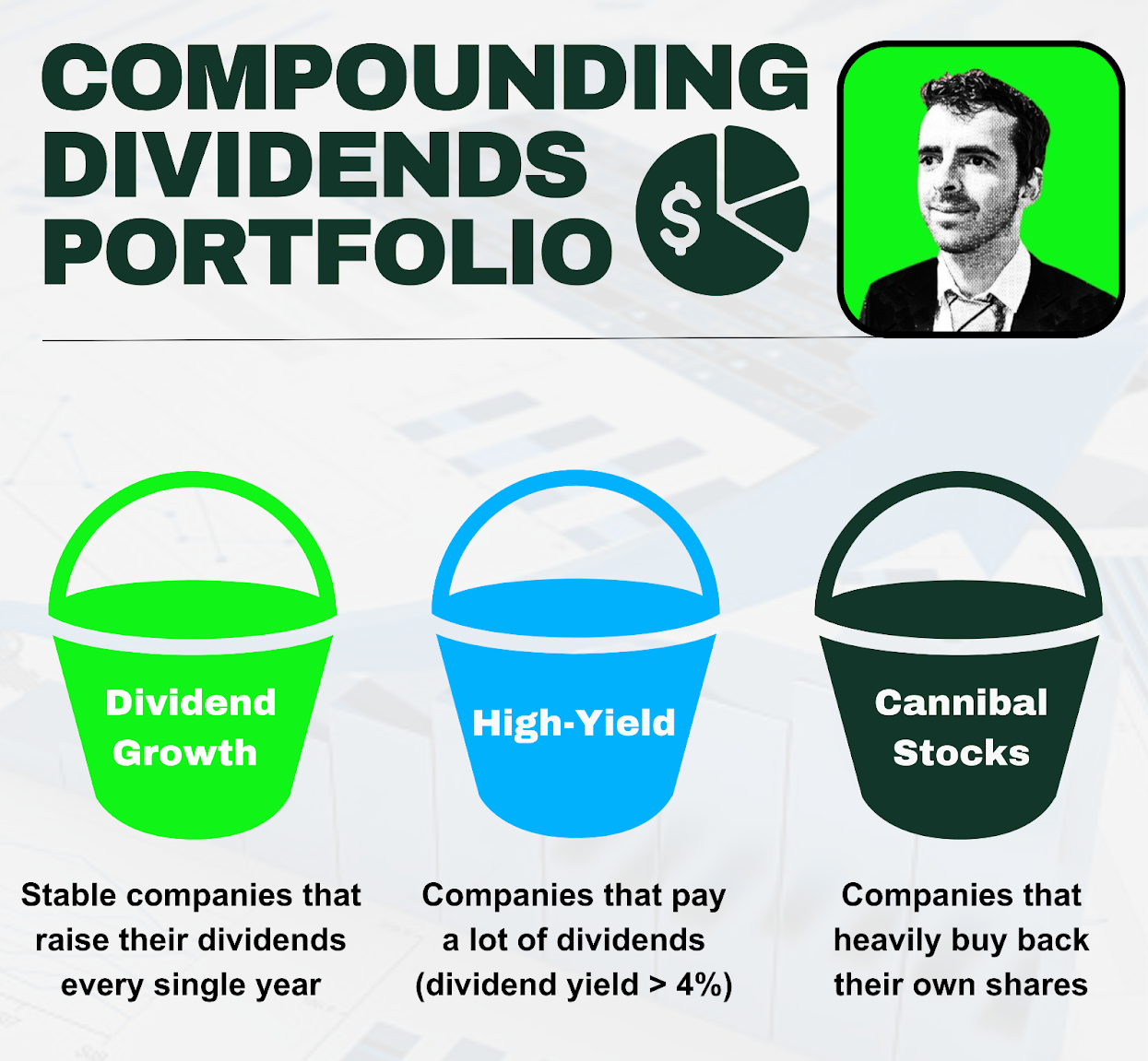

We launched the Compounding Dividends Portfolio 2 weeks ago.

Today we are announcing the second stock we’ll buy

Let’s walk our investment journeys together and build a great portfolio!

Portfolio Rules

Good agreements make good friends.

Because we are Partners, I will treat you just the same way I would like to be treated.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as Owner-Operators.” – Warren Buffett

Here are the Portfolio Rules:

You can follow the Portfolio 24/7 with 100% transparency

REAL money is invested in the Portfolio (skin in the game)

The portfolio will be based on a (fictional) amount of $1 million

For each company and transaction, you’ll see what percentage we’re investing

This way, you’ll understand our confidence in every company and transaction

No front-running

Compounding Dividends will never buy a stock before you have the chance to do so (after doing your own research—please read the disclaimer

We’ll announce new transactions during the weekend, and they will be executed the next trading day (on Monday)

Our Next Stock

Our next stock is another Dividend Growth Stock, but this one comes with a twist:

It’s already yielding over 4%.

This means it qualifies as a high-yield stock.

The company has a very established brand - it’s been operating since 1898

It also has a very strong moat created by size, network effects, and cost advantages

It generates lots of cash and returns a lot of it to shareholders

The company looks attractively valued:

It’s trading above its historic dividend yield

The Earnings Growth Model says we can expect a 14% return per year

The Reverse Dividend Model says it needs to grow the dividend at half its 5-year average rate for a 10% return.

Let’s dive into the full Investment Case and prepare our transaction for Monday.