Hi Partner 👋

Welcome to this week’s 🔒 exclusive edition 🔒 of Compounding Dividends. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

We’ve already shared our Dividend Growth Stocks and our High-Yield Stocks with you:

Today part 3 of our watchlist rolls out.

It’s all about Cannibal Stocks.

Our Dividend Portfolio

We're focusing on Cannibal Companies today, but we’re always looking for good businesses with:

Sustainable competitive advantages

Quality management

Healthy balance sheets

Attractive growth

“Pay close attention to the cannibals – the businesses that are eating themselves by buying back their stock.” - Charlie Munger

Creation of the watchlist

Our watchlist is split into three parts:

Dividend Growth Stocks: Stable companies raising their dividends every year

High-Yield Stocks: Companies that return a lot of capital as dividends

Cannibal Stocks: Companies that heavily buy back their own shares

The goal is to provide you with a reliable income stream.

Cannibal Companies

Today’s article will focus on Cannibal Companies.

These companies return capital to shareholders by buying back their own shares.

Buybacks increase your ownership of the company

An easy way to understand this is to think about sharing a pizza.

The more people there are, the smaller each slice is.

Buybacks reduce the number of slices, making your slice bigger.

How many shares you have doesn’t change, but how much of the company you own does.

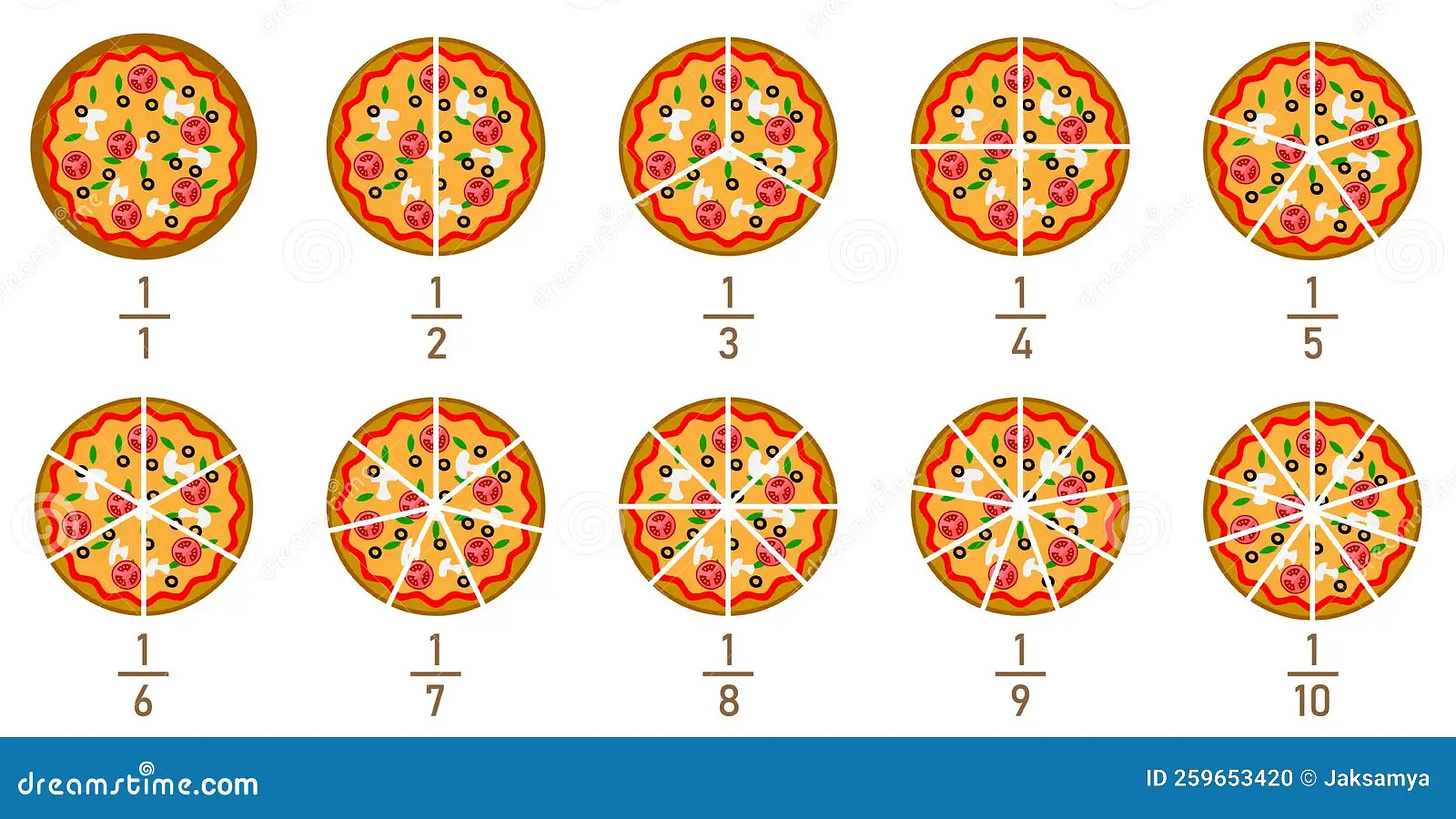

If you own a business that earns $10 per share and the company buys back 50% of its outstanding shares, EPS will increase from $10 to $20.

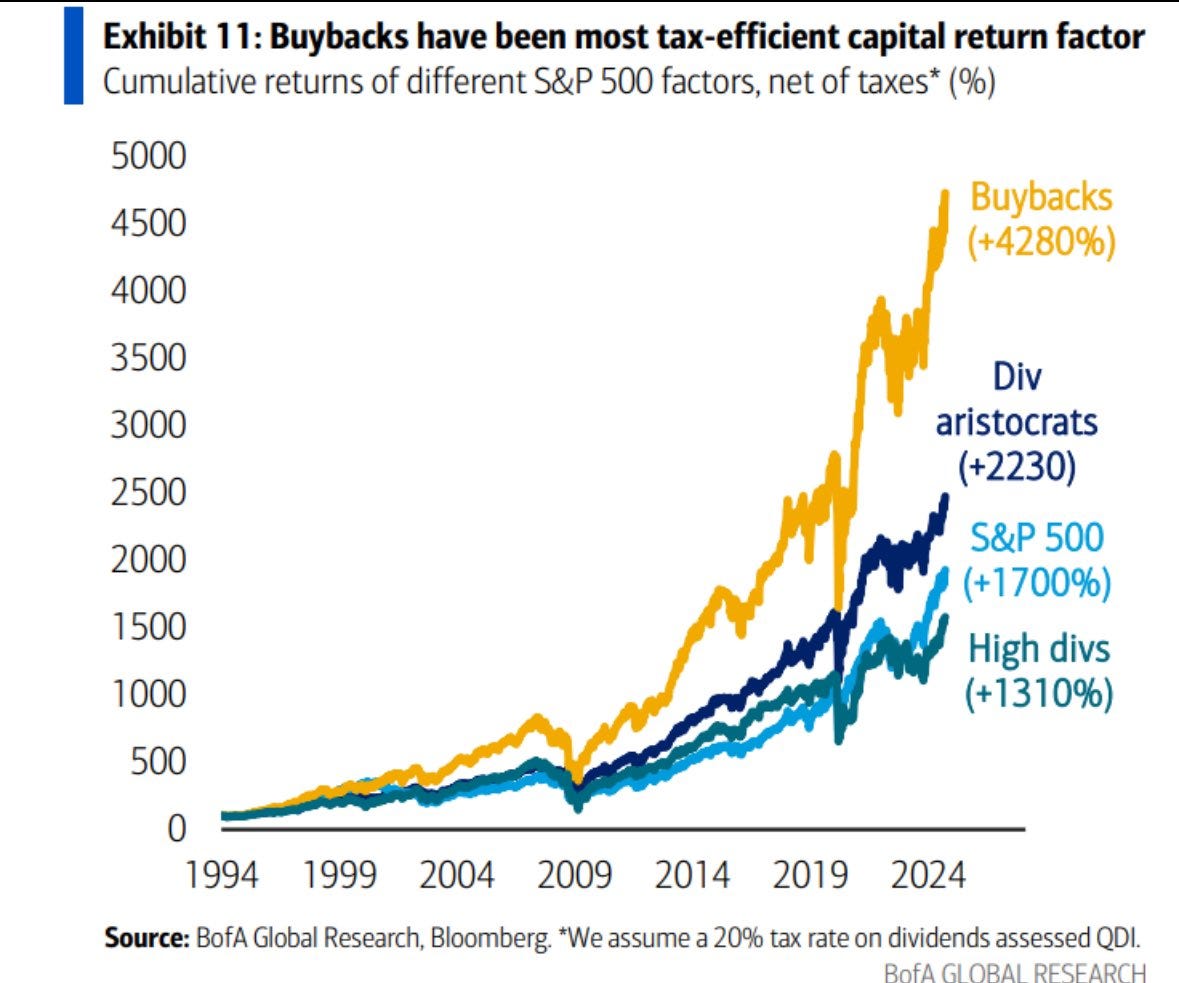

The chart below shows how different levels of buybacks affect returns:

In addition to generating attractive returns, buybacks address one of the common criticisms of dividends - taxes.

The image shows the cumulative returns of different factors, net of taxes.

Beyond Buybacks

Buybacks aren’t the only way for companies to return capital to shareholders.

Management teams can return capital to shareholders through:

Dividends

Share buybacks

Debt paydown

These three added together are called “shareholder yield”.

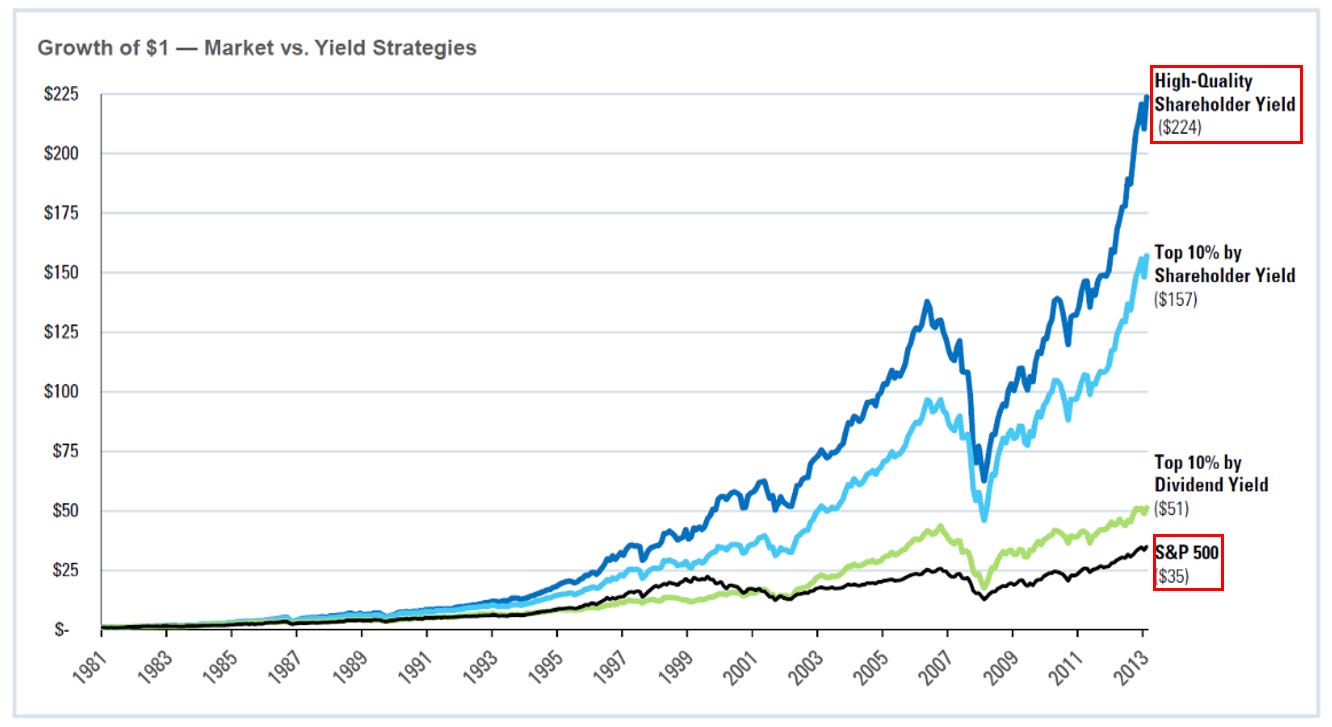

Shareholder yield performs even better than dividends alone!

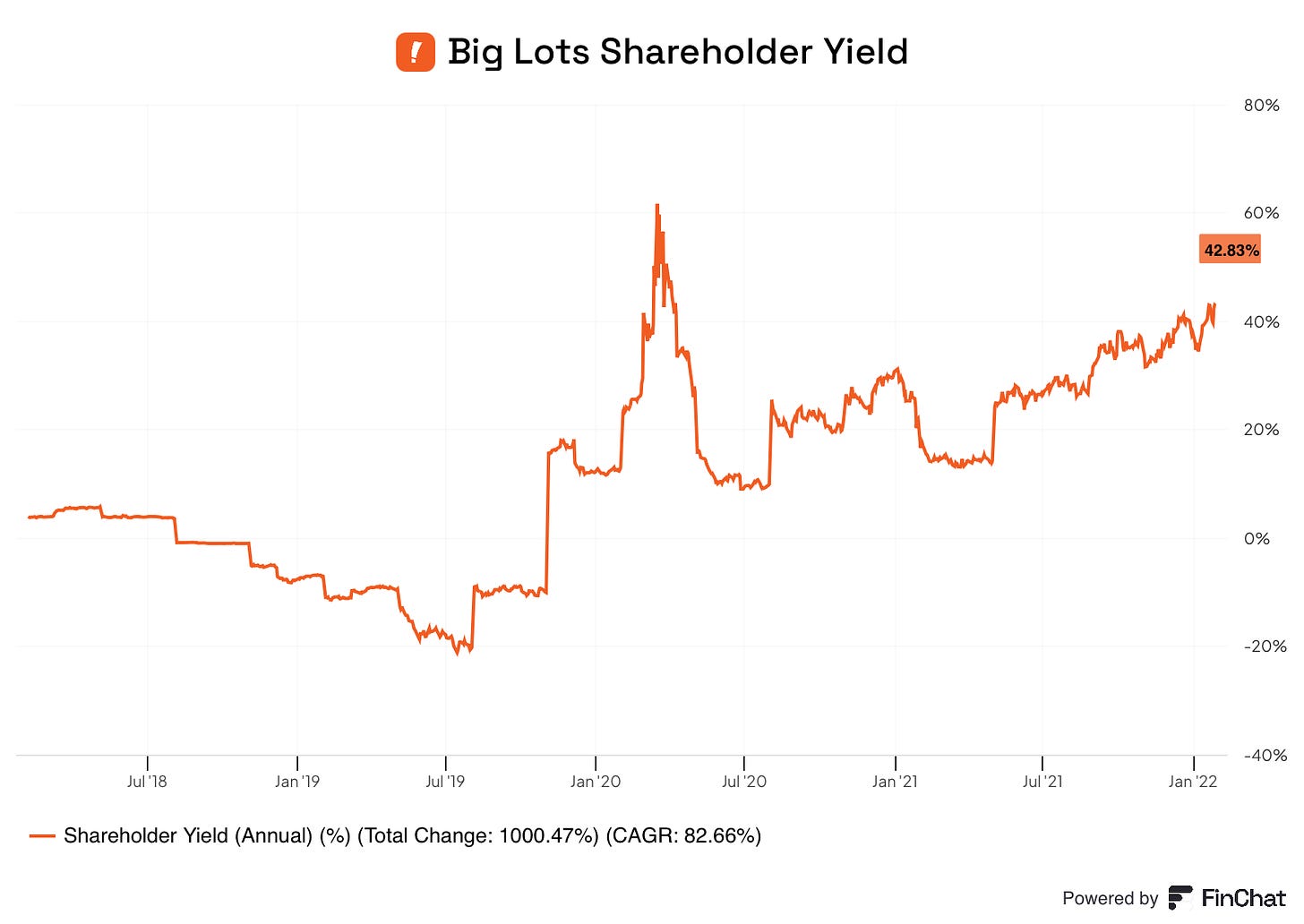

One of the reasons we love Finchat?

It calculates Shareholder Yield for you!

Here’s the shareholder yield of the company Big Lots. It’s over 40% (!):

A Cannibal Example

🏠 NVR

NVR is a homebuilder in the United States.

Between 1993 and 2024, NVR bought back more than 80% of its shares.

Shares outstanding 1993: 17.9 million

Shares outstanding 2024: 3.2 million

88.7% of shares bought back

Zero dividends, no stock splits

Stock price went from $5.50 to $9,000

1,600 bagger!

Earnings went up about 150x

A Few Highlights

The company with the highest shareholder yield on the list:

🖥️ Fidelity National Information Services at 25.3%

A few companies with consistently high shareholder yield:

🏷️ eBay: More than 5% per year for 7 years

🚗 AutoZone: More than 3% for 9 out of the last 10 years

The Cannibal Universe

Are you ready to look at more than 180 companies returning capital to shareholders?

Let’s dive into the list!