Dividends can be very attractive.

They can form a nest egg for your retirement.

In this article, I’ll highlight 10 attractive dividend stocks.

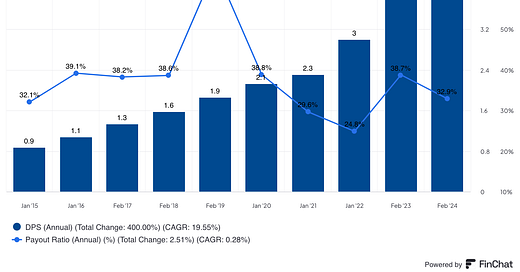

1. Lowe’s Cos. ($LOW)

Lowe's Corp operates as a home improvement retailer, providing a broad selection of products such as building materials, tools, and appliances to DIY customers and professionals. The company enhances its retail offering with services like installation and maintenance, available through its physical stores and online platforms.

Dividend Yield: 1.9%

Payout Ratio: 32.9%

Consecutive # years of dividend payments: 62 years

Source: Finchat

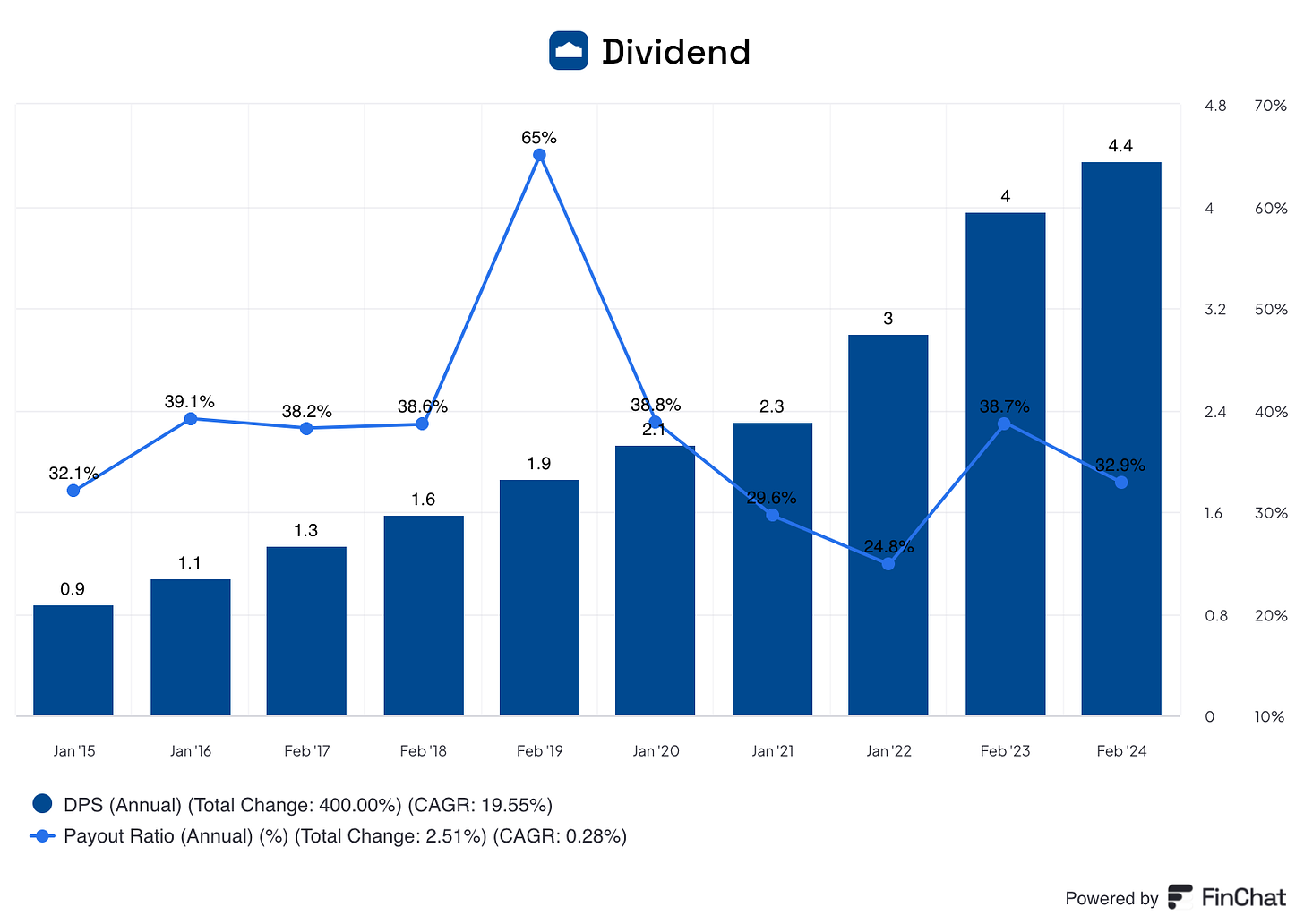

2. Johnson & Johnson ($JNJ)

Johnson & Johnson operates as a global healthcare company, providing a wide range of products in pharmaceuticals, medical devices, and consumer health.

The company focuses on research, development, and manufacturing to deliver innovative solutions for health and wellness through its extensive portfolio.

Dividend Yield: 3.2%

Payout Ratio: 69.3%

Consecutive # years of dividend payments: 62 years

Source: Finchat

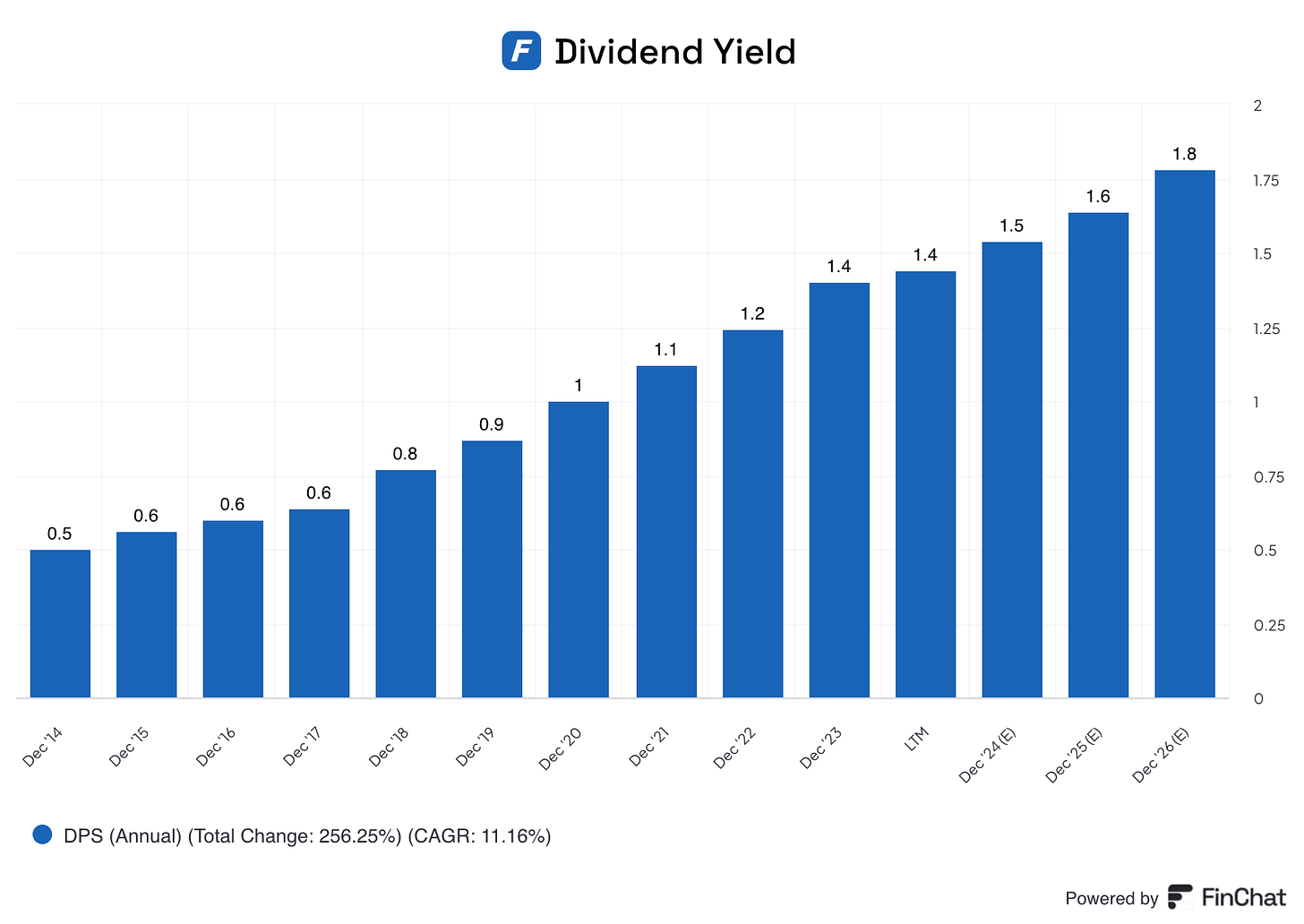

3. Fastenal ($FAST)

Fastenal is a distributor of industrial and construction supplies, offering a variety of products such as fasteners, tools, and safety equipment.

The company serves customers through its network of stores, onsite locations, and digital platforms, emphasizing efficient supply chain solutions.

Dividend Yield: 2.3%

Payout Ratio: 71.1%

Consecutive # years of dividend payments: 22 years

Source: Finchat

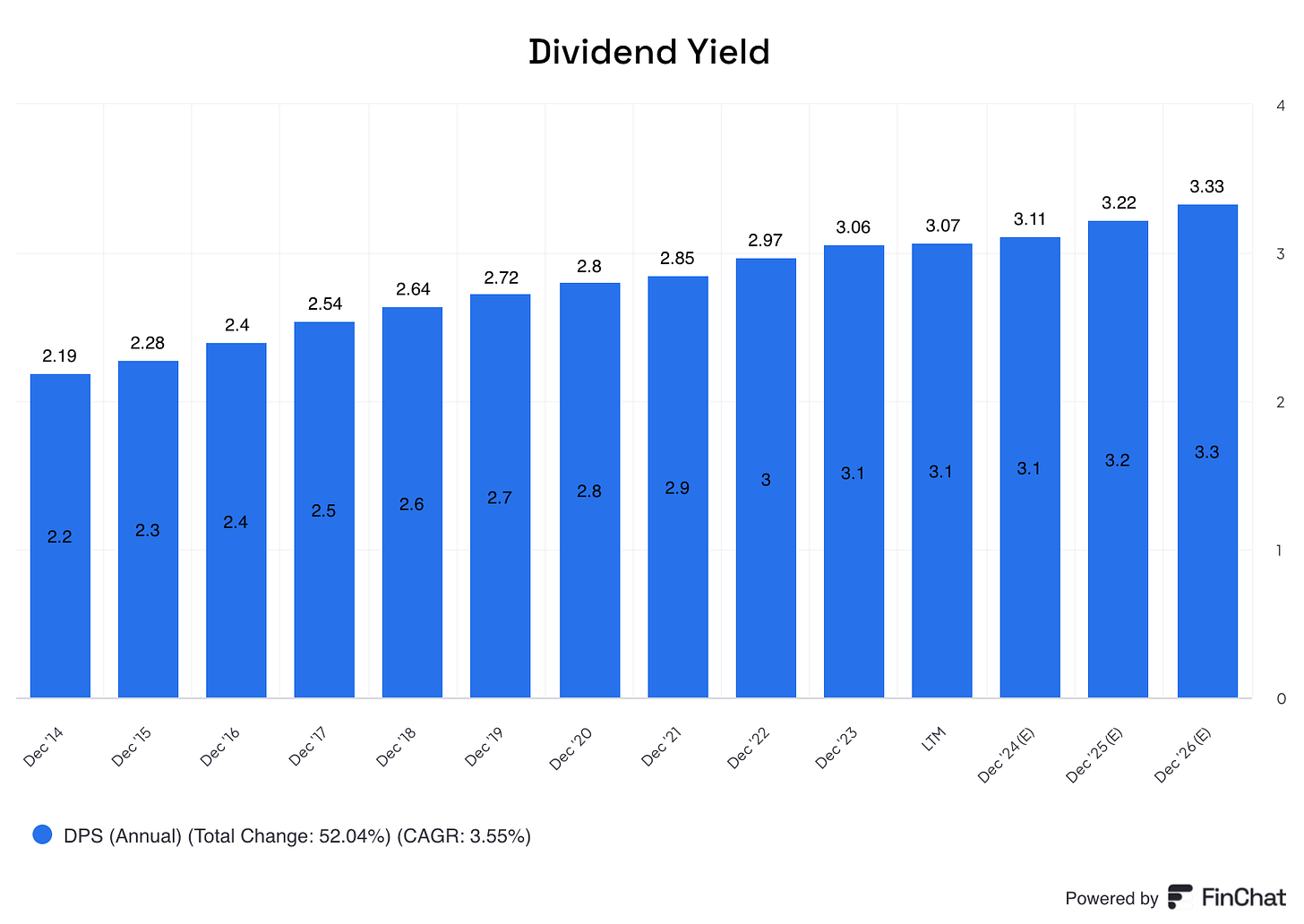

4. Coca-Cola ($KO)

Coca-Cola is a global beverage company that manufactures, markets, and sells a wide variety of non-alcoholic beverages, including sodas, juices, and energy drinks.

They leverage a vast distribution network to reach consumers worldwide and focus on brand marketing and product innovation.

Dividend Yield: 3.1%

Payout Ratio: 74.7%

Consecutive # years of dividend payments: 62 years

5. Realty Income ($O)

Realty Income is a real estate investment trust (REIT) that owns and manages a diversified portfolio of commercial properties leased to tenants on long-term agreements.

The company generates revenue through rental income, primarily from retail and industrial properties, and aims to provide consistent monthly dividends to its investors.

Dividend Yield: 5.6%

Payout Ratio: 290.9%

Consecutive # years of dividend payments: 29 years

Source: Finchat

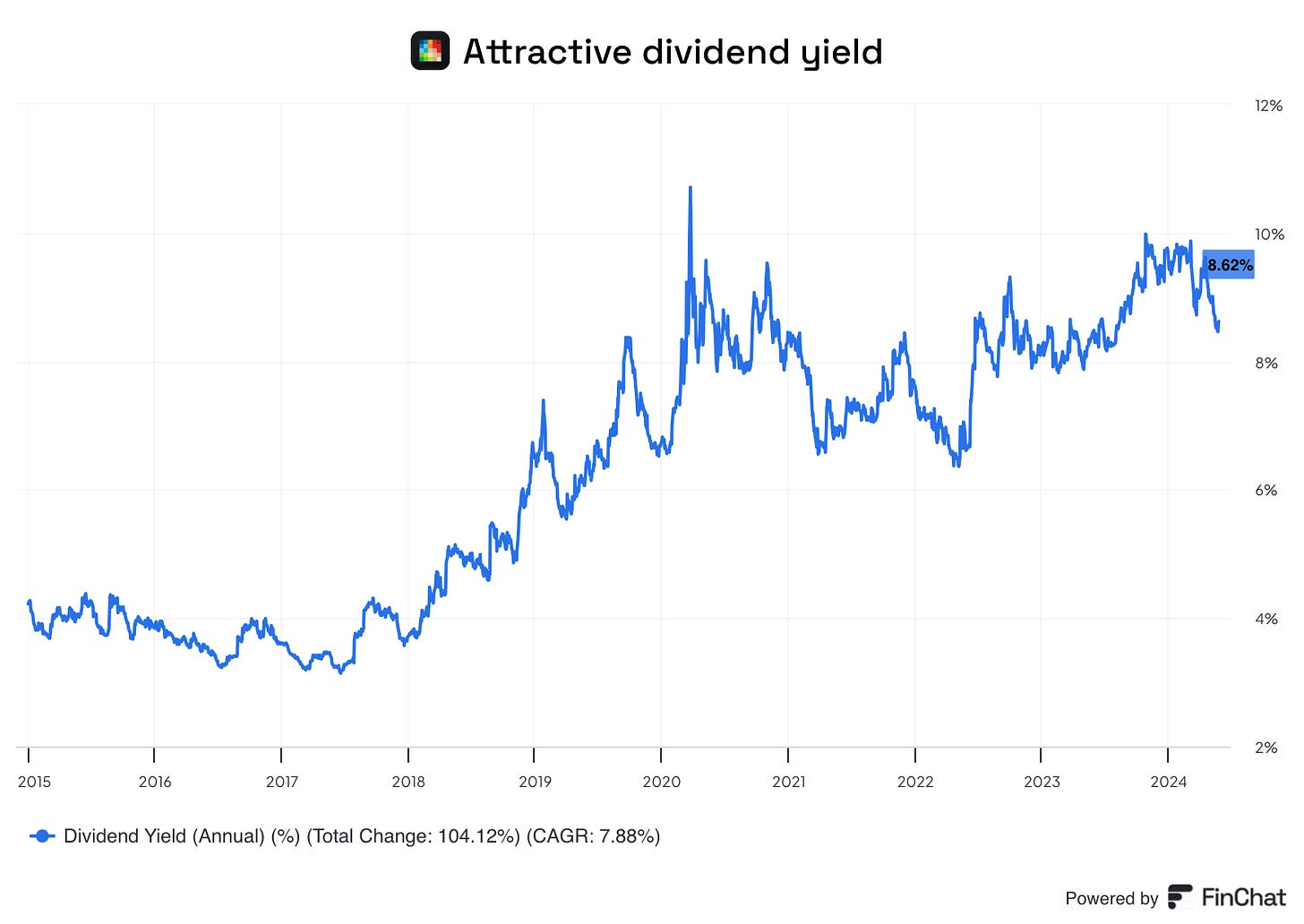

6. Altria Group ($MO)

Altria Group is a producer and marketer of tobacco, cigarettes, and related products, including brands like Marlboro. The company also invests in alternative nicotine products and has stakes in the cannabis and wine industries, focusing on regulatory compliance and market expansion.

Dividend Yield: 8.6%

Payout Ratio: 81.2%

Consecutive # years of dividend payments: 54 years

Source: Finchat

7. Air Products & Chemicals ($APD)

Air Products & Chemicals supplies industrial gases and chemicals to various industries, including healthcare, energy, and manufacturing. The company specializes in the production and distribution of atmospheric gases, process and specialty gases, and offers related equipment and services.

Dividend Yield: 2.7%

Payout Ratio: 63.4%

Consecutive # years of dividend payments: 41 years

Source: Finchat

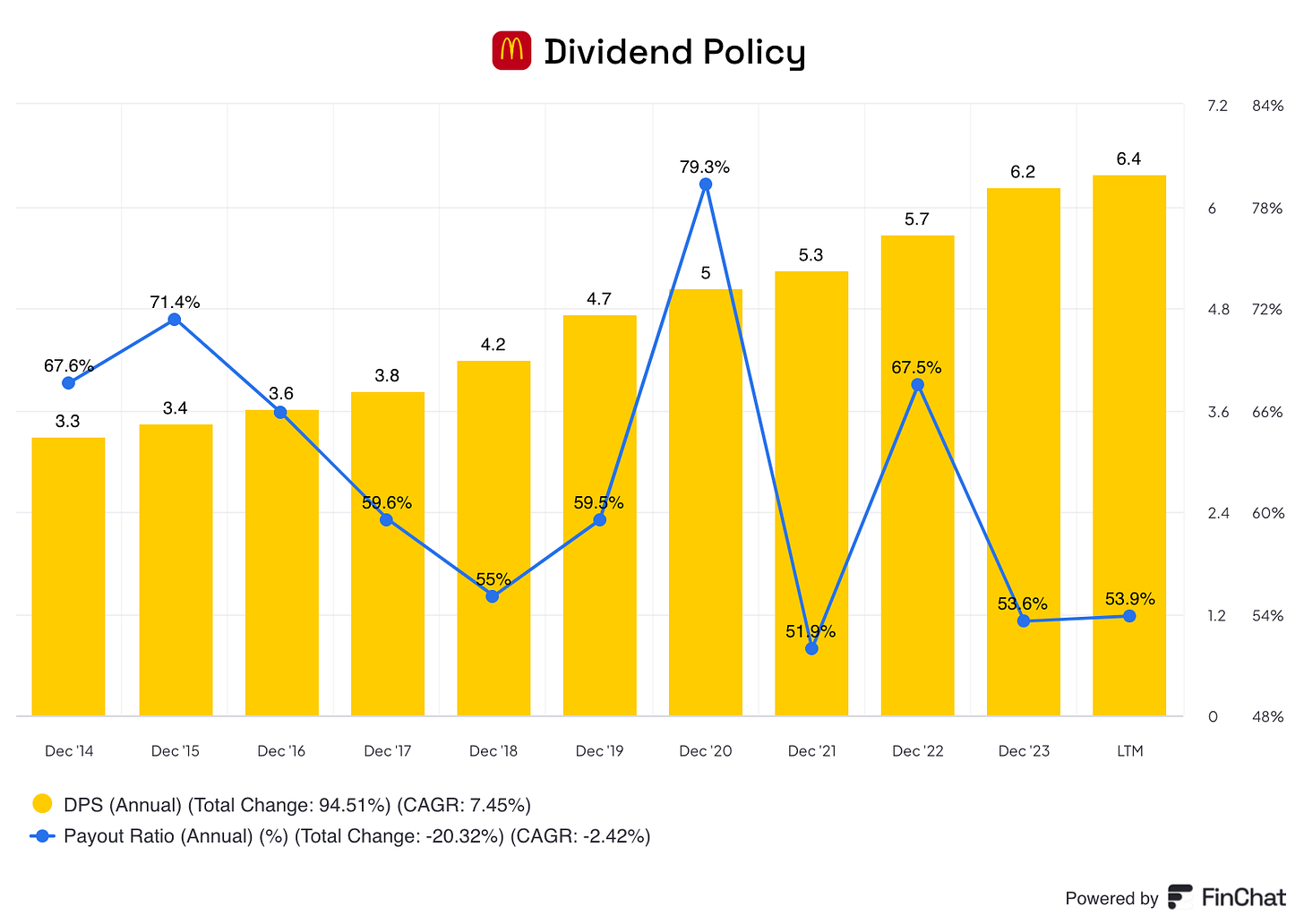

8. McDonald’s ($MCD)

McDonald’s operates as a global fast-food restaurant chain, offering a menu of burgers, fries, beverages, and other items. The company generates revenue through franchise operations and company-operated restaurants, emphasizing brand consistency, operational efficiency, and customer experience.

Dividend Yield: 2.6%

Payout Ratio: 53.9%

Consecutive # years of dividend payments: 48 years

Source: Finchat

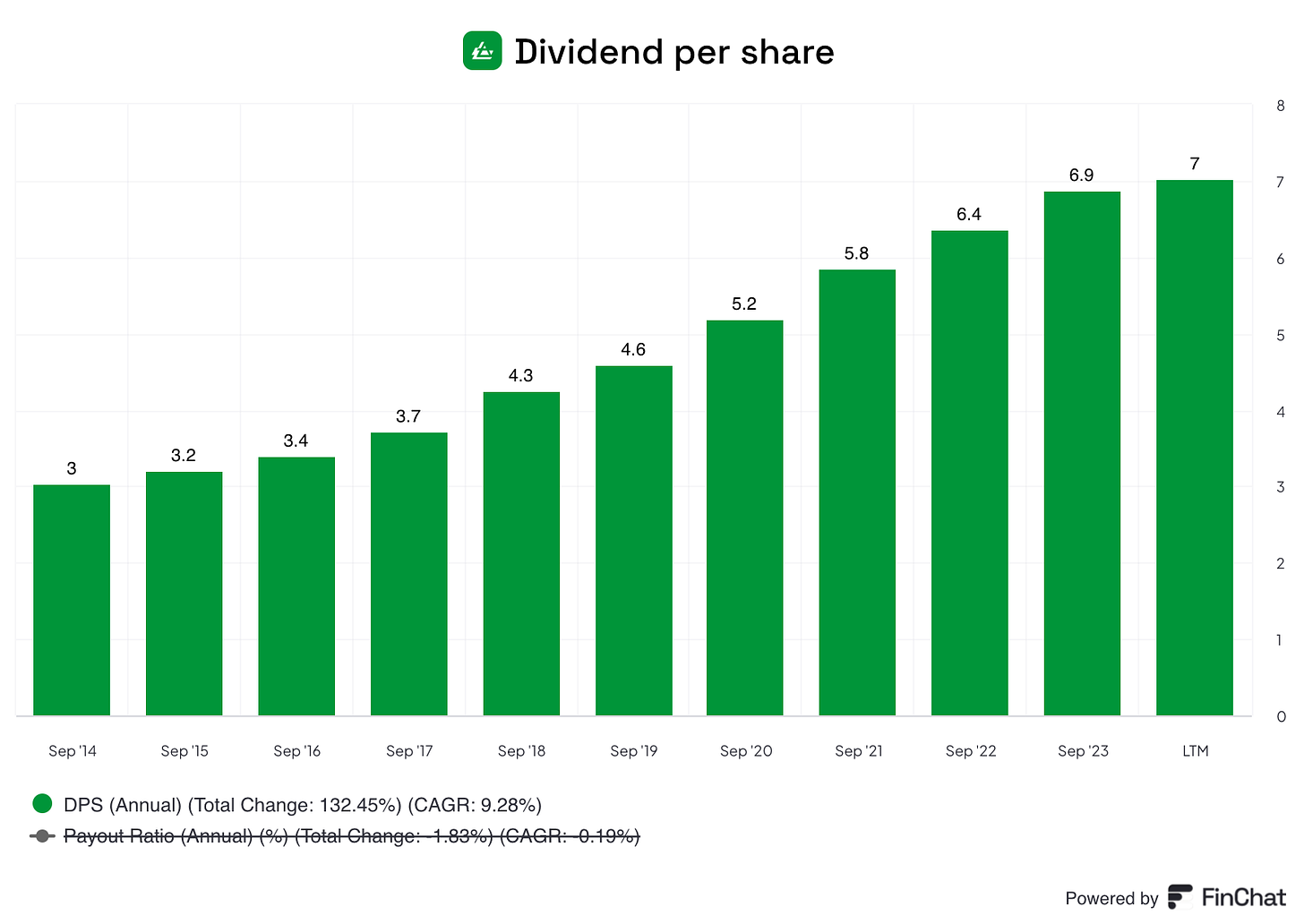

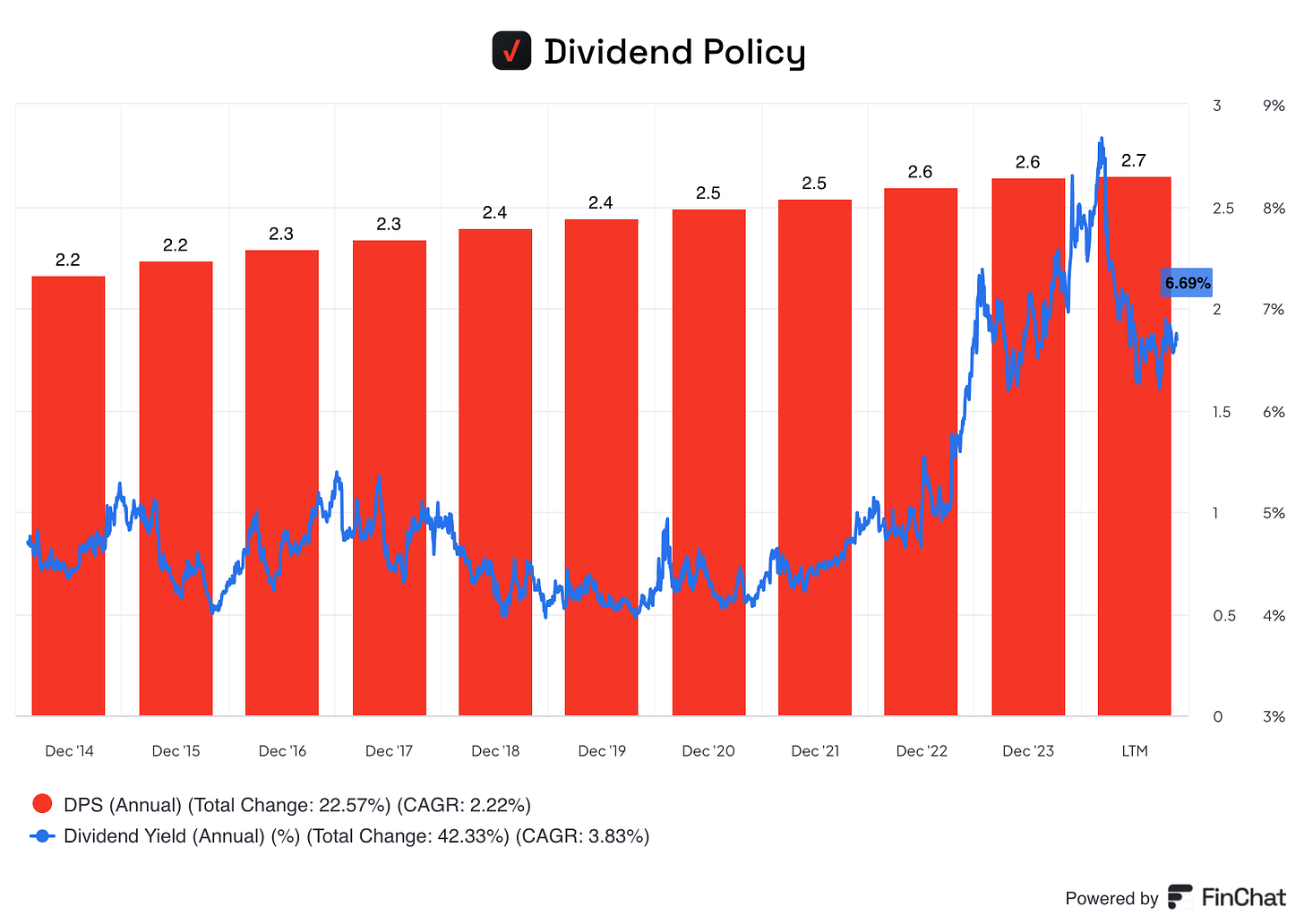

9. Verizon Communications ($VZ)

Verizon Communications is a telecommunications company providing a wide range of services, including wireless communications, broadband, and digital media. The company focuses on expanding its network infrastructure, offering innovative solutions in 5G technology, and enhancing customer connectivity.

Dividend Yield: 6.7%

Payout Ratio: 98.6%%

Consecutive # years of dividend payments: 37 years

Source: Finchat

Source: Finchat

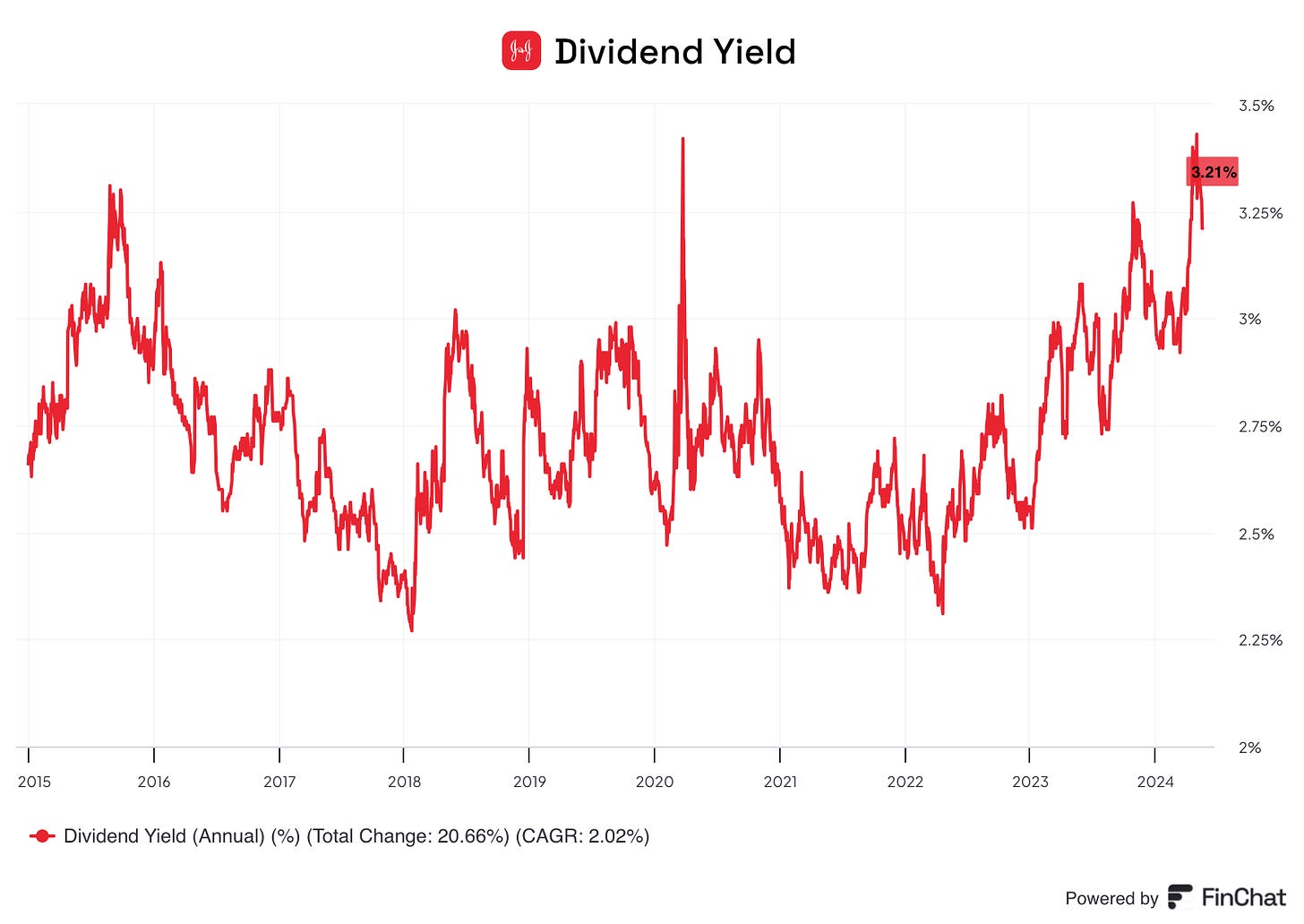

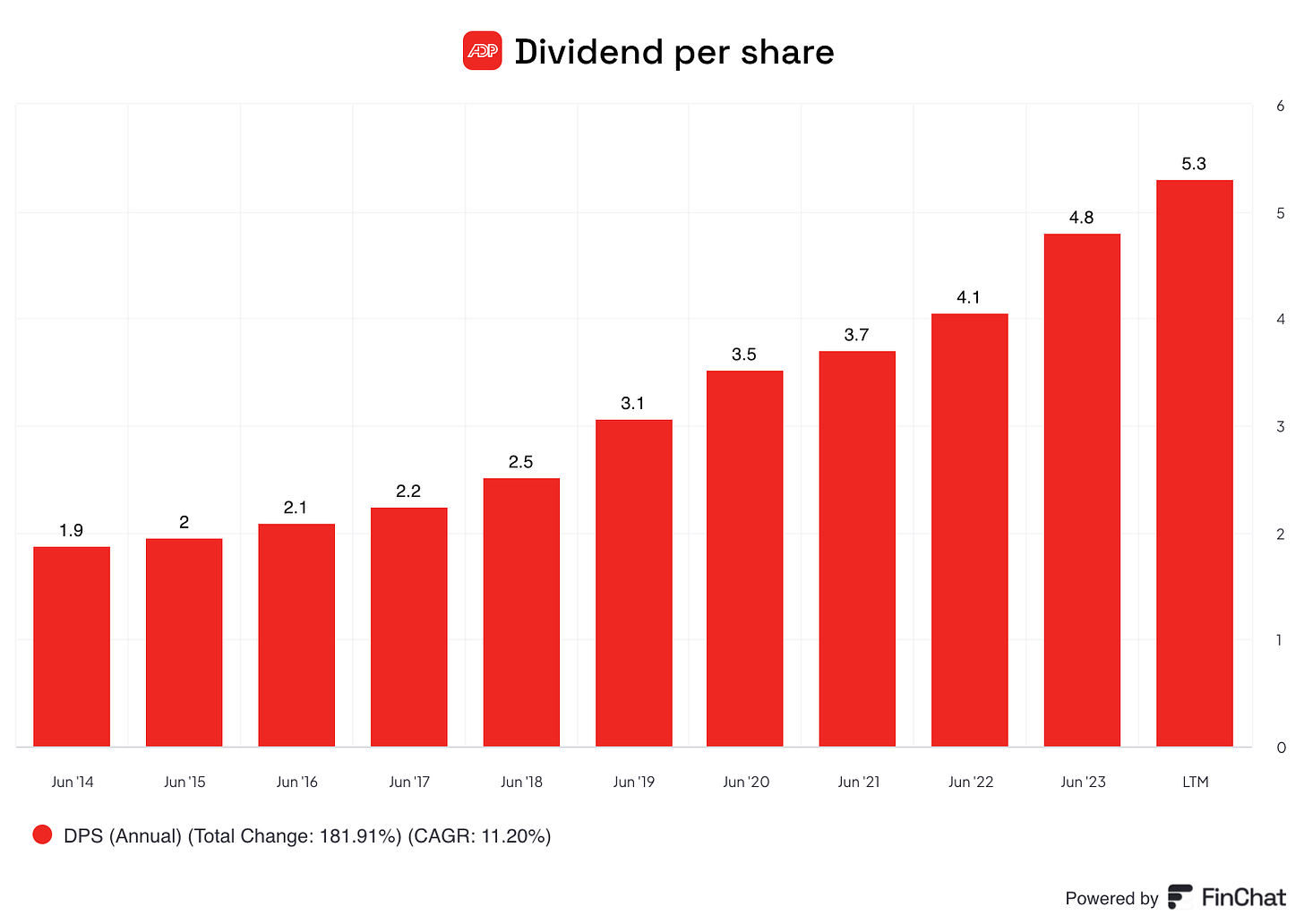

10. Automatic Data Processing ($ADP)

Automatic Data Processing (ADP) provides human resources management software and services, including payroll, talent management, and benefits administration. The company serves businesses of all sizes, leveraging technology to streamline HR processes and improve workforce management.

Dividend Yield: 2.2%

Payout Ratio: 58.9%

Consecutive # years of dividend payments: 48 years

Source: Finchat

That’s it for today

That’s it for today.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Never heard of APD I believe. Going to check on it, thank you.

Good list, some classic names in there!