4 Lies You've Been Told About Dividends

And The Truths Smart Investors Already Know

Dividends are a powerful way to build wealth.

Yet lies and bad information about dividends persist.

Let’s break everything down and allow you to make great investing decisions.

Separating dividend fact from fiction can make a huge difference in the performance of your portfolio over time.

Let’s take a look at four of the biggest lies you've been told about dividends - and show you what the smartest investors already know.

Lie #1: "Dividends Waste Capital That Could Be Reinvested"

Reality: Strong companies can grow AND pay dividends

Profitable companies often generate more cash than they can effectively reinvest.

Source: Finchat

Walmart has raised its dividend payment for 52 years in a row while:

Investing heavily in research and development (R&D) to enhance its e-commerce capabilities, logistics, and in-store technologies

Regularly pursuing strategic acquisitions to expand its product offerings and geographic reach, such as the acquisition of Jet.com in 2016

Maintaining a healthy balance sheet

Warren Buffett's Berkshire Hathaway earns $776 million in dividends from Coca-Cola alone:

Studies show dividend-paying companies often have:

Better capital discipline

Stronger cash flow management

Higher quality earnings

The idea that paying a dividend always comes at the expense of the growth of the company is simply not true.

Lie #2: "Dividends Are Just Bribes for Investors"

Reality: Dividends reflect business strength and shareholder alignment

When you buy shares of a publicly traded company, you become a minority owner of the business.

Dividends are your share of the profits.

What’s the point in owning a company if you never get to access the profit it generates?

“The prime purpose of a business corporation is to pay dividends regularly and, presumably, to increase the rate as time goes on.” - Benjamin Graham

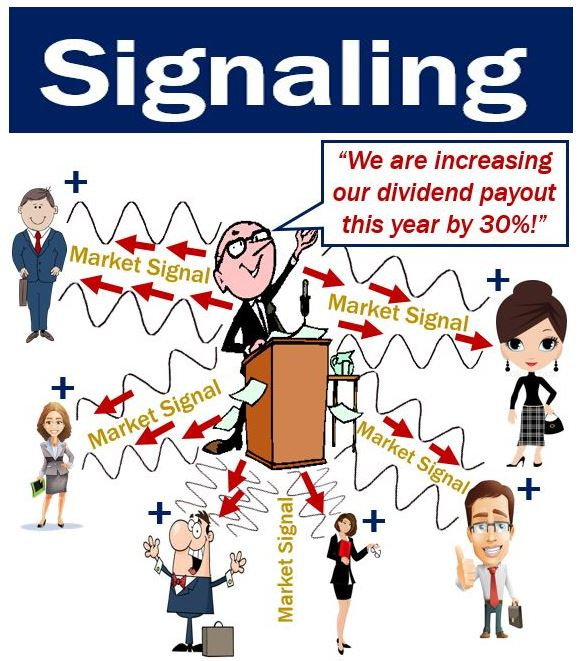

Regular dividends signal:

Sustainable earnings

Strong cash flow

Management confidence

Historical fact: Dividend-paying stocks outperformed non-payers by 1.5% annually from 1972-2022

Dividends aren’t a bribe when:

The company has excess cash

Growth opportunities are funded

The balance sheet is healthy

Dividends are a way for strong companies to align incentives and distribute profits to the owners.

Lie #3: "Dividends Create Tax Problems"

Reality: Tax are the result of making money, and their impact can be managed

Taxes happen when you make money, whether through dividends or other means.

Trying to avoid taxes by avoiding dividends is just a bad strategy.

Here’s the return of the S&P 500 considering only the price versus the total return if you would have reinvested your dividends.

While buybacks are even more tax efficient than dividends, the Dividend Aristocrats still outperform the S&P when a 20% tax is assumed:

Taxes and laws vary around the world, but there are multiple ways to manage taxes:

Tax-advantaged accounts

Dividend reinvestment plans (DRIPs) allow you to reinvest without actually receiving the cash

Accumulating ETFs exist that reinvest the dividends received instead of distributing them

Taxes are necessary when you make money. Dividend payers still tend to outperform, even when taxes are included. Rules vary around the world. Know what the implications are for you and what your options are to manage taxes instead of avoiding dividends altogether.

Lie #4: "Dividends Dilute Shareholder Value"

Reality: The "dividend fallacy" misunderstands total return

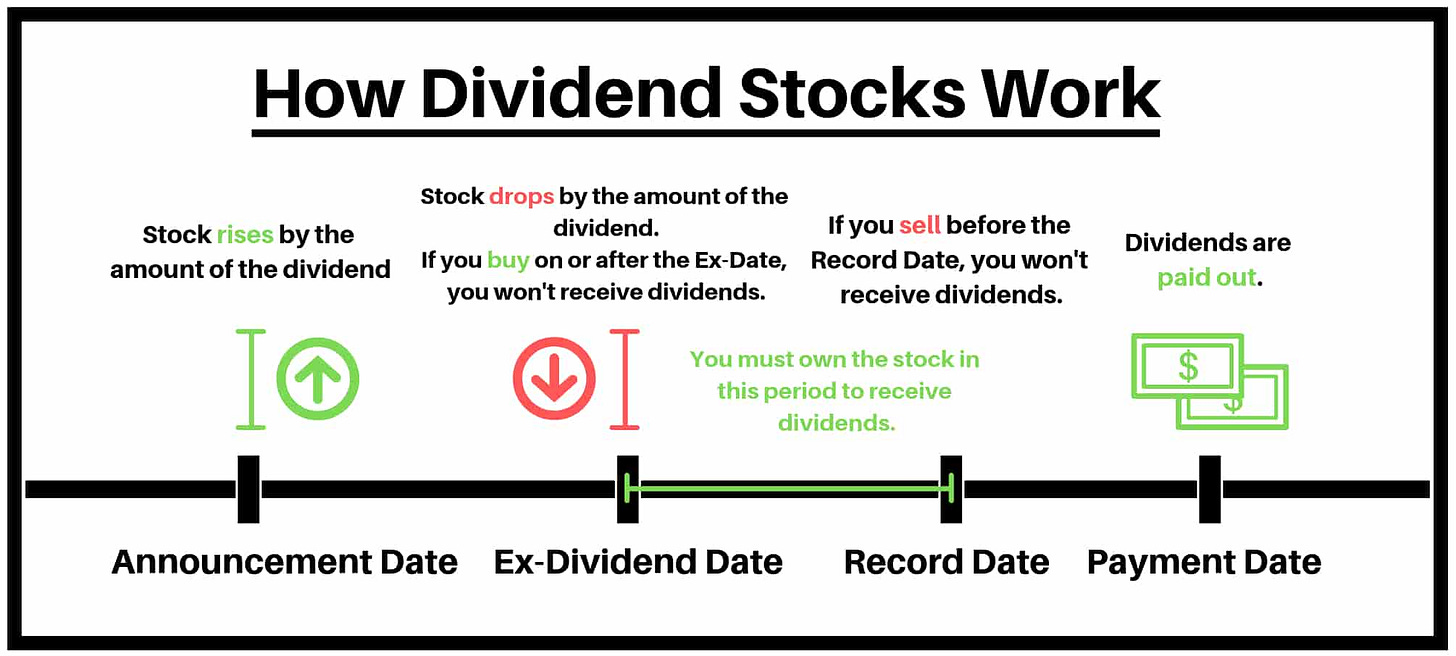

The dividend fallacy refers to the misconception that dividends are "free" money for shareholders.

Fans of this argument like to say that when a company pays a dividend, its stock price typically decreases by the same amount, meaning shareholders do not gain additional value.

Yes, in theory, the stock price drops by dividend amount, but theory also states that it first rises:

This all assumes that the markets are perfectly rational and efficient, when in reality we know that they are not.

That’s why in the real world dividend growers tend to outperform, as we’ve already shown you.

Very few dividend investors focus only on the dividend component

Most look at the total return.

This combines both the change in the investment's value and any income it produces.

It gives you the full picture of how much an investment has earned (or lost) over a certain period.

While we like consistent and growing dividend payments, we also want our capital to grow.

You can think of dividends like:

Harvesting crops while keeping the farm

Regular income from a rental property

They can provide a lot of income. You can even live off them in retirement, but they’re not the whole picture.

Bottom Line

Dividends are a powerful tool for building long-term wealth.

When quality companies maintain sustainable payout ratios while funding growth and maintaining strong balance sheets, dividends represent real value for shareholders.

Smart investors know: It's not about choosing between growth or dividends.

The best companies deliver both.

With that in mind, here are 3 companies from our investable universe that analysts predict will show strong earnings growth in the next 3 to 5 years: