💸 Will There Be A Santa Rally?

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Nordstrom going private

Have you ever shopped at Nordstrom?

You can buy clothes, shoes, and home goods there - but you can’t buy the stock anymore.

Why? The Nordstrom family is taking the company private for $6.25 billion.

When the deal closes, investors will get $24.25 in cash + a special $0.25 dividend.

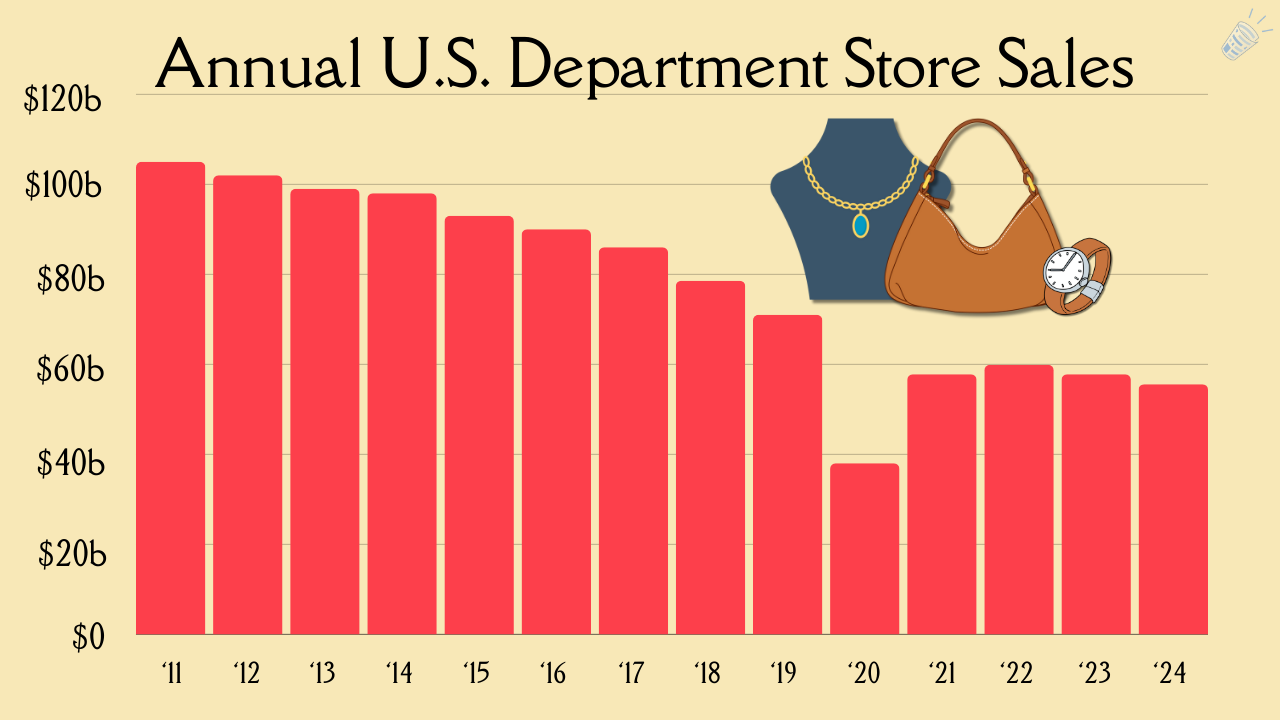

Retail is a tough business - sales at department stores like Nordstrom have been falling for a while.

2️⃣ Will there be a ‘Santa rally’?

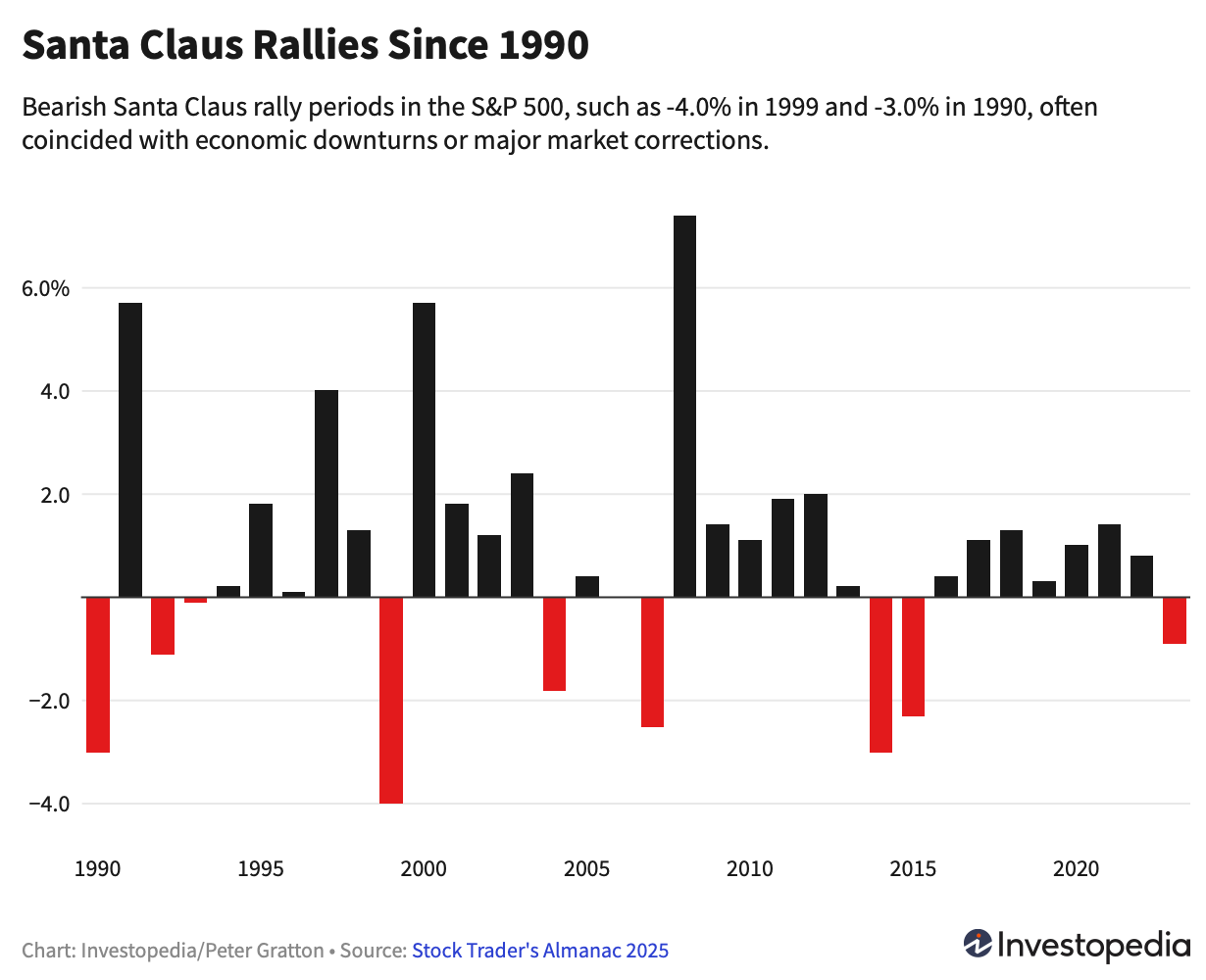

A Santa rally is the name for the tendency for the stock market to go up at the end of the year.

Since 1950, during the last five trading days of December through the first two trading days of January., the S&P 500 has gained an average of 1.3% and been positive 79% of the time.

Last year, the market was down during this window.

When the market closes on Thursday, we’ll know if Santa Claus has decided to visit Wall Street this year.

3️⃣ An investing quote

Benjamin Graham is called the "father of value investing."

He reminds us that you should buy stocks because you think they are good investments, not because you need regular income.

Focus on the quality and potential of the company - growing companies can pay growing dividends.

“It is an axiom of investment that securities should be purchased because the buyer believes in their soundness, and not because he needs a certain income.” - Benjamin Graham

4️⃣ How dividends affect accounting statements

Accounting is the language of business.

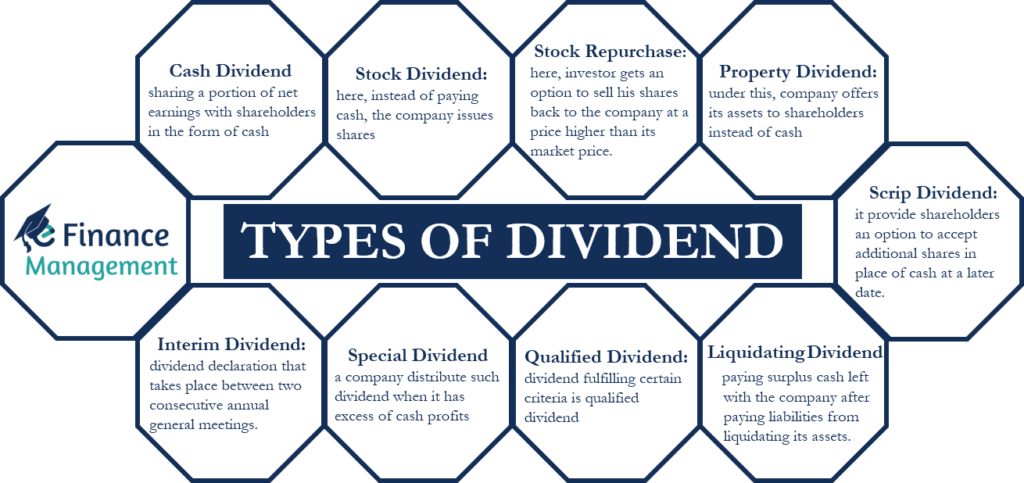

Different types of dividends affect the accounting statements in different ways.

Click the picture below to read an article from Accounting Insights on how different types of dividends influence financial statements, shareholder value, and financial planning.

5️⃣ Example of a dividend stock

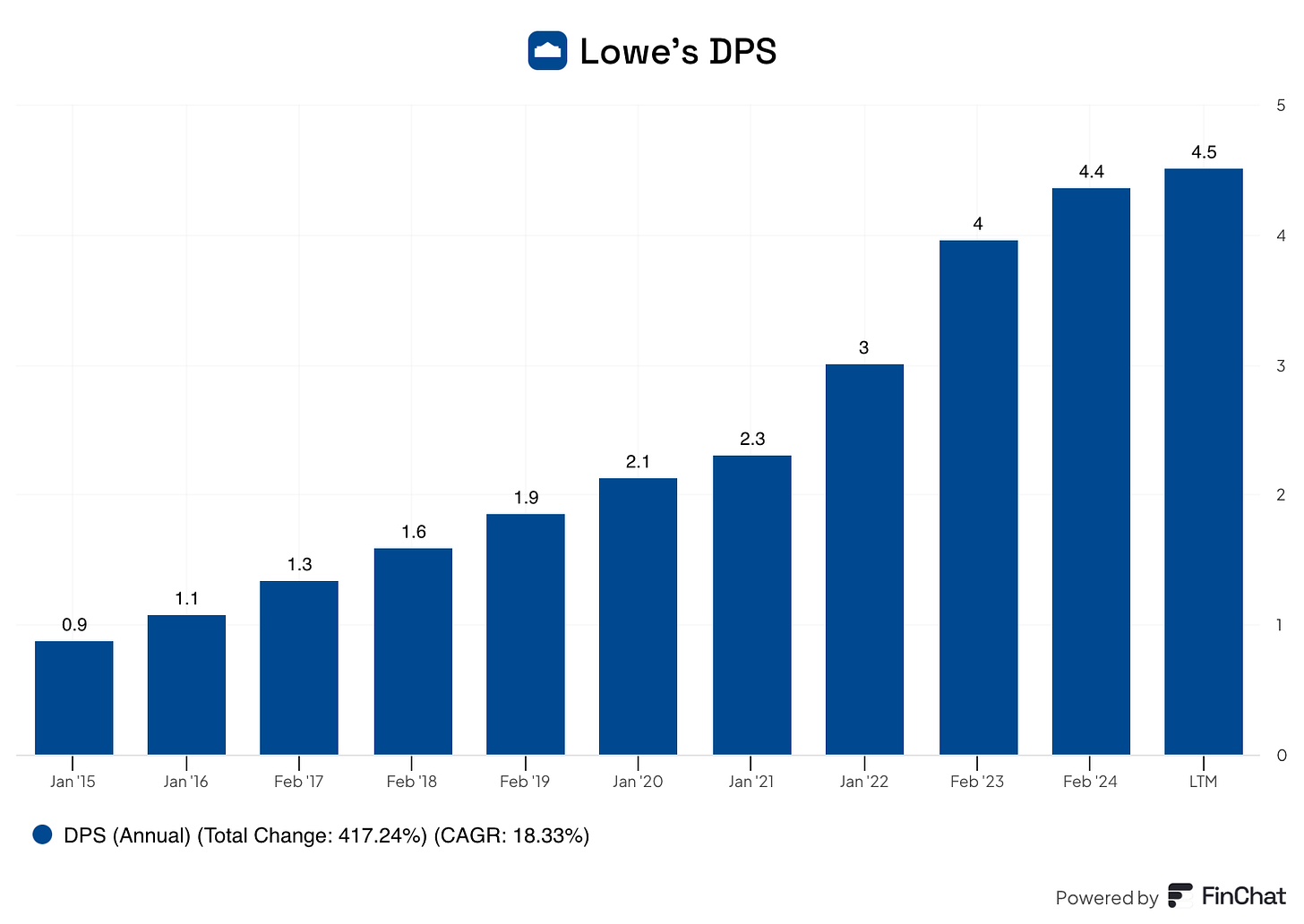

We started this email with news on Nordstrom. We’ll stay with consumer companies and look at Lowe’s today.

Lowe's sells home improvement and hardware products to both professional contractors and individual consumers.

Lowe’s is a Dividend King, raising its dividend for 53 (!) years in a row.

Profit Margin: 8.9%

Forward PE: 20.5x

Dividend Yield: 1.7%

Payout Ratio: 37.5%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data