Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Monthly Payments

Dividend investors love getting paid regularly.

But most companies only pay dividends a few times a year.

If you want to receive a dividend every single month, here are 12 companies that pay monthly dividends.

Source: Stock Masters

2️⃣ Investing beats inflation

Inflation reduces how much you can buy with your money.

Over 20 years, $1 has lost 40% of its purchasing power.

Source: St. Louis FRED

The 20-year inflation-adjusted return of the Dow Jones?

150%.

And if you would have reinvested your dividends?

300%.

Compounding is a powerful tool to fight inflation.

Source: Finchat

3️⃣ A dividend quote

John Burr Williams had a big influence on Warren Buffett.

He focused on dividends and developed the Dividend Discount Model (DDM) to estimate a stock's intrinsic value based on its expected future dividend payments.

"A cow for her milk, a hen for her eggs, and a stock, by heck, for her dividends." - John Burr Williams

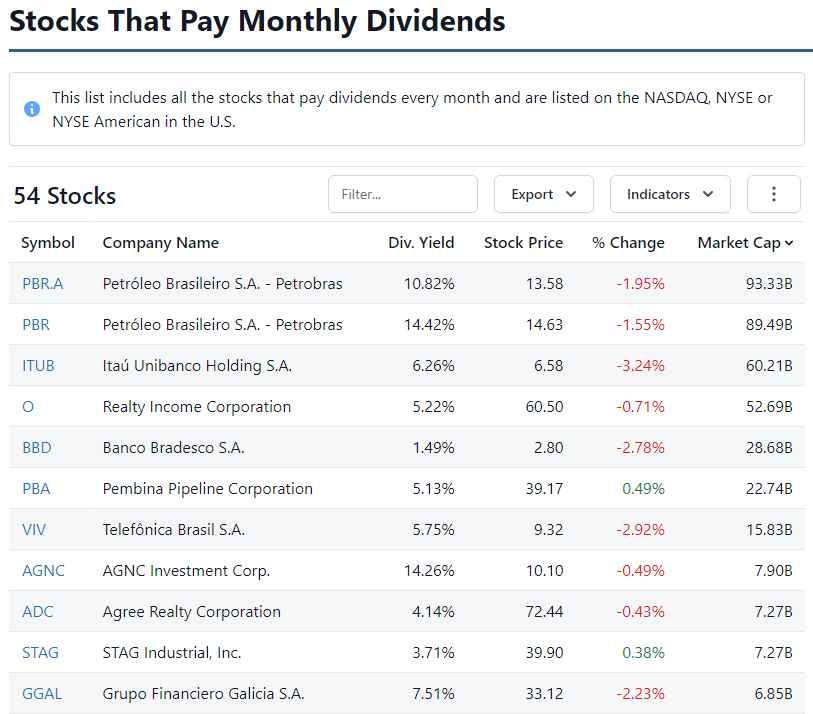

4️⃣ All monthly dividend stocks

If you like receiving dividends monthly, here’s a list of all 54 stocks that distribute dividends every month.

Click the picture to visit the entire list.

Source: Stock Analysis

On Saturday, I’ll show you how to build a dividend portfolio that pays you a dividend every single month of the year.

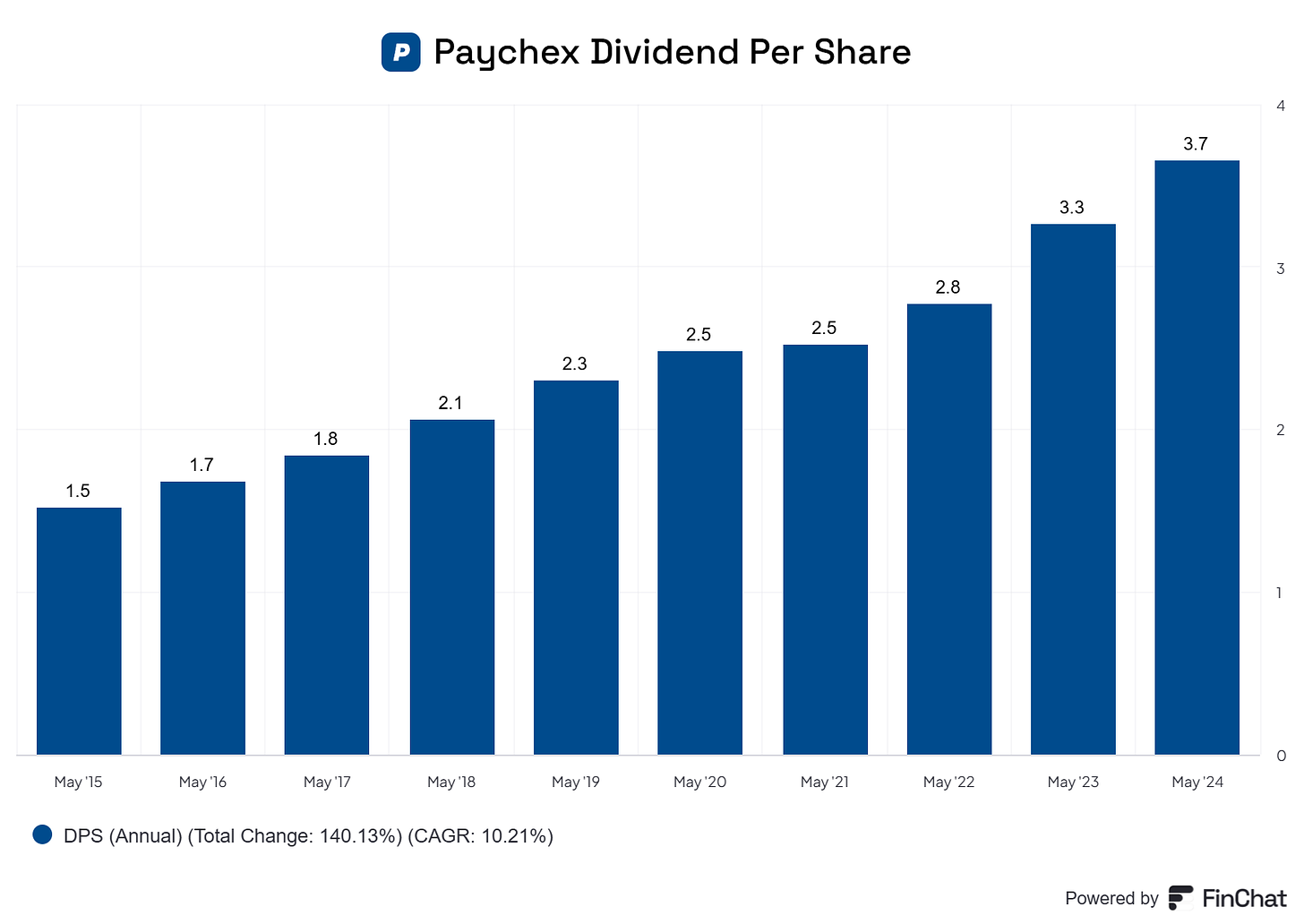

5️⃣ Example of a dividend stock

Paychex, Inc. (PAYX) makes money by providing payroll processing, human resource, and benefits outsourcing services to small- and medium-sized businesses.

They charge recurring subscription fees as well as one-time fees for some services.

Profit Margin: 32%

Forward PE: 25.7x

Dividend Yield: 3.1%

Payout Ratio: 77.8%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Monthly dividend paying issues are a great topic to explore, especially for income focused investors! 😃

As always, stay focused on the quality of the business. Look for great management and robust financials. The dividend and potential capital appreciation will naturally follow! It's very easy to start focusing on yield and fall into a trap.

Main Street Capital is BDC and is considered to be a gold standard in the industry. Their portfolio of investments is well diversified in the lower middle markets. Should any one investment bonk out the impact will be minimal. The dividend payment stream is steady and always increasing. From time to time they even pay out special dividends!

Be sure to check out their latest presentation. It's well done!

https://d1io3yog0oux5.cloudfront.net/_1346534cb3ecd0066a14fe50206a370d/mainstcapital/db/396/10863/pdf/Q2+2024+MAIN+Investor+Presentation+vFINAL.pdf

Modiv is a new, freshly formed REIT and is founder led. The CEO, Aaron Halfacre, is a great communicator and capital allocator. The REIT was formed by a merger and they are in the process of disposing of non-core assets. They recently disposed of a car dealership and gave shareholders a wonderful special distribution. I plowed mine right back into the REIT. They are also on the hunt for assets to add but are staying quiet. Their debt levels are a tad high but I let it pass because they are still forming.

Read the earnings supplement. It contains a shareholder letter from the CEO.

https://d2ghdaxqb194v2.cloudfront.net/2863/194625.pdf

Reality Income needs no introduction. It's the REIT of all REITs. Broad diversification of properties, geographic location, and tenants. Their credit rating is "A-" from S&P and "A3" from Moody's. The monthly dividend is increased about every three months. The bump is small, like around $0.0005. Yes, small! But, it's consistent. Almost like clockwork. Short term shareholders poo-poo this but as a longer term shareholder I applaud this quarterly bump with the monthly compounding.

Being as big as it is, growth opportunities here in the US are drying up. What's an additional retail property to the hundreds they already have? They need to start expanding into other real estate sectors and are doing so with data centers and gaming. We see them also expanding into other geographies, like in Europe. Time will tell how this plays out. I don't think this is a bad thing but they will probably need to fine tune their allocation strategy as they move forward.

Check out their latest presentation.

https://www.realtyincome.com/sites/realty-income/files/2024-08/investor-presentation-q2-2024.pdf

The last one I want to highlight is PennantPark Floating Rate Capital. Art Penn, the founder, is still with the company. Like Main Street, they are also a BDC with a well diversified portfolio of investments. They serve a different market and are focused on floating rate loans. Their dividend payout profile is not as stellar but it's very, very consistent. It grew from 2012 to 2015 and then stagnated. In 2018 their dividend took a tumble bumble before recovering to previous levels . Any potential growth in 2020 was frozen due to COVID but there was no cut! The dividend got a decent bump in 2023 and is holding steady. The yield is crazy high at +10% but it is sustainable, I think.

Check out their latest presentation. It's due for a refresh.

https://pflt.pennantpark.com/static-files/59ed5eaa-8fcc-40d8-bcbb-ffa8644983c6

All of these companies survived COVID without any dividend cuts.

Would be good to see which stocks get a buy rating here. Thanks.