Dividend Aristocrats are stocks that have grown their dividends for at least 25 consecutive years. Most of these companies have achieved such long dividend growth streaks thanks to their strong business models, which are characterized by a meaningful business moat and resilience to recessions.

Note: Go beyond the Dividend Aristocrats with the Dividend Kings – 53 elite stocks with 50+ years of consecutive dividend increases. Click here to get your free Dividend Kings spreadsheet now.

The following 3 Dividend Aristocrats are excellent considerations for buy-and-hold investors due to their long-term growth potential and lengthy dividend histories. All 3 Dividend Aristocrats are expected to produce over 10% annual returns over the next five years.

PPG Industries (PPG)

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

In the 2024 second quarter, PPG’s revenue decreased 1.6% to $4.79 billion. However, adjusted earnings-per-share increased 11% year-over-year. Second quarter organic revenue growth was flat compared to the prior year. Higher selling prices were offset by divestitures and a headwind from foreign currency exchange, while volume was flat. As with prior quarters, Aerospace demand was robust, with organic sales up a double-digit percentage.

Earnings-per-share were also boosted by share buybacks. PPG Industries repurchased $150 million worth of shares during the quarter, bringing the year-to-date total to $300 million. For 2024, the company expects organic sales to be unchanged to up low single-digits and adjusted earnings-per-share in a range of $8.15 to $8.30. At the midpoint, this would represent a 7.3% increase from the prior year.

PPG Industries’ earnings-per-share have a growth rate of 7.4% over the last decade. We expect earnings-per-share to grow at a rate of 8% through 2029. The company’s steady growth has allowed it to raise its dividend for many years. On July 18th, 2024, PPG Industries raised its quarterly dividend 4.6% to $0.68, extending the company’s dividend growth streak to 53 consecutive years.

Source: Finchat

Medtronic plc (MDT)

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 90,000 employees.

Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 46 consecutive years.

In late May, Medtronic reported (5/23/24) financial results for the fourth quarter of fiscal year 2024. Organic revenue grew 5% over the prior year’s quarter thanks to broad-based, mid-single digit growth or higher in all the four segments. Earnings-per-share decreased -7%, from $1.57 to $1.46, due to a -4% currency headwind and higher R&D costs and selling & administrative costs, but exceeded the analysts’ consensus by $0.01.

Thanks to expectations for somewhat improved business trends, Medtronic provided decent guidance for fiscal 2025. It expects 4.5%-5.0% organic revenue growth and earnings-per-share of $5.40-$5.50. Medtronic benefits from long-term healthcare trends. Moreover, we expect business performance to improve as soon as supply chain issues ease and cost inflation moderates. Overall, we expect Medtronic to grow its earnings-per-share by 7.0% per year on average until 2030.

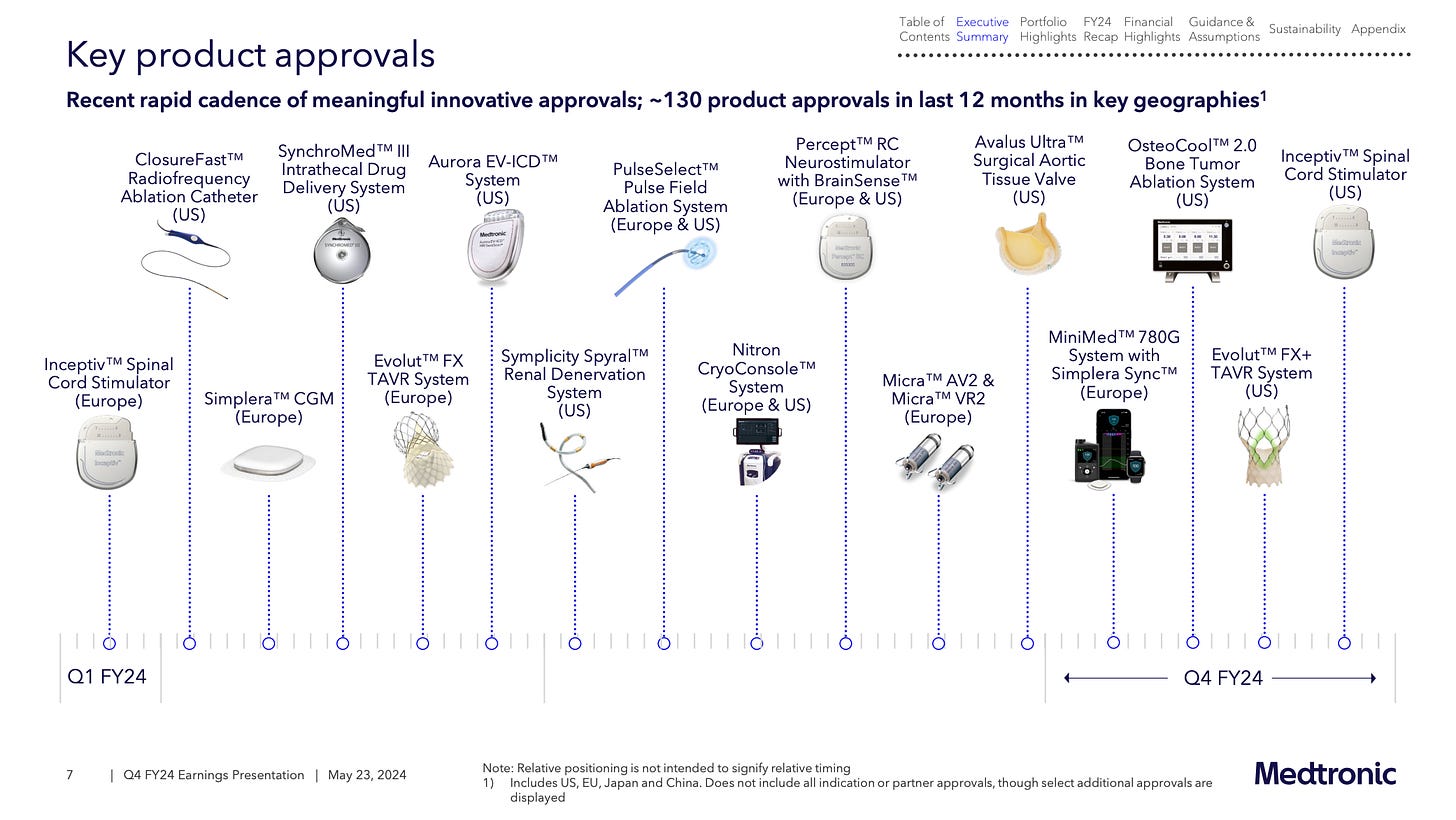

Medtronic’s most compelling competitive advantage is its intellectual leadership in a complicated industry within the healthcare sector. Medtronic also has a strong product pipeline that should drive its growth for the foreseeable future. With a dividend payout ratio of approximately 51%, the company’s dividend appears secure with room for continued increases.

MDT shares have traded hands at an average price-to-earnings ratio of 17.0 over the last decade. We believe that this is a fair valuation baseline for MDT stock, taking into consideration the quality of the company and its growth prospects. The stock is currently trading at an earnings multiple of 15. As a result, an expanding valuation multiple could boost shareholder returns.

In all, we expect total returns above 13% per year over the next five years for MDT stock.

Source: Medtronic’s website

Target Corporation (TGT)

Target is a giant retailer and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target posted first quarter earnings on May 22nd, 2024. Adjusted earnings-per-share came to $2.03 in Q1, while revenue was down 3.1% to $24.53 billion. Comparable sales fell 3.7%, which met expectations.

Target has grown its earnings-per-share at an average annual rate of about 8% during the last decade. Turnaround efforts have borne fruit and as a result, Target has significantly improved its performance in recent years. Overall, we expect 10% annualized growth from what should be a modest level for 2024 given margin issues that cropped up in recent quarters, but appear to be improving.

Earnings-per-share growth will be boosted by margin expansion from low levels in 2023, and a potential tailwind from the share buyback program. Target’s digital efforts are also working extremely nicely, although there was some pulling back after enormous sales growth during the pandemic.

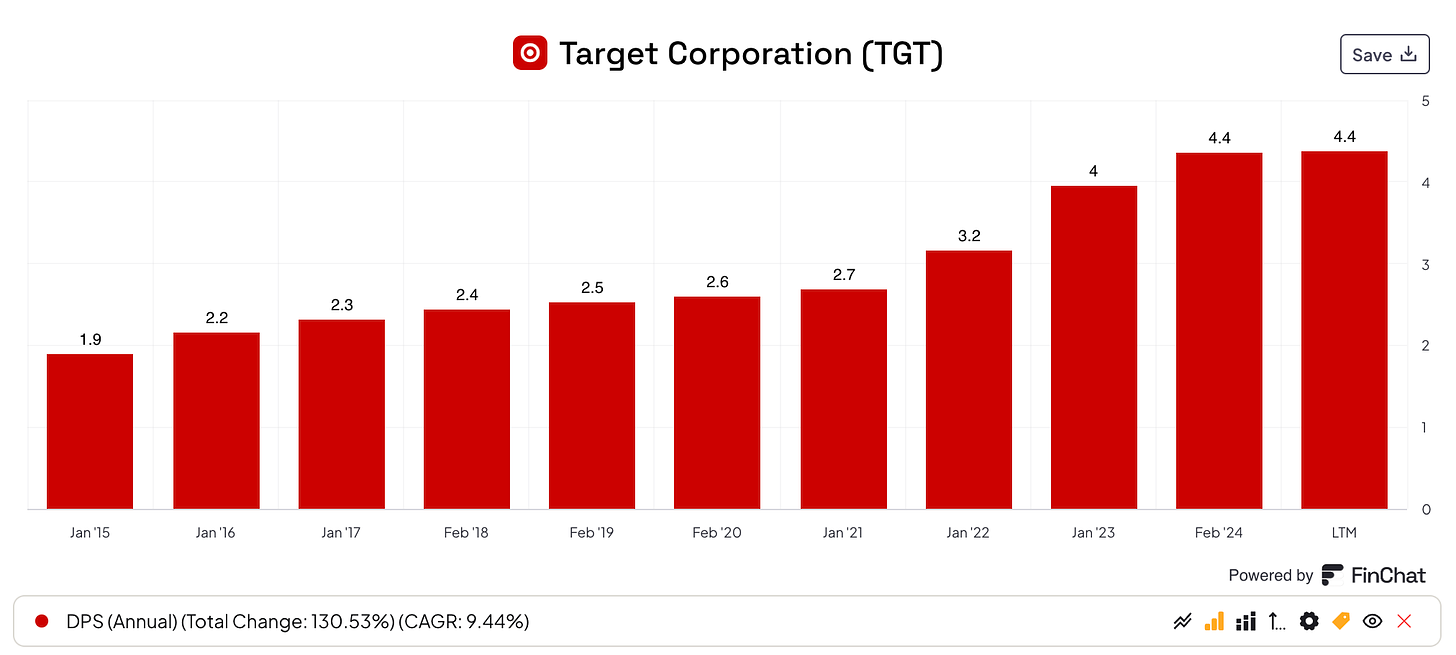

Target has grown its dividend for more than five decades, making it a Dividend King. The dividend payout is highly safe. The payout is now 47% of earnings for this year, which is elevated historically, but we expect the payout ratio to decline as earnings rise going forward. Target’s competitive advantage comes from its everyday low prices on attractive merchandise in its guest-friendly stores.

Target’s long-term dividend growth is due largely to the company’s defensive business model as a major discount retailer. Consumers tend to curtail their consumption during recessions, meaning the company is vulnerable to recessions, but it continued to increase the dividend during the Great Recession and the coronavirus pandemic. Therefore, while Target is vulnerable to economic downturns, it is much more resilient than most stocks in such periods.

TGT has increased its dividend for 55 consecutive years, and the stock currently yields 3%. We also expect earnings growth of 10% per year over the next five years. Total returns are expected to reach 13% per year over the next five years.

Source: Finchat

Disclosure: No positions in any stocks mentioned

That’s it for today

That’s it for today.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

A question to ask is why does one buy companies that distribute dividends. Do you want the dividend to reinvest back into the company stock in order to generate better overall returns for your holdings or are you seeking an income stream?

If you are looking for overall returns then PPG and MDT probably would not be your first picks. Buying a S&P 500 ETF like SPY would have walloped both of these companies. TGT is very volatile due to the cyclical nature of retail. TGT was recently boycotted by right wing conservatives because of the company's celebration of Pride Month. 😢 There's a Wikipedia article on it. Personally, I thought the boycott was stupid 👎 but we can't ignore the impact it had on the stock price. 📉 Had you bought in while the stock was down, cheap, and out of favor then you would have captured both capital appreciation and a wonderful dividend yield! 🎉 The retail sector is not simple to invest in so I stay away.

If you are looking for dividends for the income then I would pass on all three of these right now. All of them yield below 4%, which is my minimum for an income play. There are REITs like O and ADC, oil and gas companies like OKE, business development companies like TSLX, and many closed end funds like BST that produce a much thicker income stream. 💰

So, always start with "why?" and go from there.