Hi Partner 👋

Welcome to this week’s 🔒 exclusive edition 🔒 of Compounding Dividends. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

Let’s be honest with each other.

More than 95% of investors underperform the market.

The main reasons?

Trading too much (costs harm your return)

Trying to time the market

Making emotional investment decisions

Lack of patience

…

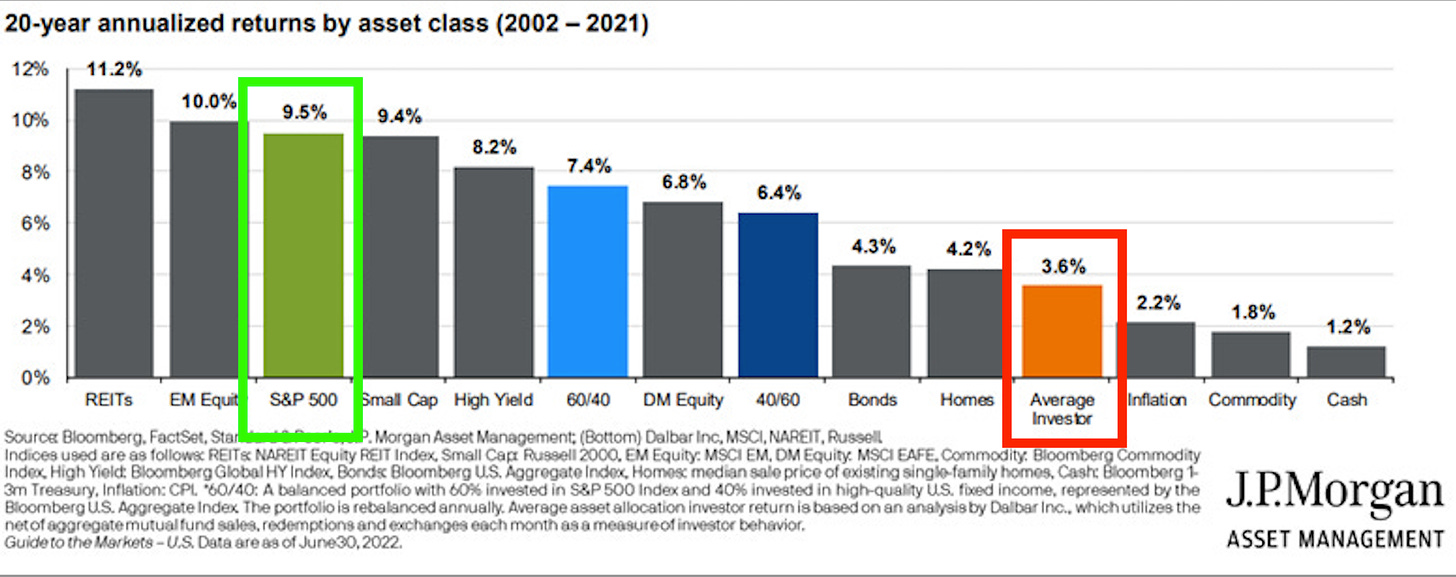

This study by JP Morgan found that the average investor earned an annual return of 3.6%, while the S&P 500 returned 9.5% over 20 years.

That's a difference of 5.9%!

We truly believe that some investors can do better than the market, but most would do better if they invested passively.

Everyone should invest

The beautiful thing about investing passively? Everyone can do it.

And everyone should.

Investing in stocks is the best way to create wealth in the long term.

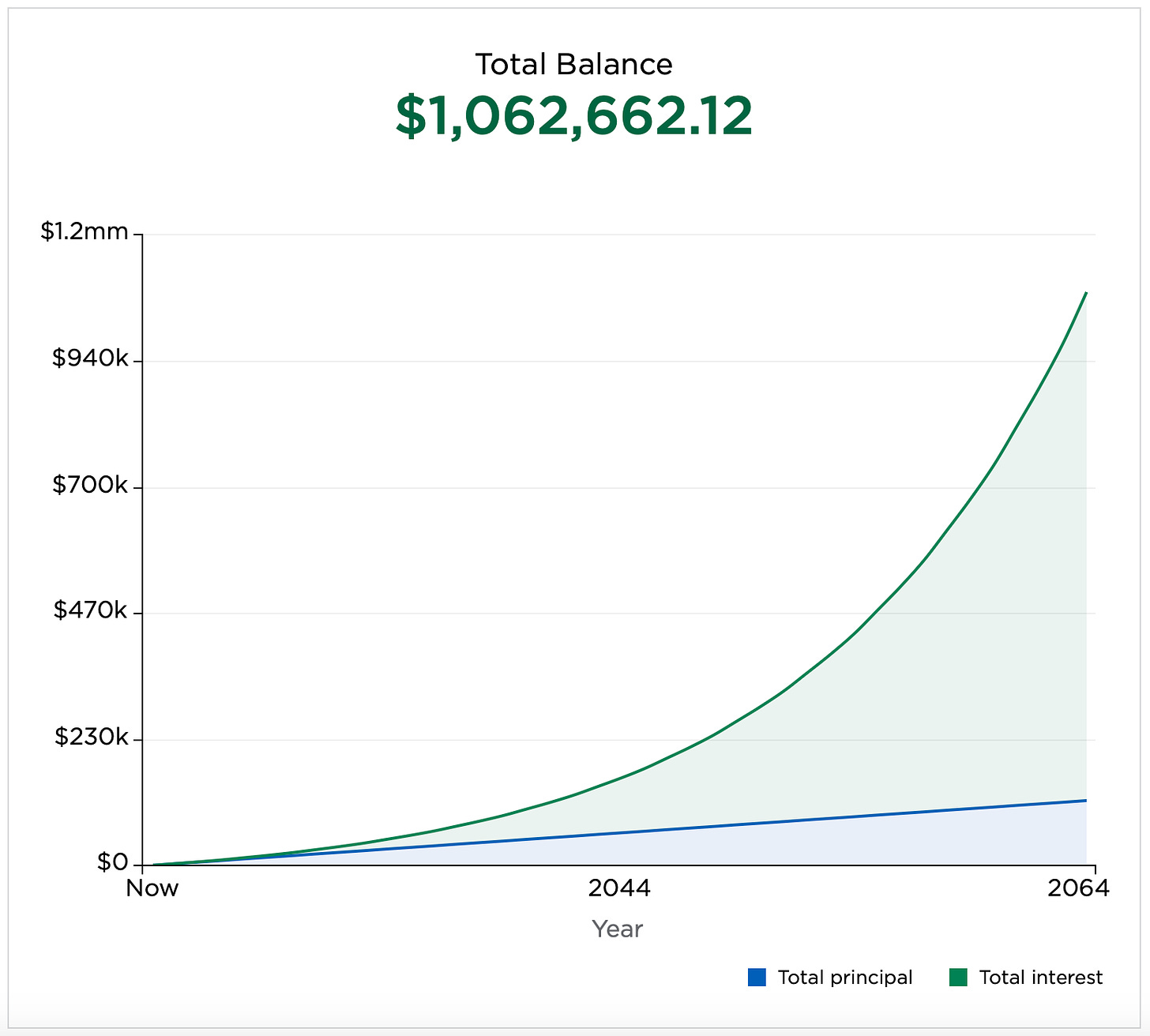

If you invest $250 monthly for 40 years you’ll be a millionaire (assumption: return of 9%/year).

This number should be adjusted for inflation but you get the point.

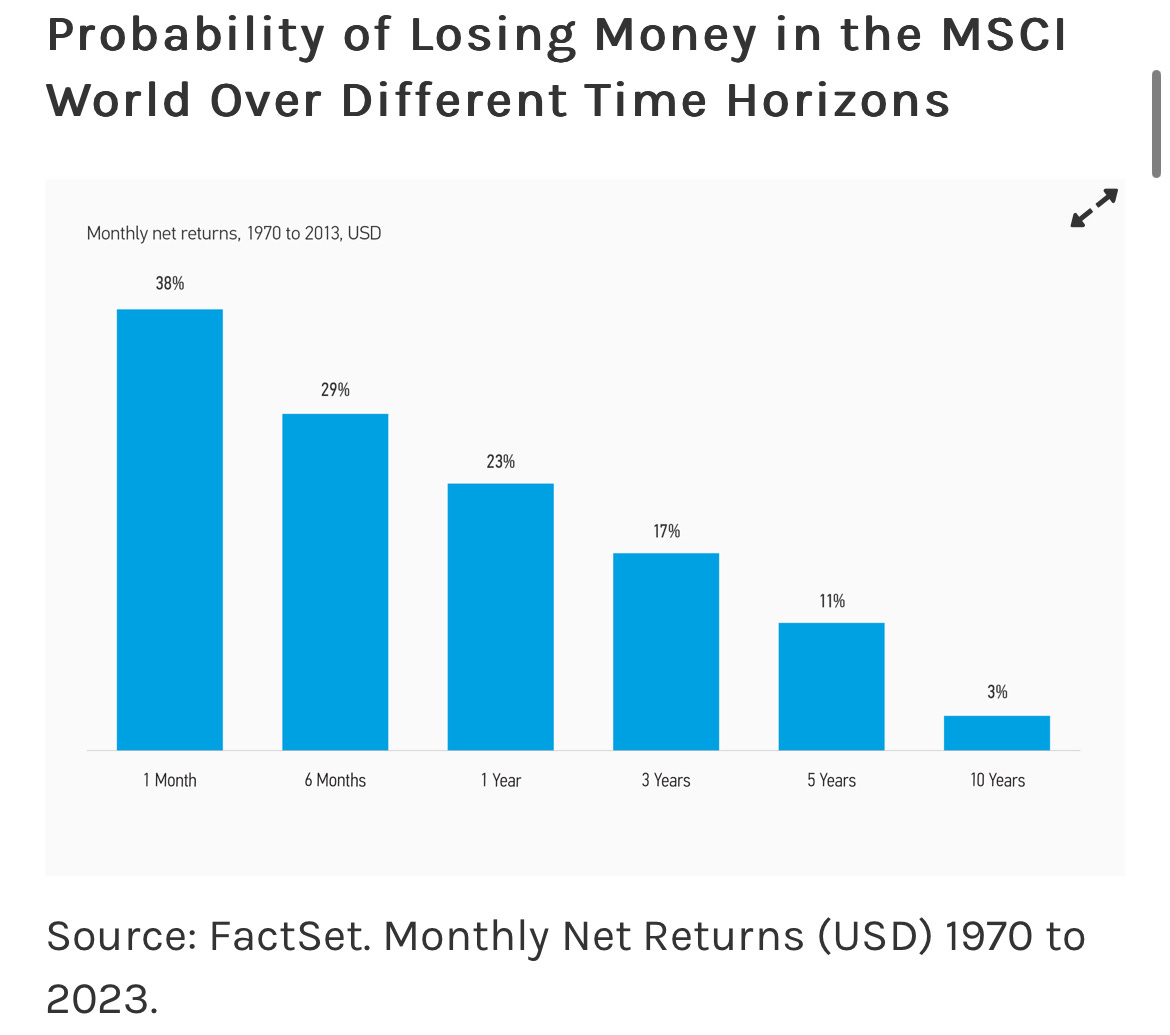

While in the short term it’s risky to invest in stocks, it’s risky to not invest in stocks in the long term.

When you invest for at least 10 years, you have a 97% chance of making money:

If you don’t want to spend too much time on researching stocks, ETFs are a great option.

It allows you to invest while only spending 10 minutes a month.

Do you want to secure your financial future? Or do you know someone who does?

This ETF portfolio can really help.

How the portfolio will work

Each month, we will buy an ETF for $500.

For both the ETF portfolio and the individual stock portfolio, purchases will happen the day after the article is published.

Why?

I want to give loyal readers like you a chance to act first.

Partners of Compounding Dividends will always be able to make their trades before I do, after doing their own research.

The ETF we’ll buy tomorrow

Has an attractive dividend yield of 3.4%

Has grown its dividend by over 10% per year

Has a 5-year earnings growth rate of 9.7%.

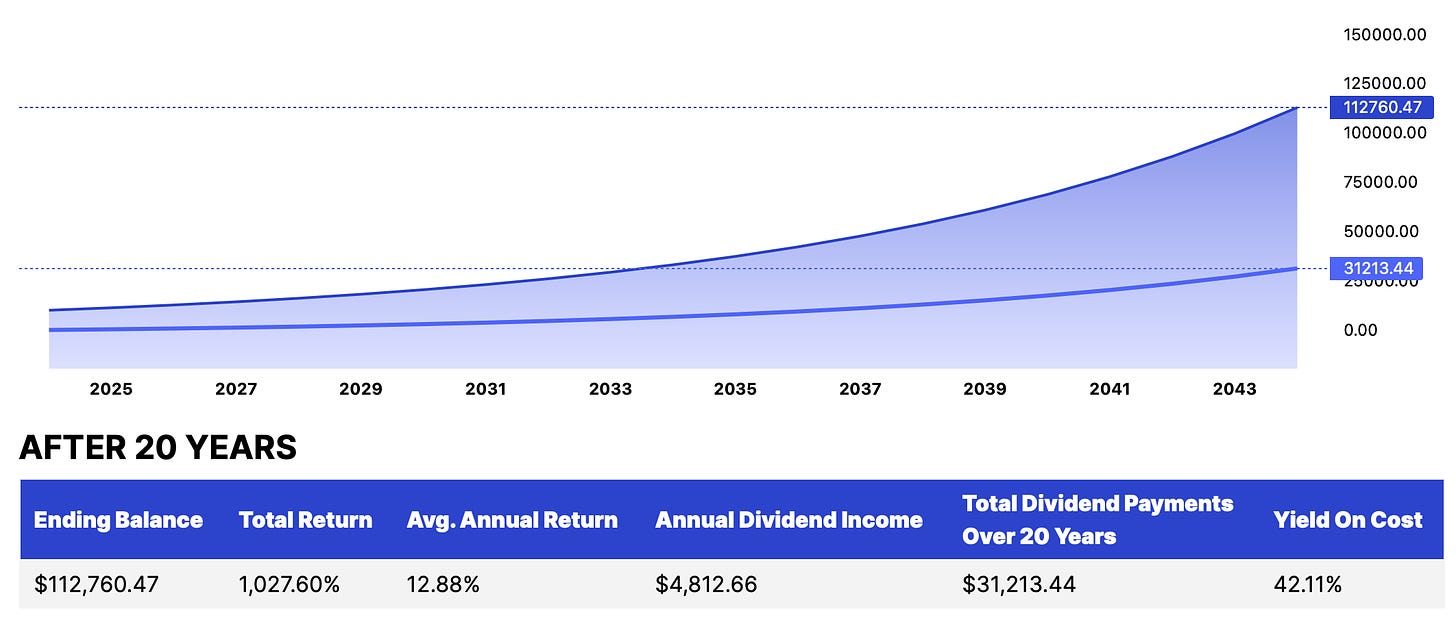

Here’s what $10,000 invested for 20-years looks like with those numbers:

Are you ready?

Let’s announce the first ETF we’ll buy within the ETF Portfolio.