Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

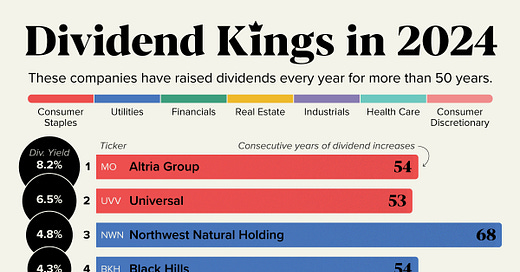

1️⃣ 50 Years of Dividend Raises

Dividend Kings are companies that have increased their dividends for at least 50 consecutive years.

FinanceCharts ranked all Dividend Kings by dividend yield as seen below:

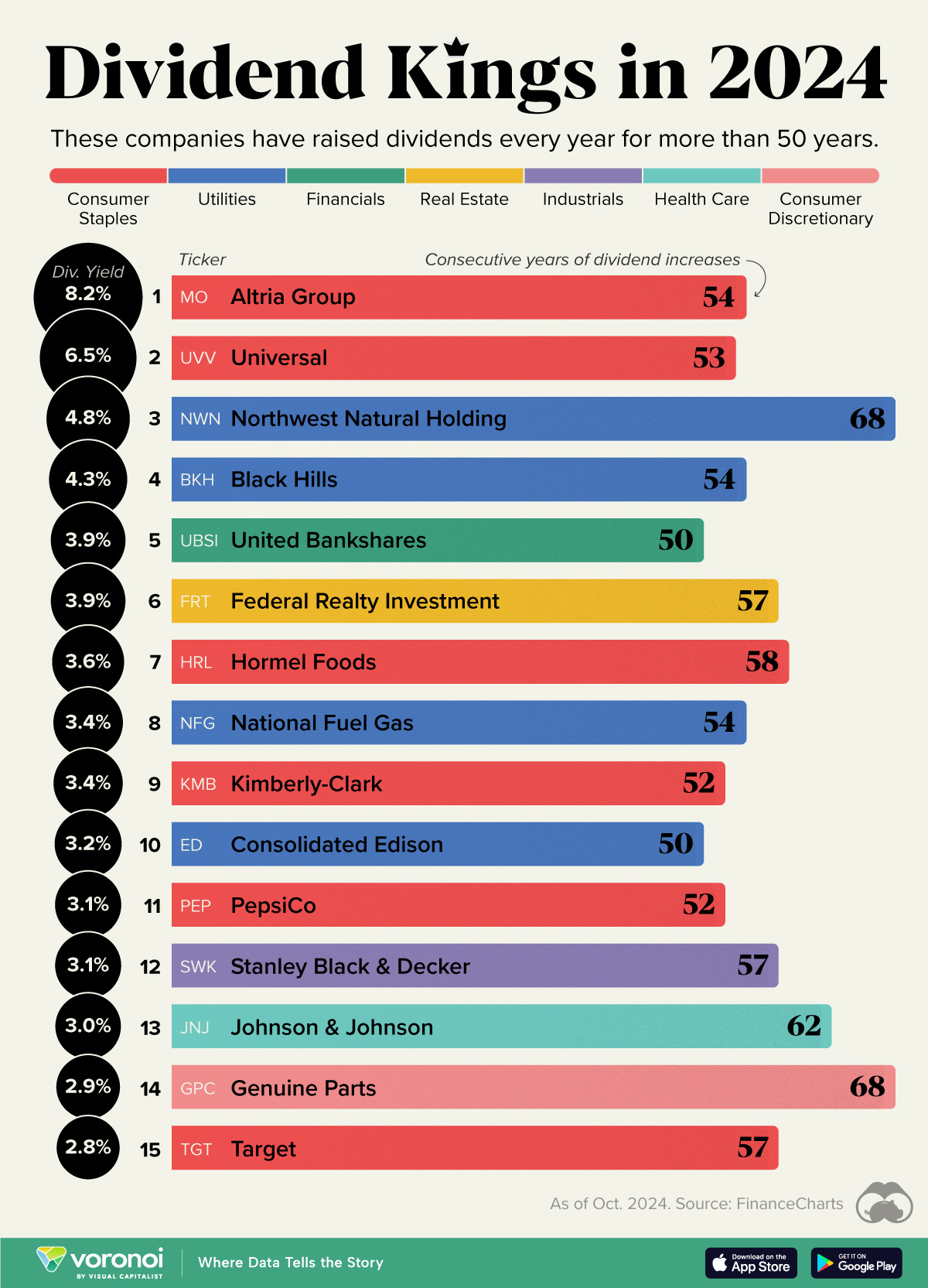

2️⃣ The Magic of Compounding

Coca-Cola is a Dividend King.

Holding these companies for a long time can produce amazing returns.

If you bought a single share of Coke in the 1919 IPO, you’d have more than 9,000 shares today!

Your investment would have gone from $40 to almost $10 million today!

3️⃣ An investing quote

Seth Klarman is known for his value investing approach and as the founder of the Baupost Group.

He is widely respected for his book "Margin of Safety," which outlines his investment philosophy and principles.

“The single greatest edge an investor can have is a long-term orientation” – Seth Klarman

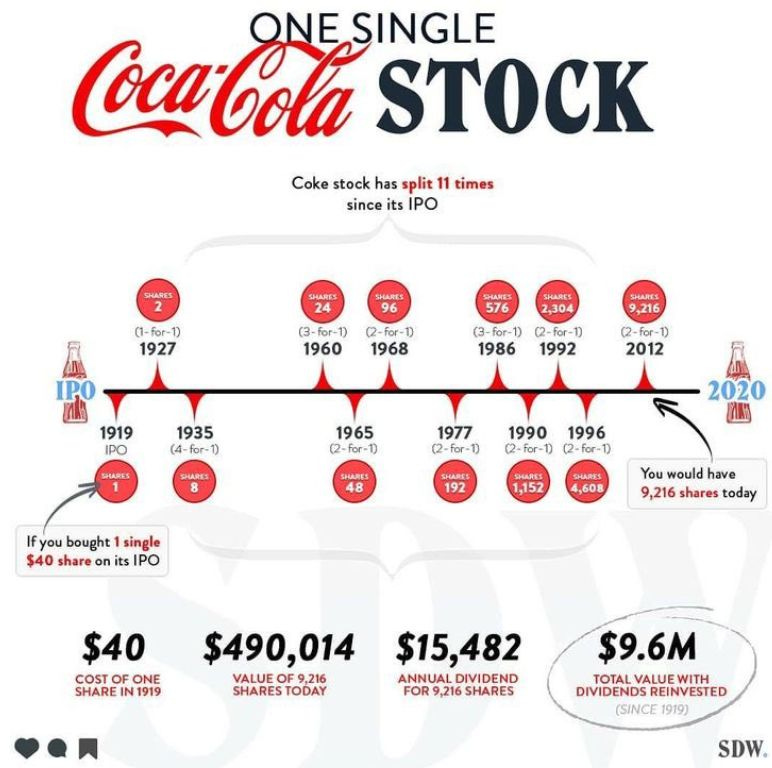

4️⃣ All Dividend Kings

Here are the Dividend Kings grouped by sector. It lists how many years they’ve increased their dividend payments.

Click on the picture to access a large, high-quality image.

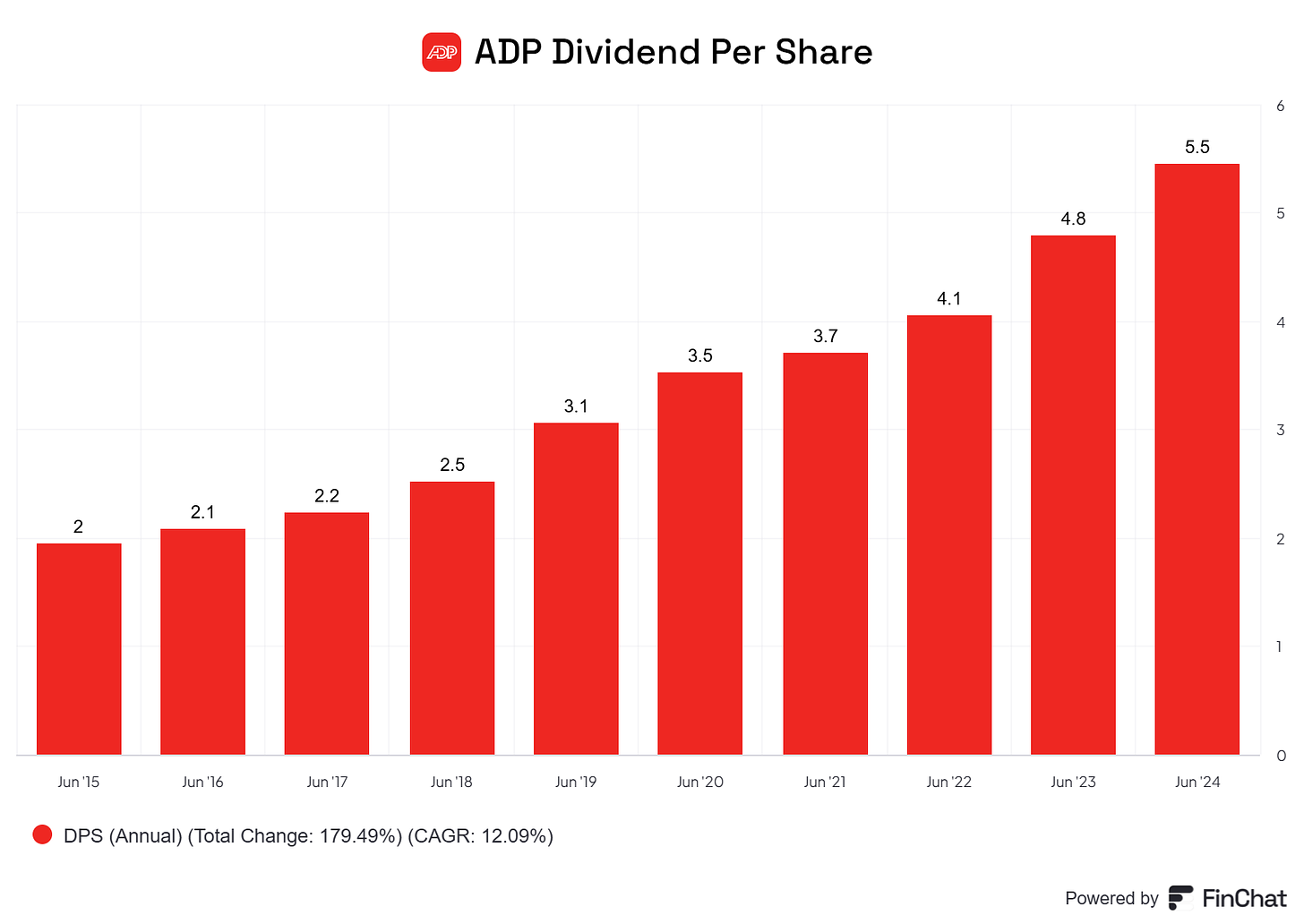

5️⃣ Example of a dividend stock

Automatic Data Processing is set to become a Dividend King.

They raised the dividend for the 49th time in 2023.

ADP makes money by providing payroll processing, benefits administration, and HR management to businesses and organizations, charging them a fee for these services.

Profit Margin: 19.5%

Forward PE: 28.7x

Dividend Yield: 1.9%

Payout Ratio: 44.7%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I'm really appreciating the articles here, TJ! ❤️ In the past I was focused on the dividend and its sustainability more so than its growth rate itself. Perhaps this is because I was building out my "income" portfolio in 2022 with beaten down REITs and BDCs. The dividend yields on those businesses was extremely high and very sustainable. My yield on cost across that portfolio is >9%. This high yield makes it kind of hard to sell out and rotate into a dividend grower. I totally feel the emotional tug.

My budget is all tapped out and planned out for the rest of the year and I am unable to join your community at the moment. I'm looking forward to see how 2025 opens up, especially after my Thanksgiving and Christmas expenditures. 👍

Hey! I stared substack 24 days ago and I’m at 385 subs, if you want to recommend each other to help both grow, let me know!