Have you ever shopped in a Target store?

Today we’re shopping for Target.

You should know that it’s a great Dividend Company with a 3.5% yield.

Let’s find out whether Target is a stock worth buying.

Target is a major U.S. retailer generating over $100 billion in total revenue, with more than 1,950 big box stores.

They sell a wide variety of products, like clothes, electronics, and groceries in their stores and online.

Target is a Dividend King, raising its dividend for 56 years in a row.

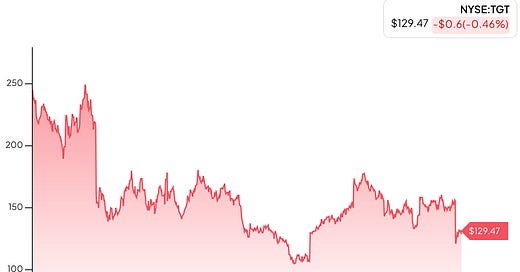

The company has been struggling to grow recently, with the stock declining around 5% so far this year, and more than 30% over the past 3 years.

Is Target on sale and an interesting dividend stock to buy?

Or is it a company in decline that should be avoided?

Let’s take a Not So Deep Dive into the company to find out!

Source: Finchat

1. Do I understand the business model?

Remember, we want a simple and attractive business model.

We’ve already established that Target is a discount retailer.

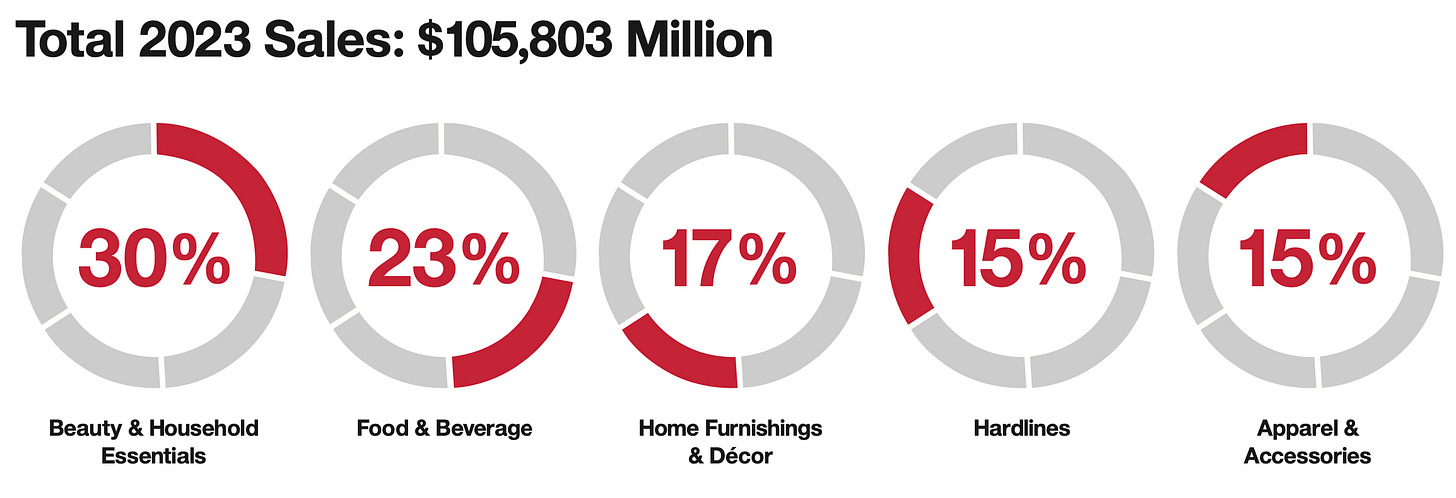

The majority of their sales come from the beauty, household items, and food categories.

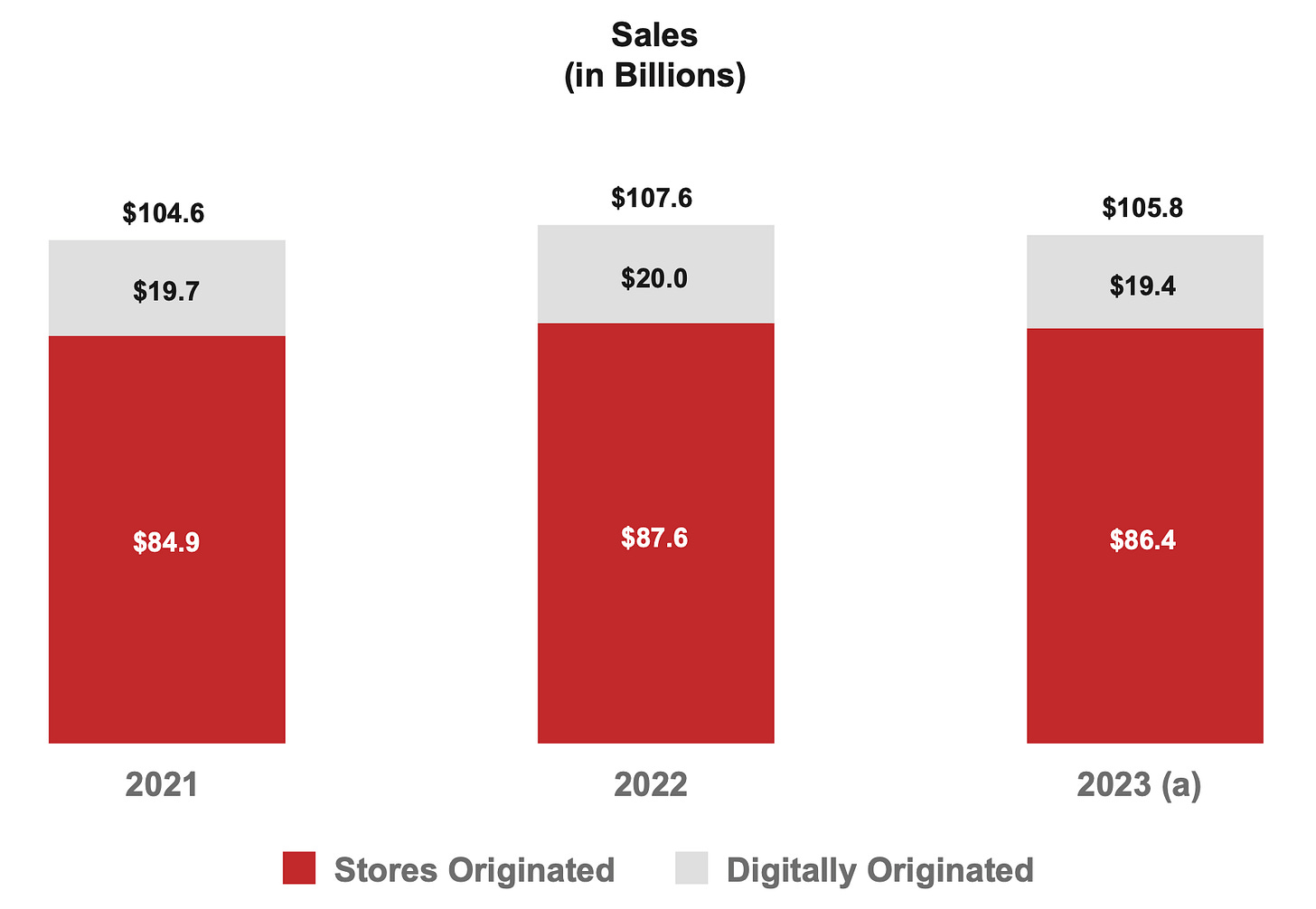

Most sales (around 80%) are made in Target stores.

The rest come from digital channels like the Target website or mobile app.

Target’s biggest strength is its brand.

They do offer low prices, but Target is known for a good in-store shopping experience, as well as trendy, fashionable merchandise that looks expensive, but isn’t.

2. Is management capable?

You want to invest in companies led by great managers.

Brian Cornell has been the CEO since 2014.

He has extensive retail experience, working at PepsiCo, Sam’s Club, Wal-Mart Stores, Safeway Inc., and Michaels Stores, Inc. in the past.

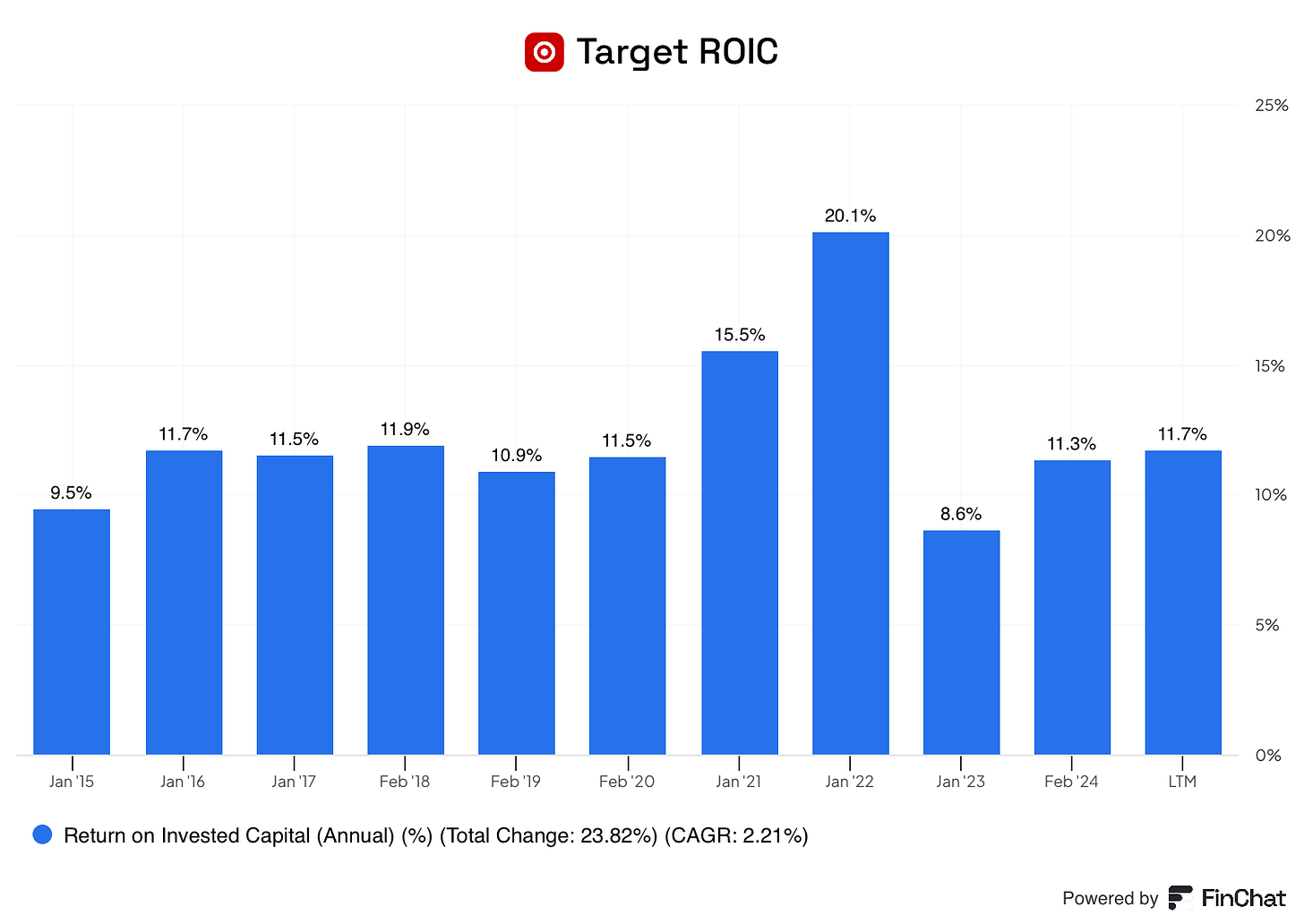

Target’s ROIC is generally around 10%. This indicates management allocates capital well.

Source: Finchat

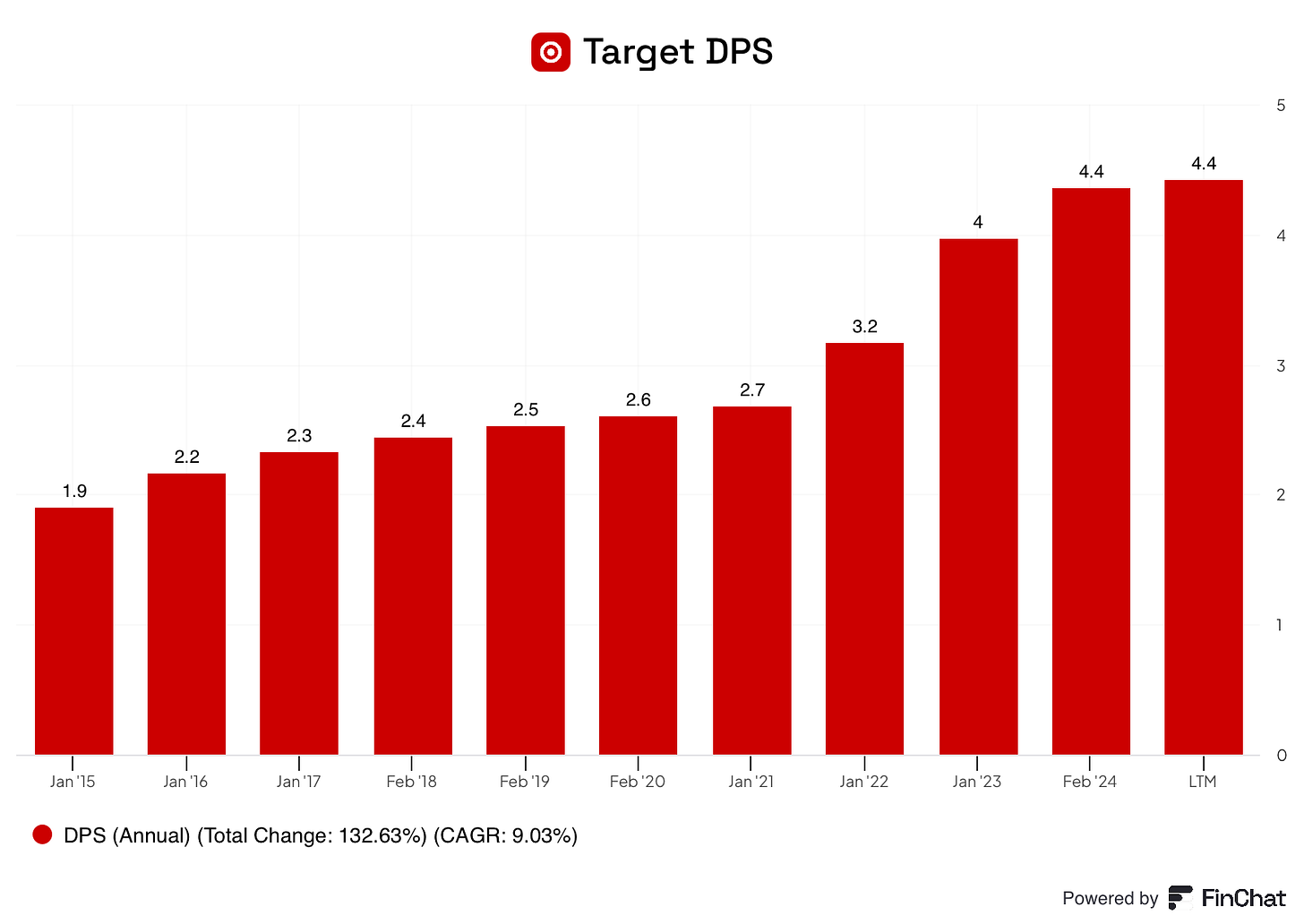

3. Has the company grown the dividend attractively?

You want to invest in companies with a history of growing their dividends.

The higher the dividend growth, the better.

Look for 2 things in the company’s dividend history:

At least 10 years of dividend growth

A 5-year record of growing dividends by 5% or more

Target meets both of these criteria:

Target is a Dividend King with 56 years of dividend growth

They’ve grown their dividend payment by 11.4% per year over the past decade

Source: Finchat

4. Is the company active in an attractive end market?

You want to invest in companies that are in stable or growing market.

Here are a few characteristics we look for:

The company sells a necessary product

Recurring sales

A secular tailwind

Target has 2 of these qualities:

They sell necessary products, many of which are recurring like food, household products (think cleaners, toilet paper, etc.)

5. What are the main risks for the company?

Disruption is the worst enemy of every long-term investor.

When you invest in a company that is losing its moat, you’ll end up with horrible investment results.

Let’s talk about Target’s largest risks

Competition

Target competes against large, strong companies like:

Walmart

Amazon

Costco

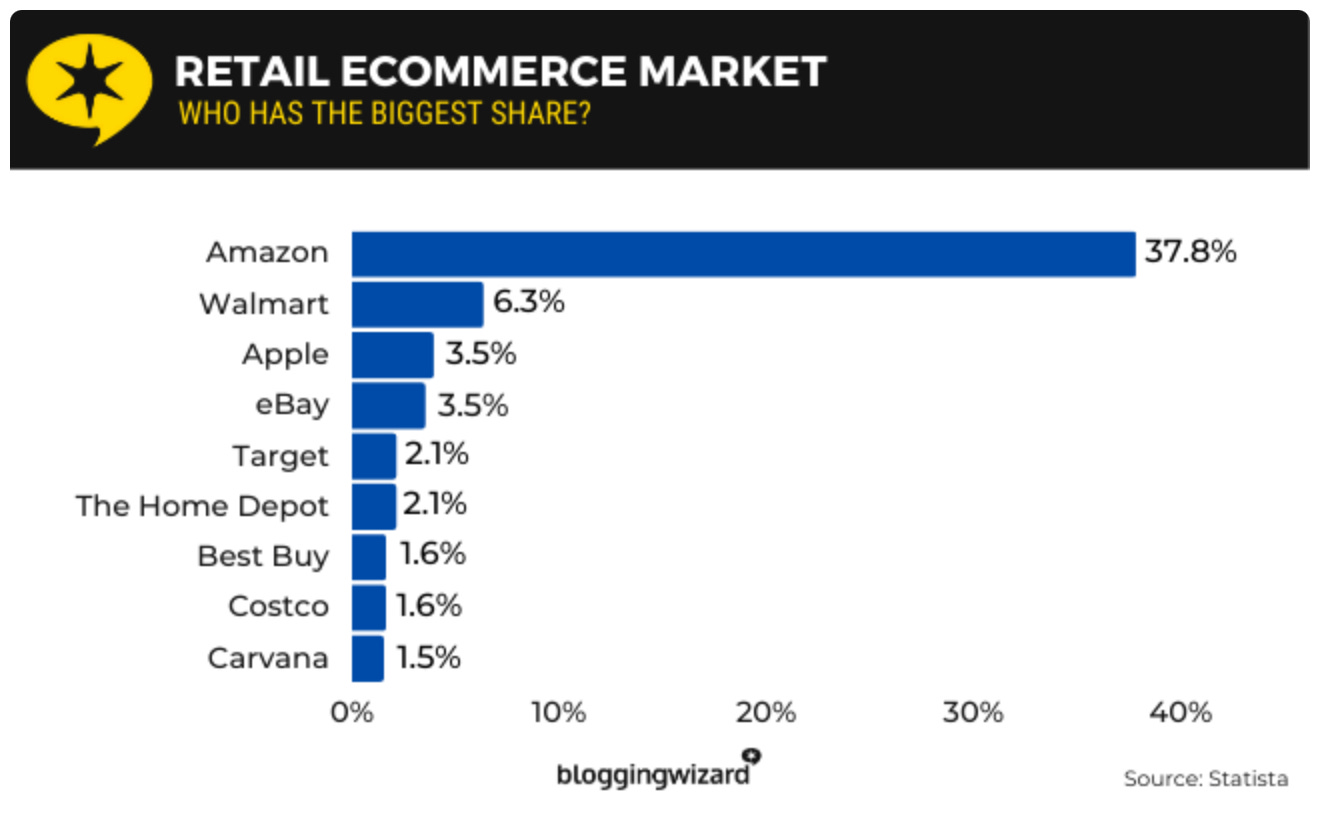

Growth of eCommerce

One of Target’s strengths is the in-store shopping experience. With the growth of eCommerce, that may not matter as much.

Amazon and Walmart have the largest shares of eCommerce:

Target is investing in growing their eCommerce capabilities.

They bought Shipt in 2017, allowing them to start offering same-day grocery delivery.

Target also offers a drive-up option where customers can make a purchase online, then pull in to a Target parking lot 2 hours later to have employees load the order into the customer’s car.

75% of the United States population lives within 10 miles of a Target store, making this a popular option for a lot of consumers.

Now let’s dive into the most important part: the Fundamentals.