Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

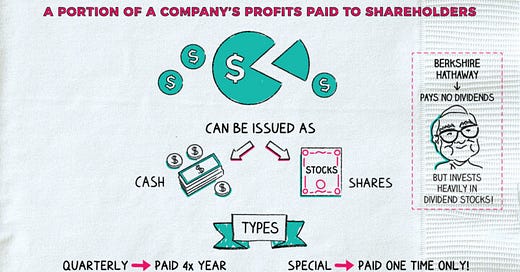

1️⃣ Dividends Made Simple

Investing might feel complex, but dividends are easy to understand.

Dividends are just a way for a company to share its profits with people who own its stock.

Here's a quick, simple explanation:

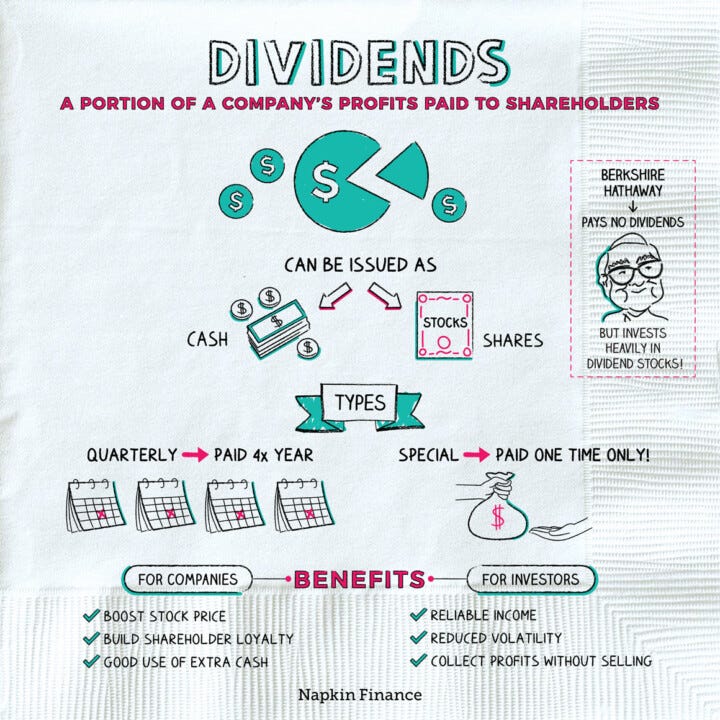

2️⃣ Don’t Lose Money

Warren Buffett once said:

"The first rule of an investment is don't lose money. And the second rule of is don't forget the first rule.” - Warren Buffett

The image shows how much you need to gain to compensate for a loss.

Dividends help you earn money, no matter what happens to the share price.

3️⃣ A dividend quote

Return OF Capital is more important than Return ON Capital.

Dividends are one way companies give money back to shareholders.

On Saturday, we'll talk about another method we like.

“I am more concerned about the return of my money than the return on my money.” - Mark Twain

4️⃣ Dividends Protect Your Investment

Dividend-paying stocks usually drop less when the market falls.

Here’s why:

Dividend returns are always positive.

Companies that pay dividends are often stable and profitable.

Investors often buy more dividend stocks when the market is down.

The image shows how often dividend-paying stocks and non-dividend stocks have negative returns.

It’s from a Crawford Investment Counsel report about how dividends protect against losses.

Click the image to view the full PDF.

Source: Crawford Investment Council

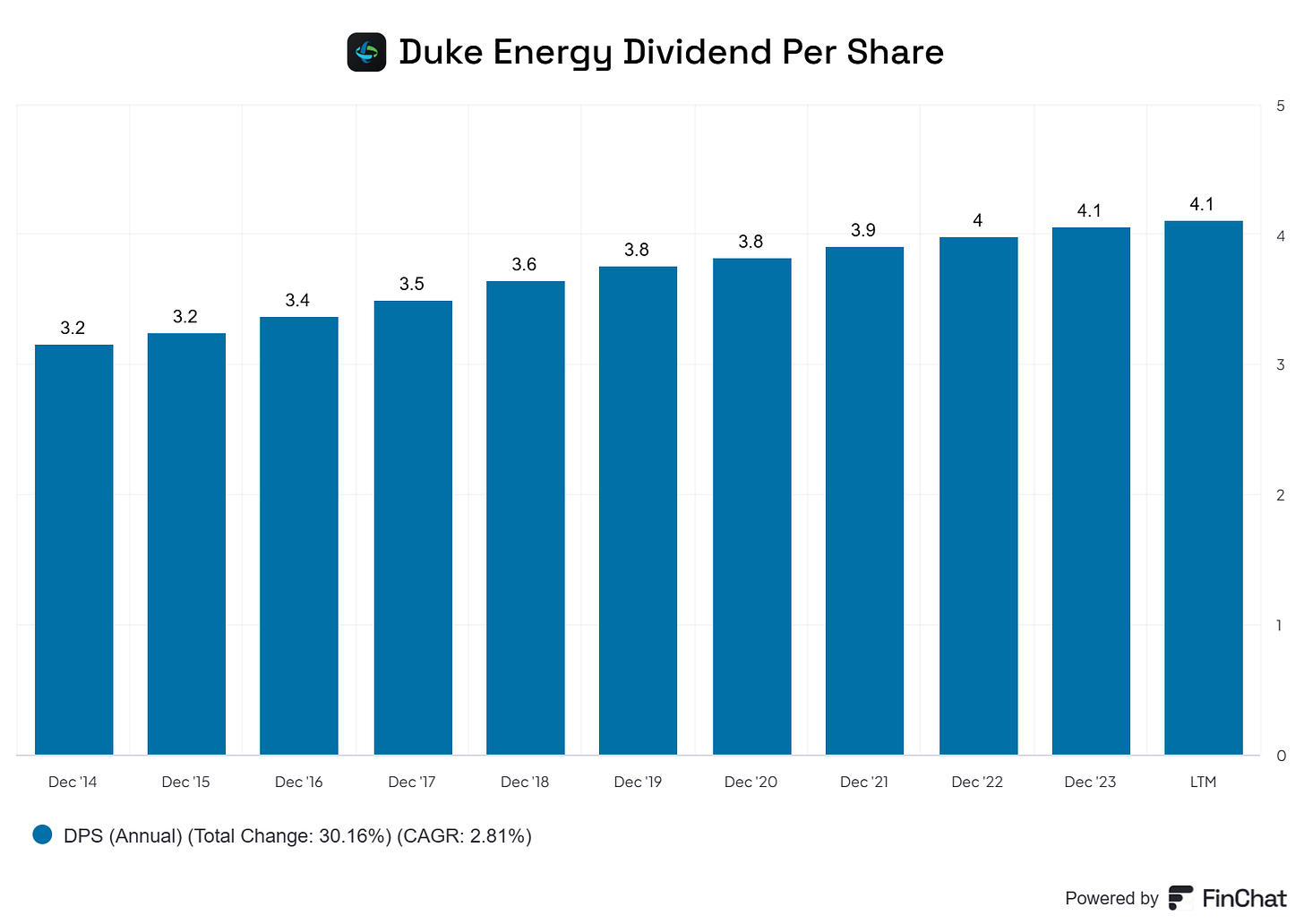

5️⃣ Example of a dividend stock

We’ve been discussing how to protect against losses, so let’s look at a defensive stock: Duke Energy.

Duke Energy provides electricity and natural gas to homes and businesses.

Utility companies like Duke are good defensive stocks because they offer services people always need, like electricity and water. Also, rules help them keep steady income.

Profit Margin: 14.5%

Forward PE: 18.7x

Dividend Yield: 3.7%

Payout Ratio: 70.5%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Cash for a company is like air for a balloon. If the balloon has enough air inside of it then it can easily let some out for others to enjoy. That's like a well managed company sharing its goodness with you. We can think of companies like Coca-Cola and Home Depot as well managed balloons. 🎈

(Well managed balloons ... now there's an expression!) 😄

Sometimes too much air is let out of the balloon. The balloon ends up deflating and losing its form. That's like a poorly managed company giving away too much cash when it should be conserving and reinvesting in itself. The stock price drops and the dividend is cut. Companies like Walgreens and Medical Property Trust come to mind. These are poorly managed balloons. 😔

Sometimes the balloon can dry up and pop. 💥 It can be unexpected like Enron when the accounting scandal was exposed or expected like Sears as the business deteriorated. We look back and say it was bound to happen. It's just hard to know ahead of time. 🤔

Making up for deflating and popped balloons is super hard. Your chart in Point #2 does a very good job showing this. I remember when I learned it way back it when. It blew my mind. When I told my kids about this over dinner they didn't believe it. Then we worked through some simple math and they still didn't believe it! 😏 They were little and their minds were probably blown away like mine was when I learned it too. 😶🌫️ Still, the mathematics don't lie!

Last idea to highlight is Point 4.1, where you quote the Crawford Investment Council PDF.

"1. Dividend returns are always positive."

Absolutely true. Why? Because you didn't explicitly pay for that dividend. You paid for the business ownership through the stock purchase ... but, you didn't put out any extra money to get that dividend. It's cost is $0.00. Someone could argue that the cost of the dividend is baked into the cost of your business ownership. After all, you are usually buying the company because of its dividend. Then we use that dividend as a return of your cost. Like we mentioned earlier, over a long enough period of time you will get all of your initial investment back. It's a refund, one little bit at time. 🙂 From either viewpoint, you win or your win. You get to pick which. 🤗