Benjamin Graham, the father of value investing, made a prediction in 1926.

He said that cash dividends would become less common.

Graham thought companies would start paying dividends in stock instead.

Let’s teach you everything you need to know about stock dividends (and buybacks).

Graham pointed out several benefits of paying stock dividends:

Stock dividends are a flexible way to return profits to shareholders while keeping cash for growth

They can raise stock prices by showing that management believes in the company’s future

Investors don’t pay taxes on them

They increase the shareholder's ownership in the company

He believed companies would pay dividends in both cash and stock to give shareholders a fair return on their investment.

Here’s what he predicted that would look like:

If stock dividends are not common today, how could Graham still be right?

Take a look at his points again but replace "stock dividends" with "stock buybacks."

Buybacks are highly relevant today.

What are buybacks?

Stock buybacks take place when a company buys some of its own shares from existing stockholders.

This reduces the total number of shares, meaning the remaining shares represent a bigger part of the company.

Benjamin Graham’s Advantages

Next, let’s examine Graham’s 4 advantages using buybacks to see if they still apply.

1️⃣ Buybacks are a flexible way to return profits to shareholders while keeping cash for growth

One of management's most important jobs is to decide how to use the company’s profits.

A company has five capital allocation choices:

Dividends are a long-term commitment.

Shareholders expect them regularly, and management tries hard to avoid cutting them.

Buybacks are flexible.

Companies can do them whenever they want, like in good years or when the stock is cheap.

This way, they can give money back to shareholders but still save cash for important things like new projects or big purchases.

2️⃣ Buybacks can raise stock prices by showing that management believes in the company’s future

Just like dividends, buybacks show that management is confident.

But buybacks have another, very powerful effect on stock prices that dividends don’t.

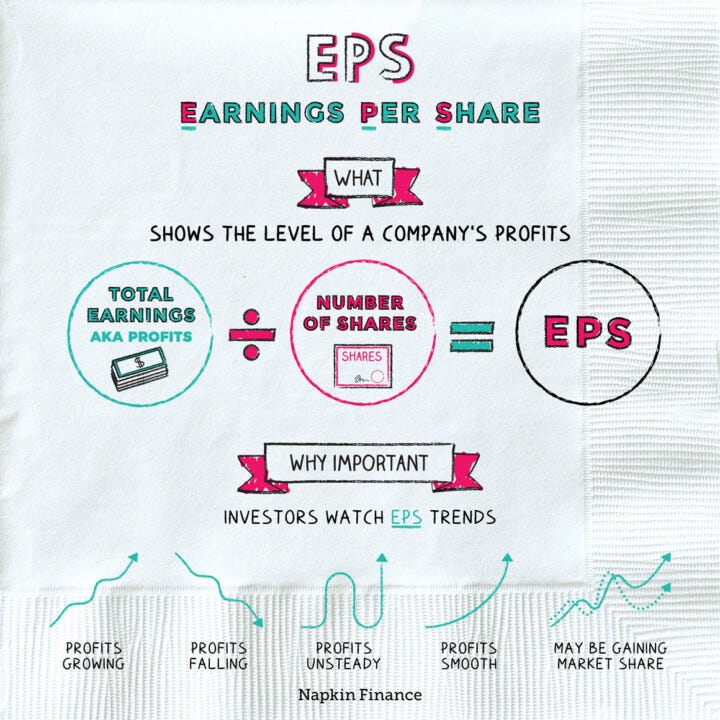

Buybacks raise Earnings Per Share (EPS).

Buybacks reduce the number of shares, so even if earnings stay the same, earnings per share (EPS) increases.

This can push the stock price higher without needing growth in earnings or changes in the price-to-earnings ratio (PE).

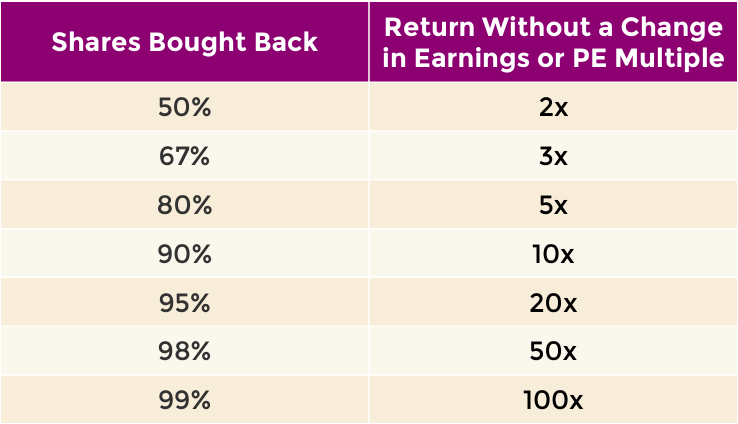

The chart below shows how different levels of buybacks affect returns:

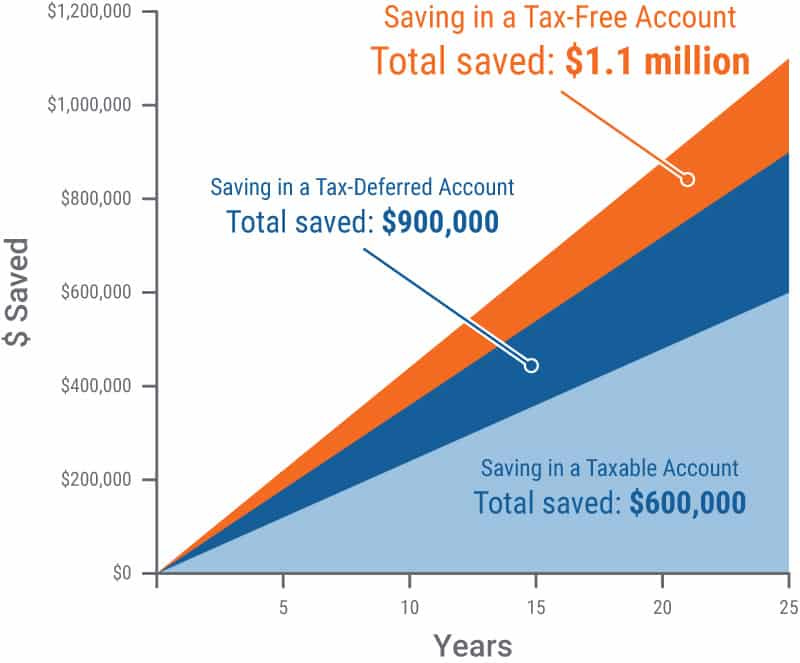

3️⃣ Buybacks are tax efficient

Taxes differ by location, so this section will be general.

In most places, investors need to pay taxes when they receive a cash dividend.

However, you usually don’t pay any taxes on share buybacks.

The image below shows how taxes can lower your returns over time.

4️⃣ Buybacks increase the shareholder's ownership of the company

To quickly understand this benefit, think about sharing a pizza.

The more people there are, the smaller each slice is.

Buybacks reduce the number of slices, making each slice bigger.

How many shares you have doesn’t change, but how much of the company you own does.

If you own a business that earns $10 per share and the company buys back 50% of its outstanding shares, EPS will increase from $10 to $20.

As a result, the stock price should also double.

Dividend Investors Should Pay Attention to Buybacks

Graham’s advantages are great for all investors, but dividend investors should pay extra attention to buybacks.

If you’re currently reinvesting your dividends:

Buybacks increase your ownership of the company, so buybacks give you the same outcome as reinvestment

Buybacks are tax efficient - you increase your ownership without paying taxes on the dividend

Insiders are doing the buying for you - good management will only buy when shares are undervalued

Buybacks only create value if they’re done when the stock is undervalued

If you’re currently spending your dividends:

Your dividends will grow as your ownership increases.

You can earn income from companies that don’t pay a dividend by selling shares.

“Periodic stock dividends are the practical equivalent of cash - readily saleable by those who want money rather than stock.” - Benjamin Graham

Buybacks are hidden dividends

Graham was right about the benefits of stock dividends, or their modern equivalent - buybacks.

Was he right that companies would use buybacks more?

Let’s look at the data.

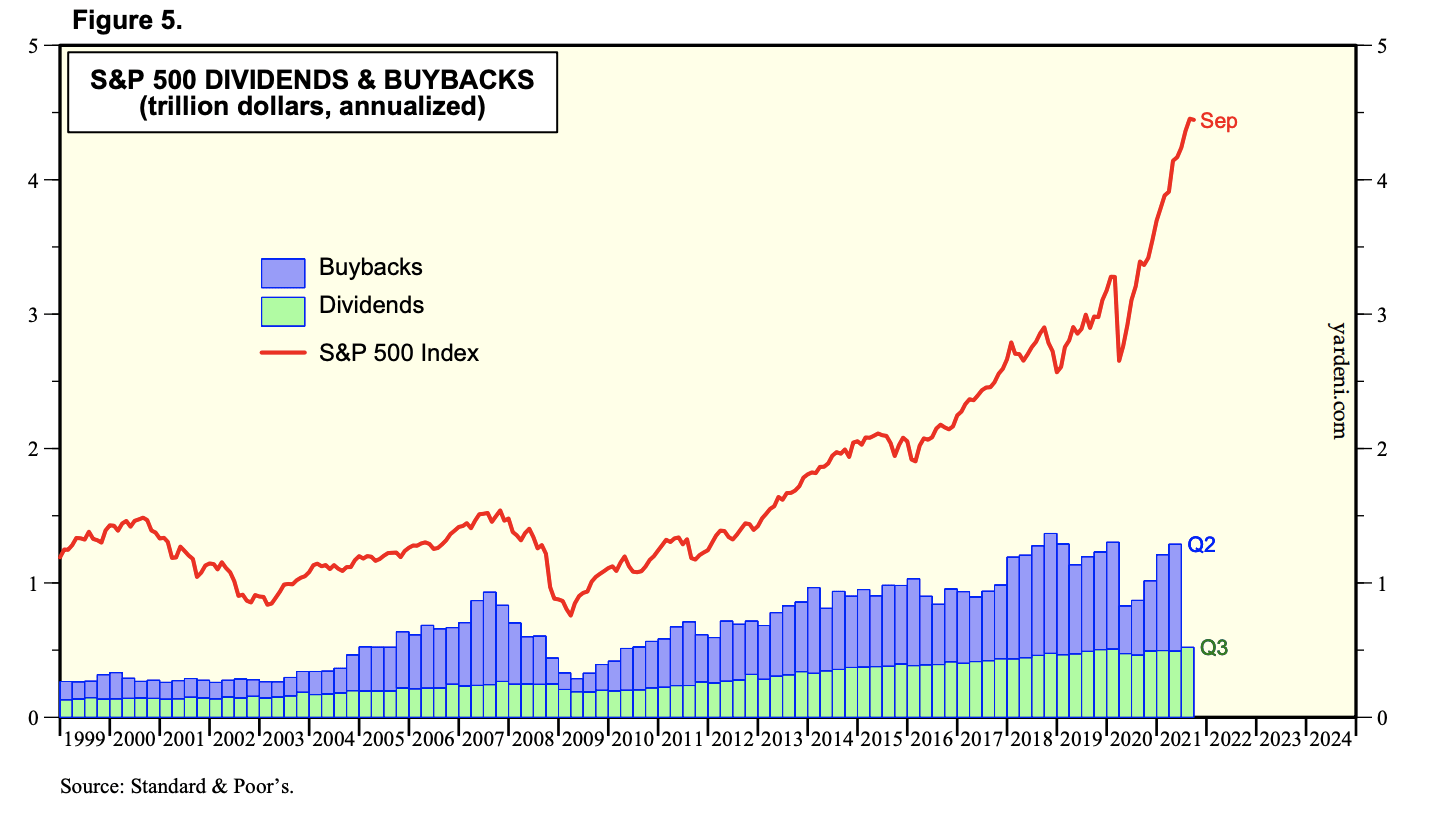

Buybacks have become more common

The green bars on the chart show cash dividends paid. The purple bars are buybacks.

Pay attention to the growth of buybacks versus dividends, especially since 2008.

Dividends + Buybacks are a powerful combination

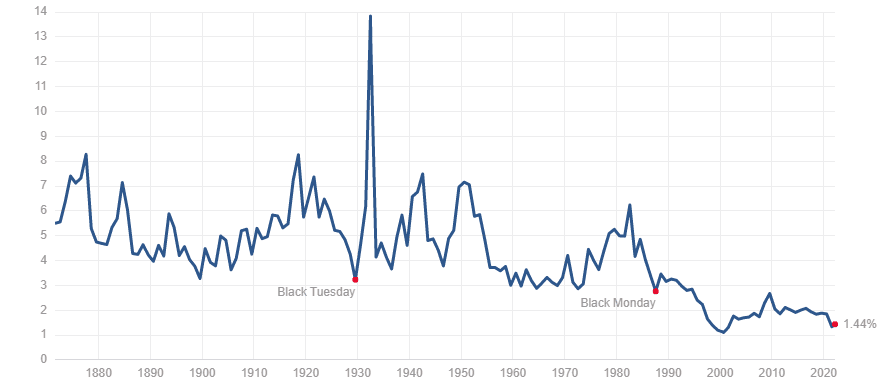

Here’s the dividend yield of the S&P 500.

The average dividend yield lies around 2%.

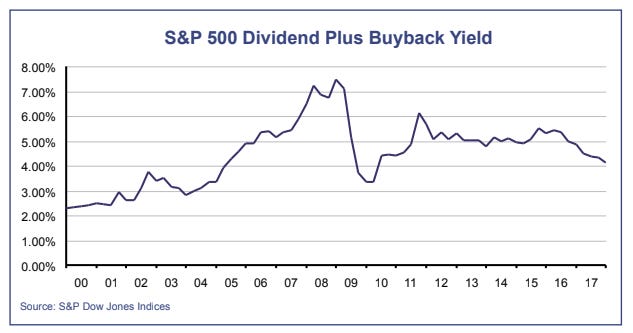

Here’s the yield if you combine dividends & buybacks.

Looking at the data again, adding buybacks doubles the yield to 4%!

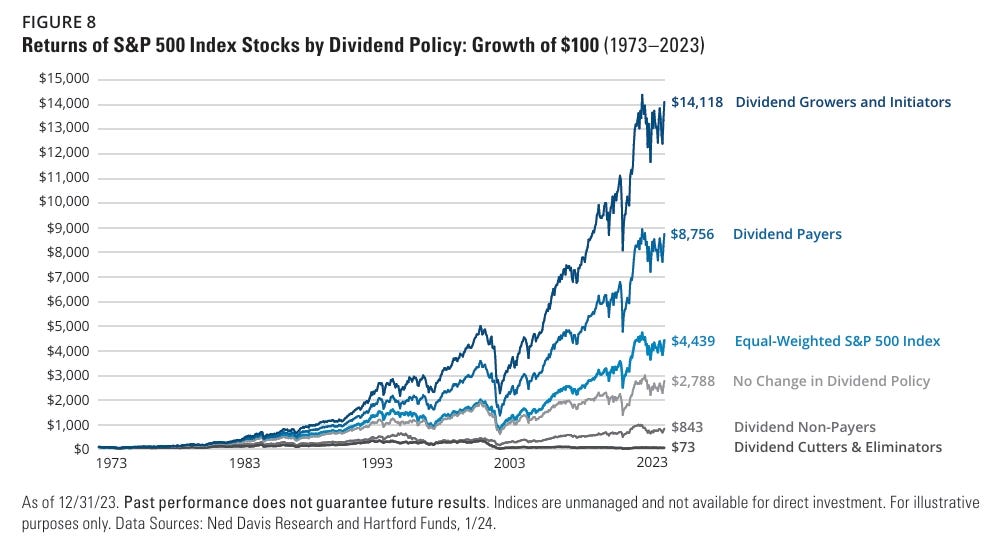

We know that companies with growing dividends tend to outperform the market

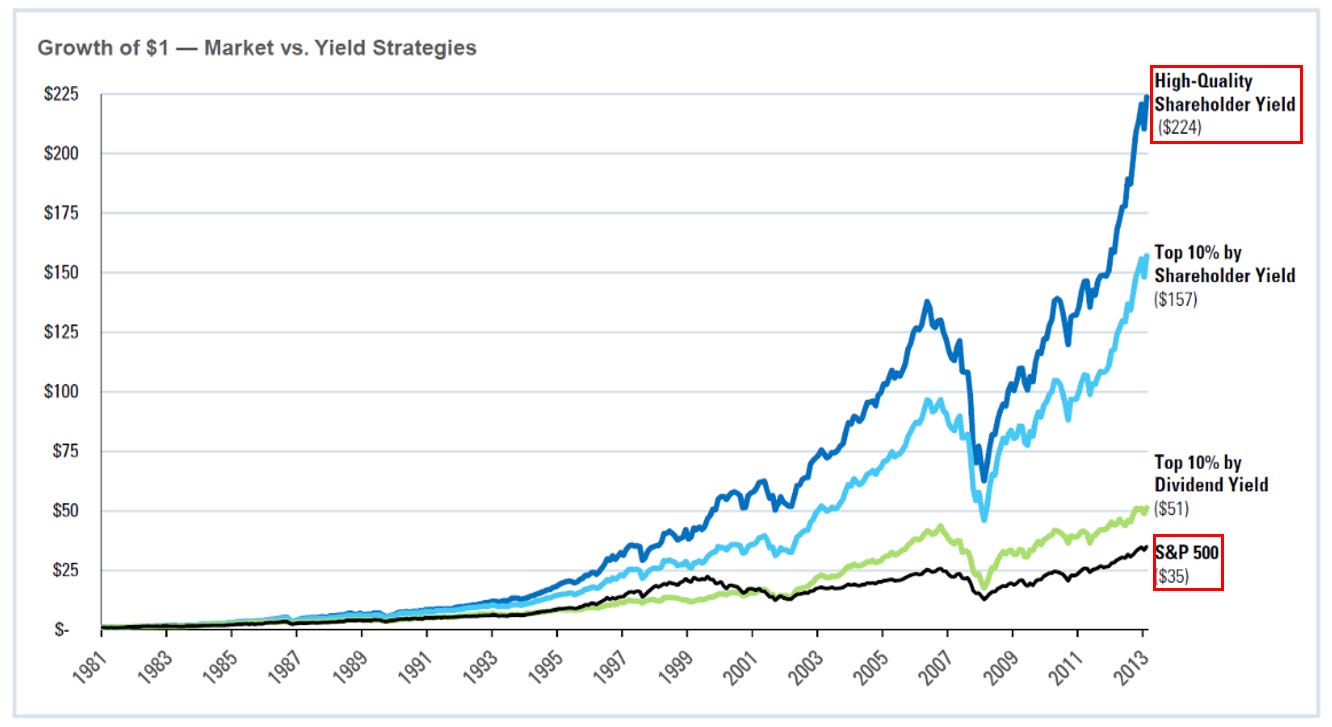

The combination of dividend and buyback yield is called “shareholder yield.”

Shareholder yield performs even better than dividends alone!

A Buyback Example

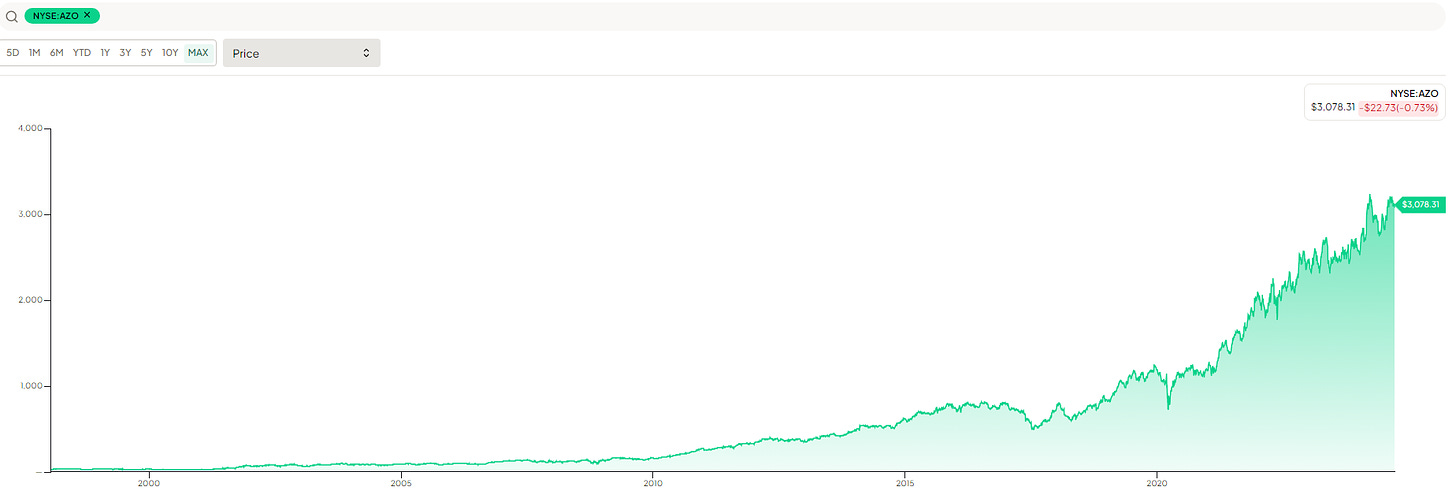

🚗 AutoZone

AutoZone sells car parts and accessories like batteries and oil.

Between 1998 and 2024, AutoZone has bought back more than 88% of their shares outstanding.

Shares outstanding 1998: 152.1 million

Shares outstanding 2024: 17.1 million

88.7% of shares bought back

Zero dividends

Split-adjusted price went from $27 to $3,070

113 bagger!

Earnings went up about 12x

Source: Finchat

Conclusion

I still love dividends. A good dividend investing strategy can provide:

Excellent returns

Protection during downturns

An income stream that grows faster than inflation

Adding shareholder yield to your strategy keeps all the benefits of dividend investing while adding:

Tax efficiency

More capital growth from increased EPS

Another way to receive capital from companies

Faster compounding from reinvesting dividends + buybacks

Companies that are committed to dividends and smart buybacks could be some of your best performers!

That’s it for today

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I'm a bit skeptical about companies undertaking massive share buyback programs.

What if the company is buying back its own shares above their intrinsic value?

Furthermore, the funds used for share buybacks could be invested in growth opportunities, research and development, or other financial activities. By opting for buybacks, the company may miss out on potential future growth with a higher return on invested capital (ROIC).

I do not disagree. Good points. I always read the proxy statement of companies as it indicates how management is compensated. If you find one that indicates ROIC, then it is worth taking a hard look.