Hi Partner 👋

Welcome to this week’s 🔒 exclusive edition 🔒 of Compounding Dividends. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

In 1833, Olivia Norris married an English candlemaker in Cincinnati, Ohio.

Her sister, Elizabeth, married an Irish soap maker.

The candlemaker’s name?

William Procter

The soap maker?

James Gamble

In 1837, they started a business called Procter & Gamble.

Today, Procter & Gamble is massive, operating in more than 180 countries with an extensive portfolio of popular brands:

Personal Care: Gillette, Head & Shoulders, Olay, Crest.

Household Care: Tide, Dawn, Febreze.

Health & Wellness: Vicks, Pepto-Bismol.

Baby & Family Care: Pampers, Bounty, Charmin.

But they didn’t start this way.

For their first 74 (!) years, P&G only sold soap and candles.

From a small soap and candle company to a global powerhouse, P&G shows the power of consistent compounding over a long time.

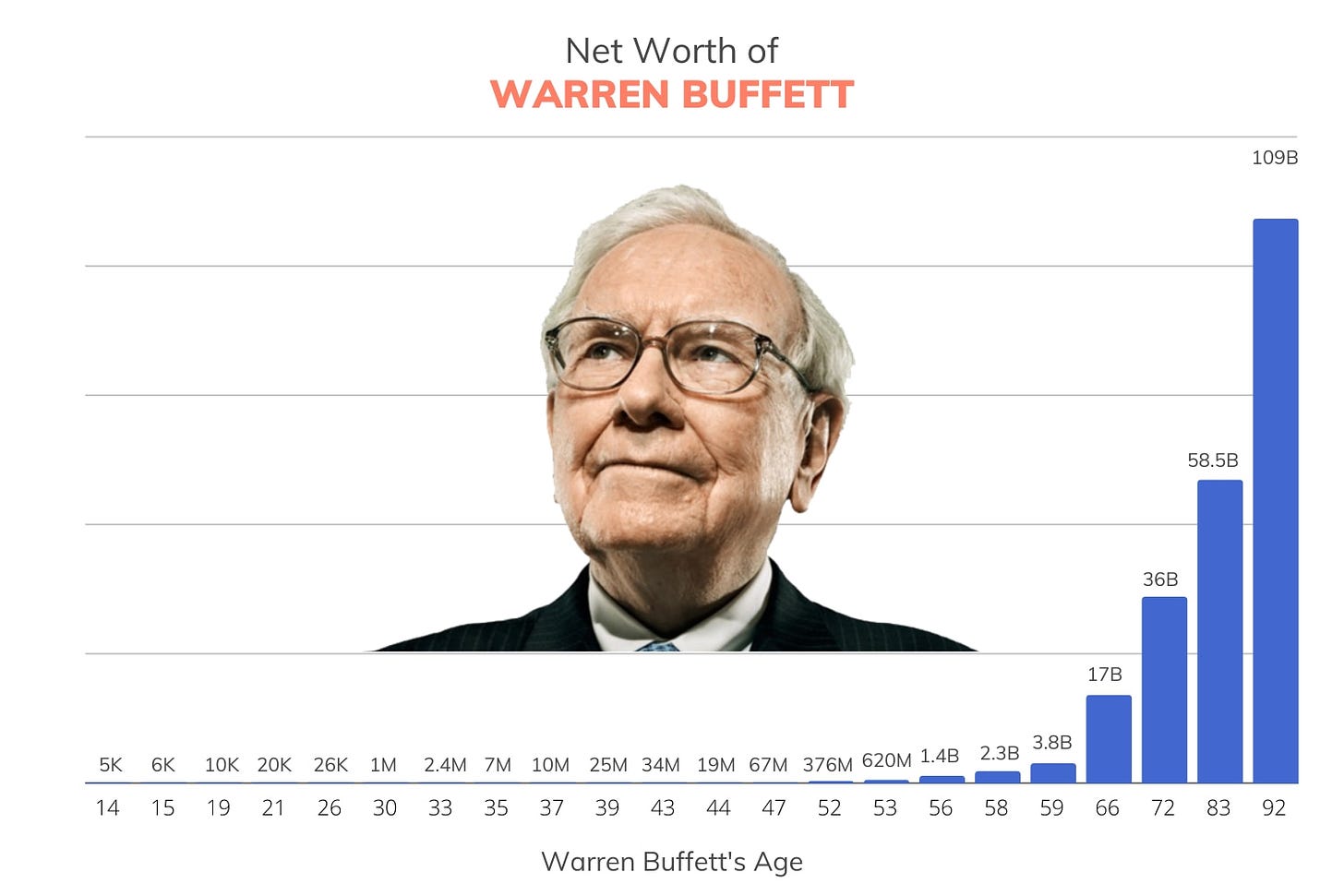

Another example of this?

Warren Buffett’s net worth:

This Saturday, we will buy the first stock for Our Portfolio.

In today’s article, I’ll share 10 stocks that I would love to own at the right price.

Spoiler alert: Our First Buy is in this list.

Ready to get started?

Let’s dive in!

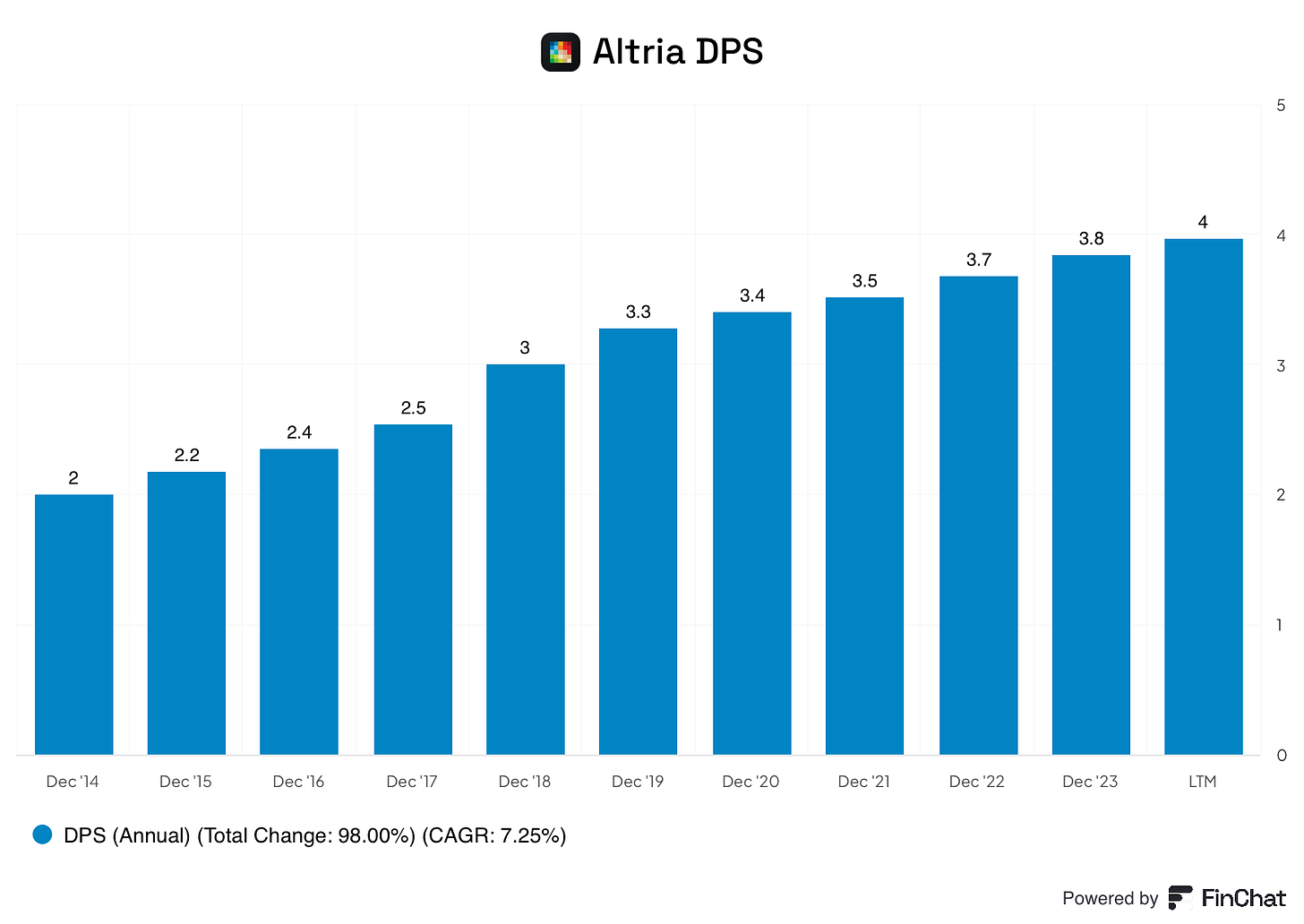

10. Altria (MO)

Business description

Altria makes tobacco products, including cigarettes and smokeless tobacco, primarily under the Marlboro brand in the U.S.

They’re also investing in alternative products like e-cigarettes and tobacco pouches and own a portion of ABInBev.

Why is Altria interesting?

Altria offers a high dividend yield, stable revenues, and consistent dividend growth.

Altria adds a lot of income and steady growth to a portfolio.

Source: Finchat

5- Year growth rates

Revenue: 0.58%

EPS: 44.7%

DPS: 4.1%

Dividends

5-year average yield: 8.1%

Current yield: 7.6%

Payout ratio: 67.0%

9. Chevron (CVX)

Business description

Chevron is one of the world’s largest oil companies, producing oil and natural gas for energy and fuel.

They also invest in renewable energy and alternative fuels.

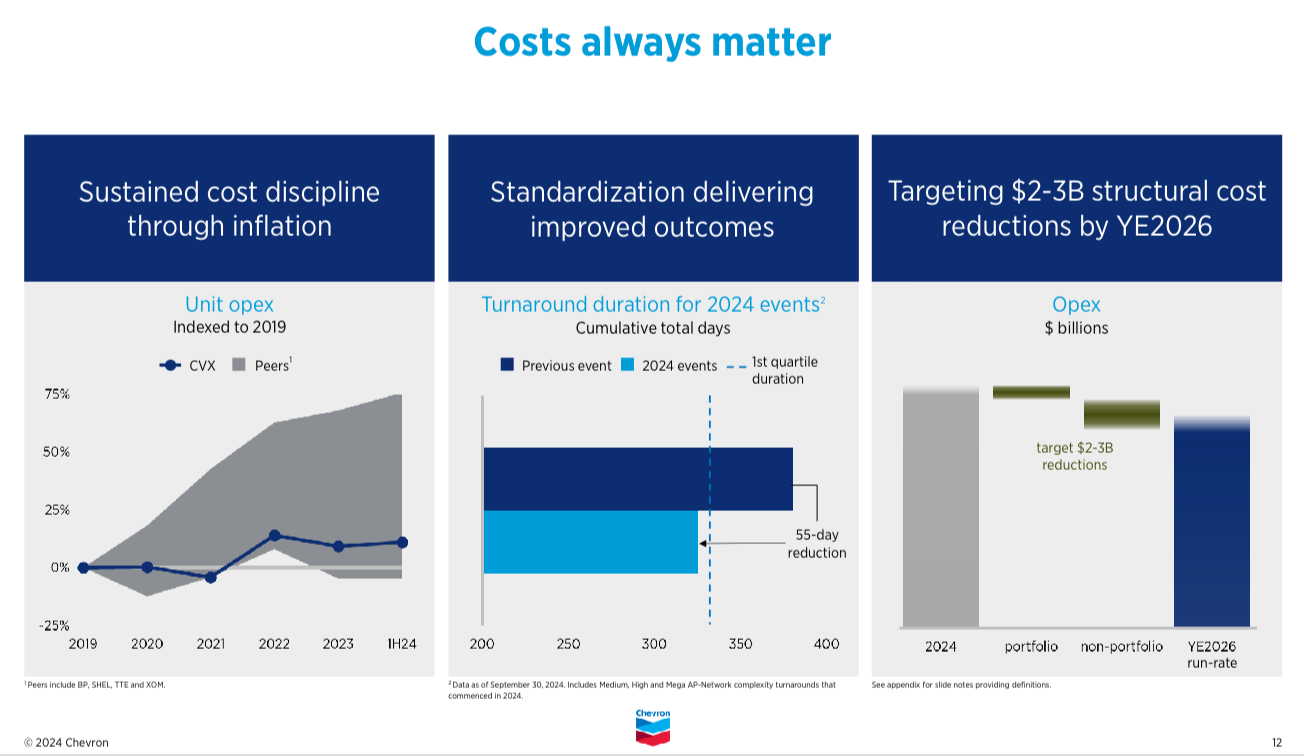

Why is Chevron interesting?

Chevron has an attractive dividend yield and a history of stable growth.

In addition, Chevron has been building its business to reduce costs and be profitable with lower oil prices.

Source: Finchat

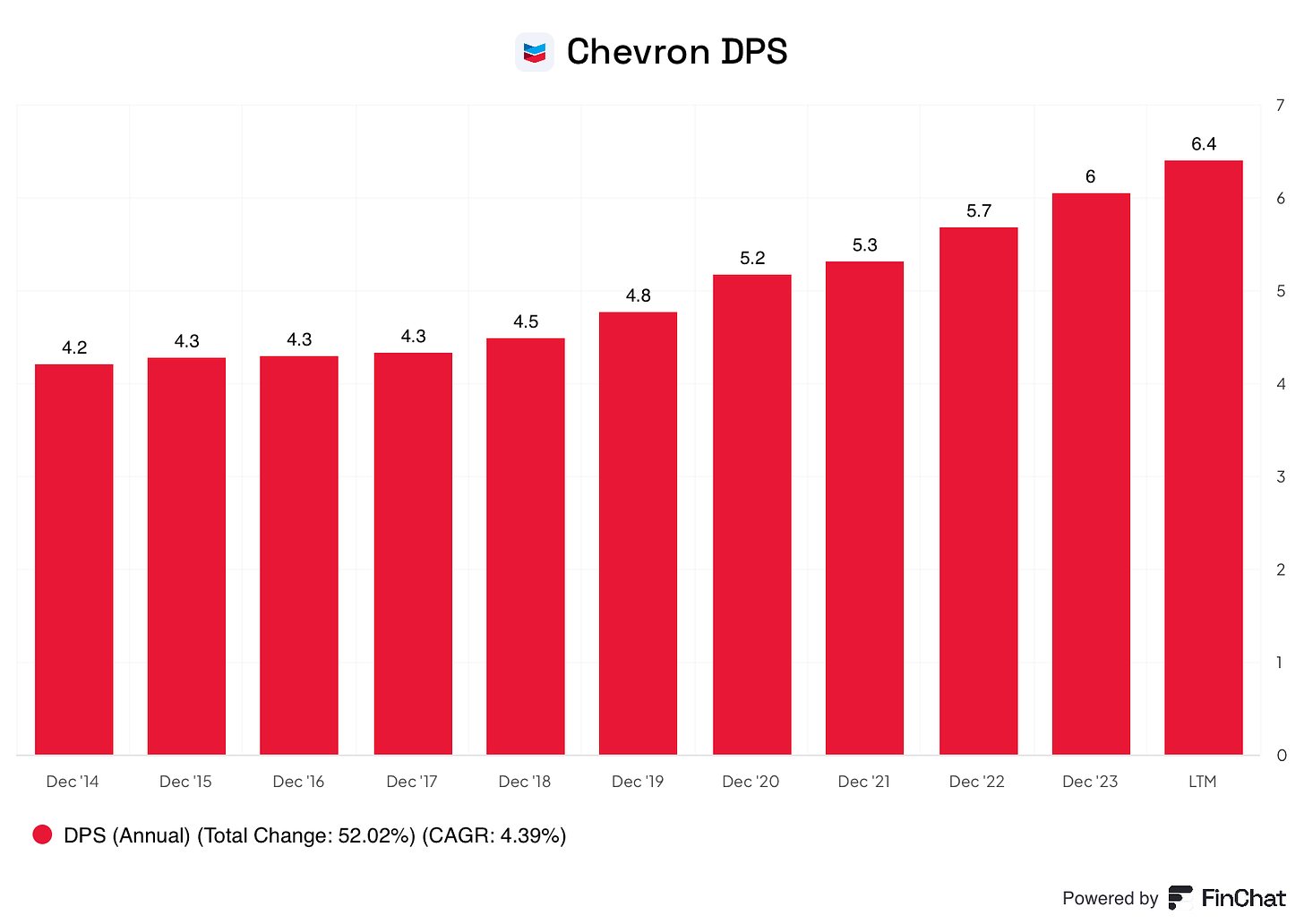

5-Year growth rates

Revenue: 6.8%

EPS: 5.4%

DPS: 6.4%

Dividends

5-year average yield: 4.4%

Current yield: 4.2%

Payout ratio: 70.3%

8. Realty Income (O)

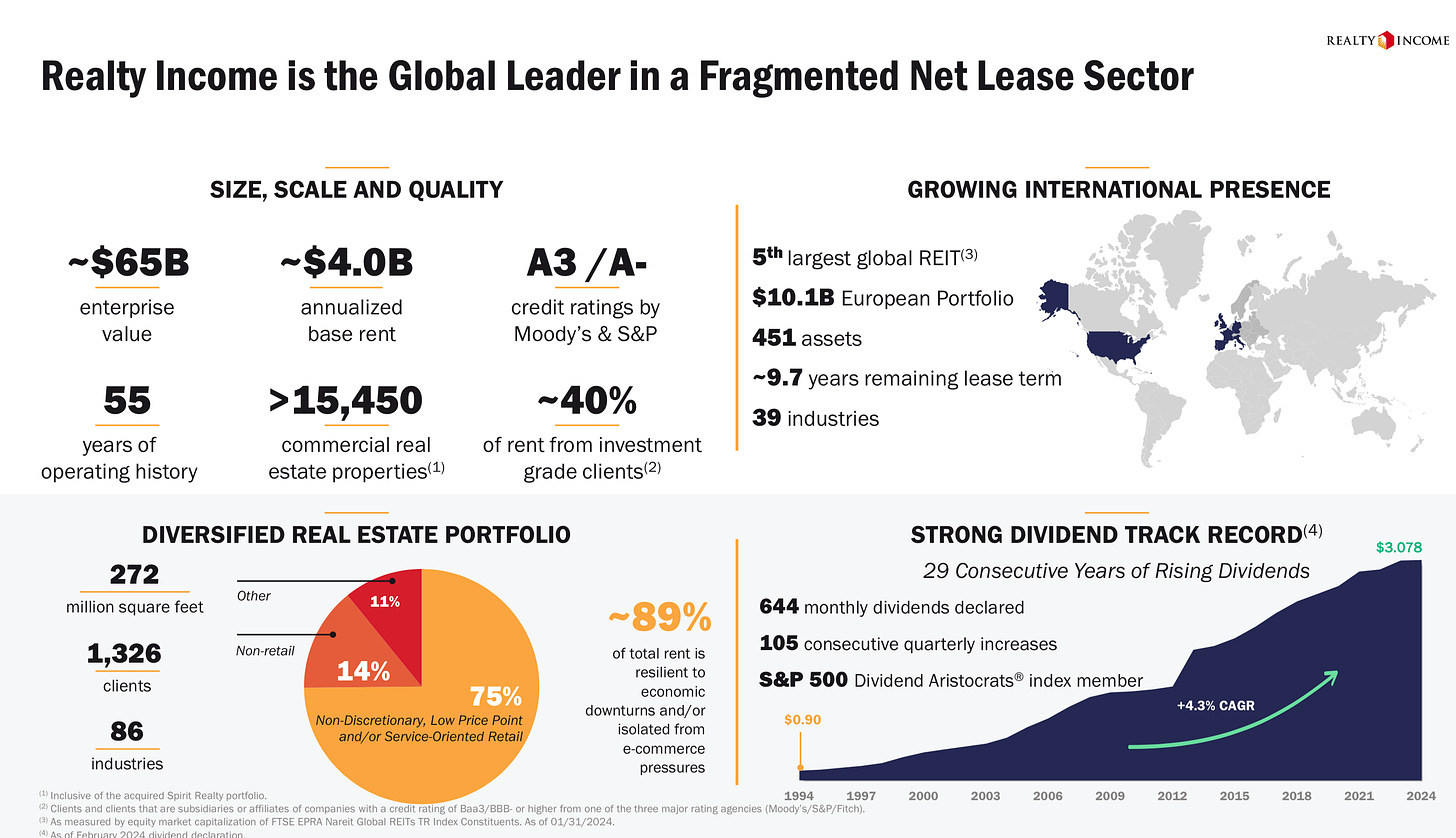

Business description

Realty Income is a real estate company that buys properties and rents them to big, stable companies, like grocery stores and pharmacies.

It pays investors monthly dividends and calls itself “The Monthly Dividend Company.”

Why is Realty Income interesting?

Realty Income has a high current yield and a history of consistent dividend increases.

Their size, and global diversification gives them access to capital and deals that other real estate companies can’t get.

Source: Finchat

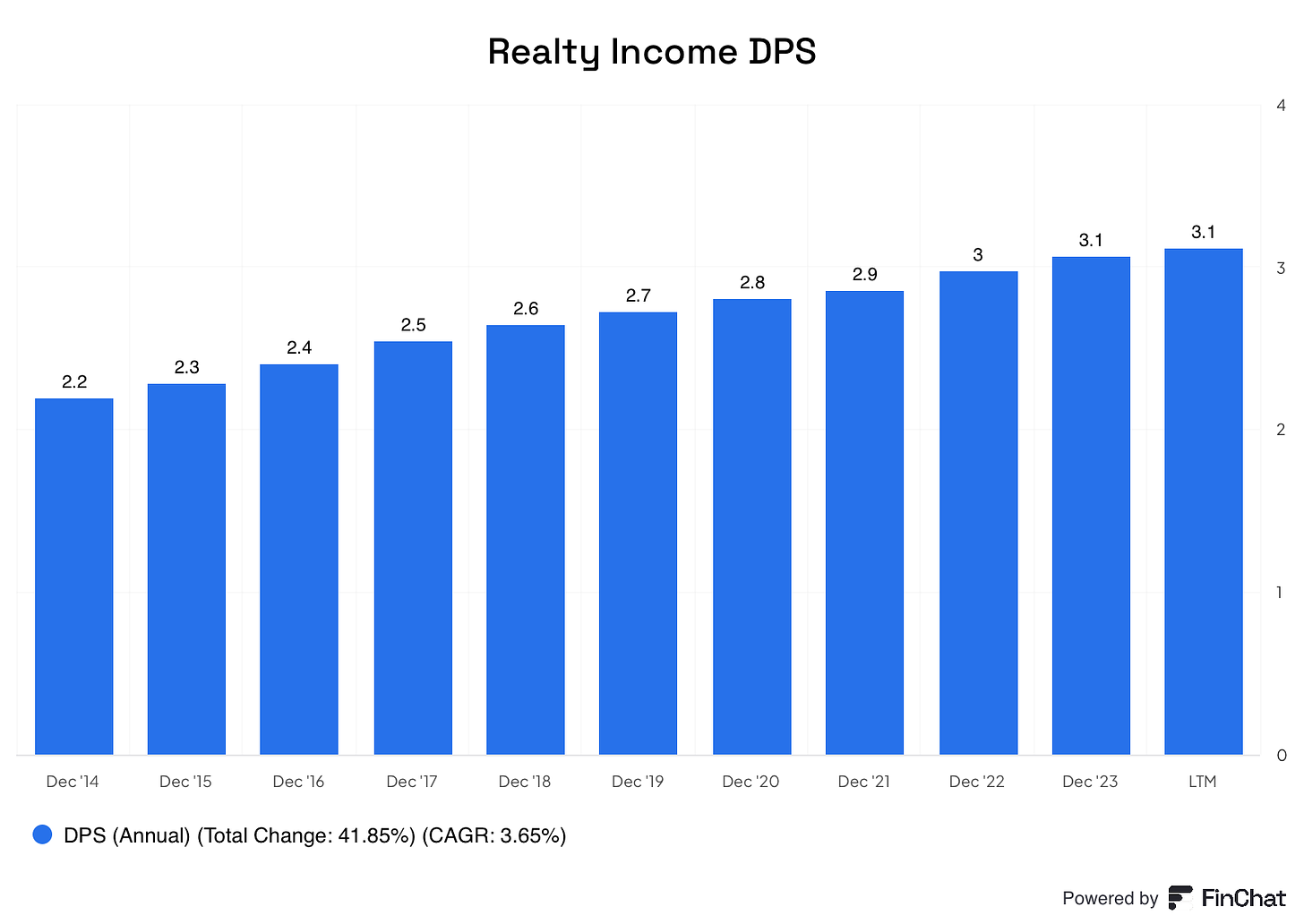

5- Year growth rates

Revenue: 28.4%

FFO/Share: 4.4%

DPS: 2.9%

Dividends

5-year average yield: 4.5%

Current yield: 5.6%

Payout ratio: 75.6% (calculated using FFO)

Altria, Chevron, and Realty Income are all strong businesses with reliable dividend growth.

But I think there are better opportunities out there.

The next 7 businesses all have:

Strong competitive advantages

Impressive past growth

Attractive current stock prices

Ready to find out what they are?

Let’s go!