Are you ready for the Compounding Dividends Universe?

The list contains more than 750 interesting dividend stocks.

In other words: when valuation looks attractive we might want to buy these companies.

Our Dividend Portfolio

Portfolio Characteristics

Here is the essence of our Portfolio:

✅ The portfolio will invest worldwide (developed countries only)

✅ We’ll own 15-20 stocks

✅ The portfolio aims to invest in great dividend companies

✅ We won’t trade a lot. Activity and costs harm our results

✅ We won’t try to time the market (We’re way too dumb for that)

✅ The characteristics of companies in the portfolio:

Sustainable competitive advantages

Quality management in place

Healthy balance sheet

An attractive history of growth

Good capital allocation

History of returning capital to shareholders

Ability to grow shareholder returns in the future

Trading at fair valuation levels

“Do you know the only thing that gives me pleasure? It’s to see my dividends come in.” - John D. Rockefeller

Creation of the watchlist

The total universe is very large (750+ companies).

That’s why we split our watchlist into three parts:

Dividend Growth Stocks: Stable companies that raise their dividends every year

High-Yield Stocks: Companies that return a lot of capital as dividends

Cannibal Stocks: Companies that heavily buy back their own shares

The goal is to provide you with a reliable income streamThe company can’t keep raising its dividends if earnings don't grow while growing your dividends.

Dividend Growth Companies

Today’s article will focus on Dividend Growth Companies.

We want to own companies that consistently increase their dividend payments each year.

Dividend Growth Stocks are attractive for a lot of reasons:

Strong businesses

Companies with a long history of dividend growth are usually strong businesses.

Why?

To keep increasing dividends, a company must also grow its earnings.

If earnings don’t grow, the company can’t keep raising its dividends.

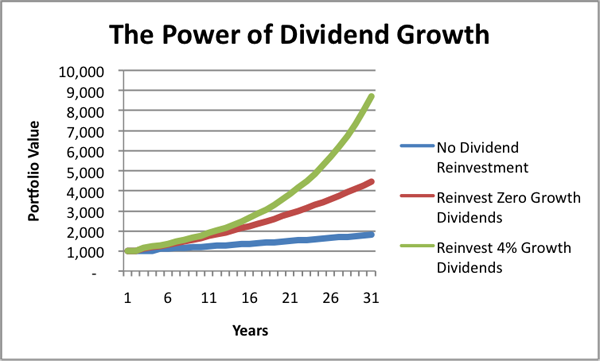

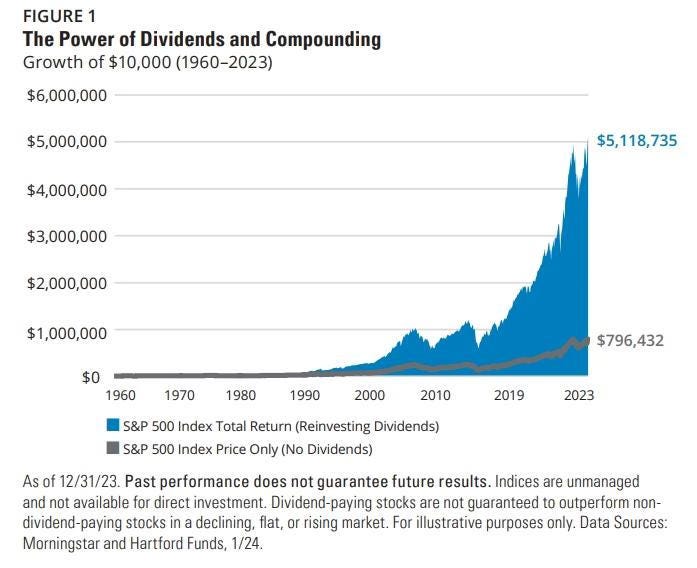

This image shows that reinvesting your dividends pays off:

Great capital allocators

A history of dividend increases often shows that management has good capital allocation skills.

Management that focuses on paying dividends:

Focuses on generating cash

Reinvests profits wisely

Plans long-term

Controls costs

Companies that pay dividends focus on returning value to shareholders.

This aligns management's goals with those of investors.

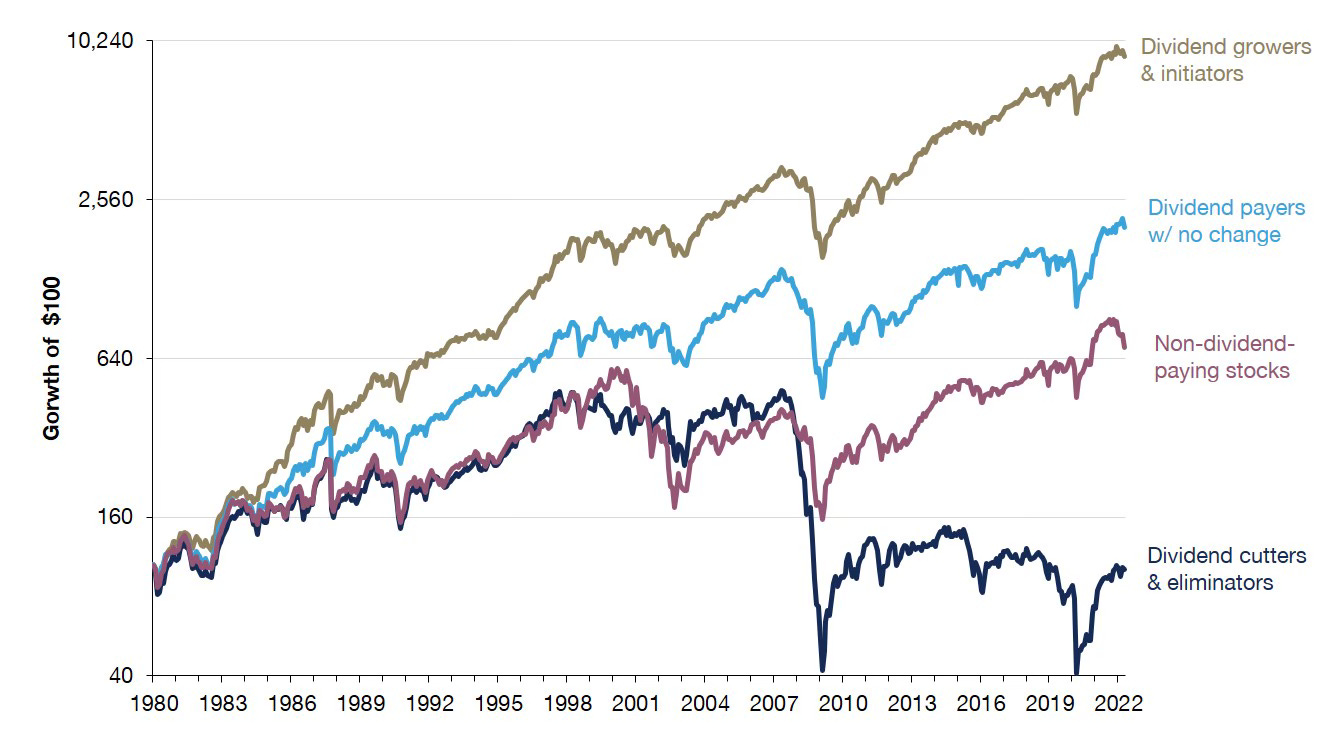

Performance

Dividend Growth Companies have done very well in the past.

They tend to outperform companies that don’t raise their dividends, or don’t pay them at all.

Reinvestment

The beautiful thing about Dividend Growth Investing is that you’ll receive a reliable source of income.

This allows you to retire comfortably.

But until you retire, you can reinvest your dividends.

This fuels compounding over time.

Selecting the companies

For the Dividend Growth Bucket, we only select companies that have raised their dividends for over 10 consecutive years.

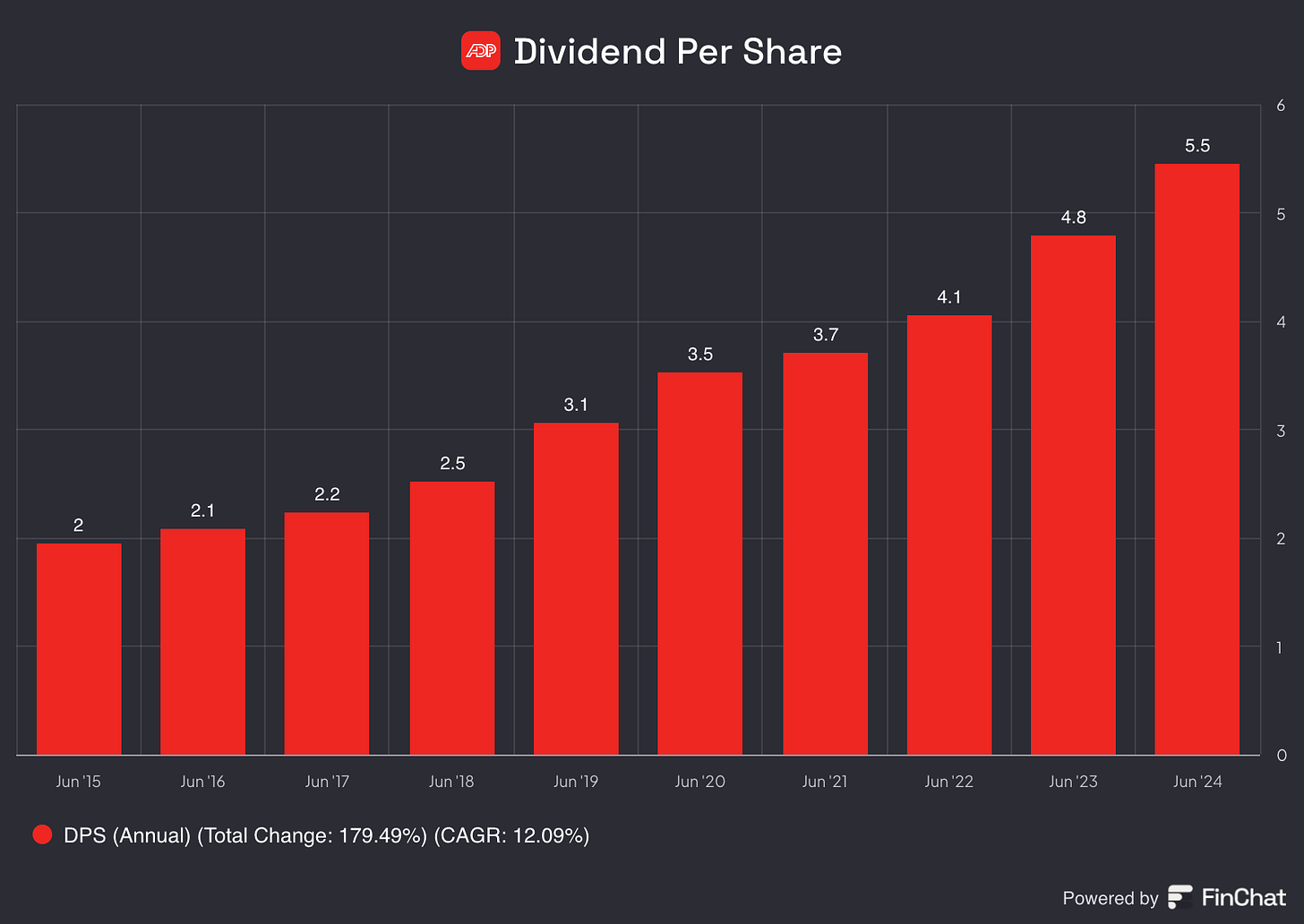

An example? Automatic Data Processing.

ADP has grown its dividend by over 12% per year over the past 10 years.

Source: Finchat

Our Portfolio will be built based on the watchlist.

Partners of Compounding Dividends will get access with 100% transparency.

This allows you to watch our entire Portfolio 24/7.

Does this interest you?

Consider becoming a Partner of Compounding Dividends.

If you join this month, you enjoy a discount of 30%:

A Few Highlights

The highest yielding company on the list:

🏡 Arbor Realty at 10.6%

A few of the strongest Dividend Growers:

👨🔧 Cintas: 22% per year

🚜 Tractor Supply: 27% per year

🛠️ Lowe’s: 17% per year

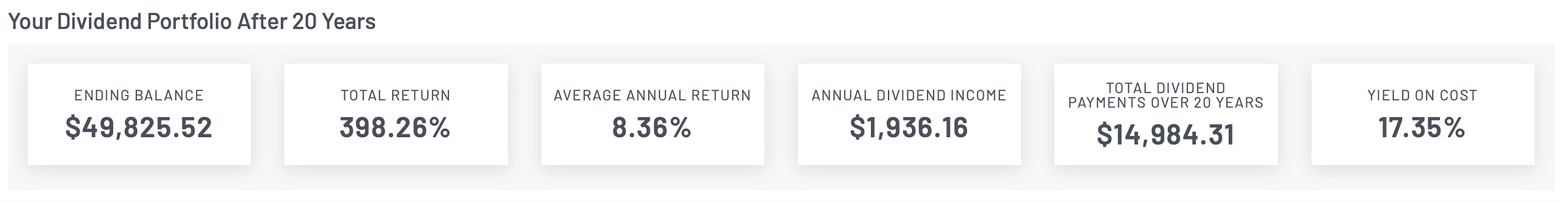

The average dividend statistics for Our Universe look like this:

Average dividend yield: 2.4%

Average payout ratio: 60%

Average dividend growth: 8.2%

Average revenue growth: 5.7%

We calculated the results of a portfolio with those numbers after 20 years, using the 5.7% revenue growth for stock price appreciation.

If you invested $10,000 in a portfolio with those averages, after 20 years, you’d have:

The Dividend Growth Universe

Are you ready to look into our entire watchlist?

Let’s dive into the list!