A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

March 2025

In March the S&P 500 decreased by 5.75%

Source: Finchat

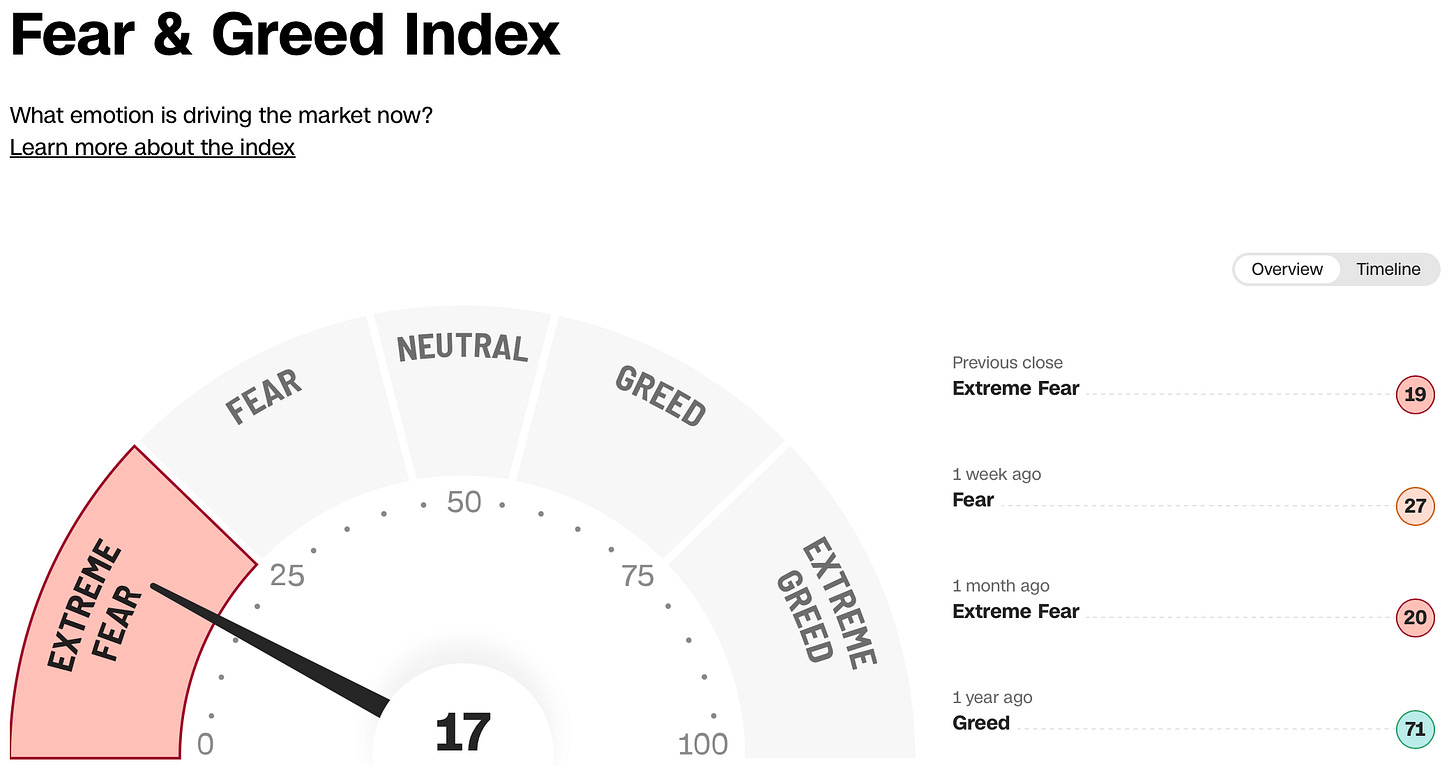

The Fear & Greed Index indicates that we ended March in ‘Extreme Fear’ Mode.

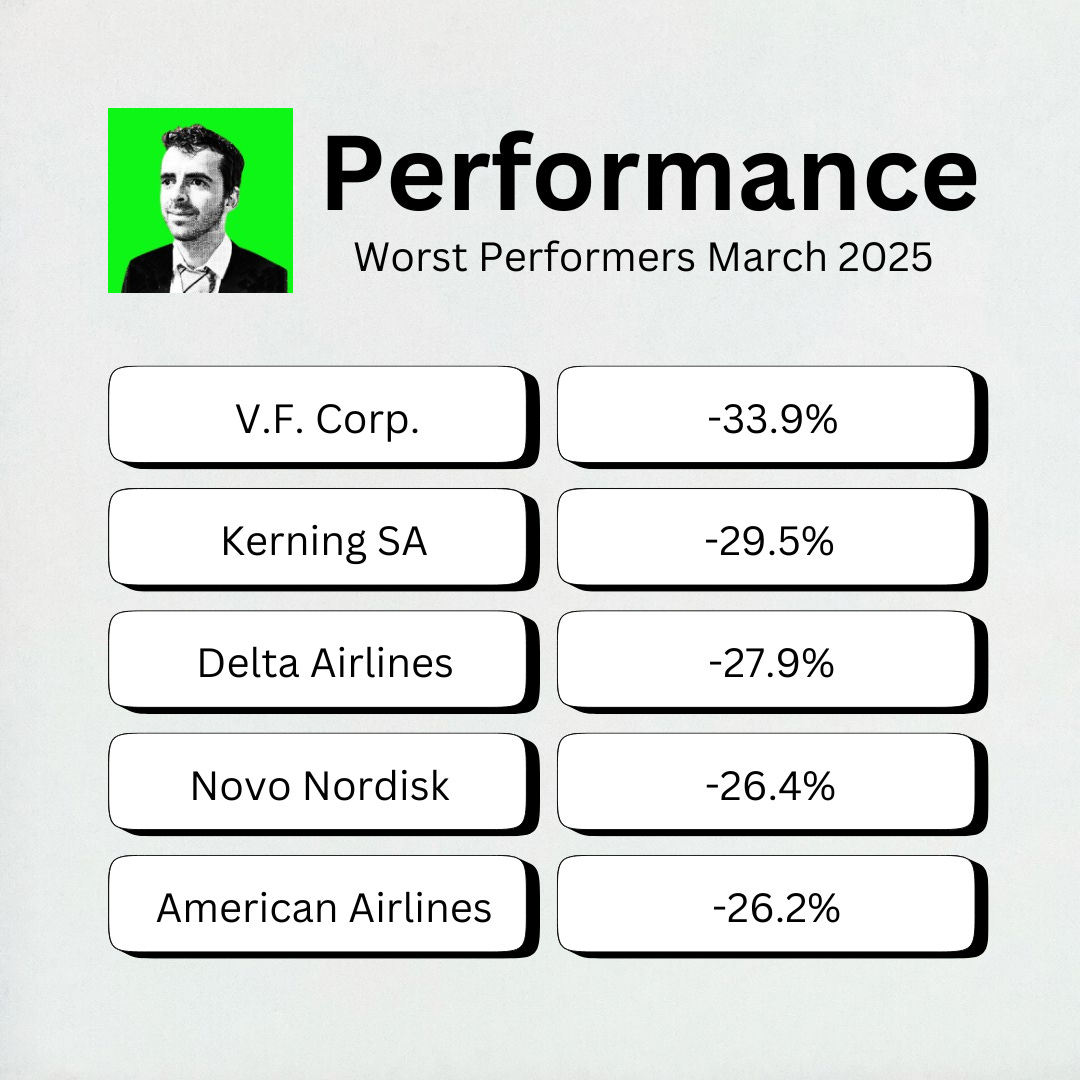

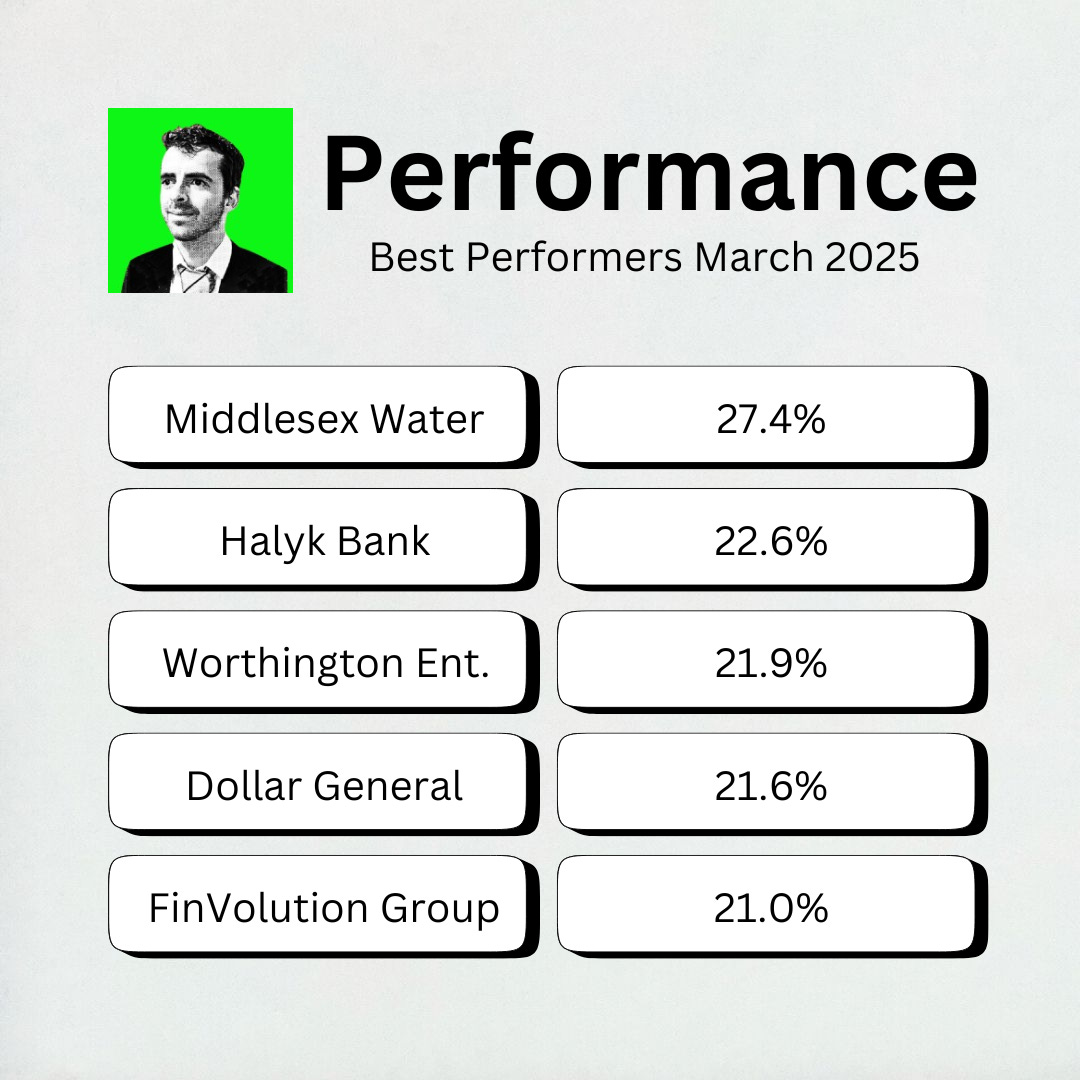

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? V.F. Corporation.

V.F. Corporation makes clothing, shoes, and accessories.

They own popular brands like Vans, The North Face, and Timberland.

Best Performers

Middlesex Water Company was this month’s best performer, rising over 27%.

They provide water and wastewater services to homes and businesses in New Jersey and Delaware.

April Best Buys

I had updated the Buy-Hold-Sell list after the market closed on Monday.

But because of the large drop in the market this week, I updated the list again after the market closed yesterday - 148 companies are now rated as a ‘buy’.

Something interesting I noticed?

A lot of very high quality companies now have a ‘buy’ rating.

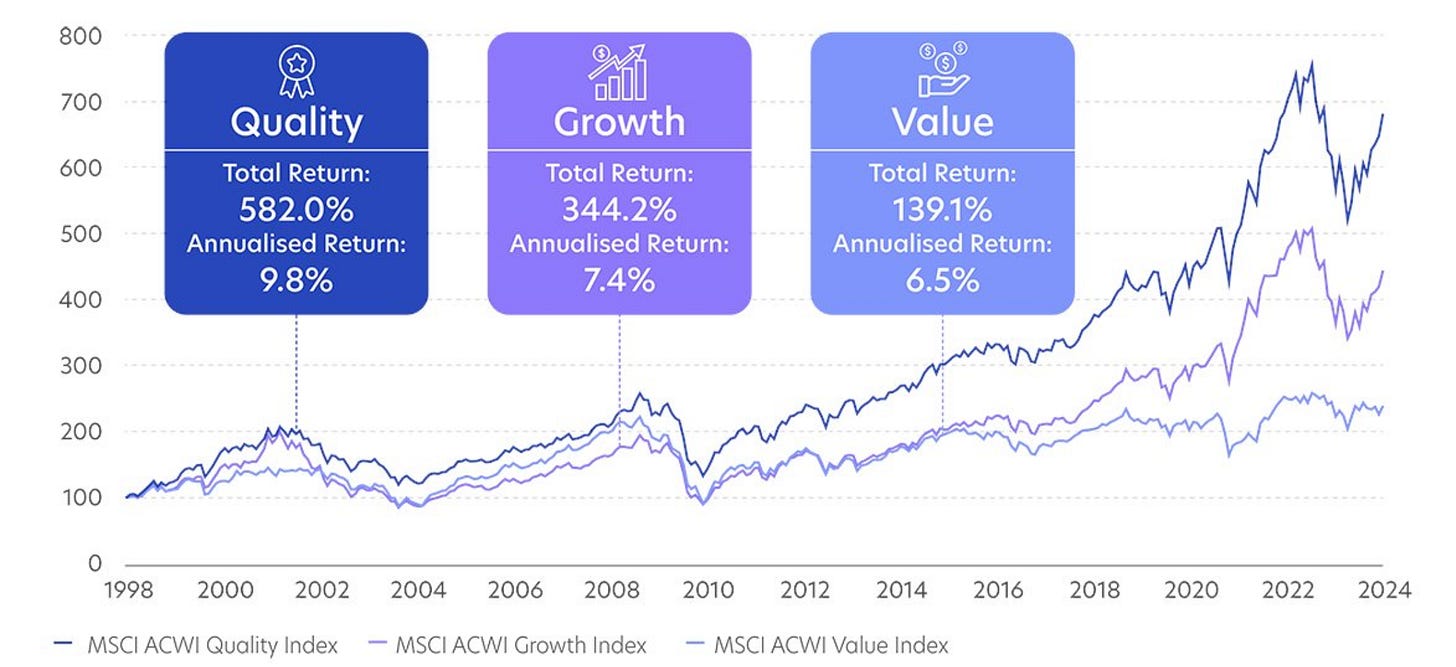

Investing in quality companies has historically produced very good returns.

That’s why this month’s Best Buys are all high quality companies with a ‘buy’ rating.

Ready to see what they are? Let’s dive in!

5. Rollins ($ROL)

How does Rollins make money?

Rollins is in the pest control business.

They own Orkin, one of the most trusted pest control brands in the world. They also own dozens of smaller regional names.

Bugs, rodents, termites - you name it, Rollins handles it.

And here’s the thing: pest control is recurring.

Once someone hires Rollins, they don’t just use them once. They keep paying every month or quarter to stay pest-free.

That means steady, reliable income.

Rollins serves millions of homes and businesses in the U.S. and over 70 countries. As long as there are pests, Rollins has work to do.

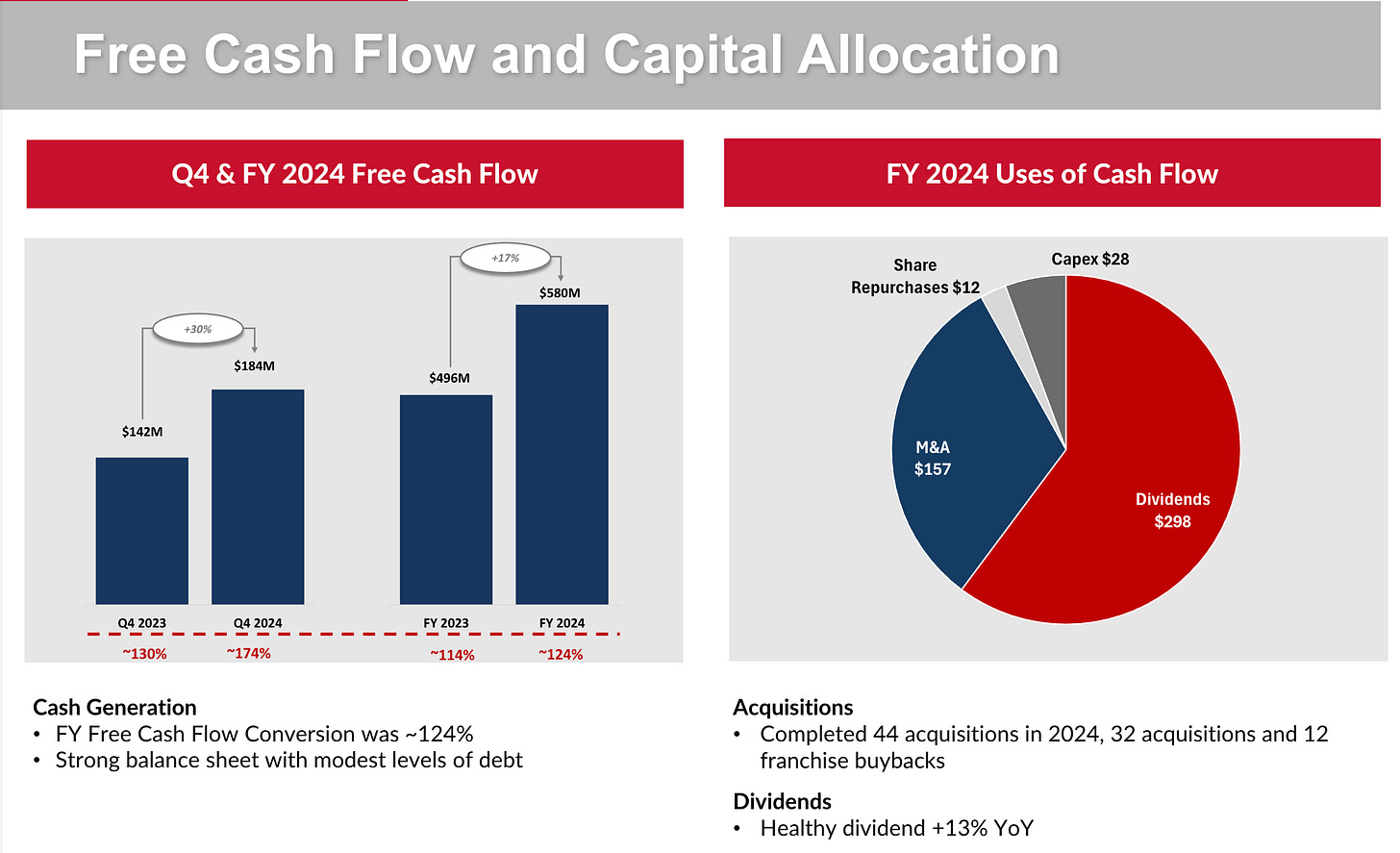

In 2024, revenue grew to $3.3 billion, and Rollins converts nearly all of the Operating Cash Flow to Free Cash Flow.

And because of its scale, Rollins can buy up smaller companies, plug them into its system, and boost profits even more.

After that, the company returns most of the Free Cash Flow to shareholders as dividends and buybacks.

4. Old Dominion Freight Lines ($ODFL)

How does Old Dominion make money?

Old Dominion is one of the biggest trucking companies in the U.S. They specialize in LTL shipping - that means “less-than-truckload.”

Instead of shipping full truckloads, they combine smaller shipments from different businesses.

This is more efficient. It saves customers money. And it makes Old Dominion a top choice in the industry.

The company has been a money-making machine for years.

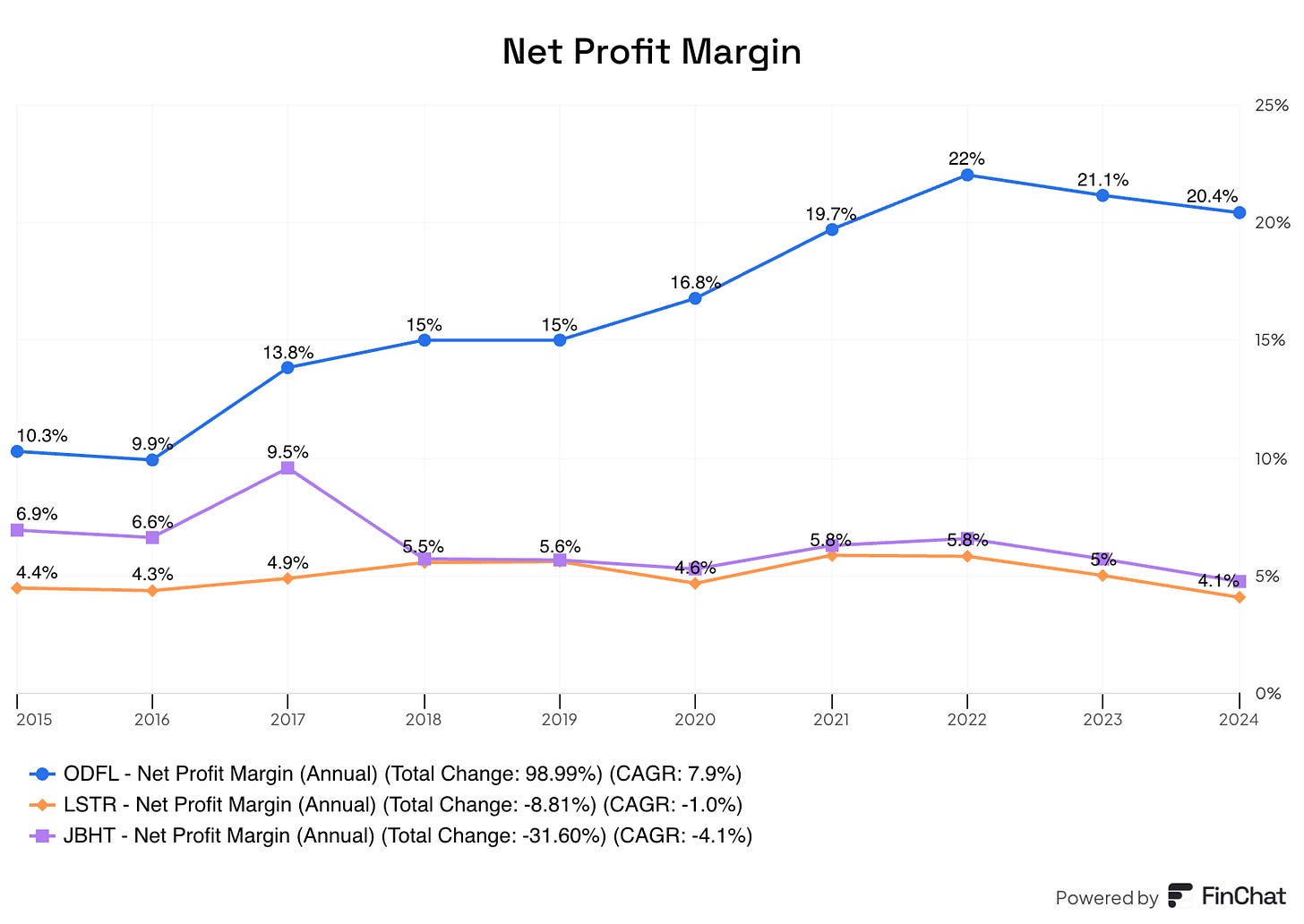

In 2024, Old Dominion’s profit margin was 20%. That’s insane for a trucking company. Most competitors struggle to get half that.

While others fight over prices, Old Dominion stays premium. Customers pay more because the service is better.

That’s why Old Dominion has been one of the best-performing stocks in the past 20 years.

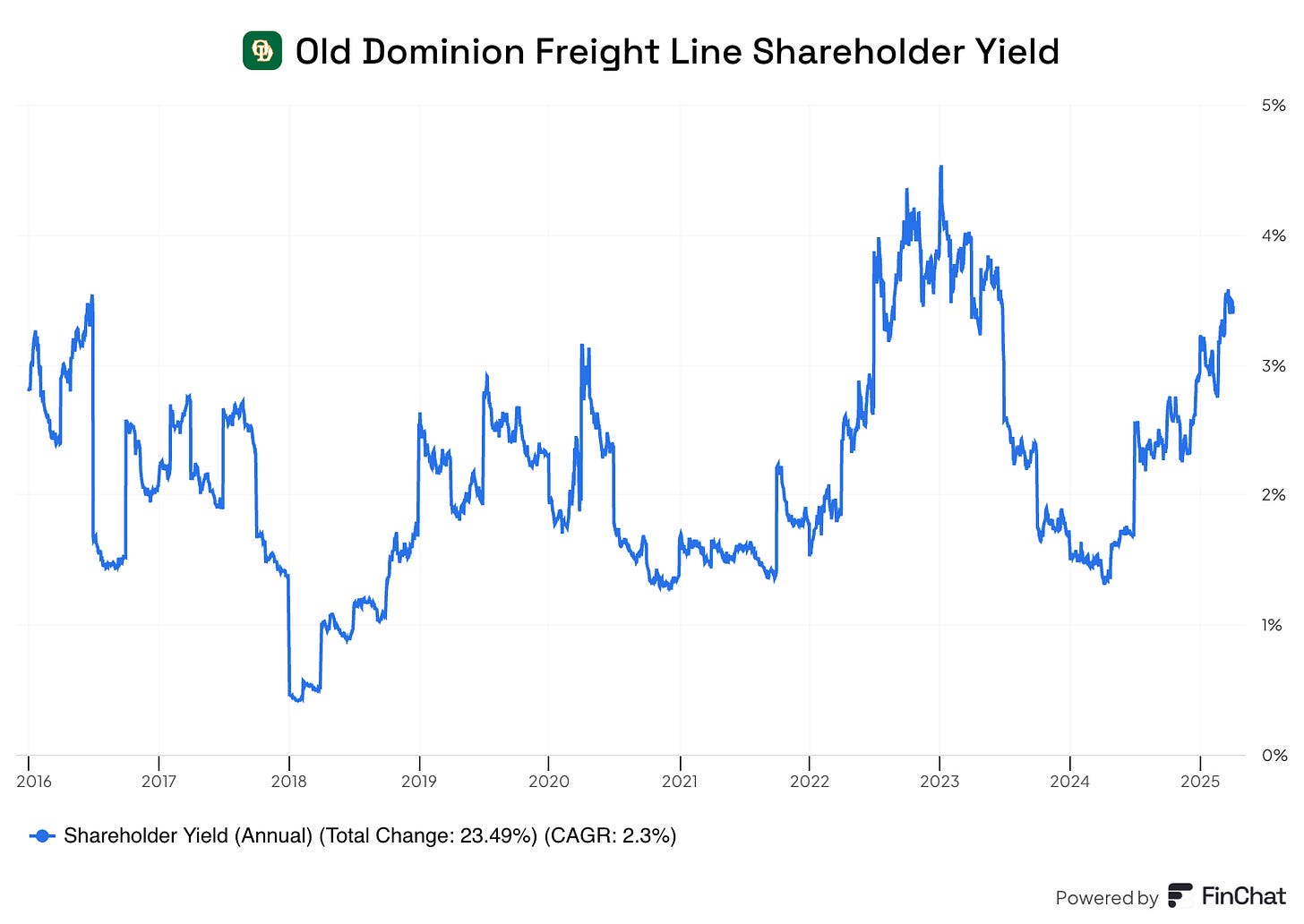

ODFL tends to spend more in buybacks than dividends, so I’ve charted Shareholder Yield - and they’re a quality company trading at a higher yield than average.