month, you’ll receive an interesting Dividend Idea you can invest in.

🔎 4. Investment cases

You’ll receive Deep Dives and Not So Deep Dives about interesting Dividend Stocks.

💡 5. ETF Portfolio

As a Partner of Compounding Dividends, you’ll get access to the ETF Portfolio. This ETF Portfolio will provide you with attractive dividend payments.

✍️ 6. Best Buys

Each month you’ll get an email notifying you about the 5 Best Buys of this month. These Best Buys are Dividend Stocks trading at attractive valuation levels.

👬 7. Partnership approach

All paid subscribers of Compounding Dividends are called Partners. We’re in this together and we all learn from each other.

Of course, you’ll also receive my exclusive report “5 Dividend Stocks For Consistent Income in 2025”.

This report isn’t available anywhere else.

But I’ll send it to you the moment you accept a risk-free trial to Compounding Dividends during Dividend Week.

By now you’re probably wondering how much access to Compounding Dividends costs.

The normal price for a one-year subscription is $499. But since it’s Dividend Week, I want to give you a much better deal.

First, let me show you another bonus you can ONLY get during Dividend Week.

I know that Partners like yourself are eager to grow and become better investors every day.

That’s why TJ and I recorded an exclusive video masterclass. It’s called…

“Build Your Dividend Income Machine”

In this masterclass we’ll dive deep into how to identify the best dividend stocks:

How to evaluate if a company has room to grow?

What’s a good profit margin?

What’s the best earnings-per-share ratio?

How to spot quality management?

What are “Cannibal Stocks”?

And much more…

This masterclass is only available during Dividend Week.

You’ll get access within minutes of joining Compounding Dividends.

Normally, Compounding Dividends is $499…

… But as a special offer, you can get a 1-year subscription for just $349.

That’s 30% off the regular price.

But that’s not everything…

Everyone who joins today will automatically be upgraded to Founding Partner status

Founding Partners will gain access to a wealth of exclusive tools in the coming months—resources that aren’t typically available.

For example…

Access to the Compounding Dividends Community once it launches

Zoom meetings with the CEOs of stocks that we own

And much more…

And to be clear, I’m not asking you to make a long-term commitment today.

I’m simply asking you to take a look and decide if Compounding Dividends is right for you.

If you aren’t happy with the information you receive, you’re backed by my…

100% Money-Back Guarantee

You have a full 90 days to check out our Compounding Dividends.

if you aren’t completely happy, for any reason at all, let me know. I'll refund every penny you've spent on the subscription — no questions asked.

All the research you receive is yours to keep, of course.

Just click the link below, select Annual plan, and you’ll be automatically upgraded to Founding Partner status. I look forward to welcoming you as a Compounding Dividends Partner!

WHAT YOU’LL GET

✅Company Deep Dives : Deep dives on great dividend stocks (Value: $1,399)

✅ Portfolio: Our Portfolio with 15-20 dividend growers (Value: $999)

✅ Investment courses: How to Analyze Stocks, How to Analyze Financial Statements… (Value: $999)

✅ Onepagers: The essence about interesting dividend stocks (Value: $799)

✅ ETF Portfolio: An insight in our ETF Portfolio (Value: $499)

✅ 8 Articles: At least 8 articles per month (Value: $399)

✅ News Report: Weekly stock news (Value: $399)

✅ Exclusive Report: 5 Dividend Stocks For Consistent Income in 2025 (Value: $399)

✅ Exclusive Video Masterclass: Build Your Dividend Income Machine (Value: $399)

✅ Upgrade to Founding Partner Status (Value $1,200)

✅ 90-days money-back guarantee

TOTAL VALUE: $7,491

SUBSCRIPTION PRICE: $349/YEAR

One Dividend At A Time

TJ & Pieter