Imagine you generate a growing source of income every single month.

The best part? You don’t need to do anything.

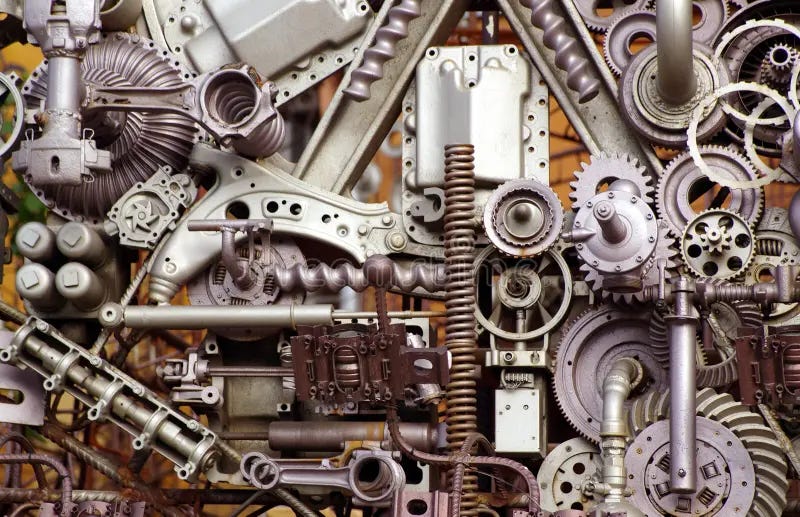

You can think of it as a Dividend Income Machine. I’ll teach you everything you need to know.

Each company you own is a part of your Dividend Income Machine.

They all work together to keep the machine running and delivering consistent payouts.

All you have to do is watch your wealth grow as the machine does its work.

If you need a review of dividend investing and its benefits, read our Dividend Investing 101 article.

Let’s teach you what you need to know about this machine and how to build one.

Compounding fuels the machine

A Dividend Income Machine runs on the power of compounding.

Imagine putting money into the machine and getting back a little more than you invested every single time.

If you keep reinvesting what you earn, your machine will eventually produce a lot of income.

This is the power of compounding.

It’s like a snowball that keeps going faster and faster.

A compounding example

This example will make everything clear.

Let’s say you:

Invest $10,000 in a Portfolio with a dividend yield of 5%

You add $7,000 to your Portfolio each year

You reinvest your dividends

After 32 years, can you guess how much dividends you will receive every single year?

This under the assumption that your Portfolio returned 7% per year and dividends increased by 6% per year.

The correct answer is $78,384.85.

And your Portfolio would be worth more than $2 million!

That’s the power of compounding put to work.

Customise your machine

Every company within your Portfolio can be seen as a ‘part’.

With these parts you can create the machine you want.

Here are a few things to think about:

Do you want your machine to focus on growth in the future, or higher yields now?

It doesn’t have to be one or the other.

You can have a mix of dividend growth and high-yield companies

How soon do you need to use the cash?

The longer you reinvest your dividends, the more dividends you’ll receive

This may influence which dividend stocks you buy

Do you want a steady income?

Most companies pay dividends quarterly.

There are 3 typical quarterly patterns for dividend payments:

January, April, July, and October

February, May, August, and November

March, June, September, and December

If you pick one from each group, you can get a dividend check each month!

Finding good parts

A good Dividend Income Machine will:

Generate regular income

Grow the income over time

Run for a long time without a lot of maintenance

Remember that the “parts” in our machine are dividend-paying companies.

A good machine should be built out of good parts.

This means you want to invest in:

Companies that can survive for a long time

While growing attractively

Companies that will survive

We want to receive income for a long time, so we need companies that will be around for a long time.

Here are some things that help ensure your companies will survive:

Low debt

A payout ratio that isn’t too high

A long history of dividend payments

Dividends that don’t grow faster than earnings

Companies that will grow

Growing dividends fuel the machine, and inflation will reduce the purchasing power of your income over time.

Making sure your companies will continue to grow is also important.

Some things we like to see are:

A history of attractive growth in revenue and earnings

A relatively high starting dividend yield

A history of attractive dividend growth

A preference for companies in an attractive market or with secular tailwinds

We can put all of these together in an example screen.

Screening for interesting companies

How to screen for good dividend companies:

Debt/equity < 50%

Payout ratio < 60%

Dividend yield > 1.5% (equal to the current yield of the S&P 500)

Dividend growth > 8%

Revenue growth > 4% (above inflation)

Feel free to adjust these, or add your own.

This is just a starting place, but here are some of the companies this screen would produce:

Source: Finchat

On Finchat you can screen for these criteria yourself.

A Final Example

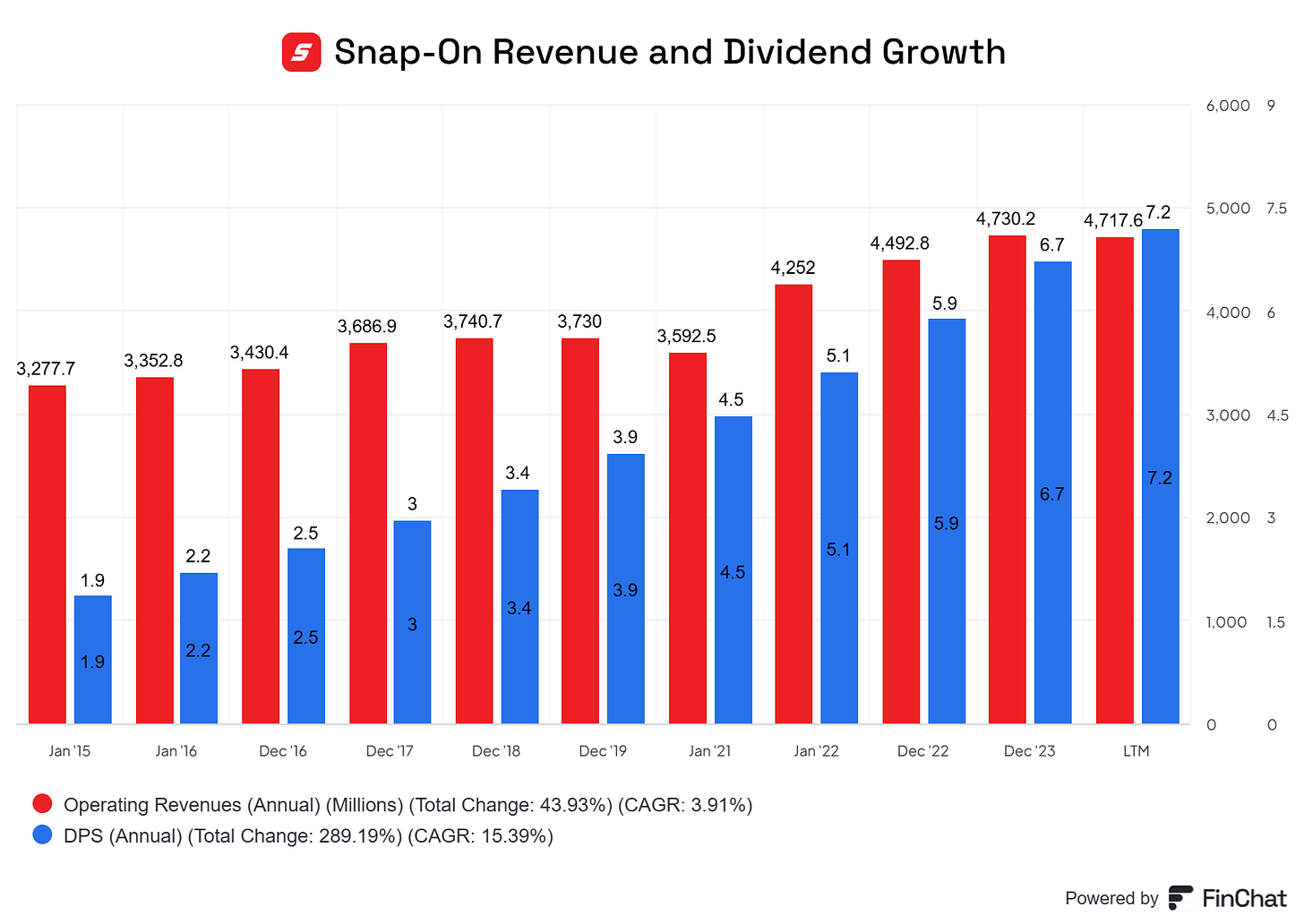

An interesting company that matches the criteria outlined above? Snap-on.

Snap-on makes money by producing and selling high-quality tools to professionals like automotive and aircraft mechanics, construction workers, and maintenance professionals.

They operate by franchising their brand to independent mobile tool dealers.

Profit Margin: 19.8%

Forward PE: 14.1x

Dividend Yield: 2.7%

Payout Ratio: 37.8%

Source: Finchat

Conclusion

You want to create a Dividend Income Machine.

This means your dividend payouts will increase every single year.

Dividend investing has a lot of advantages:

Regular cash flow

Inflation protection

Lower volatility

Income without selling assets

By reinvesting your dividends, and regularly adding to your account, you accelerate the magic of compounding for yourself.

That’s it for today

That’s it for today.

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Well done! 👍

Investing for dividend based income is a very different game than investing for capital growth. You're not necessarily looking to grow your capital, although that would be nice. Instead, you want a safe, stable, and growing dividend. If you're just starting out in building your portfolio then you will want to reinvest the dividends to accelerate the portfolio's share count. This will also reduce your yield on cost, since your cost goes down with every dividend received. Think of it as a refund in a way. 😉

There were two ETFs that paid dividends weekly - ticker symbols WKLY and TGIF. Both are defunct now. The idea is interesting though! Imagine getting a dividend payment every week! My older son really liked that idea when he started investing with his "kiddie" account. We screened for companies that paid a dividend for the past 10 years without any cuts or breaks. The minimum yield was 4%. It was quite a list. Maybe 20 or more companies? I can't remember. What I do remember is us mapping past dividends on a yearly calendar. Oh, what a project that was! We discovered rhythms in payments and came up with a portfolio in the fall of 2021 that should pay a dividend weekly.

And .. it worked! 😃

I think there were a few times when a week broke across two months and the payments were shifted. Not a big deal.

We sized the holdings so that each position will deliver the same dividend amount.

A monthly dividend paying portfolio is very attainable. 👍

I would still aim for a minimum 4% yield and include REITs in that investable universe. 🌍 Then again, I am in the US so I have my biases here. 😉

There is a well known Seeking Alpha author named Rida Morwa. He has some interesting ideas on investing for income. Some of his ideas feel like "yield chasing" and are a little risky. However, his philosophy is spot on for what he is trying to accomplish. His articles are worth a read. One of them really struck me. I can't remember the title, unfortunately. In that article he said you should pick a monthly expense, like electricity or internet service. Then build up the portfolio size such that the dividends cover that bill. Start with something small so you get a sense of accomplishment. Don't pick your rent or mortgage. 😏 Once you get that bill covered, move on to the next. Keep going until you get all your bills covered!

I think it was him who said he got the inspiration from a reader who bought enough stock of the electric company to cover the electric bill. So, the electric company was paying the electric company. 😅

There is another authors on Seeking Alpha who name is Guido Persichino. He is based in Italy and invests primarily in CEFs but has some ETFs and other issues. His articles are not very technical but they are beautifully written. He named various groups of issues after different Italian artists 🧑🎨 and artworks. I wouldn't necessarily endorse all of his picks but the fact that he focuses on CEFs is very interesting. There are some good ones with super stable performance 📈 and others that are choppy and lumpy. ⛓️💥

Another interesting author is Steven Fiorillo. He has a series of articles that documents his weekly allocation, where he puts $100 every week 💸 into a portfolio of dividend payers. His latest article in the series talks about week 182 (!), where he has $18,200 dollars allocated and is projected to get $1,678.32 in dividends. That's about a 9.2% yield. He goes wild with lots of charts and graphs 📊 which is kind of cool to see.

I mention these authors because I wanted to highlight just how wide the dynamic in dividend investing is. It's not an endorsement.

One thing I find missing among these three authors is a lack of focus on business quality. I mean, it's mentioned but not necessarily pursued. Lots of the ideas seem risky because the businesses behind the ticker symbols are a little weak. I would rather see smaller portfolio sizes than what they have (Rida has 42 positions) with higher concentrations.

I suppose it's OK to pick one or two risky, yield chasing issues if you have a portfolio of 8 - 10 solid, high quality companies. This allows you to "juice your yields" and if something goes awry then you're only exposed to one position.

I think the focus on quality and stability is essential and that's where this blog fits in nicely. Always go for quality, especially if your living expenses kind of depend on it! I mean, you will be buying food, water, cruise ship tickets, etc with this money. You ought to expect $X but what if you get $Y ... and $Y is less than $X? 😓

Thanks for the knowledge you've shared, I have been able to learn more about dividend investing.