Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ 25 Years of Dividend Raises

Dividend growth investors love regular dividend increases.

Dividend Aristocrats are companies in the S&P 500 that have raised their dividends for at least 25 consecutive years. There are only 67 of them.

With 503 companies in the S&P 500, this means just 13% qualify as Dividend Aristocrats.

2️⃣ ETF Nobility

You can invest in all the Dividend Aristocrats through an ETF.

One example?

The ProShares S&P 500 Dividend Aristocrats ETF. Ticker: NOBL

A $10,000 investment in this ETF in 2014 is now worth over $28,000, growing at more than 11% per year.

If you had reinvested your dividends, you’d have even more!

Source: Finchat

3️⃣ A dividend quote

Sir John Templeton was a renowned investor and mutual fund pioneer.

He’s best known for creating the Templeton Growth Fund in 1954 - one of the first global investment funds.

His average return was more than 15% per year for 38 years!

"The best investment with the least risk and the greatest dividend is giving." - John Templeton

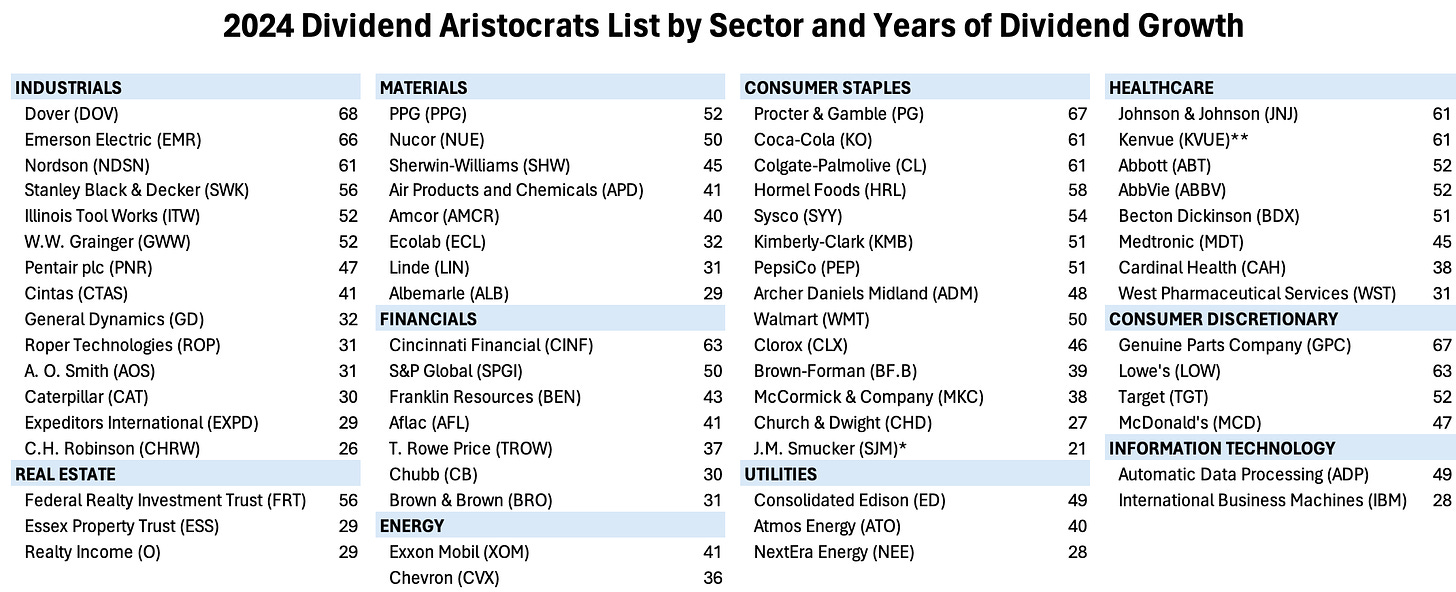

4️⃣ All Dividend Aristocrats

Here’s an interesting way to look at the Aristocrats.

The image shows them grouped by sector and lists how many years they’ve increased their dividend payments.

Click on the picture to access a large, high-quality image.

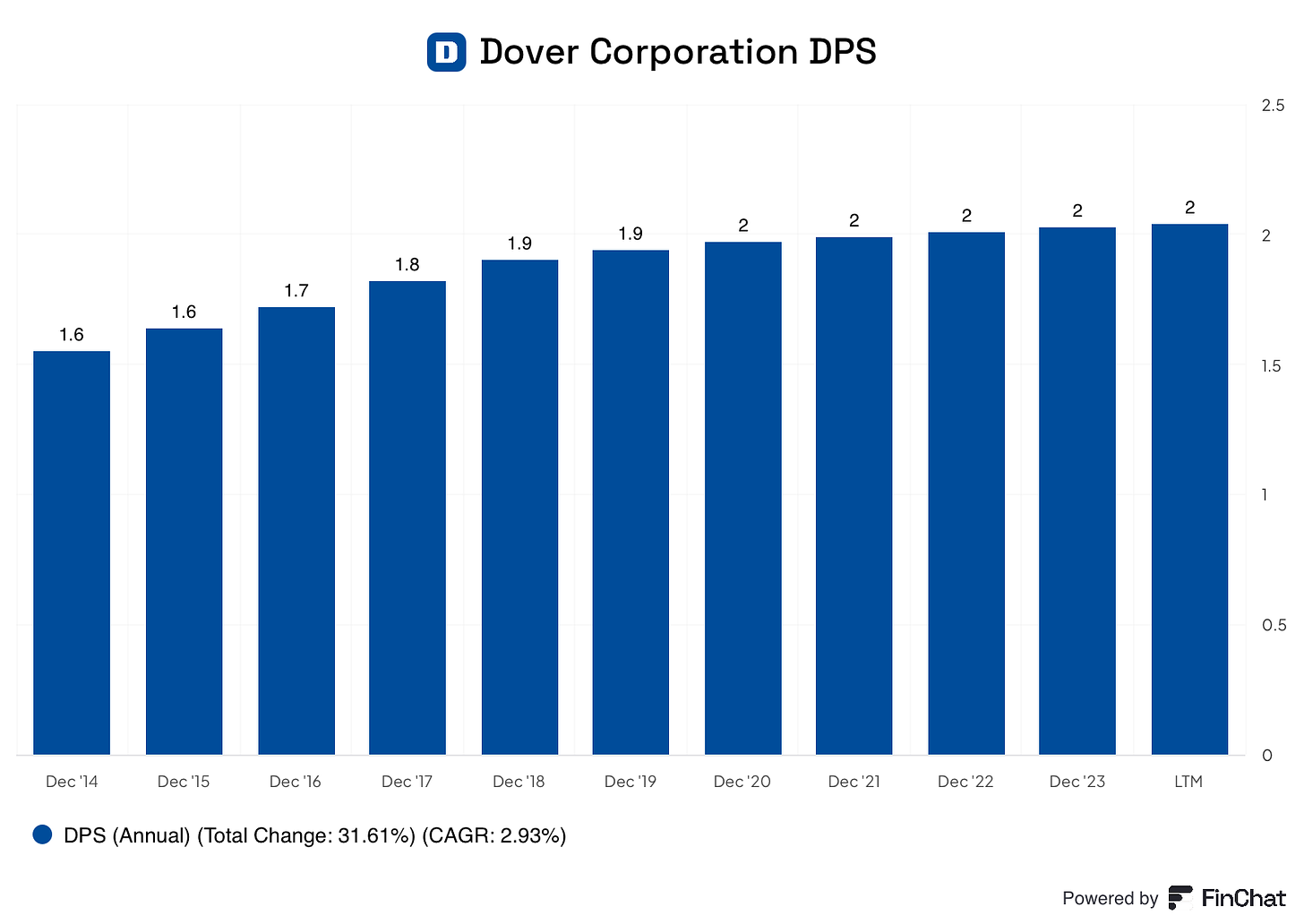

5️⃣ Example of a dividend stock

The Dover Corporation has been raising their dividend for 68 years!

They make money by manufacturing and selling a wide variety of products like industrial equipment, pumps, refrigeration and printing technology.

Profit Margin: 17.6%

Forward PE: 19.5x

Dividend Yield: 1.1%

Payout Ratio: 18.9%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Awesome concept and chart listing them all. And 67 - wow, that's a high number to me.

Does your methodology have a minimum dividend yield for the business to be considered for the portfolio?