9 Stocks for Monthly Dividends

Dividend Aristocrats to receive a dividend every single month

You need to pay bills every month.

It would be nice to get dividends every month too.

But most companies pay dividends quarterly or only once a year.

Monthly dividend payers

In our last article, we shared some companies that pay dividends monthly:

Source: Stock Masters

Most of these companies are Real Estate Investment Trusts (REITs).

What if you want to get paid every month, but you want to invest in other types of companies?

There’s another way!

There are 3 typical patterns for quarterly dividend payments

January, April, July, and October

February, May, August, and November

March, June, September, and December

If you own stocks from each group, you can get a monthly dividend check!

Source: Stock Masters

You can find all dividend payment dates with Nasdaq’s dividend calendar.

You could get paid monthly by owning just 3 stocks, but we will show you an example portfolio of 9 Dividend Aristocrats.

This would give you 3 dividend payments each month!

Payments in January, April, July, and October

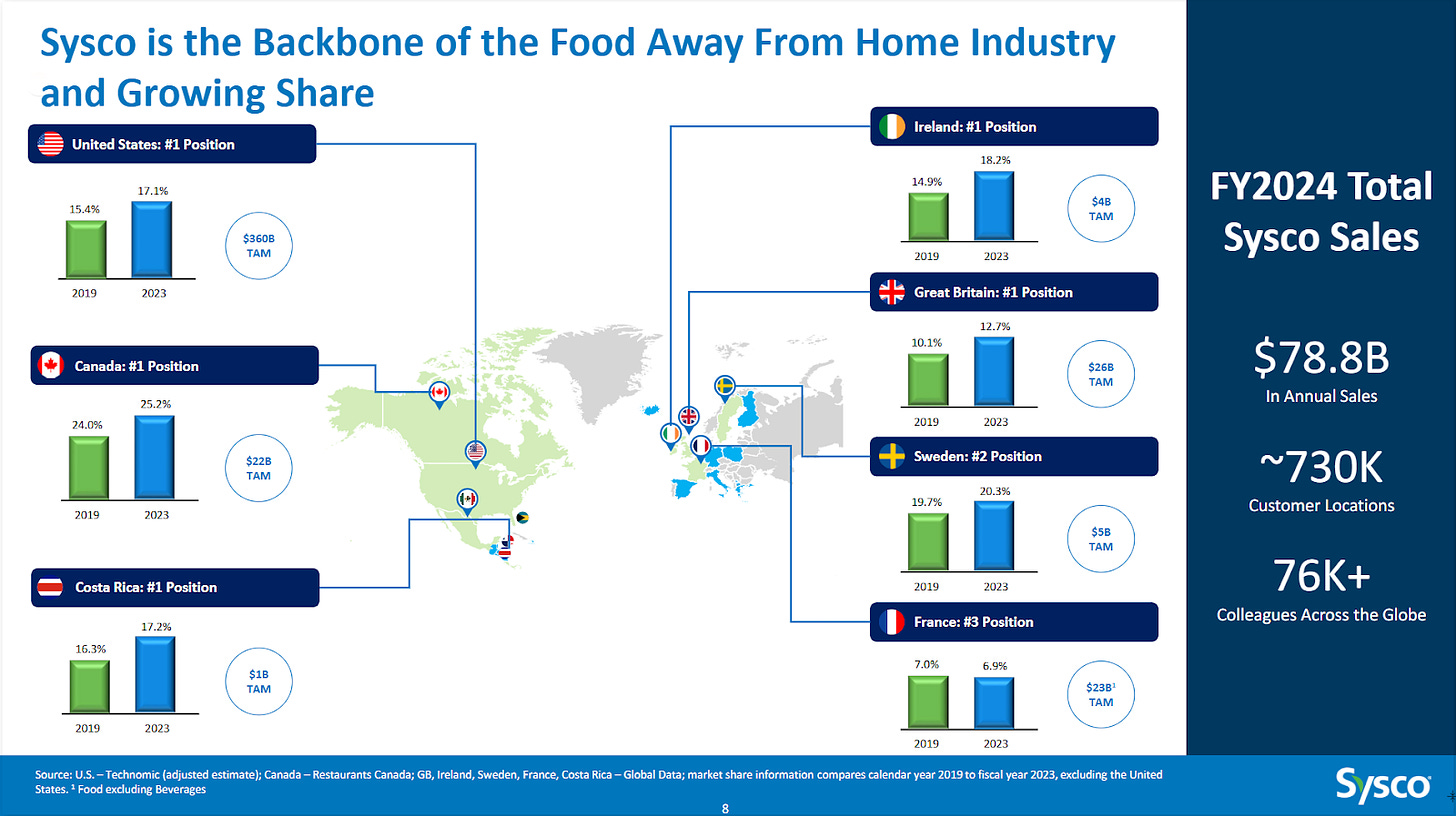

🍽️ Sysco Corporation

How does the company make money?

Sysco is the largest food distribution company in the United States. They make money by purchasing food products and supplies from manufacturers and farmers, then selling them to restaurants, healthcare facilities, educational institutions, and other food service operators at a markup.

Why is it an interesting dividend stock?

Years of dividend increases: 53

Current dividend yield: 3.8%

Payout ratio: 58.3%

2-Year Forward Dividend Growth: 5.3%

2–Year Forward Revenue Growth: 2.5%

Source: Sysco Investor Relations

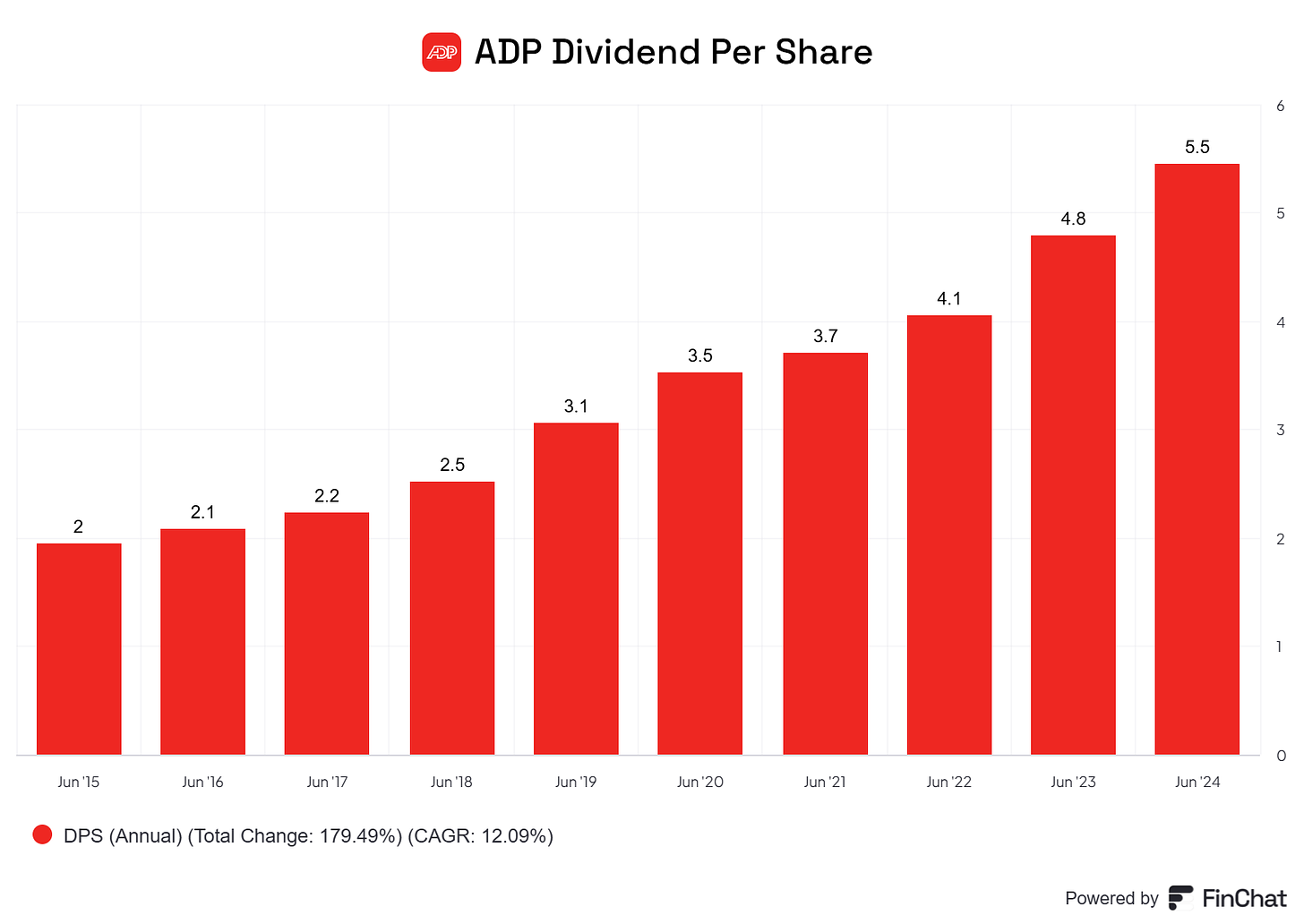

💵 ADP

How does the company make money?

Automatic Data Processing makes money by providing payroll processing, benefits administration, and HR management to businesses and organizations, charging them a fee for these services.

They also make money through data analytics and insights services.

Why is it an interesting dividend stock?

Years of dividend increases: 49

Current dividend yield: 2.6%

Payout ratio: 51.5%

2-Year Forward Dividend Growth: 5.2%

2–Year Forward Revenue Growth: 4.3%

Source: Finchat

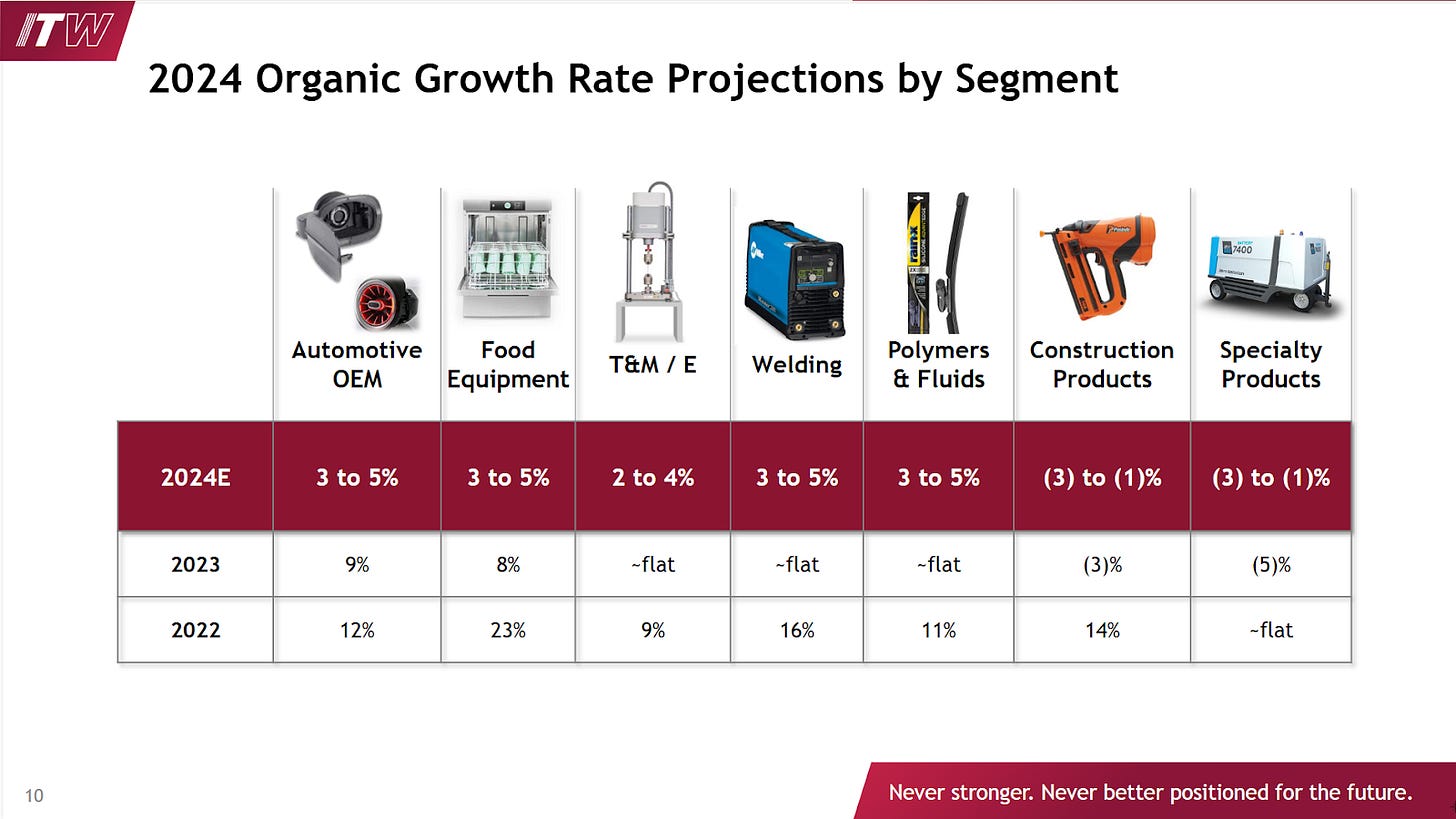

🛠️ Illinois Tool Works

How does the company make money?

The Illinois Tool Works makes money by designing, manufacturing, and selling industrial products like welding, test and measurement, and food processing equipment.

ITW also owns a diversified portfolio of businesses that sell products like fasteners, adhesives, sealants, and lubricants.

Why is it an interesting dividend stock?

Years of dividend increases: 60

Current dividend yield: 2.4%

Payout ratio: 54.7%

2-Year Forward Dividend Growth: 3.7%

2–Year Forward Revenue Growth: 1.6%

Source: ITW Investor Relations

Payments in February, May, August, and November

🚚 Caterpillar

How does the company make money?

Caterpillar makes money by designing, manufacturing, and selling heavy machinery and equipment, like bulldozers, excavators, and trucks.

Caterpillar also makes money from providing financing and insurance to customers, as well as through parts and service sales, which provide a steady stream of recurring revenue.

Why is it an interesting dividend stock?

Years of dividend increases: 30

Current dividend yield: 1.6%

Payout ratio: 24.1%

2-Year Forward Dividend Growth: 7.2%

2–Year Forward Revenue Growth: 0.5%

Source: Caterpillar Investor Relations

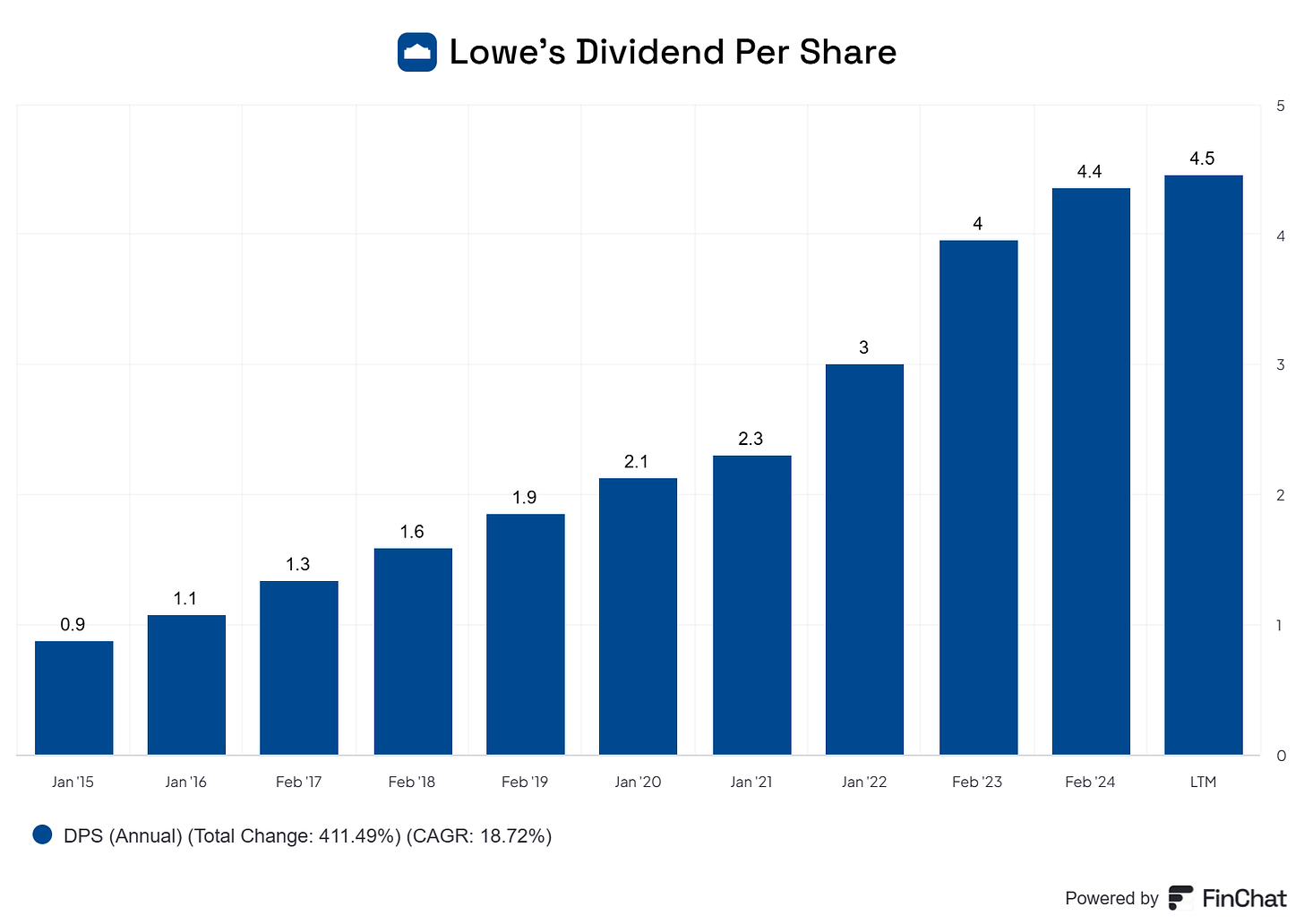

🪚 Lowe’s

How does the company make money?

Lowe's makes money by selling home improvement products, such as building materials, appliances, and gardening supplies, to homeowners, contractors, and professionals.

Lowe's also generates revenue through services like installation and repair. The company has around 1,800 stores and about 30% of the US home improvement market.

Why is it an interesting dividend stock?

Years of dividend increases: 60

Current dividend yield: 1.8%

Payout ratio: 36.8%

2-Year Forward Dividend Growth: 5.1%

2–Year Forward Revenue Growth: -0.7%

Source: Finchat

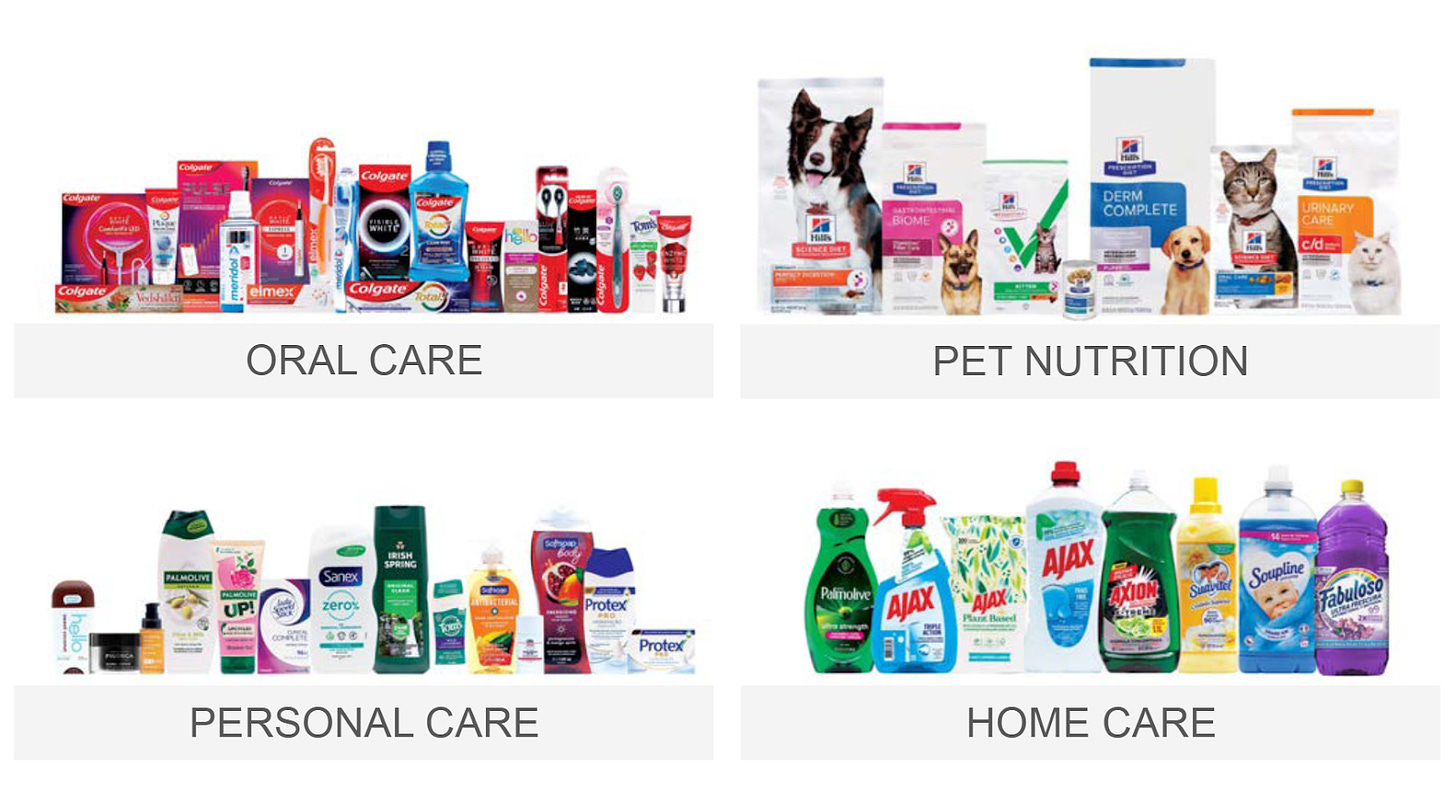

🪥 Colgate-Palmolive

How does the company make money?

Colgate-Palmolive makes money by manufacturing and selling consumer products, including oral care (toothpaste, toothbrushes), personal care (shampoo, conditioner), home care (laundry detergent, dish soap), and pet nutrition (Hill's Science Diet) products.

The company sells these products to retailers, wholesalers, and directly to consumers in over 220 countries and territories worldwide.

Why is it an interesting dividend stock?

Years of dividend increases: 63

Current dividend yield: 1.9%

Payout ratio: 56.2%

2-Year Forward Dividend Growth: 4.8%

2–Year Forward Revenue Growth: 3.8%

Source: Colgate-Palmolive Investor Relations

Payments in March, June, September, and December

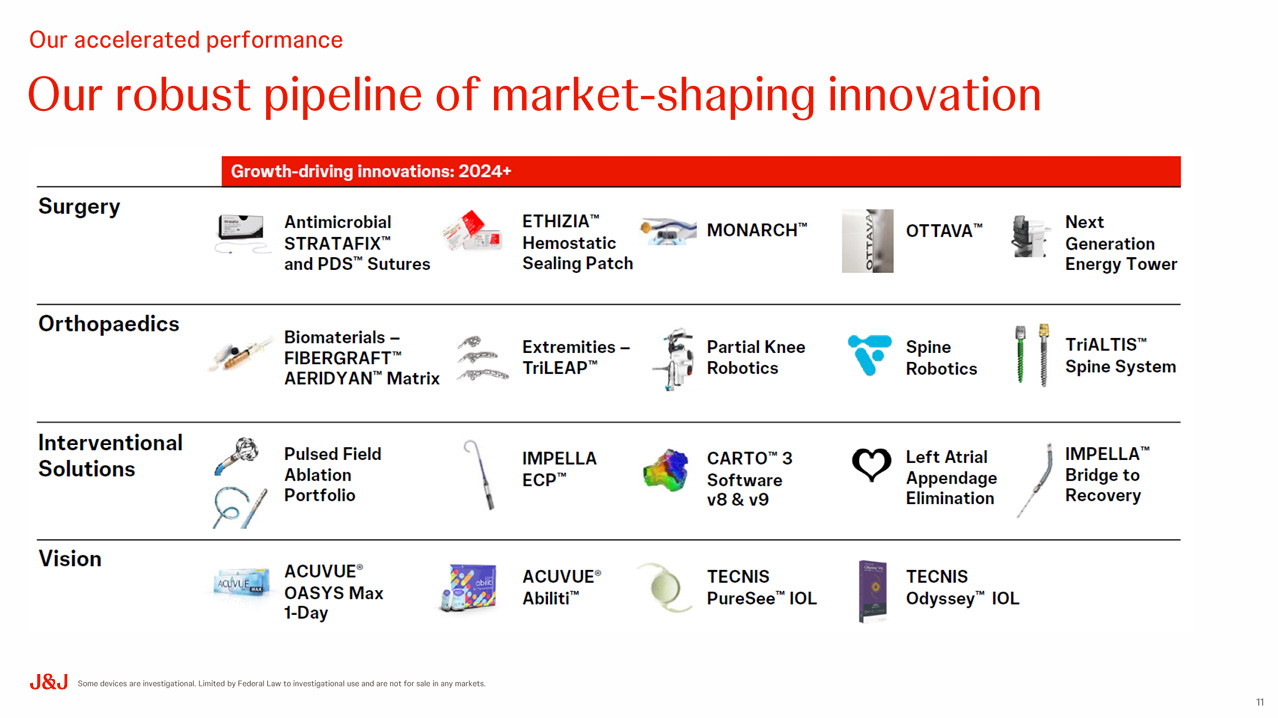

🩹 Johnson & Johnson

How does the company make money?

Johnson & Johnson makes money by developing, manufacturing, and selling a wide range of healthcare products, including pharmaceuticals, medical devices (surgical instruments, contact lenses), and consumer products (bandages, baby shampoo, acetaminophen).

The company has a diverse portfolio of brands that it sells to healthcare providers, retailers, and directly to consumers.

Why is it an interesting dividend stock?

Years of dividend increases: 62

Current dividend yield: 3.0%

Payout ratio: 71.5%

2-Year Forward Dividend Growth: 4.5%

2–Year Forward Revenue Growth: 3.4%

Source: Johnson & Johnson Investor Relations

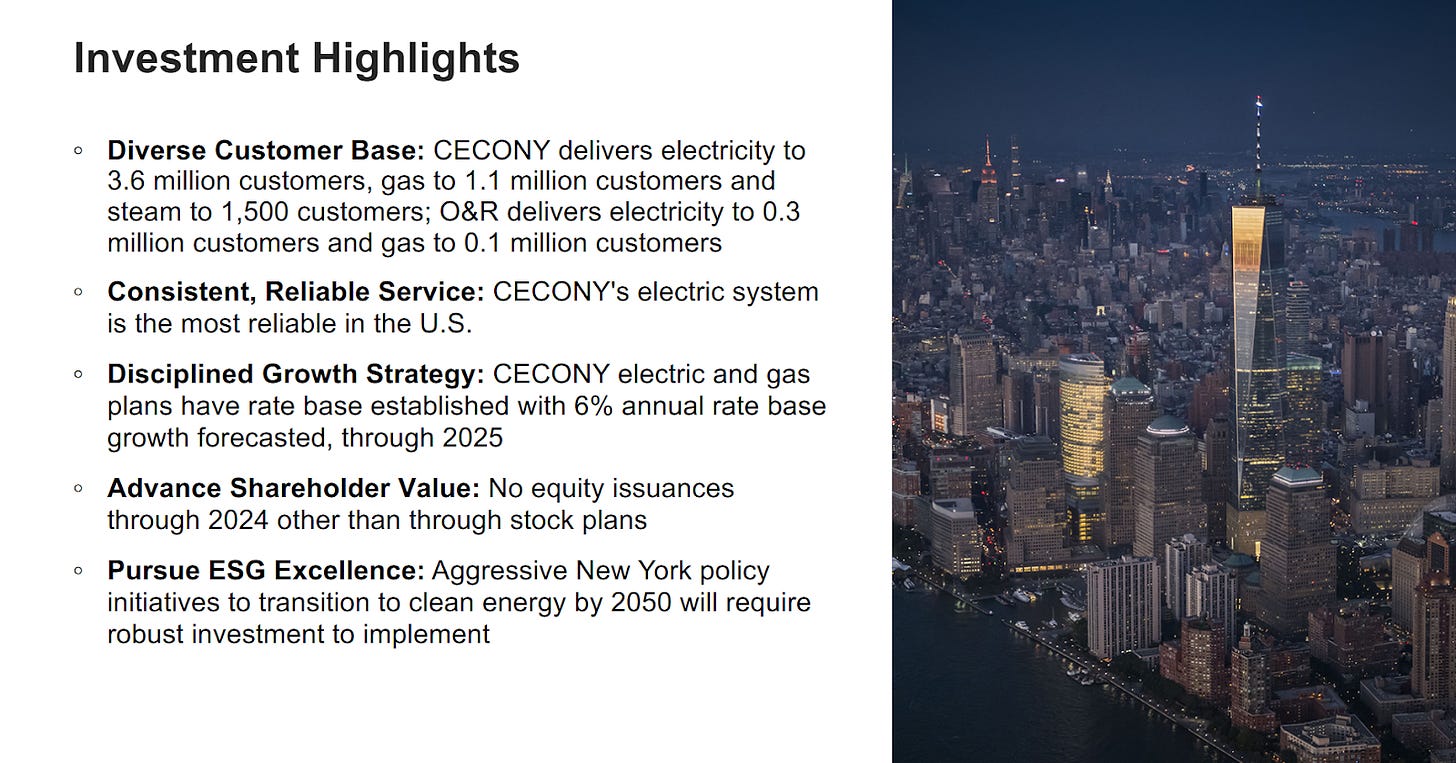

💡 Consolidated Edison

How does the company make money?

Consolidated Edison (Con Edison) makes money by generating, transmitting, and distributing electricity, gas, and steam to residential, commercial, and industrial customers in the New York City area.

As a regulated utility company, Con Edison's rates are set by the New York State Public Service Commission, providing a stable source of revenue.

Why is it an interesting dividend stock?

Years of dividend increases: 50

Current dividend yield: 3.3%

Payout ratio: 63.6%

2-Year Forward Dividend Growth: 3.0%

2–Year Forward Revenue Growth: 4.6%

Source: Consolidated Edison Investor Relations

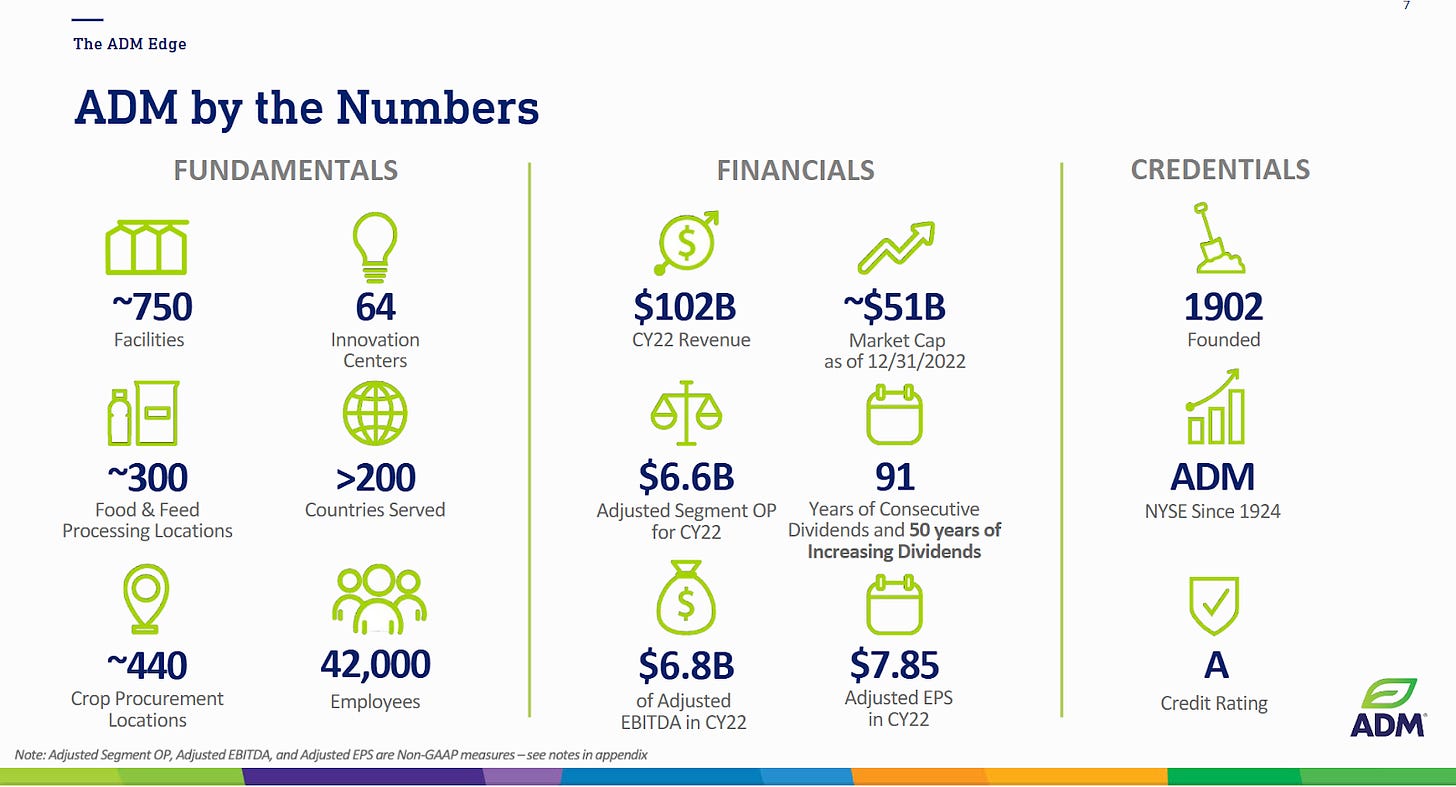

🚜 Archer Daniels Midland

How does the company make money?

Archer Daniels Midland (ADM) makes money by processing and trading agricultural commodities like corn, soybeans, and wheat, which are then turned into food ingredients, animal feed, biofuels, and other industrial products.

The company also earns revenue by providing global logistics, transportation, and storage services for these commodities.

Why is it an interesting dividend stock?

Years of dividend increases: 51

Current dividend yield: 3.3%

Payout ratio: 37.9%

2-Year Forward Dividend Growth: 7.8%

2–Year Forward Revenue Growth: -2.2%

Source: ADM Investor Relations

Conclusion

By strategically selecting dividend-paying stocks from different payment schedules, you can create a steady stream of income throughout the year.

Our example portfolio of 9 Dividend Aristocrats has increased their dividend payments for between 30 and 63 years in a row, and includes a diverse range of industries:

Food processing and distribution

Payroll processing

Heavy machinery

Consumer goods

Utilities

Here’s when you would receive your dividends from each company in this portfolio:

January, April, July, October:

Sysco Corporation

ADP

Illinois Tool Works

February, May, August, November:

Caterpillar

Lowe's

Colgate-Palmolive

March, June, September, December:

Johnson & Johnson

Consolidated Edison

Archer Daniels Midland

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Glad you recognized so many of the companies! I tried to pick companies are familiar with to show that there are plenty of aristocrats with businesses that are understandable

Ahh, more monthly dividend payers! 😀💰🥳

The article highlight some very strong companies. 💪

Sysco - I see their trucks very often at our company. They provide a lot of the food and ingredients used in the cafeteria. It's not just us they feed. Their trucks also deliver to restaurants and hotels. Some of their metrics, like debt to equity is high 🤔 which would make me feel uncomfortable but I think their revenue stream is strong enough to support it.

ADP - US folks who work for a large corporation. Chances are their W-2 is handled by ADP. The stock price took a tumble-bumble 📉 back in November. That would have been a great time to get in. Even if you bought the day before the tumble bumble you would have recovered the paper loss and gone on to a paper gain! 📈

Caterpillar - People will be harvesting Earth's resources until the planet cracks in half. What better way to do it than with Caterpillar hardware? 🤗 The 52 week range has seen a wild ride and the price has been range bound for a while. I think it's probably fairly valued for what it is.

Johnson & Johnson - They seem to have bullseye on their chest. Lots of lawsuits! They may be the good student who is having a bad day? 🤷

Archer Daniels Midland - Their stock price got slapped down hard due to a small account scandal. The CFO lost his job for it. I can't remember all the details but I think they worked through it. The price is recovering. That would have been a great time to buy in. 👈

Buying the right companies like these at the right allocation percentages can give you a steady monthly dividend check!