Hi Partner 👋

Welcome to the 🔒 subscribers only 🔒 Best Buys list for November of Compounding Dividends. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you my favorite stocks.

October 2024

In October the S&P 500 decreased by 1.8%

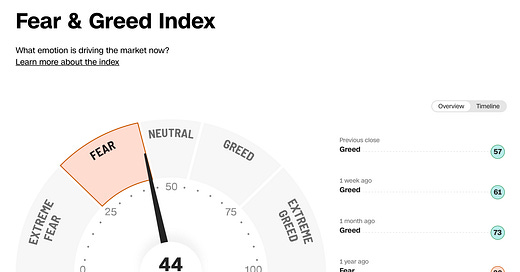

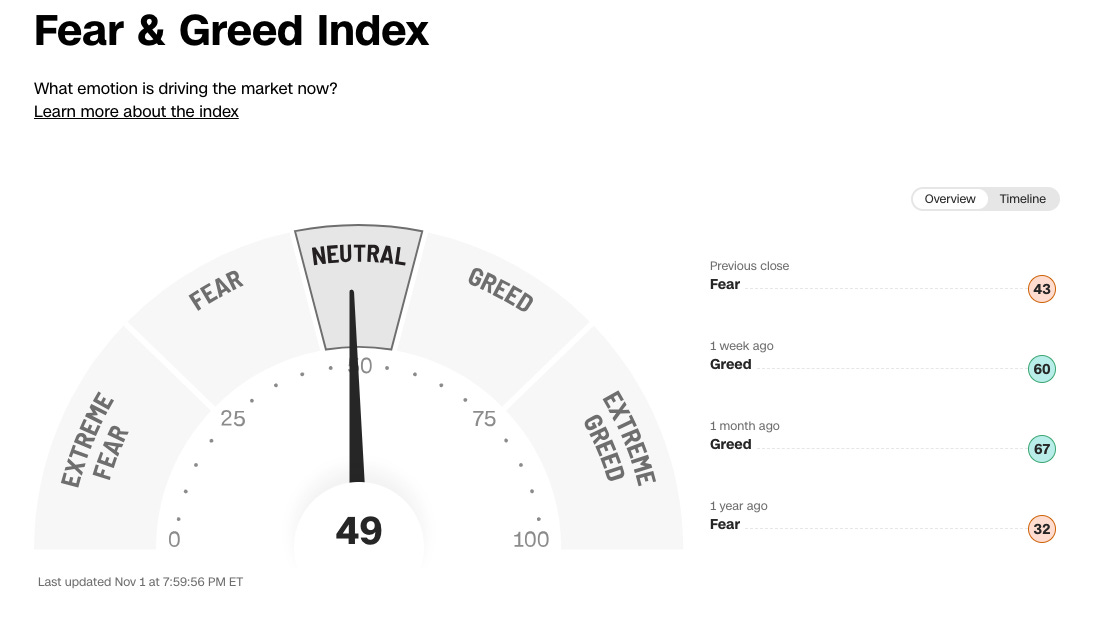

The Fear & Greed Index indicates that we are currently in ‘Neutral’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

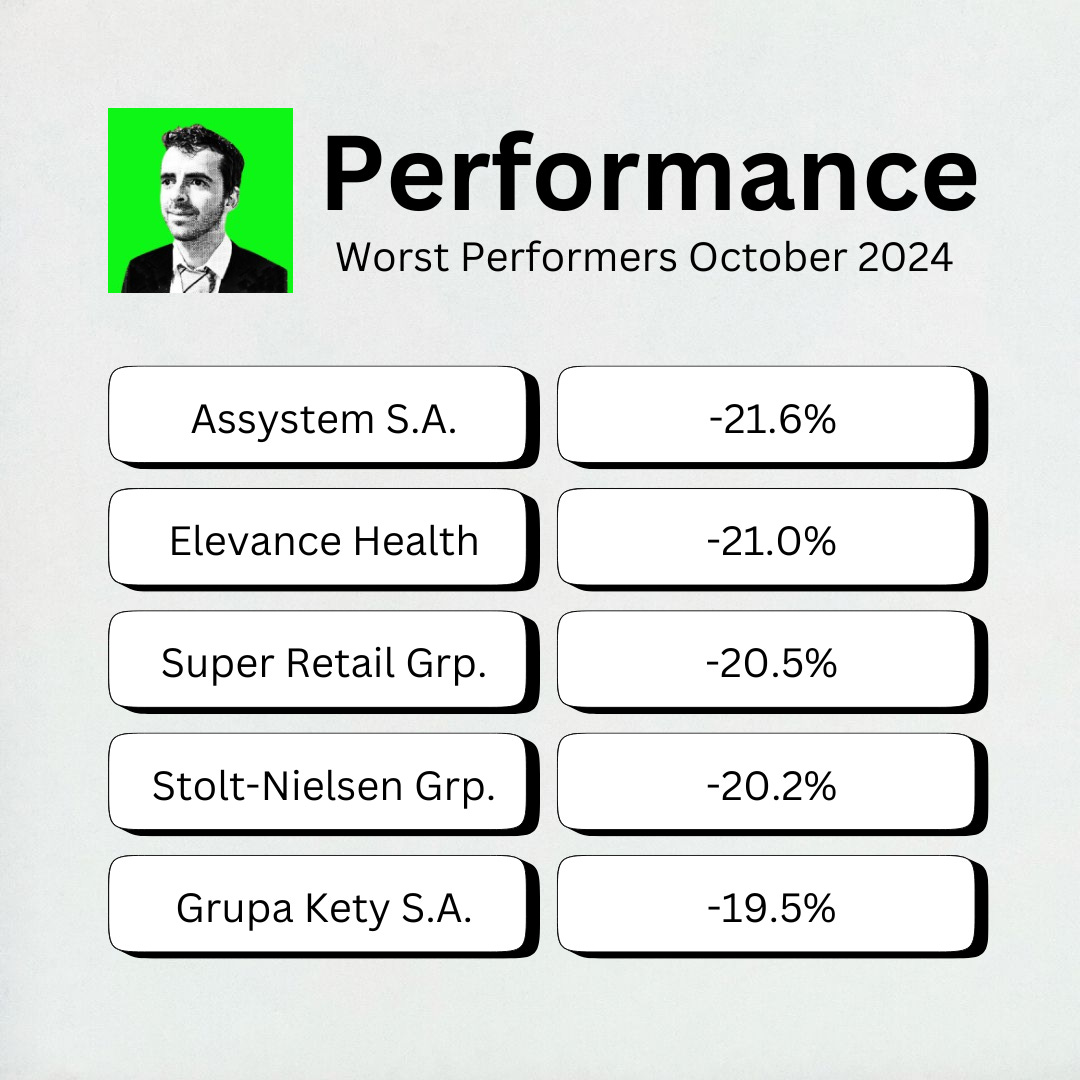

Worst performers

The cheaper we can buy great companies, the more we like it.

The biggest decliner this month? Assystem S.A.

They provide engineering and consulting services for complex projects in industries like nuclear energy, aerospace, and transportation.

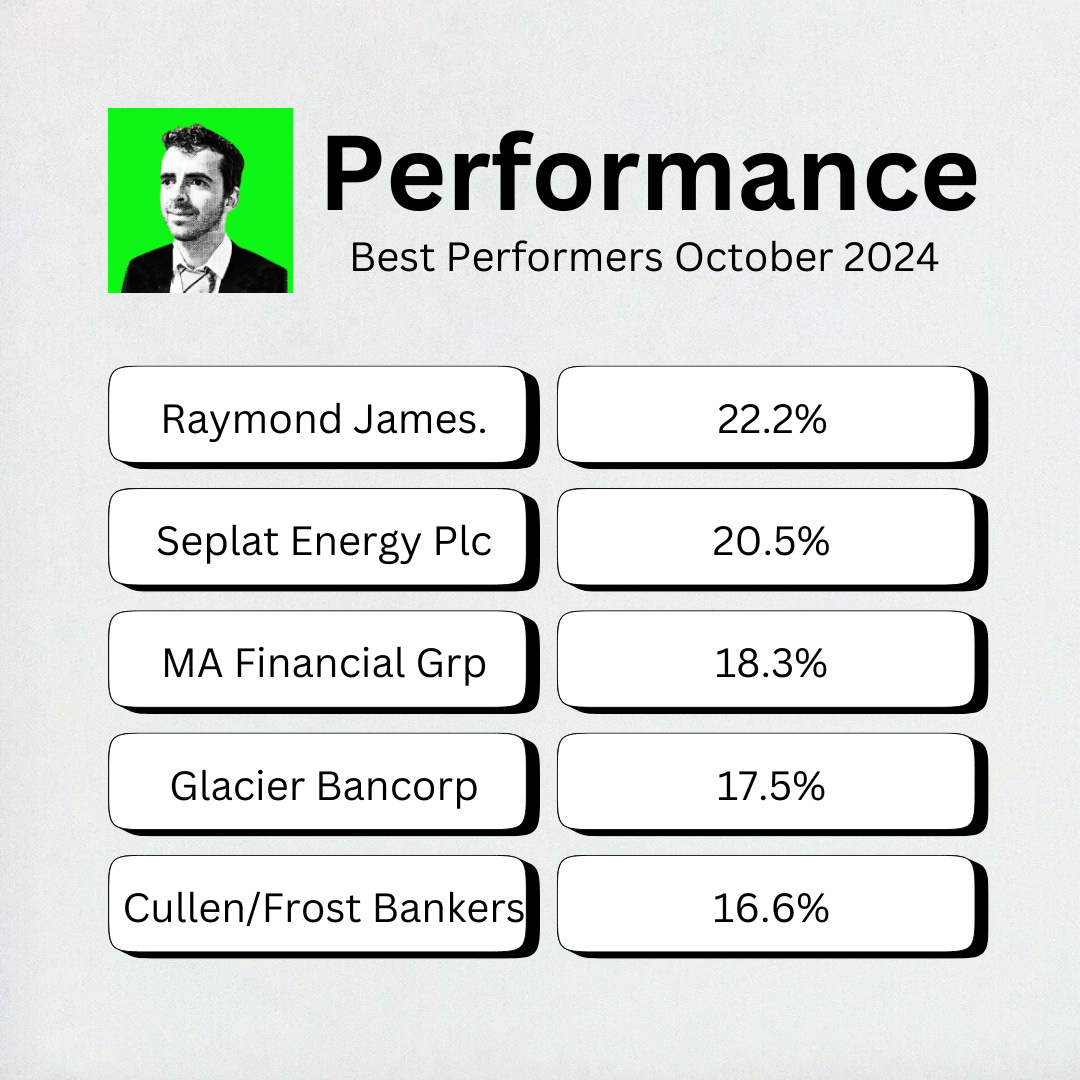

Best Performers

Raymond James was this month’s best performer, rising over 20%.

Raymond James offers individuals and businesses financial services like investment banking, wealth management, and financial planning.

McDonald’s (MCD)

McDonald’s is making headlines recently, but not in a good way.

People are becoming ill with E. Coli from contaminated onions on the company’s Quarter Pounder hamburgers.

The stock price is down 4% this month.

While this is terrible for the people affected, this is a temporary issue for the company.

As you know by now, we love to buy great dividend growth companies at cheaper prices.

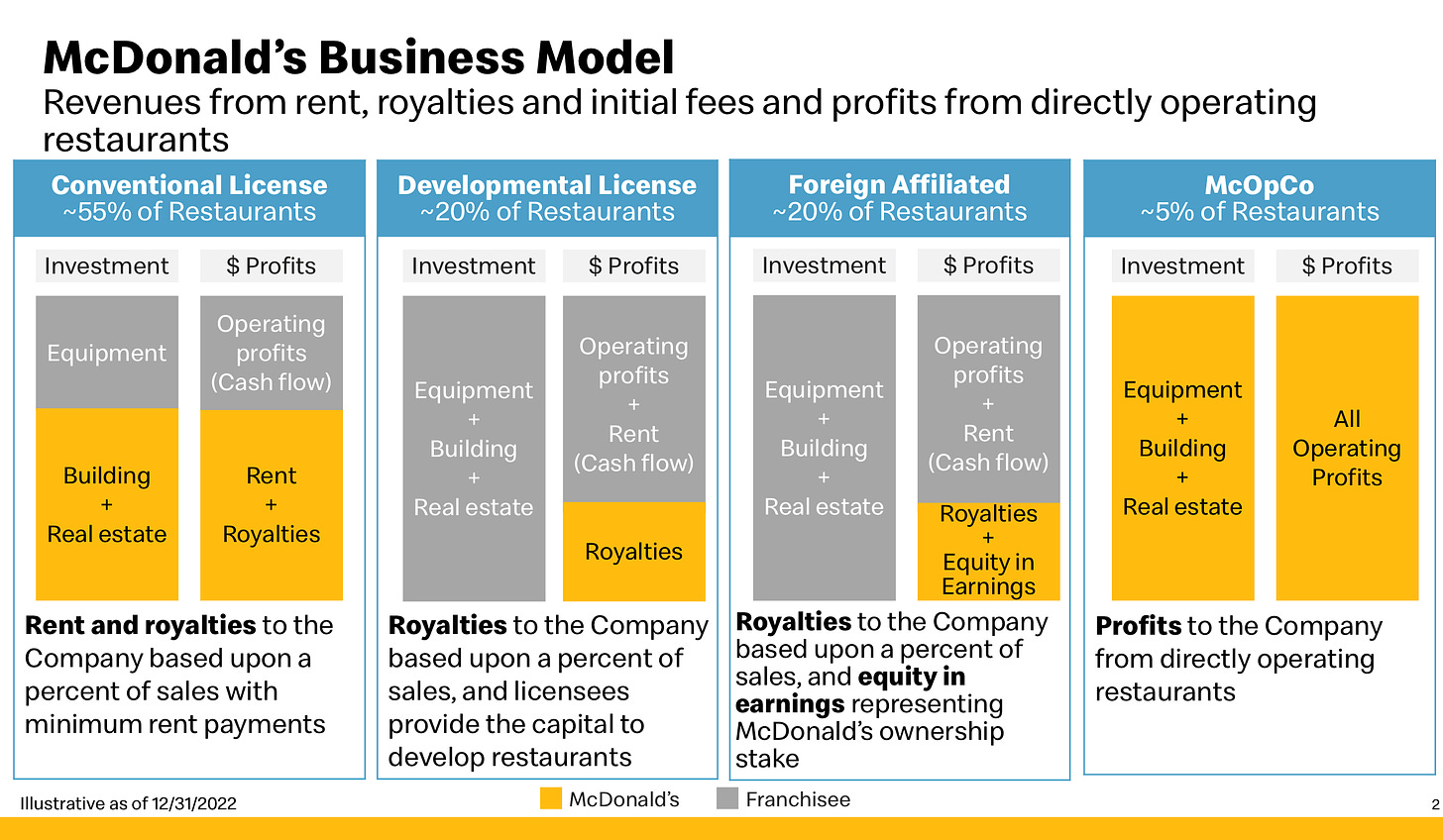

How does McDonald’s make money?

McDonald's makes money by selling food and drinks at its restaurants, which are popular for their quick service and low prices.

They also earn a lot from franchise fees, where other people pay to run McDonald's restaurants using their brand and recipes. Around 95% of McDonald’s locations are franchised.

McDonald’s real estate

Another interesting thing about McDonald’s?

They own a lot of the real estate.McDonald’s owns the building and land in more than half of the restaurants

In more than half of the restaurants, McDonald’s owns the building and land.

The franchisee running the business pays rent to McDonald’s in addition to the royalty fees.

“We are not technically in the food business. We are in the real estate business. The only reason we sell fifteen-cent hamburgers is because they are the greatest producer of revenue, from which our tenants can pay us our rent.” - Former CFO McDonald’s

Why might McDonald’s be interesting?

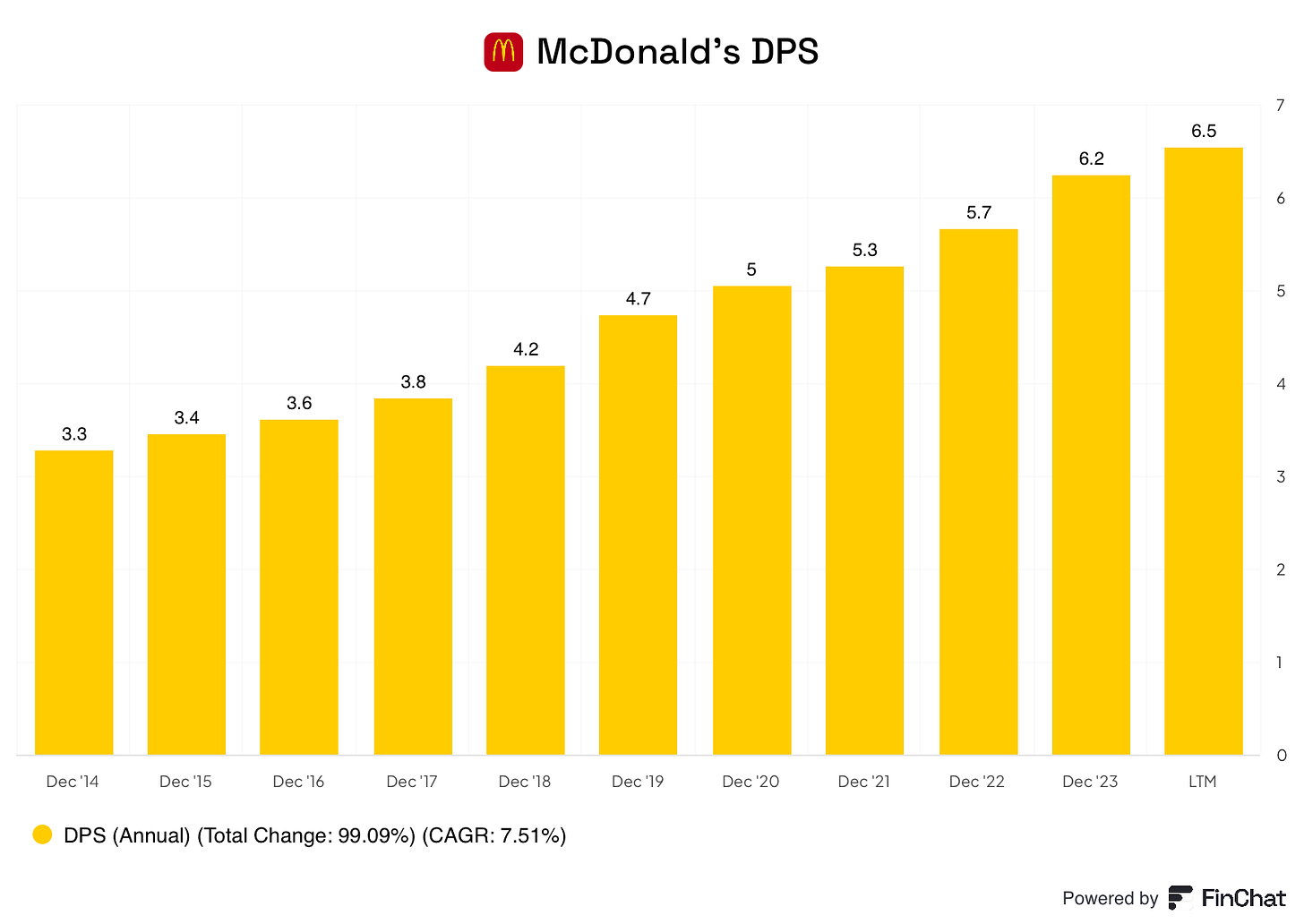

McDonald’s is about to become a Dividend King.

They increased their dividend for the past 49 years.

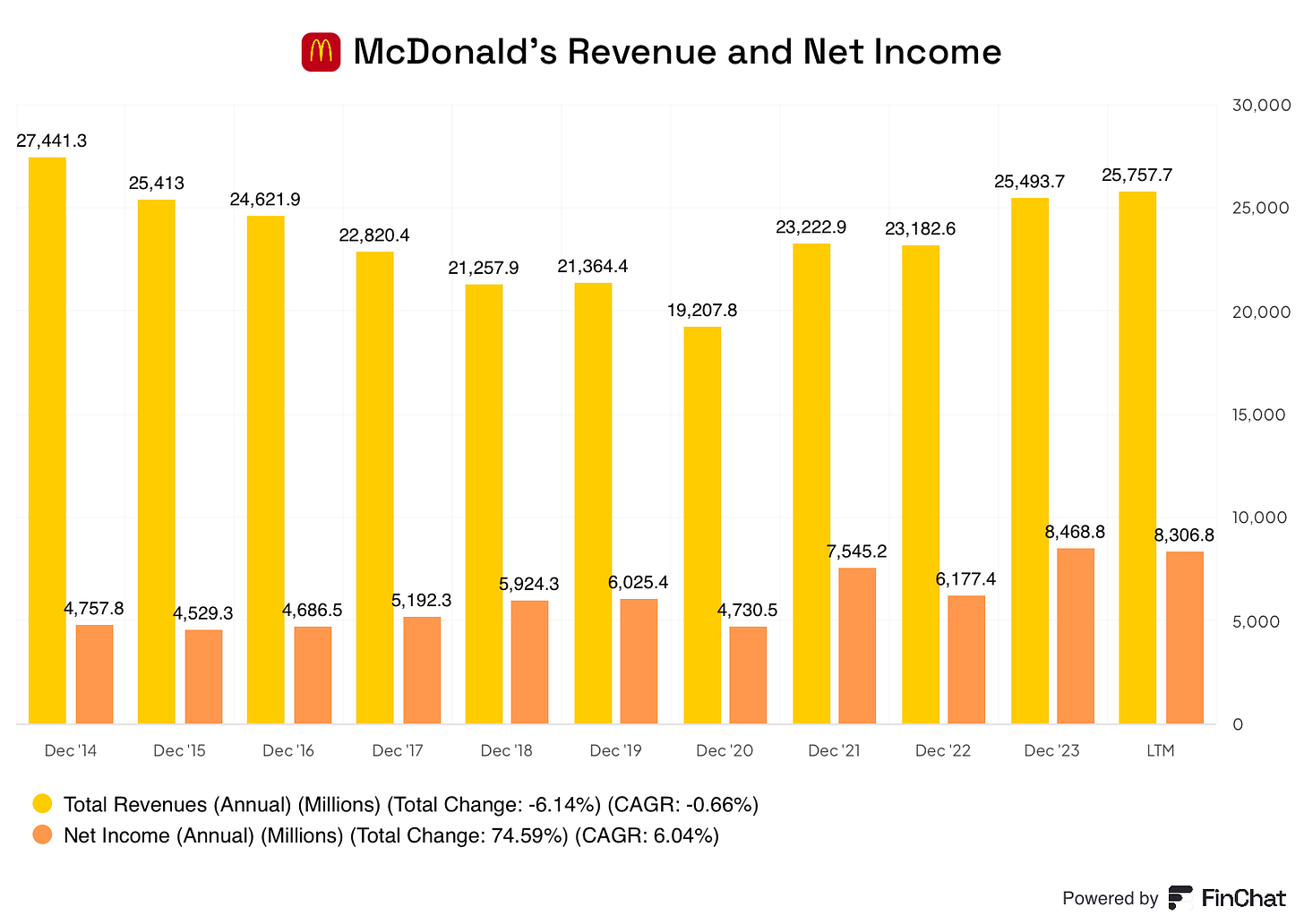

In addition, they have been growing their revenue and net income since 2020:

Let’s take a look at a few more important metrics:

Profit Margin: 33.2%

Forward PE: 23.9x

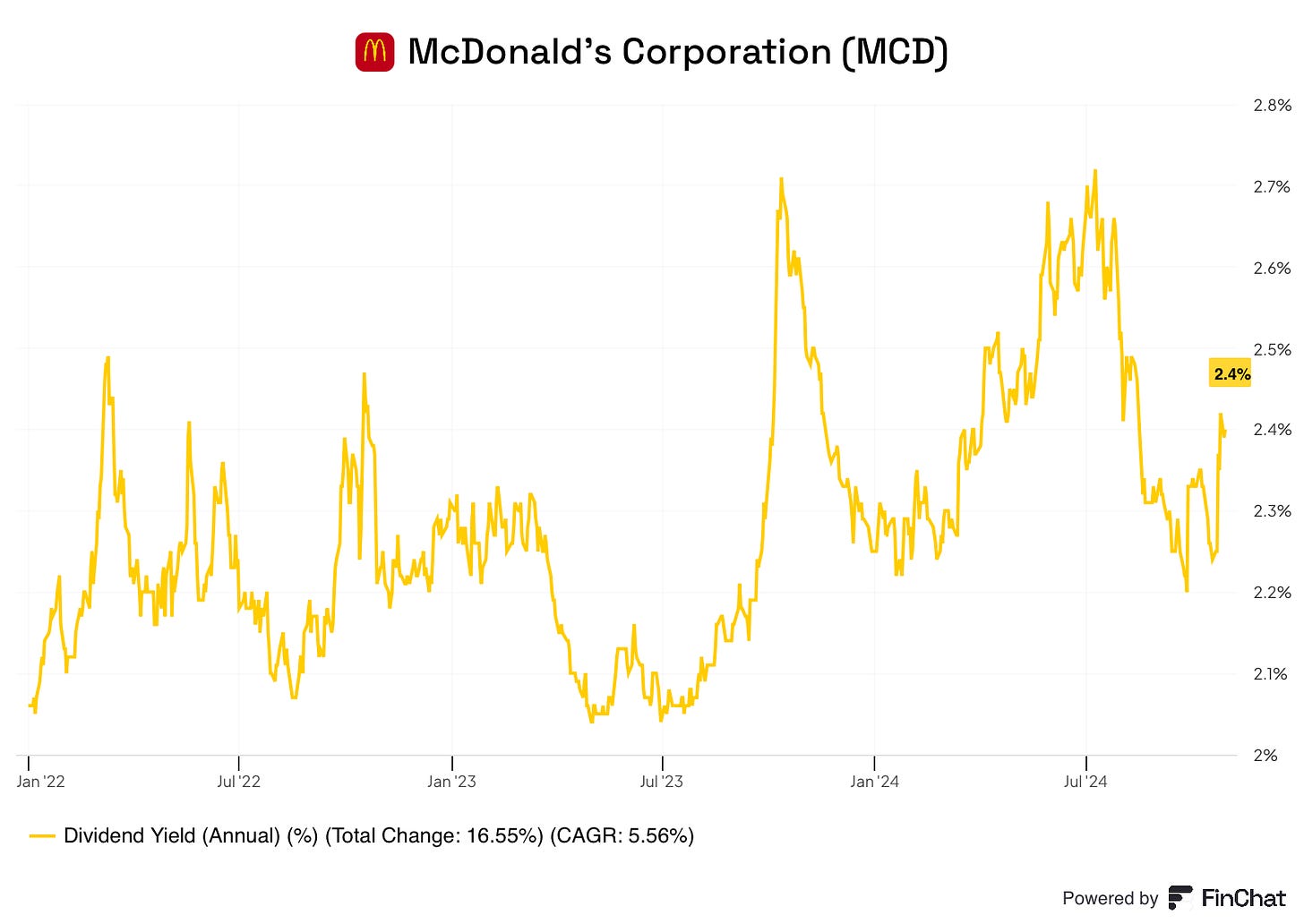

Dividend Yield: 2.4%

Payout Ratio: 56.7%

The Dividend Yield has been increasing since the E. coli outbreak was announced, indicating that the company is becoming more attractively valued.

While McDonald’s is becoming more interesting, it didn’t make the Best Buys list this month.

Are you ready to find out what companies did?

Best Buys November 2024

Let’s dive into my favorite stocks for November 2024.

Here are our 5 Best Buys of the month.

5. Unum Group (UNM)

How does Unum make money?

Unum Group provides insurance products, such as disability, life, and supplemental health insurance.

The company provides group insurance products to businesses, which then offer these benefits to their workers as part of their employee compensation packages.

Unum also serves individual policyholders who purchase supplemental insurance directly.

They earn premiums from policyholders and invest those funds to generate additional income, which helps them cover claims and operational costs while making a profit.

Why is Unum Group interesting?

Unum has increased its divided payment for 16 years in a row

Unum Group offers a nice blend of buybacks (4.3% yield) and dividends (2.6% yield)

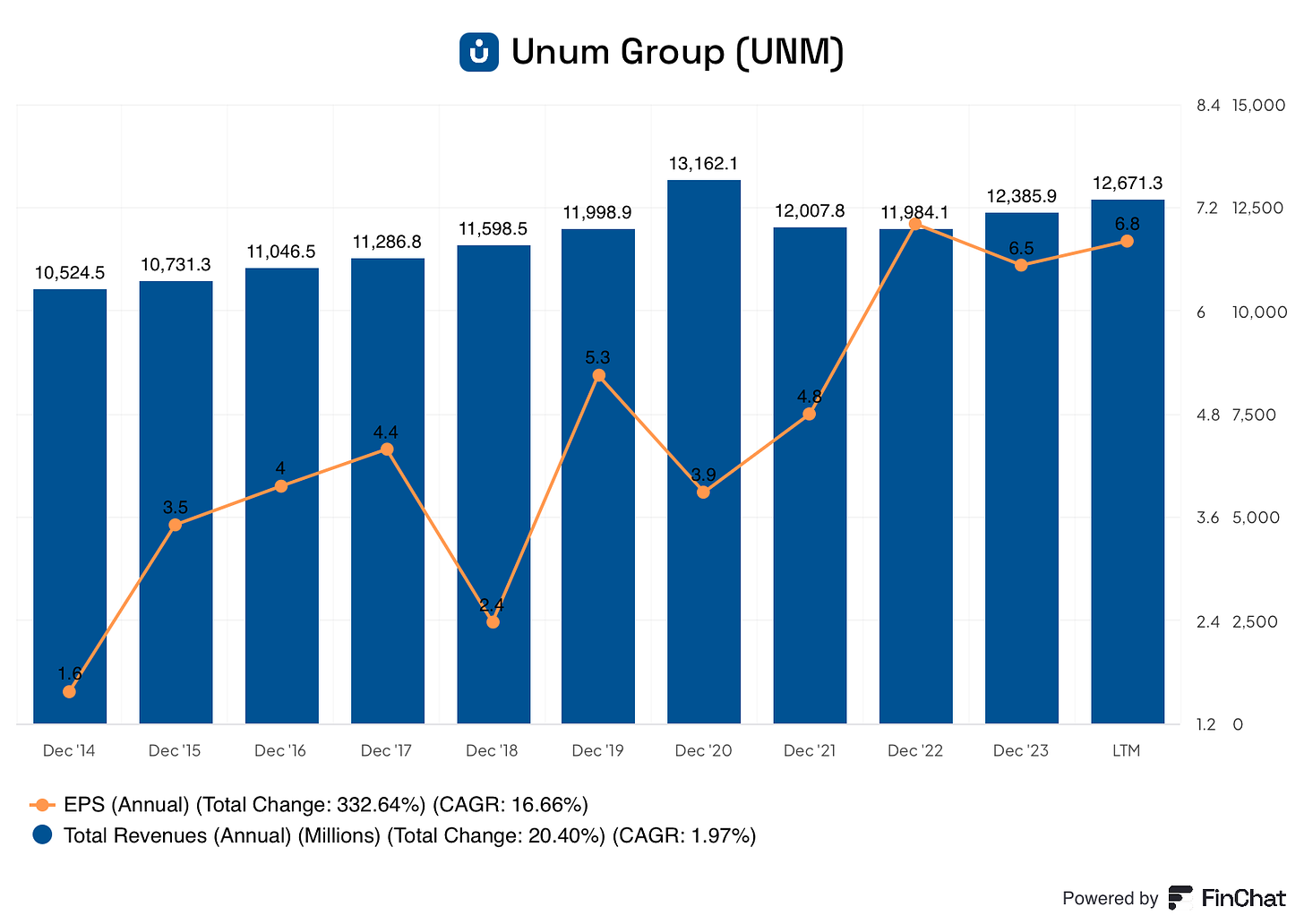

They have a nice trend of growing revenue and EPS

Valuation

Current yield versus historical yield: 2.7% (5-year average: 4%)

Earnings Growth Model: Expected return of 10.6% per year

Reverse DDM: Unum Group needs to grow its dividend by 6.9% to return 10% to shareholders (5-year CAGR 7.3%)

Why is Unum Group in our Top 5 right now?

Unum Group offers significant shareholder yield, a solid balance sheet (Debt/Equity of 35%), and looks to trade at a fair to undervalued price.

4. Realty Income (O)

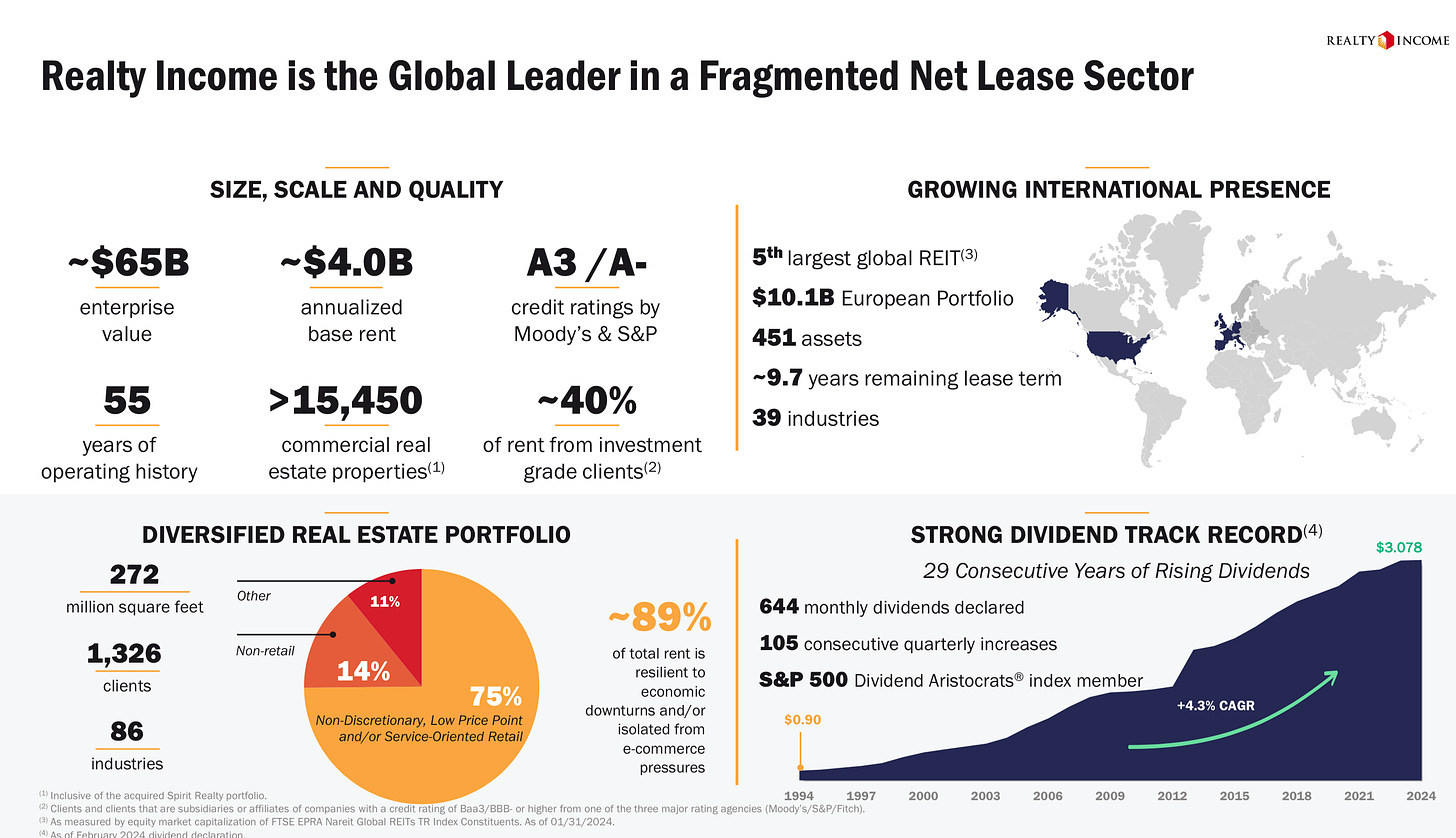

How does Realty Income make money?

Realty Income owns commercial properties and rents them to businesses like grocery stores, convenience stores, and pharmacies.

Realty Income focuses on long-term leases.

They collect rent every month and pay a monthly dividend.

Why is Realty Income interesting?

Realty Income has increased its dividend for 32 years in a row

They’re still trading at prices below the pre-pandemic level

Realty Income’s size gives them opportunities unavailable to other REITs.

Valuation

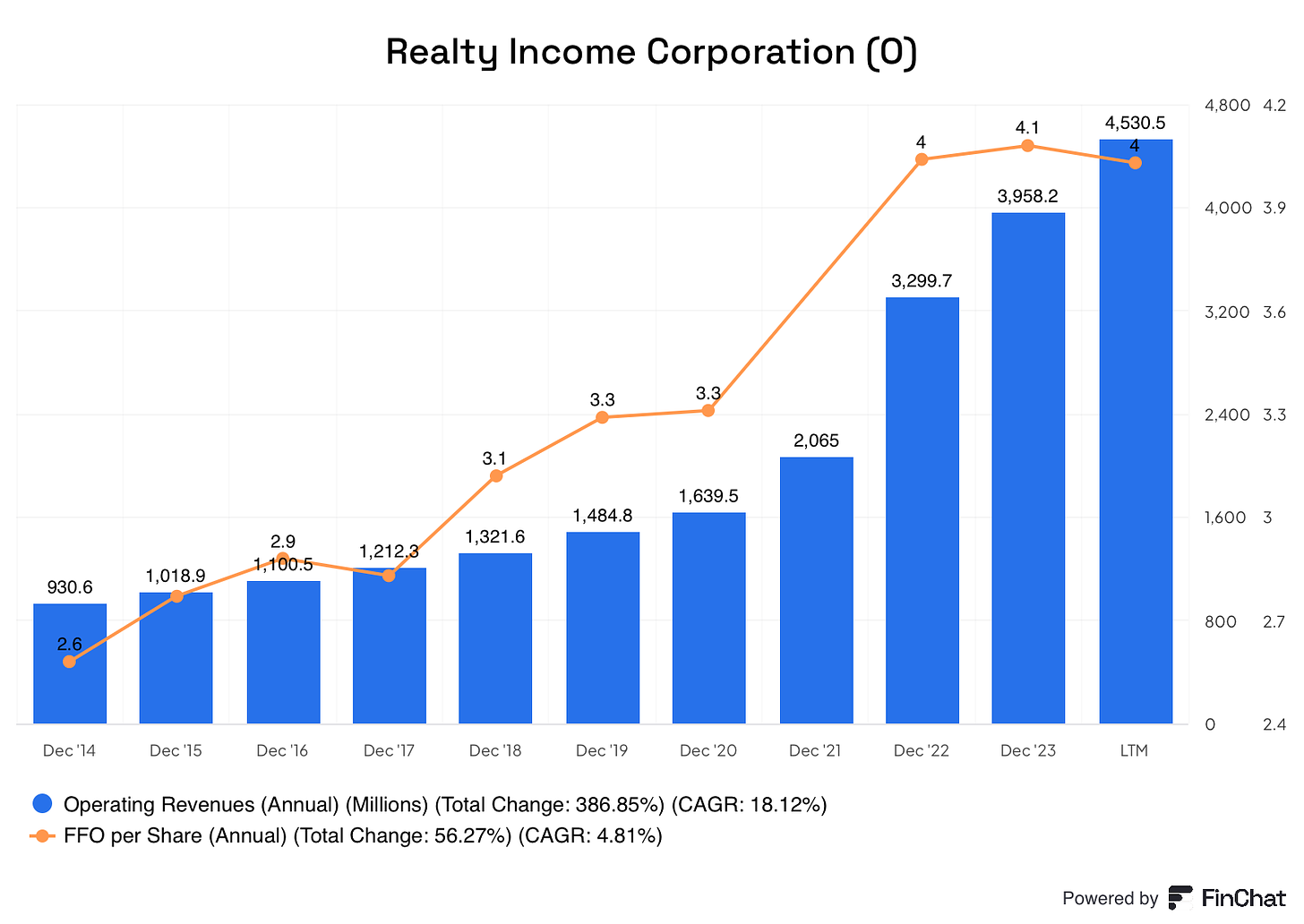

Current yield versus historical yield: 5.2% (5-year average: 4.5%)

Earnings Growth Model: Expected return of 10.5% per year

Reverse DDM: Realty Income needs to grow its dividend by 4.9% to return 10% to shareholders (5-year CAGR 2.8%)

Why is Realty Income in our Top 5 right now?

Realty Income is still priced lower than it was pre-pandemic despite significantly growing its revenue and Funds From Operations/share (think of it as EPS for a REIT) since 2019.

Now let’s dive into the top 3.