💸 10 Strong Brands That Pay Dividends

And dominate the market

Today is Dividend Day, but in January, something special is coming -

Dividend Week.

Watch your inbox for daily emails all about dividend investing, and exclusive offers to become a partner of Compounding Dividends.

I don't know what the market will offer in 2025, but I know we have upgrades planned for Compounding Dividends that you won't want to miss out on.In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ 10 Strong Brands That Pay Dividends

Soething dividend investors really love? Consumer brands.

The image shows how major companies like Nestlé, PepsiCo, and Unilever dominate their markets with vast portfolios.

Investing in them can offer both stability and growth.

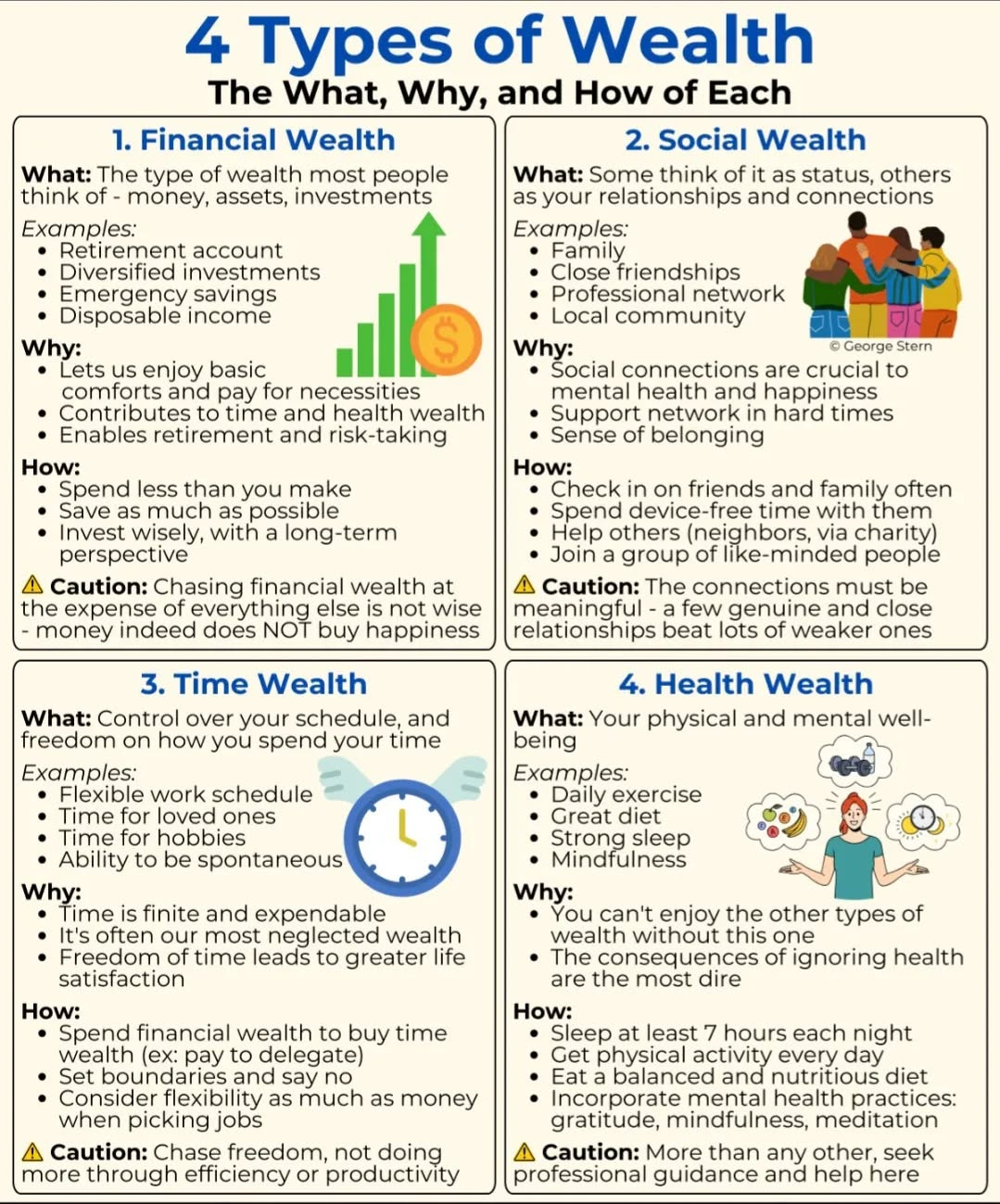

2️⃣ Four Types of Wealth

We like to compound our capital and our dividends.

But life isn’t only about money.

How else can you be wealthy?

Here are 4 different types of wealth:

3️⃣ An investing quote

Howard Marks is the co-founder of Oaktree Capital Management.

He is known for his expertise in distressed debt and value investing, as well as for his books and investment memos.

Here he is reminding of us of the power of thinking long-term:

"Day traders considered themselves successful if they bought a stock at $10 and sold at $11, bought it back the next week at $24 and sold at $25, and bought it a week later at $39 and sold at $40. If you can't see the flaw in this - that the trader made $3 in a stock that appreciated by $30 - you probably shouldn't read the rest of this book."

- Howard Marks in “The Most Important Thing”

4️⃣ Why Dividends Matter

Guinness Global Advisors produced a report on why dividends matter.

Dividends are an important part of total returns over the long term.

Look for companies that can maintain and grow their dividends consistently and reinvest them for long-term growth until you need the income.

The image shows the proportion of returns from dividends and price of the S&P 500 over different periods.

Click on it to read the report.

5️⃣ Example of a dividend stock

Let’s look at one of the 10 brands we started with.

Mondelez is a packaged food company that makes and sells snacks and treats like cookies, crackers, and chocolate.

Some of their well known brands are Oreo cookies, Cadbury, Ritz crackers, and Toblerone.

Profit Margin: 10.6%

Forward PE: 19.1x

Dividend Yield: 2.9%

Payout Ratio: 61.6%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Absolutely love that busy, visually overwhelming brand chart! Usually something like that would make my brain skip a beat but that one is oddly soothing to look at. Maybe it's because I recognize the brands!

I am carefully watching some of those companies and their yields. Recent declines in their stock prices are starting to make them attracting for income! 4% is my threshold.

The four types of wealth graphic remind me of the five capitals of well being defined by Jay Hughes.

1) Human Capital

2) Intellectual Capital

3) Social Capital

4) Spiritual Capital

5) Financial Capital

https://jehjf.org/wp-content/uploads/2023/06/Five-Capitals-One-Page-JEHJF.pdf

These five capitals are defined in the context of a family so they read a little differently.