Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

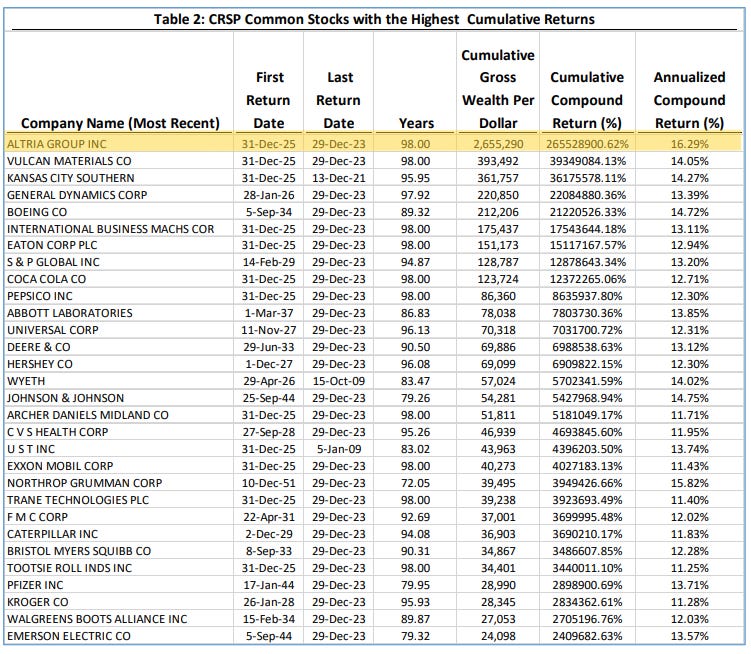

1️⃣ Best performer of the century

Do you know the best-performing stock over the past 100 years?

It’s Altria!

A big reason for this?

Dividends.

Altria was formerly known as Philip Morris. They’re a tobacco company that sells cigarettes, primarily under the Marlboro brand, as well as smokeless tobacco products.

Source: Which U.S. Stocks Generated the Highest Long-Term Returns?

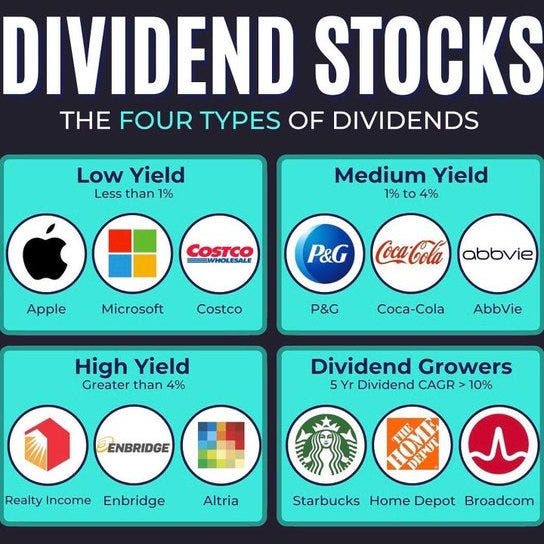

2️⃣ 4 Types of dividends

What kind of dividend investor are you?

Here are the 4 different types of dividend stocks:

Source: Andrew Lokenauth

3️⃣ A dividend quote

John D. Rockefeller co-founded Standard Oil in 1870, revolutionizing the petroleum industry and becoming the wealthiest person in modern history.

He was a fan of dividends too:

"Dividends are a great way to build wealth." - John D. Rockefeller

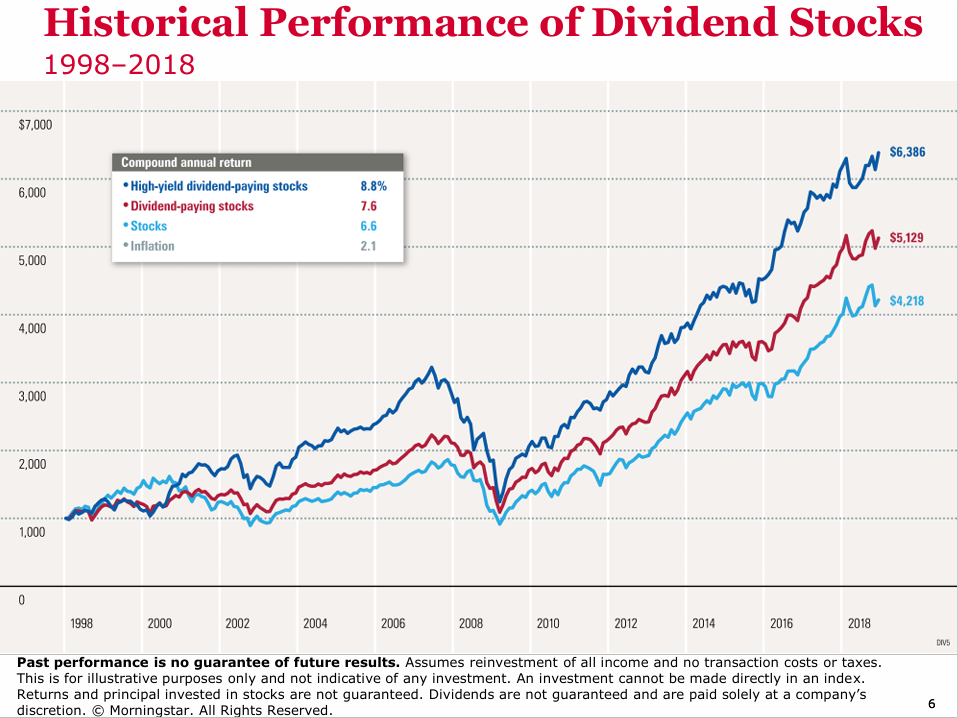

4️⃣ Dividend stocks outperform

The difference in performance of dividend payers versus companies that don’t pay dividends is remarkable.

Check out this chart from a Wells Fargo presentation.

Click the image to see the whole PDF

In Saturday’s article, we’ll teach you how to build a wealth-creating machine from dividend-paying companies!

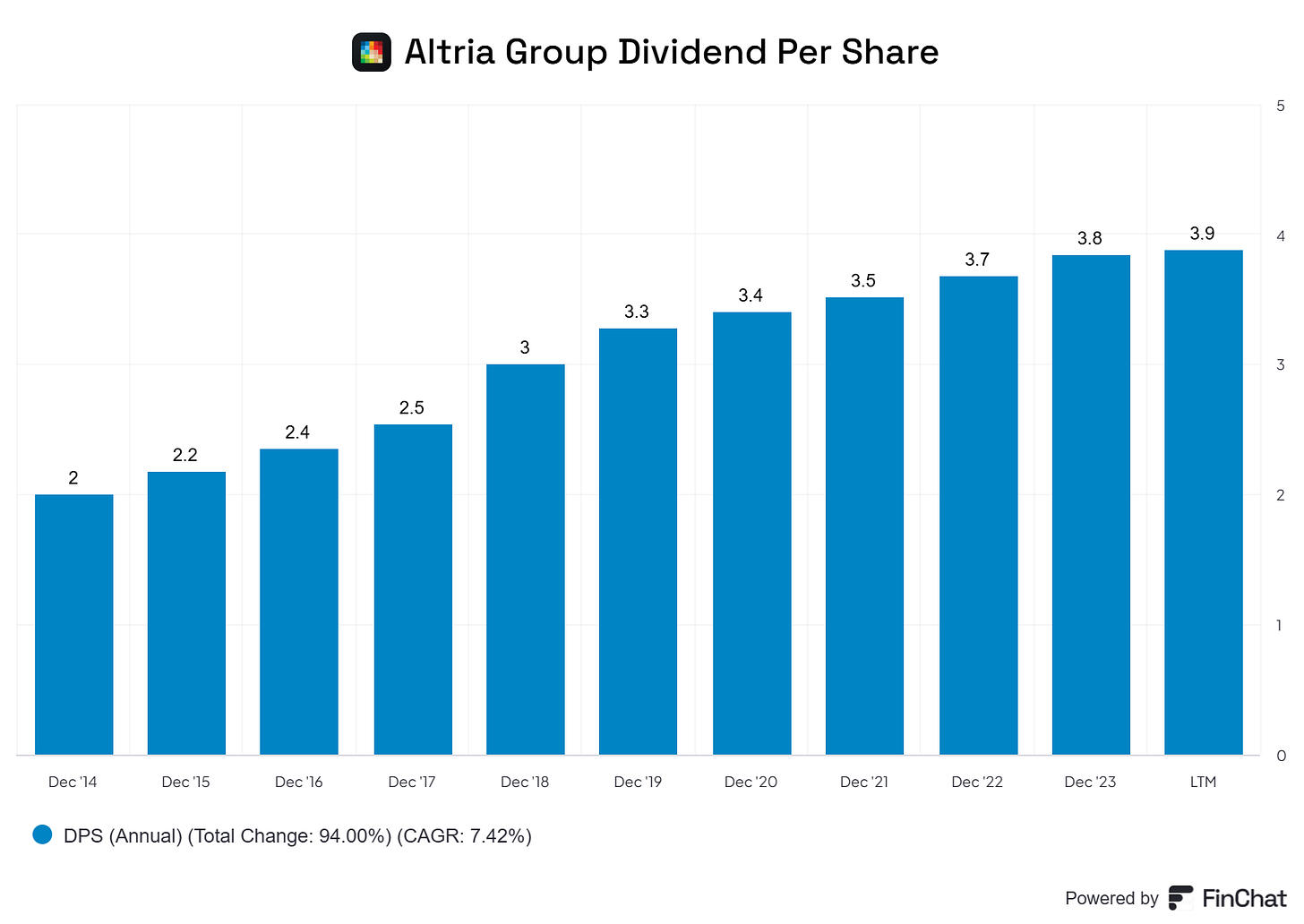

5️⃣ Example of a dividend stock

Altria makes money by selling tobacco products like Marlboro cigarettes and through investments in alcohol, cannabis, and nicotine products.

Here’s a look at the current numbers.

Profit Margin: 41.4%

Forward PE: 9.8x

Dividend Yield: 7.4%

Payout Ratio: 81.2%

Source: Finchat

That’s it for today

That’s it for today.

🙏 Compounding Dividends is a new project. We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

From a technical standpoint, I can understand why Altria is a good dividend paying company. I also understand the business model. They make a chemically addictive product 🚬 that people find very hard to give up. In fact, there's a whole business around giving up tobacco. Think of all the nicotine patches and nicotine gum sold. And this is where the thesis for Altria starts falling apart.

Again, from an interview on Talking Billions ... can't remember the guest's name ...

Altria's business model is built around the idea of someone getting paid to dig a hole and another person getting paid to bury the hole. In the end, the ground stays flat. Altria produces a legal product that makes a hole and a company like Glaxo Smith Kline buries that hole. Nothing is rising above ground level. 😑

I would not feel good about owning a business like this and pocketing a piece of the cash flows. Also, with two kids, the last thing I want to see is them start a tobacco related habit. The health issues from long term tobacco use is devastating. There is no "moderate amount" that can be consumed without ill health effects. ☠️

I understand the same idea can be applied to many businesses. Coca-Cola for their sugary drinks 🥤(diabetes). Coors for their beer 🍺(alcoholism and drunk driving), Las Vegas Sands for the casinos 🎲(gambling addictions). These are all vices. Each of us has to find where that line of acceptability is. In some cases, we can even contract ourselves. 🤷 We're OK with something here but not there. Altria crosses that line for me.

The market is big and there are many high yielding options that don't run the risk of being value traps. BDCs like Hercules Capital (HTGC) and Main Street Capital (MAIN) come to mind. In some cases their total return performance may not match Altria's. But think of the business model. As a lender, a good portion of the economy flows through their books. They still dig a small hole (debt, loans, etc) but the pillars grown on top of the fill-in can far outshine the impact of the initial hole.

Just some thoughts. 😃