Don't look for the needle in the haystack. Just buy the haystack!

That’s the entire philosophy of passive investing.

Let’s dive in and announce the second ETF for the Portfolio.

The essence of passive investing

Passive investors aim to match the market's performance instead of trying to beat it.

To build wealth you don’t have to beat the market, just follow these simple steps:

Spend less than you earn.

Invest at least 10% of your income in stocks every month.

If every family did this from the time they started working until retirement, most would become millionaires.

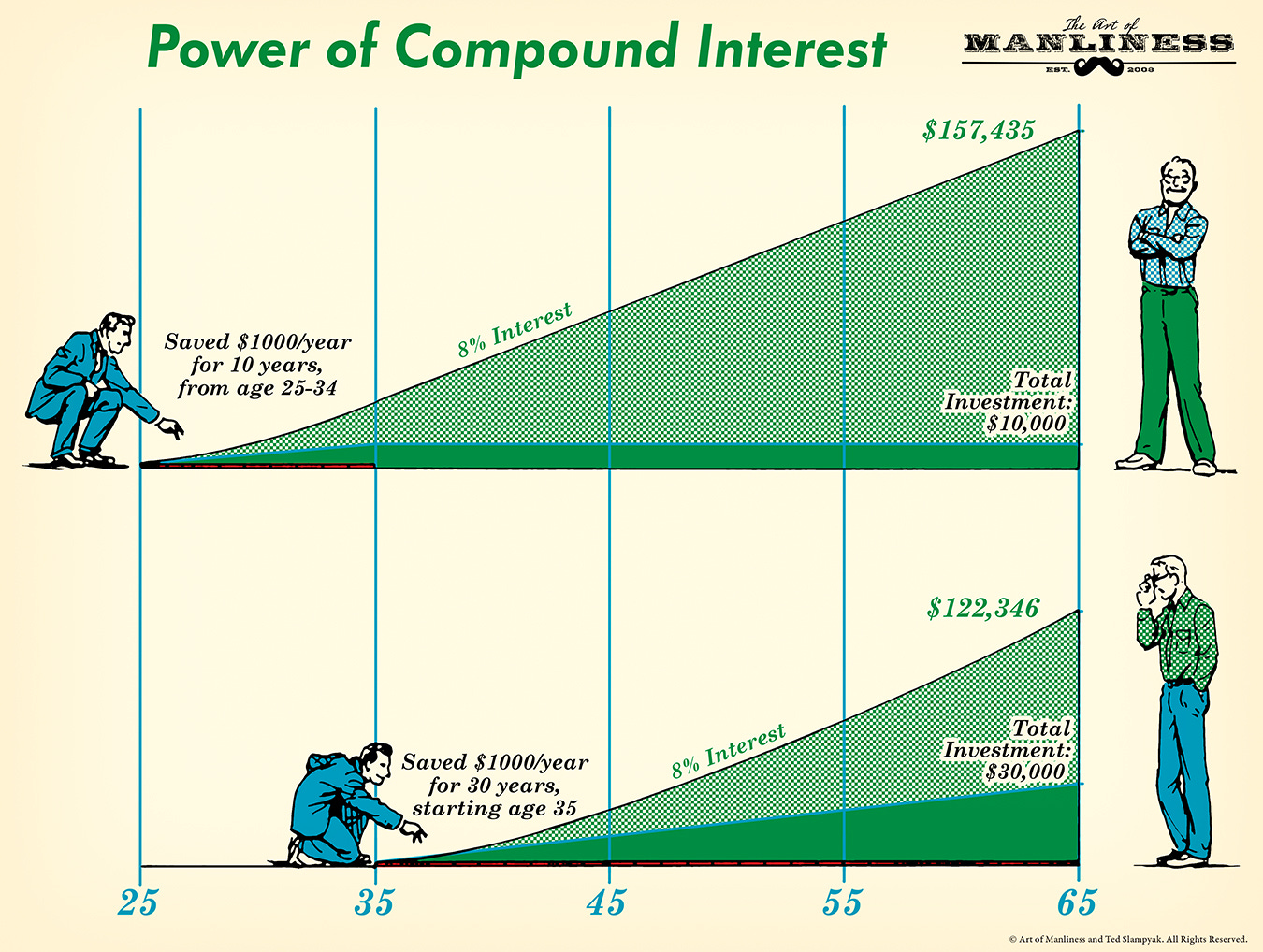

Compounding is truly powerful.

So, the sooner you start, the better!

How Does It Work?

ETFs: An ETF (Exchange-Traded Fund) is a collection of different stocks or investments you can buy and sell on the stock market, just like a single stock.

Buy and Hold: You buy shares of good ETFs and keep them for a long time. As the market grows, your investment grows too.

The Best Part?

Everyone can do it.

You don’t need to be interested in investing or spend a lot of time researching stocks.

“Paradoxically, when 'dumb' money acknowledges its limitations, and starts to invest periodically in an index fund, it ceases to be dumb.” - Warren Buffett

Why Does Passive Investing Work?

Lower Costs: Passive investments have low fees because you’re not paying a manager to try to pick stocks. This means more of your money stays invested.

Less Stress: Since you’re not constantly checking the market or trying to make quick trades, it’s less stressful. You just set it and forget it!

Market Growth: The stock market has ups and downs, but tends to go up over the long run. By investing passively, you benefit from its overall growth.

Diversification: When you invest in an ETF, you own a small part of many companies. This spreads out your risk. If one company does poorly, it won’t hurt you as much because you have a lot of other investments.

In Short

Passive investing is simpler, costs less, and can lead to good returns over time if you’re patient!

Diversification

Diversification is an important part of passive investing.

By spreading your money across many different investments, you can reduce risk and boost returns.

By owning a little bit of everything, poor performers don’t hurt your returns too much.

You also increase your chances of gaining from the best-performing assets.

Diversification doesn’t just mean owing a lot of different companies.

It means owing companies in different places.

“I view diversification not only as a survival strategy but as an aggressive strategy because the next windfall might come from a surprising place.” –Peter Bernstein

Global Diversification

As Peter Bernstein points out, you can’t predict where the next winner will come from.

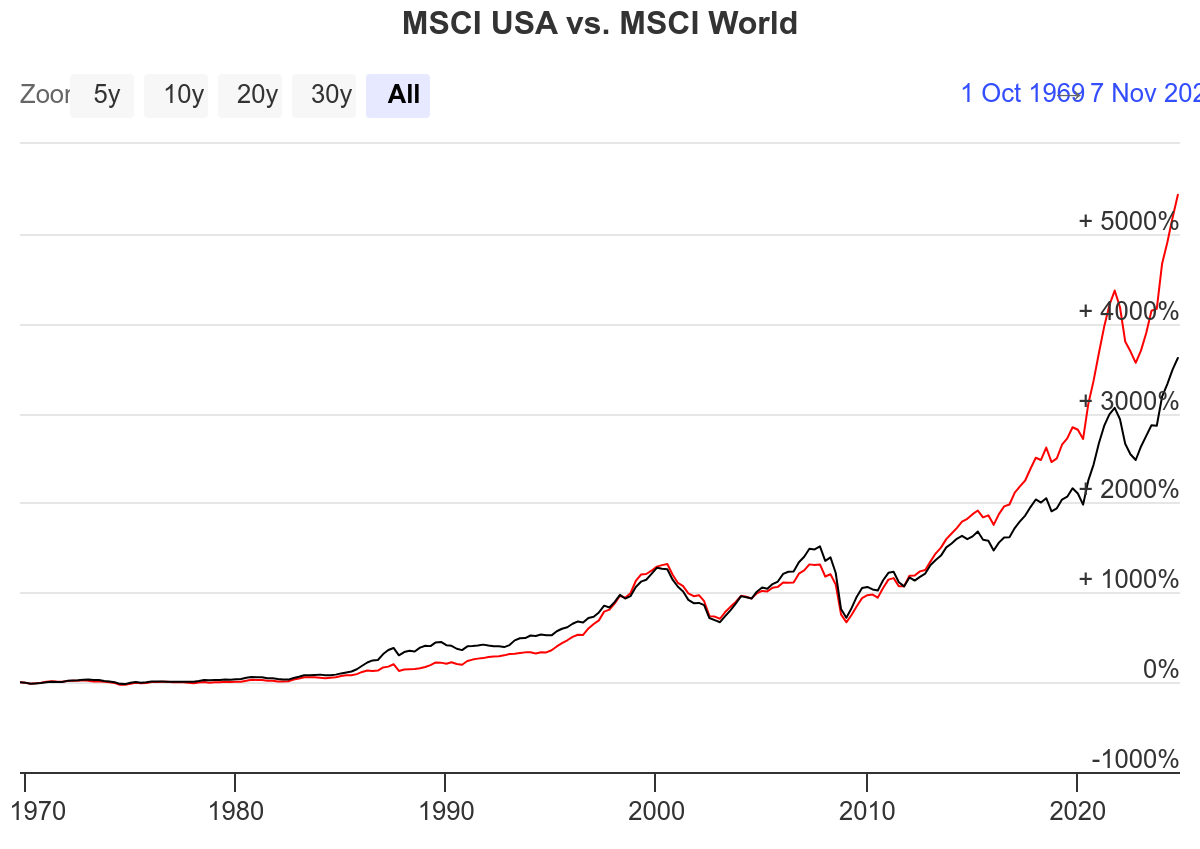

Since the bottom of the Global Financial Crisis in March of 2009, US stocks have compounded at about 15% per year.

They have outperformed almost every asset over this period.

It feels like US stocks will keep going up forever.

So, why not just invest in U.S. ETFs?

Because US stocks don’t always outperform.

The chart below compares the performance of the MSCI USA index to the MSCI World index.

When the ratio goes up, it means U.S. stocks are doing better than the rest of the world.

When it goes down, it means U.S. stocks are lagging behind the global market.

This ratio can’t keep growing forever.

If it did, U.S. stocks would eventually make up 100% of global stocks.

Here’s another view, with U.S. stocks shown in red and global stocks in black.

Another great thing about buying stocks outside the US?

They’re cheaper.

Here are the PE ratios of different countries.

The US is the most expensive market.

The cheaper you buy stocks, the better your returns will be.

Remember this: lower stock prices are GOOD for you as an investor.

It always feels good to see your investments go up.

That’s why you should learn to feel excited when stock prices go down.

Still not sure? Think of stocks like hamburgers.

Here’s what Warren Buffett says about it:

Now let’s diversify globally by buying our Second ETF.