12 European Stocks Built for a World in Flux

Why These Companies Matter Now More Than Ever

Let’s start with a truth bomb:

Global headlines have never been louder - or less useful.

Tariffs are on.

Then they’re paused.

The U.S. says they are in talks with China.

China says they’re not.

Companies are reporting earnings and suspending guidance because nobody knows what things will look like next week, or next month.

It’s chaos out there.

And in chaos, most investors panic.

But not us.

We lean in.

Because we know something most investors forget:

Great businesses don’t care about headlines.

They keep making money.

They keep paying dividends.

They keep quietly compounding wealth… even when the world feels like it’s falling apart.

Why Europe Matters

✅ Some European investors like companies doing business in euros, pounds, and francs. They may be worried about the falling U.S. dollar

✅ American investors need true international exposure. Not companies that look international but live and die on U.S. demand.

European Companies With big U.S. Exposure

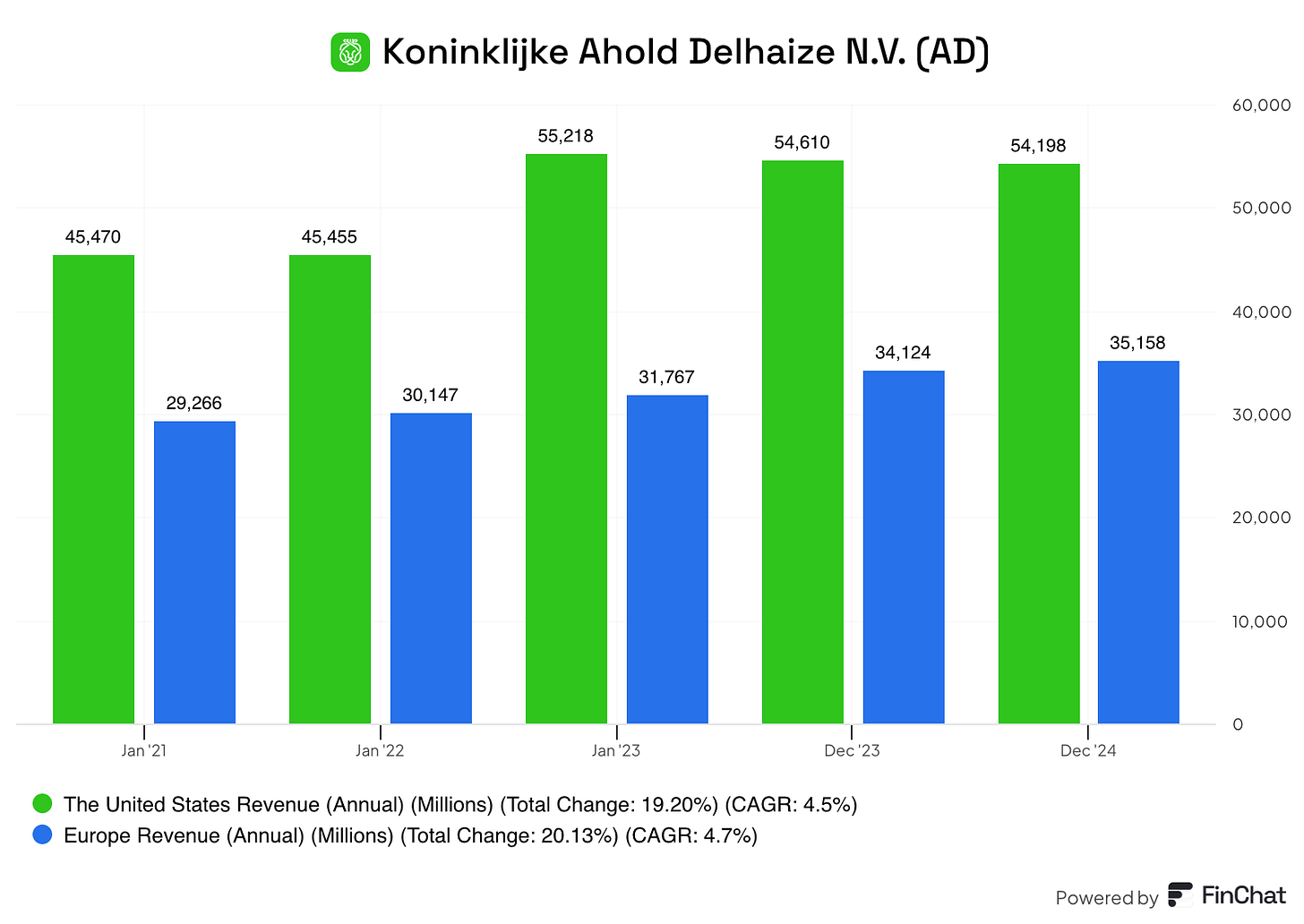

Take Ahold Delhaize. Dutch company. Big in groceries.

But 60% of its revenue comes from the U.S.

Ashtead Group? Over 70% of its money is made renting gear in America.

Stellantis? 40% of its revenue is from North America.

Even Bunzl and LVMH count the U.S. as a huge piece of their sales pie.

I’m not saying these are bad businesses.

I’m saying… they’re not European businesses in the way you think.

So what should you own instead?

The Real European Compounders

These 13 companies offer something special:

Real euro-denominated cash flows

Essential services or dominant niches

And little exposure to political drama on Capitol Hill

Let’s dig in…