Covered calls can be very interesting.

But what are they? And can we play this idea via ETFs?

In this article, we’ll teach you everything you need to know about Covered Call ETFs.

Covered call ETFs like JEPI and QYLD have become popular recently.

Their goal is to provide high yields and reduce volatility.

While it can be interesting, this strategy does have some risks and trade-offs that you should understand…

Call Options

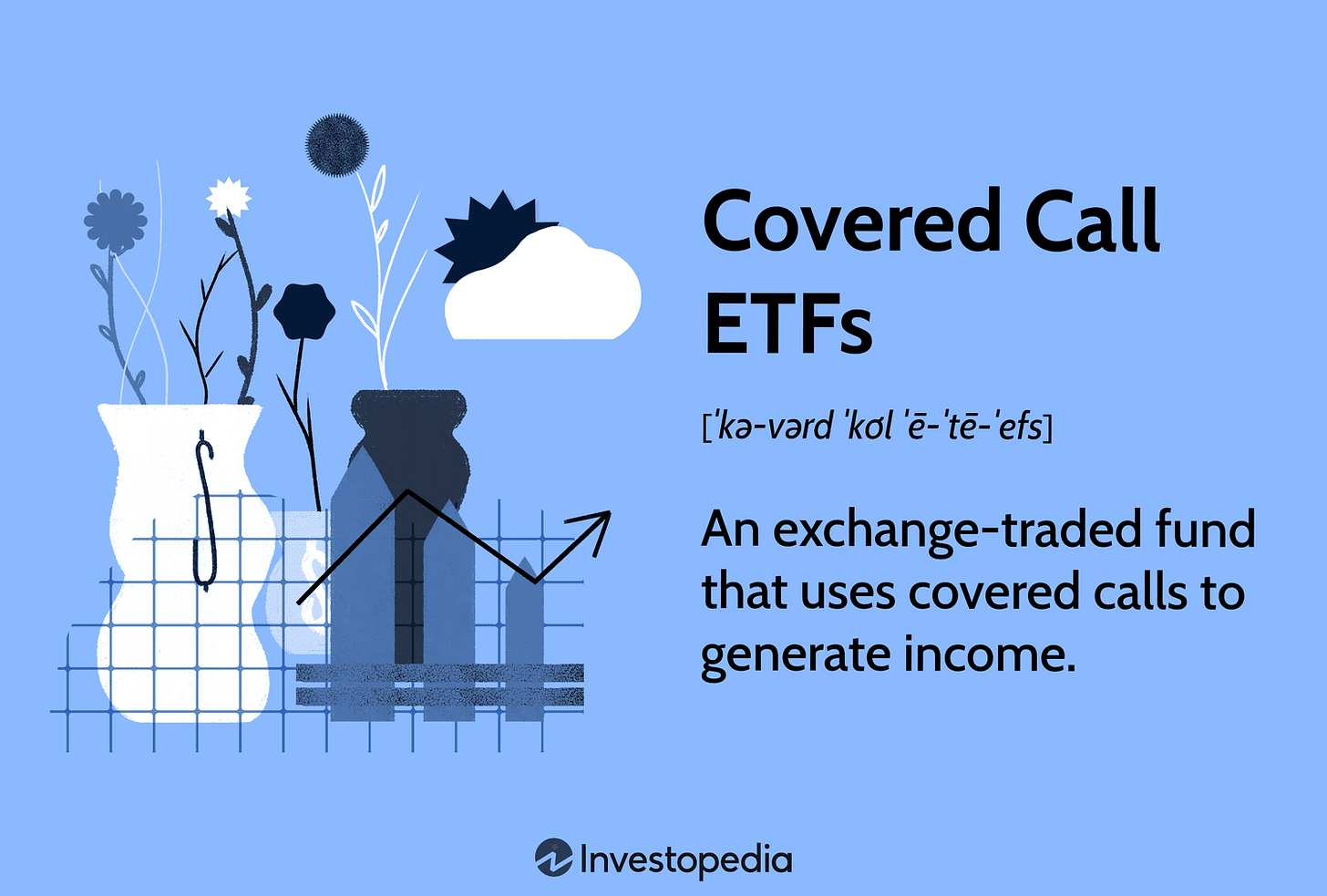

Let’s start with what a call is.

A call option is a contract that gives the buyer the right, but not the obligation, to buy a certain stock at a set price (called the "strike price") within a certain time period.

The buyer of the call gives the seller a payment upfront, called a premium.

Here's an example:

Let's say a stock is currently trading at $50 per share. A call option on that stock might have a strike price of $55 and an expiration date 3 months from now.

If you buy this call option, you have the right to buy the stock for $55 per share at any time over the next 3 months.

If the stock price goes above $55 before the option expires, you can buy it at $55 and sell it at the higher market price for a profit.

If it does not go above $55 in the next 3 months, then your option expires worthless.

Either way, the seller keeps the premium.

How Covered Call ETFs Work

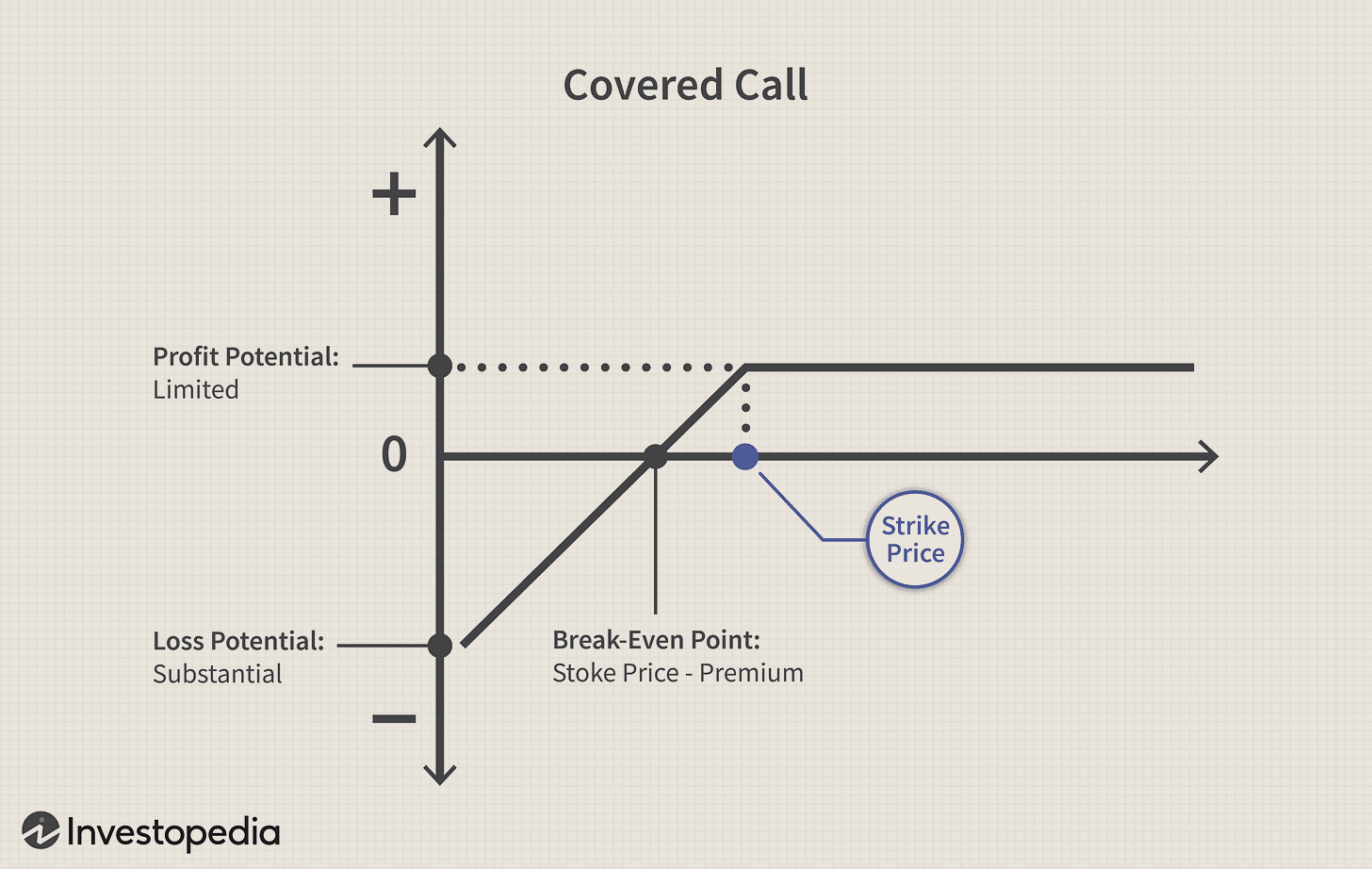

Covered Call ETFs sell call options on the stocks they own.

This generates extra income from the premiums, which is paid out as a dividend.

It also caps the upside you can receive on the underlying stock or index.

If its price goes above the strike price, you’ll have to sell it to the owner of the call.

The option contracts generally expire 1 month out, and the ETFs often pay dividends monthly.

Dividend Safety

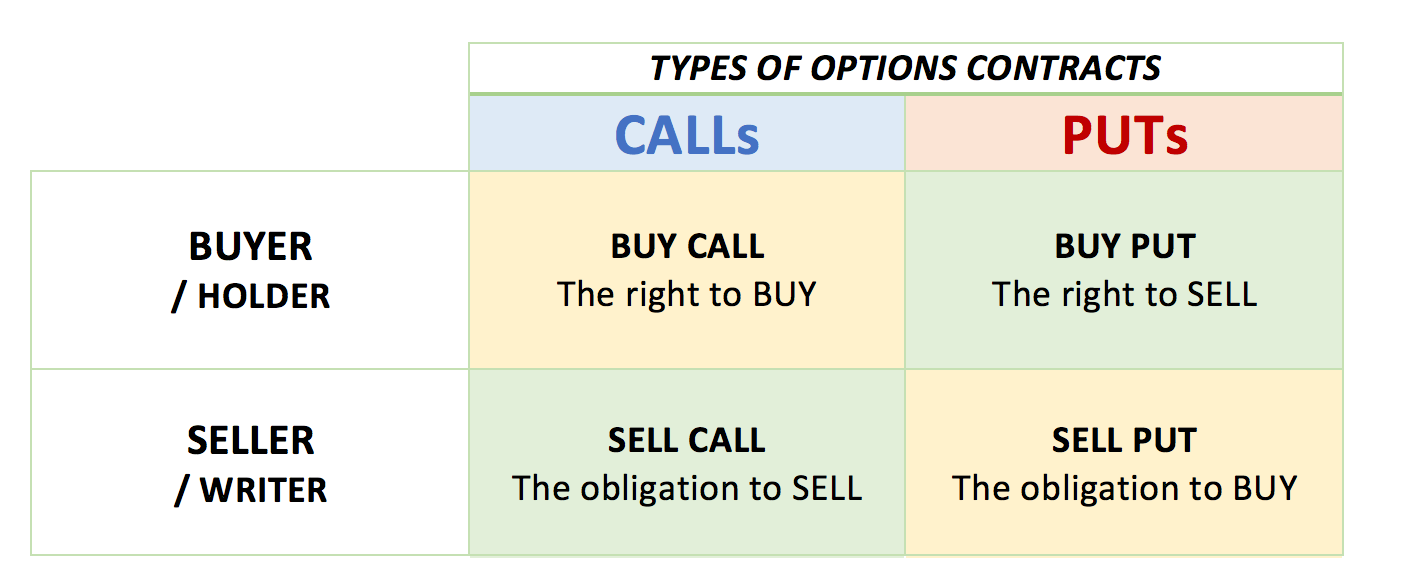

Dividend income from covered call ETFs can fluctuate a lot. Potentially 30% to 50% year-over-year.

Here’s a chart of the dividend payments for the last 4 years of JEPI:

You can see that some months the dividend payment was $0.60 and others it was around $0.30.

The reason is that a significant portion of the dividends come from the premiums received from selling call options.

The price of call options is dependent on the market's expectations of future stock price volatility.

When volatility is expected to be high, option premiums become more expensive, increasing the ETF's dividend income.

But when volatility expectations decline, so does the price of option premiums.

The potential for high yields can be appealing, but the lack of dividend safety and stability is an important consideration.

Capped Upside

Covered call ETFs have another key trade-off to consider - they cap your upside potential compared to just holding the underlying stocks.

This can lead to underperformance during strong bull markets.

Covered call ETFs pay the full price to own the stocks, but don't get the full upside when those stocks rise significantly.

The call options they sell limit their gains.

Additionally, if a stock in the portfolio falls by more than the premium collected from the call option, the investor still experiences the downside.

In strong, sustained market rallies, stocks often tend to go up more than what the options market had priced in.

As a result, covered call ETFs often trail the performance of long-only stock indexes during bull markets.

You can see this with QYLD charted against SPY:

Source: Finchat

This trade-off is an important consideration for investors.

The potential for lower volatility and income generation from covered call strategies may come at the cost of lagging performance in robust, rising markets.

Tax Considerations

Because covered call ETFs generate a lot of the cash from selling options, these distributions are taxed differently.

Investors in covered call ETFs should be aware of the potential tax implications:

Income from option premiums is generally taxed as short-term capital gains, which are typically higher than long-term capital gains tax rates

Tax treatment can vary from year to year as well - in 2022 nearly all of QYLD’s distributions were taxed as returns of capital

JEPI uses equity-linked notes, not options to generate income, so the distributions from that fund are taxed as interest

Investors should review the tax information provided by the specific covered call ETFs they own to understand the potential tax consequences

It’s often advantageous to hold these types of ETFs in a tax-advantaged account like an traditional or Roth IRA

The tax implications of covered call ETFs are more complex than traditional stock or bond ETFs. Planning for this ahead of time is important.

Higher Fees

These funds do have higher fees compared to a passive index fund.

For example, SPY has an expense ratio of 0.09%.

For JEPI and JEPQ you’ll pay 0.35%.

The expense ratio for QYLD is 0.61%.

"The miracle of compounding returns has been overwhelmed by the tyranny of compounding costs." ~ John C. Bogle

Should You Own These Types of Funds?

If you’re mainly concerned with generating income and avoiding volatility - like in retirement, Covered Call ETFs can play a role.

But they do have downsides.

Many investors don’t like the idea of investing in funds that rely on derivatives.

Additionally, the current double-digit yields are likely unsustainable and the payouts may be volatile.

Remember that the upside for price appreciation is capped, so these funds will likely underperform when markets rise quickly.

For long-term investors seeking to maximize total returns, low-cost, long-only strategies like buying dividend stocks or index investing is probably more suitable.

Key points:

Covered call ETFs generate income by selling call options on the stocks they own.

This can provide higher yields than owning the underlying stocks alone, but this caps upside potential.

Retirees may find the steady income stream and lower volatility appealing.

However, the high yields may not be sustainable, and there are potential tax consequences to consider.

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I'm always a little torn about these covered call ETFs, like QYLD, XYLD, etc.

The dividend payout is inconsistent and difficult to predict. Compare the dividend to something smooth and sexy like Realty Income.

Taking a note from the Compounding Quality framework (and some inspiration from Buffett), I want to own quality businesses that provide strong desired goods and services inside of a robust business model run by superb management teams. (is that a run-on sentence or what?! 😄) These ETFs don't really "do anything" or "make anything" in the traditional sense. They make money off of speculation of price movements. You could almost call them unproductive assets.

For those reasons, I wouldn't make ownership of something like this a cornerstone of my income portfolio. However, I can see an instrument like this riding on top of a well established income portfolio to give it some extra juice. If people/funds are willing to kick out money and there's nothing illegal, immoral, or unsafe about it then who I am to close my satchel and refuse the coins? 💰 Seeking Alpha says the yield on XYLD is ~9%.